Financial inclusion means ensuring everyone, individuals and businesses, can access affordable financial services (payments, savings, credit, insurance) that meet their needs in a responsible way.

It’s vital for reducing poverty and boosting prosperity: having a bank account, mobile wallet, or microloan helps people save for the future, invest in businesses, and weather emergencies.

Yet, as of 2021, about 1.4 billion adults worldwide remain unbanked, disproportionately women and low-income households. They operate in a cash economy, unable to get credit or insurance, and are vulnerable to shocks.

In the last decade or so, fintech innovation has emerged as a powerful force bridging this gap. Mobile technology, for instance, has brought millions into the financial system – the share of adults with an account rose from 51% in 2011 to 76% by 2021.

Solutions like mobile money wallets, app-based microloans, blockchain networks, low-cost remittances, and digital banking platforms are transforming how underserved communities access money.

During COVID-19, digital payments surged, showcasing how fintech can reach the last mile when traditional banks can’t.

Below, we showcase fintech startups that are breaking barriers to financial access. They span categories like Digital Banking, Remittances, Microfinance, SME lending, and Blockchain.

Each is reimagining finance for the underserved, from a mobile wallet reaching remote villages to a blockchain platform giving refugees digital identities.

Together, these innovators are building a more inclusive global economy where everyone can save, borrow, transact, and thrive.

Digital Banking & Mobile Wallets for All

Kuda – The bank for Nigeria’s youth and entrepreneurs.

Kuda is a Lagos-based neobank providing full-service banking through a mobile app with zero monthly fees.

Launched in 2019, Kuda targets Nigeria’s huge population of young adults and micro-entrepreneurs who find traditional banks inconvenient or too expensive.

With Kuda, users get a free account and debit card, small overdraft facilities, and helpful budgeting tools – all managed on a phone.

By 2023, Kuda had surpassed 6 million customers and continued to grow across Africa. The startup leverages Nigeria’s high mobile adoption to reach people in both cities and remote areas who may never have entered a bank branch.

Impact: Kuda’s no-fee, user-friendly approach has expanded banking access for millions of Nigerians.

It brings banking to the smartphone generation, making it easy to save money and make payments, and helping to formalize the informal cash economy.

Nubank – No-fee digital banking for Latin America’s underserved.

Nubank started in Brazil as a simple purple credit card with no annual fee; it has since grown into Latin America’s largest digital bank. Nubank focuses on people often overlooked by traditional banks – those with no credit history or fed up with high fees.

Through a smartphone app, users can open accounts, get small loans, and build credit easily.

Nubank’s mission of “democratizing financial services” has resonated: it now reaches over 100 million customers across Brazil, Mexico, and Colombia, many first-time account holders.

By leveraging technology and a customer-friendly approach, Nubank proved that a bank with zero monthly fees and fully digital service can include vast segments of the population.

Impact: In Brazil, Nubank has helped bring millions into the financial system –84% of adults now have access to financial services, up from ~50% a decade ago, thanks in part to Nubank and its peers’ products.

TymeBank – A South African digital bank leveling access with no fees.

TymeBank is South Africa’s first fully digital bank, launched in 2019 to serve the mass market. Account opening is simple and free, customers can sign up online or at kiosks in supermarkets in 5 minutes.

TymeBank charges no monthly fees, offering a low-cost savings account and goal-based “Save Goals” with competitive interest.

By eliminating the paperwork and fees that kept many South Africans out of banking, TymeBank rapidly gained trust.

In under six years it reached 10 million customers, making it the country’s fastest-growing bank. Most are first-time bank clients from lower-income segments.

Impact: TymeBank’s accessible model has brought millions of unbanked South Africans into the financial system, contributing to the country’s progress toward financial inclusion for 80%+ of adults. It also spurred incumbents to lower costs, transforming banking in South Africa to be more inclusive.

Rain – On-demand pay access reducing financial stress for workers.

Rain is a U.S.-based fintech providing Earned Wage Access (EWA), allowing employees to access their earned wages instantly instead of waiting for traditional payday cycles.

Rain integrates seamlessly with payroll systems and is the first EWA provider embedded directly into Workday, making implementation simple for employers of all sizes.

With partners like Pizza Hut, Hilton, Goodwill, Marriott, and Subway, Rain is helping millions of hourly and shift-based workers gain immediate control over their income.

Impact: By reducing reliance on payday loans and high-interest credit, Rain directly addresses financial stress among workers.

Surveys show that 89.9% of employees feel more satisfied at work, 78.5% report less stress, and 77.5% say they are more likely to refer friends to their employer after using Rain.

bKash – Mobile money powering Bangladesh.

Launched in 2011, bKash is a household name in Bangladesh and a verb for “sending money”. Its mobile wallet allows anyone with a basic phone to deposit, withdraw, and transfer money at local agents.

bKash has built a network of 330,000+ agents and 550,000 merchants, reaching the grassroots.

Today, it serves nearly 80 million customers, many of them previously unbanked. By enabling instant digital transactions for daily needs, bKash has become an integral part of life and a model for financial inclusion.

Ualá – A fintech super-app bringing millions of Argentines into finance.

Ualá is an Argentine startup offering a prepaid Mastercard and finance app that has resonated with unbanked youth and adults.

Signing up is simple via smartphone, with no account maintenance costs. Users can pay bills, top-up phones, send money, save and invest – all through Ualá’s app.

Since launching in 2017, Ualá has reached 8 million users, about 17% of Argentina’s adult population.

It expanded to Mexico and Colombia, acquiring licenses to offer more services like personal loans. Ualá’s founder, seeing Argentina’s economic volatility and low banking penetration, aimed to give people a secure, convenient tool to manage money digitally.

Impact: Ualá has empowered millions of Argentines who previously dealt only in cash. For many, it’s their first card and entry into e-commerce or digital payments.

By promoting savings and providing financial education tips in-app, Ualá is improving financial literacy. The company also reported that nearly 40% of its users are women under 35, indicating progress in including demographics often left out by traditional banks.

Papara – Turkey’s e-wallet making cashless easy for all ages.

Papara is a digital wallet and payment app in Turkey that gained enormous popularity, especially among young people and those without access to credit cards.

Papara operates under the supervision of the Central Bank of the Republic of Turkey. Papara users' funds are guaranteed and held in accounts in the Central Bank.

With Papara, users can send money 24/7 for free, pay bills, get a prepaid card for online shopping, and earn cashback rewards.

Crucially, Papara accounts can be opened online in minutes with just an ID, and even teenagers (with parental consent) can use Papara.

The platform has grown to over 10 million users (and reportedly even more), becoming one of Turkey’s largest fintechs.

Impact: Papara has brought a large swath of Turkey’s unbanked or underbanked population into the digital payments realm. For example, many gig workers and students use Papara as their primary financial account.

By integrating with bank ATMs and retail stores for cash deposits/withdrawals, Papara bridges the cash and digital worlds.

Papara’s success shows how a simple, well-designed mobile wallet can drive financial inclusion at scale, even in a middle-income country.

Wave Mobile Money – A low-cost mobile money revolution in West Africa.

Wave (also known as Wave Mobile Money) is a Senegal-based startup making mobile money dramatically more affordable across West Africa.

Launched in 2018, Wave introduced a model with free deposits and withdrawals and just a 1% fee on transfers – undercutting older mobile money services that charged users 5–10%.

Using a QR-code based app and an agent network for cash in/out, Wave rapidly gained users in Senegal, Côte d’Ivoire, and beyond.

It became Francophone Africa’s first fintech unicorn in 2021.

By offering a user-centric, ultra-cheap service, Wave has grown to over 5 million active users in Senegal alone, including many first-time mobile money users.

Impact: Wave’s arrival sparked a price war that slashed the cost of digital financial services for millions in the region.

Customers who once found mobile money too expensive (and thus stayed cash-only) can now transact digitally for near-free, increasing financial inclusion.

Wave also enhances rural access: its easy-to-use app and wide agent coverage mean even villagers can save money securely or receive remittances without long travels. Overall, Wave is accelerating the drive toward a cashless Africa by making mobile money accessible “for the next billion” consumers.

M-Pesa – The pioneering mobile money service that transformed Kenya (and beyond).

No discussion of fintech for inclusion is complete without M-Pesa, launched in 2007 by Safaricom in Kenya. M-Pesa turned the humble mobile phone into a bank-in-your-pocket, allowing users to text money to each other and store value on their SIM cards.

It was life-changing in a country that had very low bank penetration at the time. Today M-Pesa has over 50 million monthly active users across 7 African countries, making it Africa’s largest fintech platform.

In Kenya alone, 59% of the country’s GDP flows through M-Pesa – people use it for everything from buying groceries to paying school fees.

Impact: M-Pesa lifted an estimated 1 out of 10 Kenyan households out of extreme poverty by improving financial resilience and enabling entrepreneurship (especially among women).

It introduced the concepts of savings via mobile, digital credit (M-Shwari), and pay-as-you-go solar financing, spawning a vibrant fintech ecosystem. M-Pesa proved that mobile phones could bank the unbanked at scale, inspiring similar services globally.

It remains a shining example of how technology and telecom innovation can drive financial inclusion, economic empowerment, and even national development.

Remittances & Payments: Connecting the Unbanked to the World

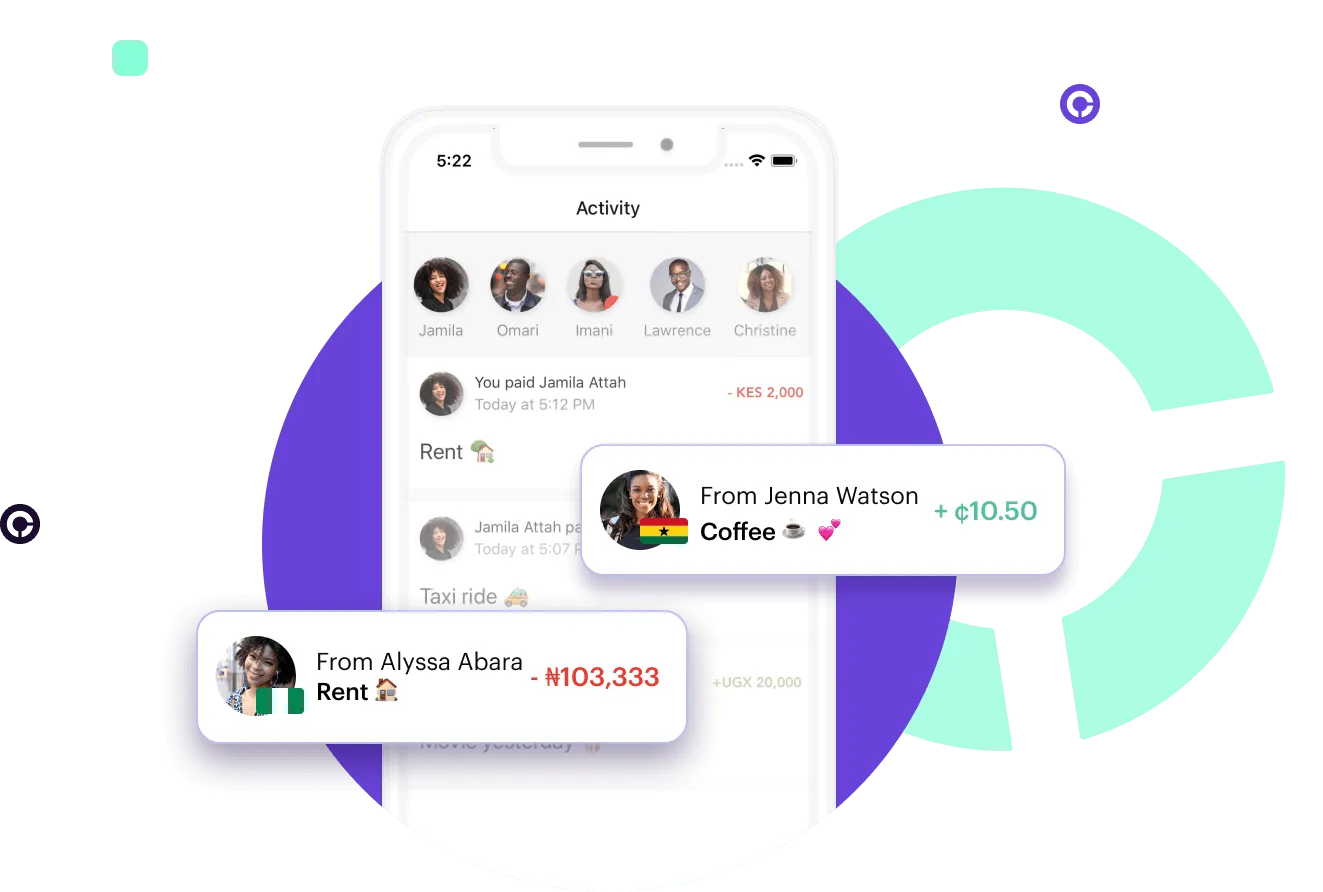

Chipper Cash – Free cross-border payments for Africa’s individuals and small businesses.

Chipper Cash is a Pan-African fintech that enables fee-free money transfers between African countries, a service that was once difficult and expensive.

Founded in 2018 and serving over 5 million users, Chipper provides a mobile app for instant peer-to-peer payments across borders (and within countries) at no cost.

Before Chipper, sending money from, say, Kenya to Ghana required high remittance fees; now it’s as easy as sending a text.

Chipper also offers virtual dollar cards, crypto trading, and business payment solutions, making it a one-stop financial platform.

Impact: By eliminating fees, Chipper Cash has “revolutionized moving money in Africa”. It especially empowers young entrepreneurs, freelancers, and families who support relatives across African borders, allowing them to keep more of their hard-earned money.

During the pandemic, Chipper saw usage soar as digital transfers replaced hand-carrying cash.

The startup has also expanded into the US and UK to facilitate remittances from diaspora communities to Africa.

Chipper’s mission is to provide the most accessible financial services for Africans at home and abroad, and it’s already saved users millions in fees while fostering intra-African trade and support.

Remitly – Affordable global remittances putting more money in families’ hands.

Remitly is a Seattle-based fintech focused on one thing: making international money transfers faster, cheaper, and more convenient for migrants sending money home. Remitly operates via an easy mobile app and website available in North America, Europe, Asia, and Australia, sending to 100+ countries.

By using digital channels and local partners, Remitly cuts costs versus traditional agents. In 2024 alone, Remitly’s customers sent over $54 billion to loved ones across 5,100 corridors.

The service has 8 million active customers and growing. Crucially, Remitly often charges a fraction of what a bank or Western Union would, and deposits money directly into mobile wallets or bank accounts, saving recipients a trip.

Impact: Remittances are a lifeline for millions of families in developing countries, and Remitly helps maximize that impact by reducing fees and increasing speed.

For example, a Filipino nurse in the US can send $200 home at a low cost, and her family can receive it instantly in their mobile wallet – saving on bus fares and lost work time.

Remitly also innovates on transparency and security, providing real-time tracking and eliminating the uncertainty of informal remittance channels.

Mural Pay

Mural Pay is a global payments platform built on stablecoin technology to make moving money across borders faster, cheaper, and more transparent.

Designed for businesses, fintechs, and financial institutions, Mural Pay provides modern APIs and global stablecoin accounts for instant pay-ins, payouts, and invoicing.

By combining the reach of blockchain with the usability of traditional banking, Mural Pay helps companies unlock real-time payments, reduce foreign exchange costs, and expand access to financial services in emerging and established markets alike.

The platform’s mission is simple, to connect the world financially through reliable, compliant, and inclusive digital payments.

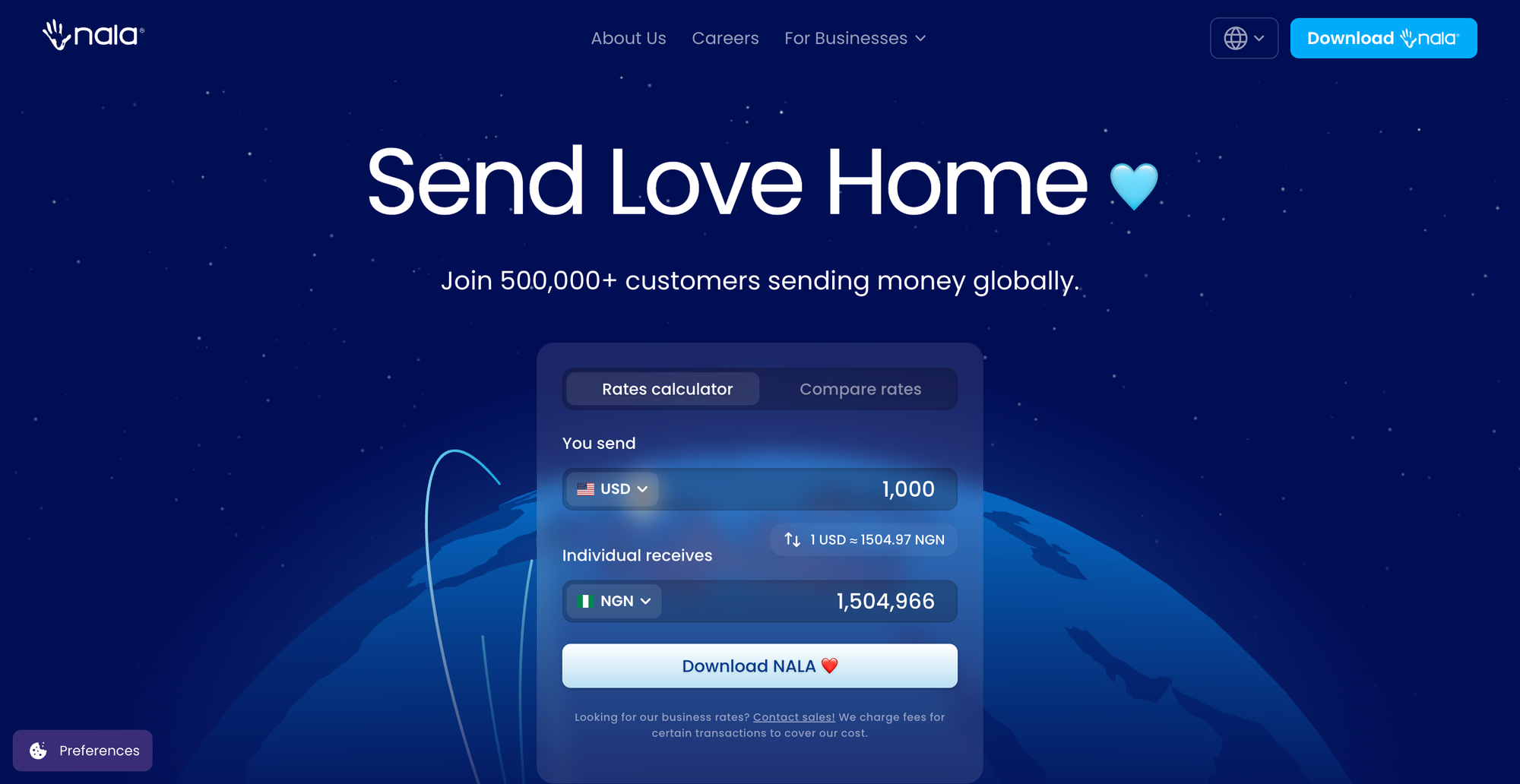

NALA – A Tanzania-born remittance app slashing costs for the African diaspora.

NALA is a fintech making it easier and cheaper to send money from the UK, EU, and US back home to Africa. Founded in Tanzania and now headquartered in London, NALA initially launched as an offline mobile payment app for East Africa, then pivoted to cross-border remittances in 2021.

Users can link their bank accounts and instantly send money to mobile wallets or bank accounts in countries like Kenya, Uganda, Tanzania, Ghana, and more, with transparent low fees.

NALA prides itself on great rates and an easy experience, and in its first year facilitated over $1 billion in transfers to Africa and Asia.

It has also grown a community of 250,000+ users by 2023.

Impact: Remittances to sub-Saharan Africa are the most expensive in the world (averaging ~8%), but NALA’s platform significantly cuts that cost, meaning a higher portion of each $100 sent reaches family members for necessities.

For example, African students in Europe use NALA to pay tuition back home without hefty bank charges, and migrant workers use it to support relatives.

By obtaining licenses and building payment infrastructure in multiple African countries, NALA contributes to stronger financial connectivity for Africa.

Its success demonstrates the power of diaspora-led innovation in solving problems – built by Africans for Africans – and keeping wealth within communities through better remittance value.

Afriex – Stablecoin-powered remittances with zero fees for the African diaspora.

Afriex is a startup tackling the high cost of sending money to Africa by leveraging stablecoins. The Afriex app allows users in the US, UK, and Canada to send money to Nigeria, Ghana, Kenya, Uganda (and more) instantly with no fees, by converting the cash to stablecoins, moving it on blockchain, then converting to local currency on arrival.

For the user, the experience feels like a normal transfer – they might not even realize crypto is involved – but under the hood Afriex bypasses expensive intermediaries.

Impact: Afriex’s stablecoin approach can save recipients ~5-10% per transfer compared to traditional means.

For example, a Nigerian expat sending $500 home through Afriex can have the full amount (converted to naira) delivered to their family’s bank or mobile wallet, instead of losing $30+ in fees elsewhere.

This directly supports household incomes. Additionally, Afriex provides multi-currency accounts, so users in volatile economies can hold some savings in USD stablecoins as a hedge against inflation – a valuable service in countries with unstable currencies.

Microfinance & Consumer Lending: Small Loans, Big Impact

Tala – AI-powered microloans via smartphone, building credit for the underbanked.

Tala is a fintech that offers quick, unsecured microloans to people in emerging markets simply through a mobile app.

Starting in Kenya and now active in countries like India, Mexico, the Philippines, and Tanzania, Tala analyzes smartphone data (like SMS records, utility payments, etc.) to assess creditworthiness of thin-file customers.

Borrowers can get loans as small as $10 to a few hundred dollars in minutes on their phone, without any collateral.

Since launching in 2014, Tala has disbursed over $3.4 billion to nearly 8 million customers. Many users are small entrepreneurs – like kiosk owners or farmers – who use Tala loans to buy inventory or invest in their businesses.

Impact: Tala’s service often marks the first formal loan for its customers, who previously might only rely on informal lenders or family. By providing affordable credit (with transparent fees) and an education in responsible borrowing, Tala helps users build a digital credit history.

JUMO – Banking-as-a-service platform enabling digital microloans and savings at scale.

JUMO is a South Africa-based fintech that provides the infrastructure for banks, mobile operators, and fintechs to offer financial services (like credit, savings, insurance) to emerging market customers via their phones.

Essentially, JUMO’s AI-driven platform handles credit scoring (using alternative data), underwriting, and loan management so that a telco or bank can extend small loans to users who lack formal credit histories.

Since 2015, JUMO has facilitated over $8 billion in loans to 31 million customers across Africa and Asia – an astonishing reach.

It partners with major mobile money providers in countries like Ghana, Uganda, Zambia, Pakistan, and more to embed loan products into familiar apps.

Impact: JUMO massively amplifies the reach of microfinance. For instance, in Zambia a mobile user can get a short-term loan via MTN Mobile Money thanks to JUMO’s engine assessing their phone usage and mobile wallet habits; or in Tanzania, a customer can earn interest on a micro-savings account through a telecom app powered by JUMO.

By handling the heavy lifting, JUMO enables local institutions to serve marginalized customers profitably. Its scale speaks to success: with 30+ million people served, many are rural or low-income folks who before had zero chance of a bank loan.

Kiva – Crowdfunding microloans to lift entrepreneurs worldwide.

Kiva is a nonprofit fintech pioneer that popularized person-to-person microlending online. Founded in 2005, Kiva allows anyone with $25 to lend to low-income borrowers (mostly entrepreneurs) globally via its platform.

These loans (0% interest from lenders) are channeled through local microfinance institutions or nonprofits who vet the borrowers.

Over the years, Kiva has facilitated $1.5+ billion in loans to over 4 million borrowers in 90 countries. Notably, about 80% of Kiva loans go to women, and typical borrowers include farmers needing seeds, artisans, small shop owners, or students paying tuition.

Impact: Kiva’s crowdfunded approach has demonstrated the vast appetite of ordinary people to support financial inclusion.

The loans help borrowers start or expand businesses, increase their income, and improve their quality of life.

According to Kiva, 9 in 10 borrowers reported that a Kiva loan helped them grow their business and improve their household income.

And despite serving high-risk populations, Kiva boasts a ~96% historical repayment rate, busting the myth that the poor are not creditworthy.

Beyond direct loans, Kiva’s model has raised awareness and funds for the microfinance sector globally.

It also innovates with programs like Kiva U.S. (loans to underserved entrepreneurs in the States) and Kiva Protocol (digital ID for refugees).

By enabling a teacher in Canada to lend $25 to a tailor in Cambodia, and get repaid to lend again, Kiva has built a worldwide community advancing financial inclusion. It’s a shining example of technology empowering generosity and economic justice at the grassroots level.

PayJoy – Smartphones as collateral, unlocking credit for the underbanked.

PayJoy is a fintech that enables people with little or no credit history to access financing by using their smartphones as collateral.

Founded in 2015, the company partners with retailers and carriers to let customers purchase smartphones and other goods through affordable installment plans.

PayJoy’s proprietary technology allows lenders to lock or unlock the phone remotely, ensuring repayment while making credit more accessible to first-time borrowers.

Operating across Latin America, Africa, and Asia, PayJoy has become a gateway to the formal financial system for millions who previously had no way to access credit.

Impact: By linking credit to a device that people already use daily, PayJoy has extended financial access to millions of underbanked consumers worldwide, helping them build trust with formal lenders and paving the way for broader financial inclusion.

SoLo Funds – A community-based alternative to payday loans in America.

SoLo Funds is a U.S. fintech tackling the predatory payday loan industry by offering a peer-to-peer lending marketplace for small, short-term loans.

Founded by entrepreneurs Travis Holoway and Rodney Williams, SoLo Funds lets users who need, say, $200 to cover an emergency post a loan request on the app, which can be funded by other members.

Borrowers pay back on their next paycheck, possibly with a tip or “thank you” fee (voluntary) to the lender instead of formal interest. Loans are only up to $1,000 and for 1–4 weeks.

SoLo’s premise is to harness community capital to provide an affordable, non-predatory option when life happens.

The company has grown rapidly, becoming one of America’s fastest-growing fintechs, especially among underserved communities.

Impact: SoLo directly addresses the needs of the nearly 80% of Americans living paycheck-to-paycheck who might otherwise turn to payday lenders charging 300-600% APR.

By contrast, a SoLo loan might cost a small tip (often equivalent to a single-digit APR) and a nominal admin fee – dramatically less debt for the borrower.

This can help someone fix a car to get to work or pay a utility bill on time without falling into a debt spiral.

Importantly, SoLo also builds credit: it reports successful repayments, helping users improve their credit scores. The platform has cultivated a sense of financial community and empowerment, demonstrating that people are willing to help each other given the right tools.

FairMoney – Nigeria’s digital bank and loan app giving instant loans to the masses.

FairMoney started as one of Nigeria’s popular loan apps and has evolved into a licensed digital microfinance bank.

Via its Android app, users can get collateral-free personal loans in minutes, from about ₦1,500 up to ₦1,000,000 (roughly $4 to $2,500), depending on their history.

FairMoney uses algorithms to analyze user data (like phone records and bank SMS) to make credit decisions.

It also offers a spending account, bill payments, and recently, savings and investment products – becoming a full-stack financial app for those who often lack access to traditional bank credit.

With over 5 million users and 10,000+ loans disbursed daily, FairMoney has been a crucial source of quick funds in Nigeria.

Impact: In a country where an estimated 60 million adults are unbanked or underbanked, FairMoney has provided many with their first formal loans.

Customers use these small loans to cover urgent needs or grow micro-businesses, similar to other microfinance impacts.

What sets FairMoney apart is the speed and scale – a street vendor can download the app and get a loan within 5 minutes at any time, something inconceivable at a bank branch.

By proving the repayment capacity of users, FairMoney also helps integrate them into the financial system; some users graduate to larger loans or other products.

Esusu – Building credit and financial health for renters and immigrants in America.

Esusu is a U.S.-based fintech focused on closing the racial wealth gap by helping people build credit. It allows rent payments to be reported to credit bureaus, so that tenants (often with thin credit files) can boost their credit scores simply by paying rent on time.

Considering rent is the largest expense for many but traditionally didn’t count toward credit, Esusu’s solution is game-changing.

The company works with large landlords and public housing authorities: over 3 million rental units are on Esusu’s platform, enabling over 2.5 million renters to build credit history through rent reporting.

Esusu also offers zero-interest microloans for renters facing hardship, funded through a rotating capital pool (reflecting its name, which comes from a Nigerian savings circle concept).

Impact: Esusu has helped establish 189,000+ new credit scores for renters as of 2024. Many users have seen their scores jump from subprime to prime after a year or two of rent reporting, unlocking access to cheaper credit and financial products.

For example, over 12% of Esusu users improved from subprime to prime credit scores, a life-changing shift that can mean qualifying for a mortgage or a small business loan.

In tangible terms, Esusu reports that its users have since accessed billions in auto loans, student loans, and even mortgages thanks to credit score improvements.

Branch – Global mobile lending app bringing fast loans to millions (Kenya, Nigeria, India).

Branch is a prominent digital lending app that began in Kenya and has expanded to Nigeria, Tanzania, and India. Via the Branch app, smartphone users can apply for microloans 24/7 and receive money in their mobile money or bank account within minutes if approved.

Branch uses phone data and machine learning to score creditworthiness without paperwork. Loan sizes start small (e.g. $5) and grow with good repayment behavior, and interest rates are transparent.

Branch has been downloaded by millions and disbursed over $500 million in loans across its markets. It also attracted significant investment from the likes of the IFC and Visa, highlighting confidence in its model.

Impact: Branch directly tackles the credit gap where formal options are absent or too slow. In Kenya, for instance, many small traders and students have turned to Branch for quick cash flow support – whether to stock a shop or pay school fees – rather than resorting to shylocks or risky loan sharks.

The convenience (no need for collateral or guarantors) and speed are empowering; even people in rural areas can get a loan with a few taps if they have a smartphone. This kind of access was unheard of a decade ago.

Small Business & SME Lending: Fueling Entrepreneurship

Konfio – Mexico’s online lender unlocking credit for small businesses.

Konfío is a Mexican fintech that provides unsecured working capital loans to small and medium enterprises (SMEs) which often can’t get bank loans due to lack of collateral or credit history.

Using a proprietary credit algorithm, Konfío analyses data like online sales, invoices, and bank transactions to underwrite businesses in a few minutes.

SMEs can apply online and receive loans within 24–72 hours, far faster than traditional banks.

Loan sizes range based on business size, and Konfío also expanded into offering credit cards and B2B payments management.

It has become Mexico’s largest online SME lending platform, recognized for its impact on a segment that generates over half of Mexico’s employment but was largely credit-starved.

Impact: Konfío addresses a massive financing gap – in Mexico, only ~15% of SMEs had access to bank credit.

By 2021, Konfío had lent to tens of thousands of businesses, increasing SME lending by 68% in its portfolio even as bank SME lending shrank nationwide.

Its efficient digital process and use of alternative data (like connecting to SAT tax records) mean even “informal” semi-formal businesses can qualify if they have strong sales.

Lulalend – South Africa’s SME lender providing fast funding and now digital banking.

Lulalend is a Cape Town-based fintech offering quick online loans to small businesses in South Africa. SMEs can apply on Lulalend’s website by connecting their bank data or accounting software, and within hours receive a decision and potential access to funding up to R5 million.

The process is paperless and requires no collateral – a major departure from traditional banks’ lengthy, collateral-heavy SME loans.

Lulalend realized many healthy small businesses were cash-flow constrained and missing opportunities due to lack of timely credit.

Since launching in 2015, it has served thousands of businesses across sectors (retail, manufacturing, services).

In 2022, Lulalend also introduced Lula, a digital banking platform for SMEs, offering a business bank account with integrated cash flow management tools.

Impact: Lulalend’s financing has been a lifeline for businesses that lacked access to bank loans.

For example, during the pandemic, many SMEs turned to Lulalend to stay afloat when banks pulled back.

Its loans have supported companies in purchasing inventory in bulk (getting supplier discounts), buying new machinery to increase production, or bridging receivables gaps so they can pay salaries on time.

By providing funding within 24–48 hours, Lulalend helps entrepreneurs seize time-sensitive opportunities and avoid the cash crunches that often cripple small enterprises.

TiendaPago – Micro-loans for shopkeepers in Latin America to buy inventory on credit.

TiendaPago is a fintech operating in Mexico and Peru that addresses the working capital needs of corner stores and small shops (tiendas).

Many of these mom-and-pop stores struggle to pay upfront for inventory (like beverages, snacks) from distributors, limiting how much they can stock.

TiendaPago steps in by offering a short-term line of credit that the shopkeeper can use to purchase goods from partner suppliers.

Essentially, TiendaPago pays the supplier immediately, and the store owner repays TiendaPago within 1–2 weeks, aligning with their sales cycle.

The model is like a small B2B BNPL (Buy Now, Pay Later) for inventory.

TiendaPago’s credit is digital (accessible via SMS/WhatsApp) and they use transaction history and supplier references to underwrite.

It was listed among the top inclusive fintechs in Latin America.

Impact: By unlocking inventory financing, TiendaPago helps tiny retailers keep their shelves full and sales flowing. A corner store with TiendaPago credit can stock more sodas and chips (especially during peak seasons) without cashflow worries, thereby earning more revenue and serving their community better.

This increases their profitability and likelihood of success. It also strengthens the supply chain – distributors sell more and can extend reach into poorer neighborhoods confidently because TiendaPago guarantees payment.

For the shop owners, who are often family-run businesses, such credit provides stability (no need to borrow from loan sharks at high rates to stock up).

In Peru, TiendaPago has been shown to reduce stockouts by 80% and increase store sales because owners can carry broader product ranges.

Over time, as stores grow and establish credit history, they may graduate to bigger financial services.

First Circle – Financing small businesses and suppliers in the Philippines’ supply chain.

First Circle is a fintech in the Philippines that provides revenue-based financing to SMEs, especially those dealing with larger corporate or government purchase orders.

In the Filipino market, small suppliers often have to wait 30-60 days to get paid after delivering goods (common in B2B transactions), which strains their cash flow.

First Circle offers invoice financing and purchase order financing, advancing funds to SMEs so they can fulfill orders and grow.

Using data and fintech speed, it makes applying easy and evaluates credit based on business health and contract quality.

It has become a vital funding source for hundreds of local businesses that don’t have access to bank credit.

Impact: First Circle’s loans have helped SMEs take on bigger projects and clients, knowing they can count on working capital.

For instance, a small furniture manufacturer could accept a large hotel furnishing order because First Circle finances the materials and labor costs upfront, and then gets repaid when the hotel pays.

This allows SMEs to climb the value chain and increase revenues, which in turn creates jobs. On a macro level, First Circle is tackling the Philippines’ notoriously high SME financing gap – by some estimates, only 10% of Filipino SMEs are adequately financed.

Through partnerships with government agencies and supply chain platforms, First Circle has also improved trust in SME lending. Its model often reduces the need for collateral by focusing on the strength of receivables, thus democratizing credit for businesses without property to pledge.

Asaak – Asset financing for motorcycle taxi drivers and gig workers in Uganda.

Asaak is a Ugandan fintech that provides loans for income-generating assets – notably motorcycles (boda bodas) – to unbanked individuals like moto-taxi drivers.

In East Africa, owning a motorcycle can be a path to steady income, but many drivers rent motorcycles daily because they can’t afford to buy one outright or lack credit to finance it.

Asaak changes that by offering lease-to-own financing: drivers get a motorcycle upfront and repay in installments from their earnings.

Asaak assesses applicants through data from ride-hailing apps (like Uber, SafeBoda partnerships), driving history, and even smartphone data. Since 2016, Asaak has financed thousands of motorcycles and smartphones for drivers, enabling them to become owners.

Impact: By turning renters into owners, Asaak dramatically improves the income of its clients. A driver who owns his motorcycle keeps all his earnings minus maintenance, whereas previously a large cut went to rental fees.

Over the loan period, drivers on Asaak typically end up owning the asset in 12–15 months, after which their take-home income increases substantially.

Asaak has also been shown to improve drivers’ quality of life – many open bank accounts for the first time to handle repayments, and some even use the motorcycle ownership as collateral for other needs (Asaak provides digital proof of ownership).

According to reports, Asaak has financed over 50,000 clients with productive assets, a number that includes drivers who now have financial stability and the dignity of ownership.

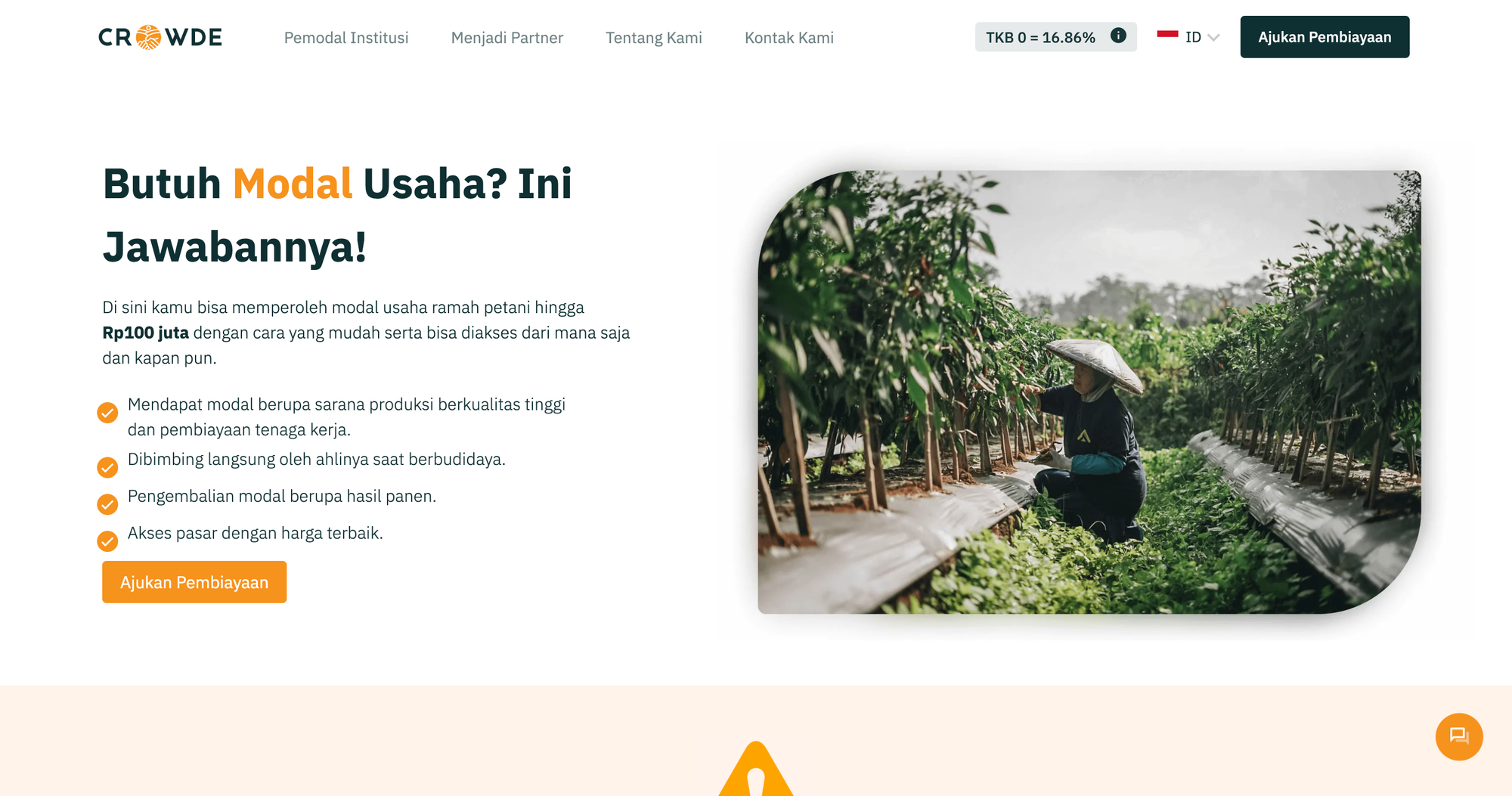

Crowde – Crowdfunding agriculture in Indonesia to fund farmers’ projects.

Crowde is an agri-fintech startup from Indonesia that connects small farmers with retail and institutional investors willing to fund their farming projects.

Think of it as Kickstarter for farmers: a farmer needs capital for, say, a rice planting season or a poultry business expansion – Crowde pools funds from the crowd to finance inputs and operations, and investors get repaid with a share of the profits.

By 2020, Crowde had financed thousands of farmers, enabling them to break out of the cycle of relying on middlemen or loan sharks.

Crowde leverages technology for transparency and monitors projects closely to manage risk (even taking physical commodity as collateral in some cases).

Impact: Agriculture employs many Indonesians, yet farmers are mostly unbanked and struggle to get loans.

Crowde changes that by providing accessible financing tailored to agricultural cycles (repayments come after harvest). This has allowed farmers to adopt better seeds, fertilizers, and techniques, thereby boosting yields and income.

In a broader sense, Crowde contributes to food security and rural development by injecting much-needed capital into the agricultural sector where traditional finance has shied away.

It demonstrates a scalable way to crowd-solve the perennial issue of financing smallholder farming, with fintech efficiency.

By empowering farmers financially, Crowde helps them become more prosperous and resilient, while giving everyday people a chance to invest in and impact their communities’ agricultural success.

ShopUp – Bangladesh’s one-stop platform providing small shops with inventory, logistics, and financing.

ShopUp is a fast-growing startup in Bangladesh that offers a suite of services to small retail shops (the many neighborhood stores known as “mudir dokan”).

Through its app, ShopUp allows shopkeepers to order wholesale inventory from a vast range of products at good prices (via its supply arm called “Bazaar”), get next-day delivery through its logistics network (“RedX”), and crucially, access buy-now-pay-later financing for these stock purchases.

In partnership with banks, ShopUp gives short-term credit so the stores don’t have to pay upfront. By 2023, ShopUp was serving hundreds of thousands of merchants and had raised significant funding to become one of Bangladesh’s largest tech startups.

Impact: Bangladesh has millions of mom-and-pop stores forming the backbone of retail, but they have long been inefficient in restocking and cut off from formal credit.

ShopUp is revolutionizing that – shops on its platform reportedly increased their sales and income because they can carry more variety and avoid stockouts.

The BNPL financing means even a small shop can load up before big festivals or seasons and pay after selling, which smooths their cash flow.

Shopkeepers also save time and transport costs by ordering via app instead of traveling to wholesale markets. Meanwhile, ShopUp’s logistics improvements benefit consumers with fresher goods and the overall supply chain becomes more resilient.

In essence, ShopUp is supercharging small businesses – helping them thrive in the modern economy with the tools and financing they need.

Siembro – Argentina’s agri-fintech linking farmers to lenders at the point of sale.

Siembro is an online platform in Argentina that makes it easier for farmers to access credit when purchasing agricultural inputs and machinery.

It acts as a marketplace connecting farmers (borrowers) with multiple financial institutions (lenders) right at the dealer or supplier’s shop.

When a farmer is buying a tractor or seeds, instead of negotiating separate bank loans (which can be slow), the dealer can use Siembro to offer on-the-spot financing options from partnering banks or fintechs in a seamless process.

Siembro leverages digital applications and data to approve loans faster and under better terms.

This opens up rural credit which is otherwise often limited.

Impact: Agriculture is a major part of Argentina’s economy, but volatile macro conditions and high interest rates have made credit expensive and scarce for farmers. Siembro helps by increasing competition among lenders and simplifying the borrowing process for farmers.

They can get tailored loan offers within hours, ensuring they don’t miss the planting window due to financing delays.

By 2022, Siembro had facilitated hundreds of such equipment and input loans, supporting growth for medium and small farms.

It especially aids farmers who might not have strong existing bank relationships – via Siembro, even a lesser-known regional bank or a fintech will finance them if data shows their farm is productive.

Blockchain & Web3 for New Frontiers

Celo – A purpose-driven Ethereum Layer 2 powering global financial inclusion

Celo has evolved into a leading Ethereum Layer 2 (L2), positioning itself as the frontier chain for global impact.

Secured by Ethereum, Celo delivers high scalability, ultra-low costs, and intuitive user experiences designed to bring the next billion people into the digital economy.

With an average block time of 1 second, transaction fees around $0.0004, and the ability to pay gas in stablecoins and ERC20 tokens, Celo removes many of the frictions that have historically excluded underserved communities from blockchain-based financial services.

The ecosystem has already processed over 936 million transactions, with 641,000 daily active users and $1.7 billion in monthly stablecoin volume.

Beyond numbers, Celo integrates real-world impact into its core: the network has offset 3,845 tons of CO₂ while securing more than $402 million in total value.

Its modular stack includes OP-Stack L2, EigenDA v2 for scalable data availability, and a zkEVM via Succinct SP1 to ensure interoperability and security.

Impact: By prioritizing accessibility, sustainability, and mobile-first experiences, Celo empowers builders and communities to launch apps that solve real-world problems – from low-cost remittances to community currencies and microloans.

Through programs like Proof-of-Ship, Celo funds entrepreneurs creating solutions that scale inclusion globally.

Its vision is ambitious yet clear: to build a trillion-dollar onchain economy that is both regenerative and accessible, ensuring that blockchain innovation delivers prosperity for all, not just the few.

Gluwa – Blockchain-based credit and savings, bridging investors and underserved markets.

Gluwa is a fintech that uses blockchain to connect global investors with credit opportunities in underserved markets. Instead of requiring traditional collateral or restricting lending to crypto-native borrowers, Gluwa partners with financial institutions in emerging economies to offer real-world loans funded by decentralized capital.

Through its credit and savings platform, anyone with internet access can provide capital, while local partners use that liquidity to extend loans to consumers and small businesses who are often excluded from traditional banking.

Founded in the U.S., Gluwa focuses on expanding access to financial products in regions like Africa, Latin America, and Southeast Asia. Its system is designed to work across borders, leveraging stablecoins and blockchain transparency to make lending more efficient, trustworthy, and inclusive.

For borrowers, this means affordable access to credit. For lenders, it creates a chance to invest in emerging markets responsibly, with blockchain ensuring accountability.

Impact: By bypassing restrictive banking systems and connecting global liquidity to local financial needs, Gluwa is pioneering a new model of cross-border inclusion. It not only unlocks credit for people who would otherwise be left out but also builds a transparent bridge between global investors and the communities that need capital most.

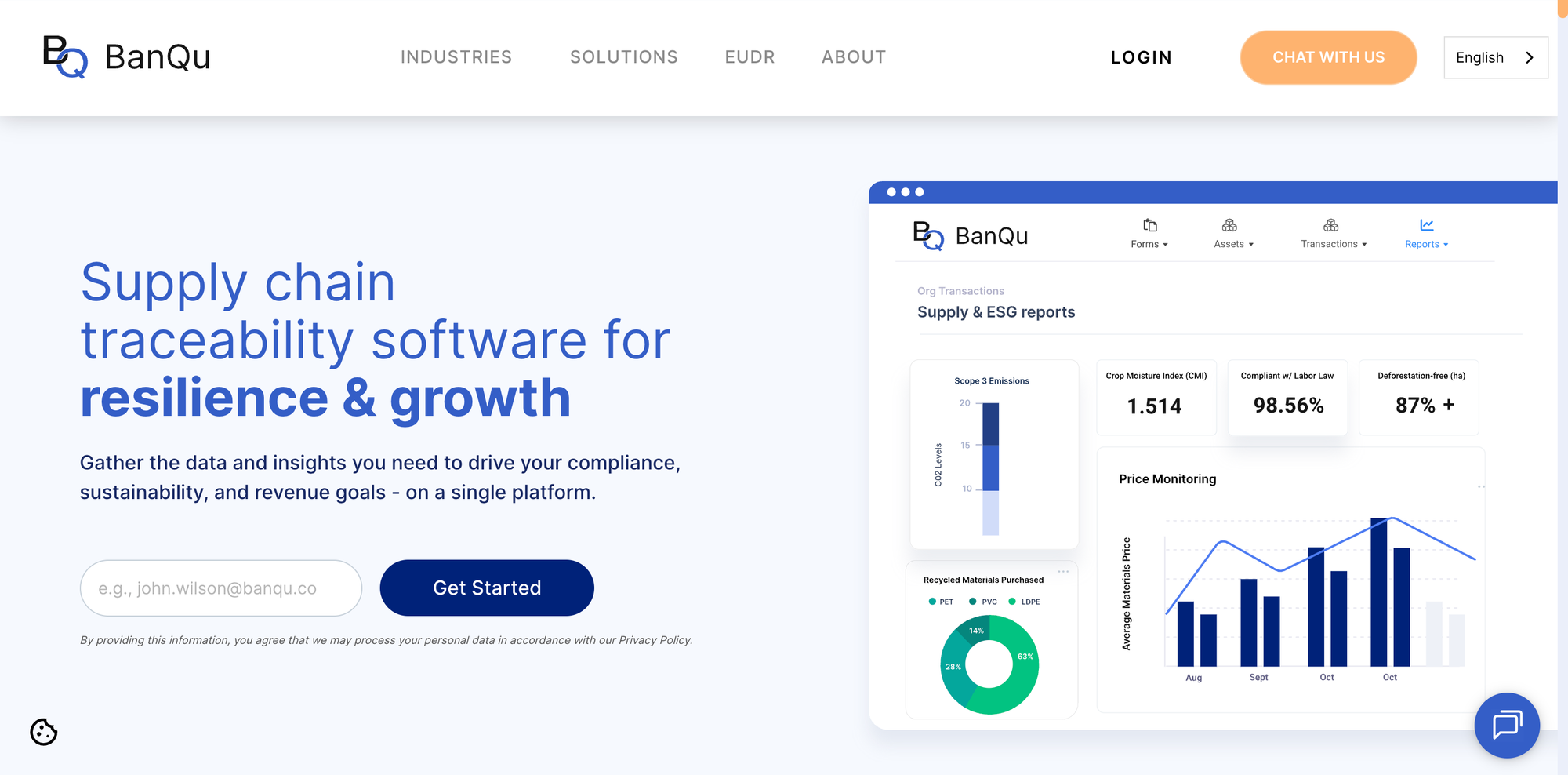

BanQu – Blockchain-based economic identities connecting unbanked farmers and workers to global supply chains.

BanQu is a US/South Africa-based startup using blockchain (non-crypto) to create a digital economic identity for people at the very ends of supply chains – like smallholder farmers, recyclers, or factory workers – so they can prove their transactions and get credit for their work.

The platform records every transaction (for instance, a farmer selling crops to a processor) on an immutable ledger, generating a history that the user owns. This history can serve as proof of income and reputation that previously didn’t exist on paper for them.

BanQu partners with large companies (e.g. AB InBev, Coca-Cola) which integrate it to improve traceability and also include their base-level suppliers in the formal economy.

As of 2021, BanQu was active in 40+ countries, making 300,000+ digital connections a day, and had onboarded at least 600,000 people onto its network.

Impact: BanQu turns an “invisible” person in the supply chain into a visible one. For example, a cassava farmer in Zambia using BanQu can show a digital record of all deliveries and payments from Zambian Breweries (AB InBev).

Equipped with that, she can open a bank account or get a microloan whereas a year prior a banker literally said “I can’t bank her”.

BanQu essentially gives unbanked people a “bankable” economic passport by validating their contributions in global trade.

The results have been uplifting: one program saw small farmers increase incomes and one mother of 13 was able to triple her cassava sales in a year once in the system.

Similarly, waste pickers using BanQu in Latin America gained access to financial services and better working conditions when big recyclers started recognizing them as suppliers and paying via digital means.

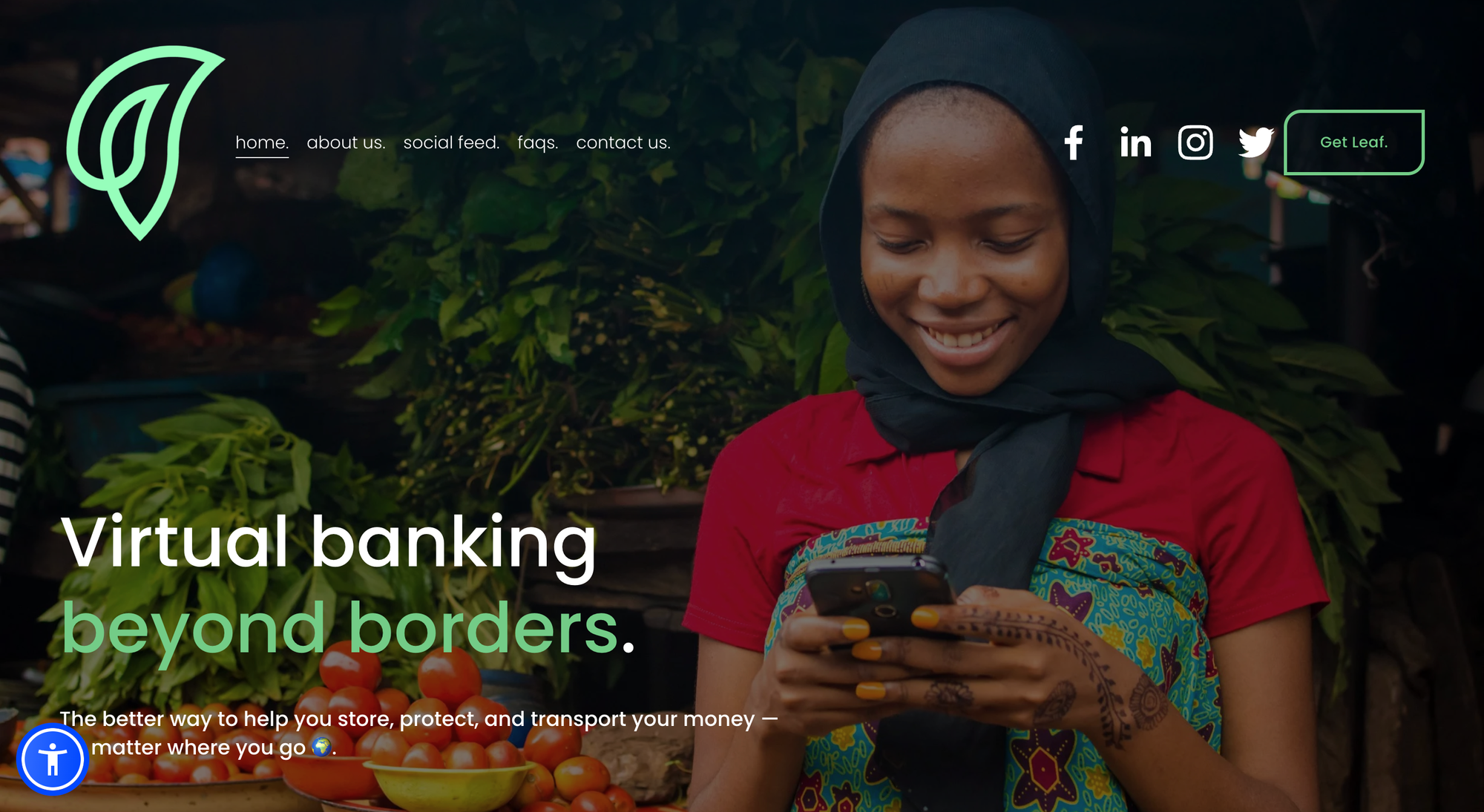

Leaf Global Tech – A virtual bank for refugees and cross-border traders.

Leaf Global is a fintech leveraging blockchain to help refugees and migrants safely store and transport their money across borders.

Often, people fleeing conflict or disaster must carry cash (risking theft) or leave assets behind. Leaf provides a virtual wallet accessible via a basic mobile phone (no smartphone needed).

Users in, say, a refugee camp can deposit local currency at a Leaf agent, it gets converted to a stable digital value (US dollar or Rwandan franc token) on a blockchain, and they can later withdraw in another country by converting to that local currency.

Essentially, it’s like a cross-border mobile bank account you can open without an ID or address – crucial for displaced populations.

Leaf launched in East Africa (Rwanda, Uganda, Kenya) targeting Congolese refugees and cross-border market vendors.

Impact: Leaf gives vulnerable people financial security and continuity. A refugee woman can arrive in a new country and still access savings she stored with Leaf, enabling her to rebuild faster.

It also facilitates remittances: family members separated by conflict can send value through Leaf cheaply and immediately.

For cross-border petty traders (like those selling goods between DRC and Rwanda), Leaf removes the need to change money at predatory rates each trip – they can keep a float in Leaf and withdraw what they need, saving on fees.

In pilot communities, users reported feeling safer and more empowered; some even used Leaf’s transaction history as informal proof of income to gain trust with local merchants or landlords.

As conflicts and climate displacements unfortunately continue globally, solutions like Leaf could scale to provide a financial lifeline to millions of the world’s most vulnerable, ensuring they are not financially erased when they lose everything else.

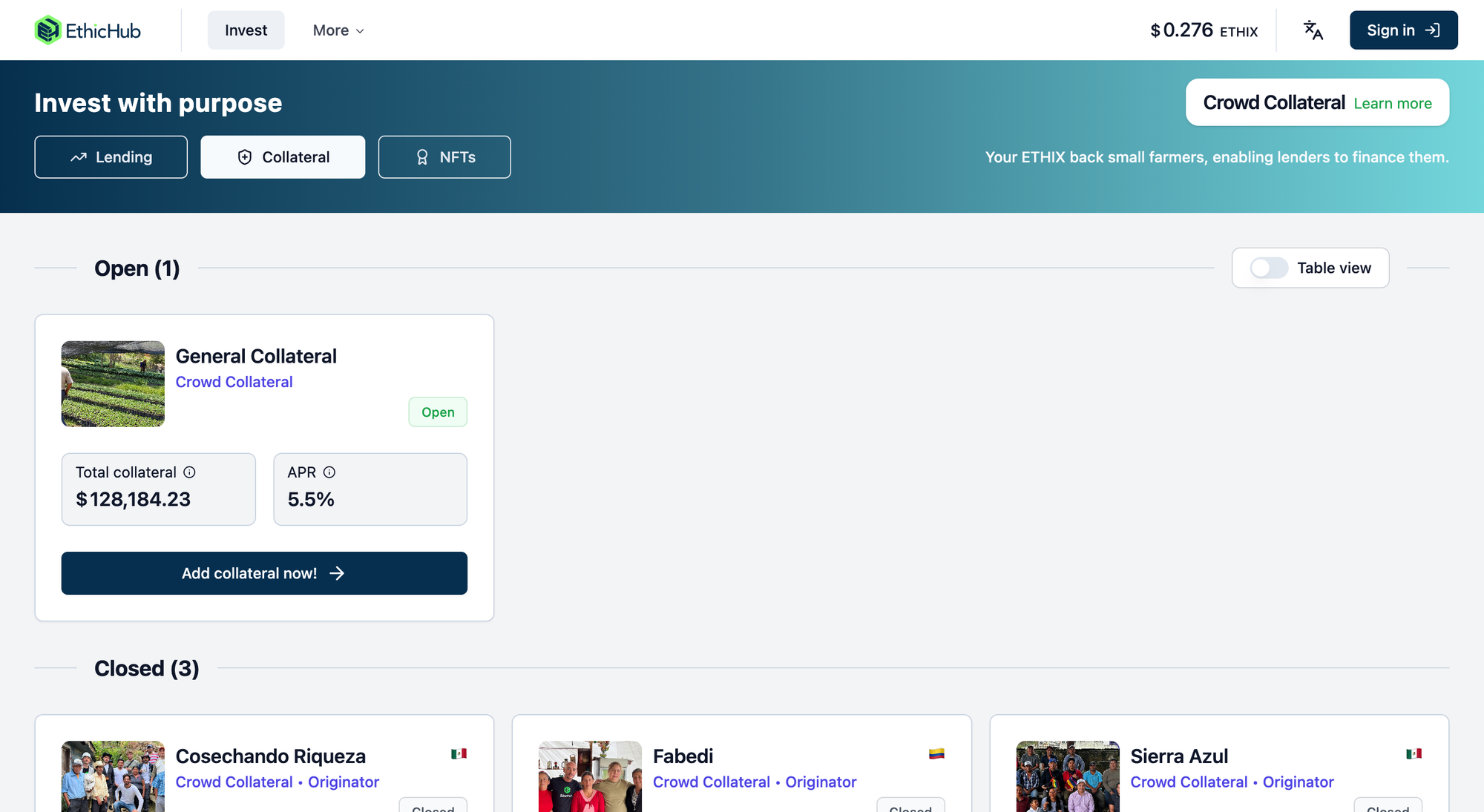

EthicHub – DeFi crowdlending connecting global crypto-lenders to unbanked coffee farmers.

EthicHub is a Spain/Mexico-based platform that uses blockchain and crowdfunding to finance smallholder farmers (initially coffee cooperatives in Latin America) at affordable rates.

Here’s how it works: impact-minded lenders anywhere can contribute cryptocurrency (e.g. stablecoins) into lending pools on EthicHub’s platform; those funds are then loaned to groups of unbanked farmers in countries like Mexico, Brazil, Honduras, to invest in their crops.

Smart contracts and community “co-signers” are used to secure the loans. Lenders earn modest interest in crypto, and farmers get loans in local currency at much lower interest than local informal lenders charge.

EthicHub also helps farmers sell their coffee to specialty markets, improving income.

Impact: EthicHub creates a win-win: farmers who typically had to borrow at 50-100% interest annually (if at all) now can access dollars at under 15%, and lenders get both financial and social returns.

By 2022, EthicHub had funded dozens of coffee and cacao cooperatives, benefiting hundreds of farming families, and the repayment rate has been strong.

One concrete result: coffee farmers in Chiapas, Mexico through EthicHub increased their annual income significantly by both getting cheaper financing and selling their beans at better prices via EthicHub’s marketplace.

Kotani Pay – Connecting Africa’s mobile money to blockchain, enabling crypto remittances and DeFi access.

Kotani Pay is a Kenya-based startup providing a technology bridge between crypto and local mobile money platforms (like M-Pesa) via simple interfaces (USSD menus, APIs).

Essentially, Kotani Pay allows users to send, receive, and convert crypto through text-based commands on any mobile phone, with settlement into or out of mobile money.

This is huge for financial inclusion because it brings blockchain capabilities (like cross-border payments, stablecoin savings, etc.) to people without smartphones or internet. Kotani Pay has been deployed in projects like enabling diaspora remittances: e.g., an NGO used it to transfer stablecoins to South Sudanese refugees, which they withdrew as local cash seamlessly.

Impact: Kotani Pay tackles two inclusion challenges: accessibility of crypto services for the bottom of the pyramid, and interoperability between the old and new financial systems.

By making blockchain rails usable on basic phones, Kotani opened up new possibilities: families can receive international aid or remittances faster and cheaper than Western Union, all through a normal phone – they might not even realize crypto is involved.

One example is a project where solar energy entrepreneurs in refugee camps were paid in a stablecoin (cUSD on Celo) for excess energy they sold, and they could cash it out to M-Pesa to buy necessities.

Kotani also empowers local innovators: African DeFi and GameFi platforms can plug into its API to offer cash-in/cash-out to users, making their solutions more viable in low-income markets.

In the bigger picture, Kotani Pay is accelerating the adoption of stablecoins and crypto in Africa for real utility – savings in USD stablecoins to hedge inflation, borrowing from DeFi platforms, and so on – by solving the last-mile problem.

Strike (Lightning Network) – Instant global remittances using Bitcoin Lightning, reaching the unbanked.

Strike is a US-based fintech app that leverages the Bitcoin Lightning Network to enable instant, low-cost money transfers globally, often without users even touching Bitcoin themselves.

Strike gained fame when El Salvador used it to implement Bitcoin as legal tender – Salvadorans can receive remittances from the US via Strike almost instantly and convert to dollars, saving up to 70% on fees compared to Western Union.

Strike basically allows a sender to pay in their local currency (deducted from bank or card), it converts that to BTC on the Lightning Network to zip across borders in seconds, then converts to the recipient’s local currency.

This means a user can send $10 from Chicago to a friend in Nigeria and the friend gets Naira in their bank, in less than a minute, with negligible fee.

Impact: Strike is shrinking the cost and time of remittances and international payments to near-zero, which especially benefits the unbanked or underbanked who rely on remittances.

For example, the average fee to send money to Africa is ~8%; Strike can do it for pennies. This can put billions of dollars of extra income into the hands of families.

In El Salvador, following Strike’s introduction, millions who didn’t have bank accounts started using the Chivo digital wallet (which integrated Strike), leading to greater financial inclusion – nearly 4 million Salvadorans (70% of adults) now have a digital wallet, many for the first time.

Strike has since expanded to markets like the Philippines, enabling cheap US-to-Asia transfers benefiting gig workers and families.

As Strike continues to expand in Latin America, Africa, and Asia, it could significantly erode the monopolies of traditional remittance firms, forcing them to lower costs as well.

Ultimately, Strike illustrates how Bitcoin’s network can be harnessed not for speculation but for practical, inclusive finance, connecting communities and allowing money to flow as freely as information.

Final Word

These fintech startups and initiatives together paint an inspiring picture of a global movement toward financial equity.

From the bustling markets of Lagos and Dhaka to rural villages in Kenya and farms in Mexico, they are breaking down financial barriers and bringing essential services to those long excluded.

Crucially, they show that financial inclusion is not just about charity – it’s about innovation and opportunity. Digital banks are proving the unbanked can be valuable customers when served with respect and low fees.

Remittance platforms and crypto-tools are slashing costs, putting more money into families’ pockets. Microloan providers and SME financiers are fueling entrepreneurship, demonstrating that with a little credit or layaway plan, people can uplift themselves and their communities.

Yet, even as we celebrate these pioneers, we must acknowledge ongoing challenges. Over 1.4 billion people remain unbanked globally, and billions more are underserved by expensive, inefficient services.

Encouragingly, the trend is toward collaboration. These startups aren’t working in isolation: we see partnerships between fintechs and traditional banks, between crypto innovators and development agencies, between telcos and tech hubs.

The 50 stories above also highlight the importance of impact investment – mission-driven capital that sees the long-term social and financial returns of inclusion.

Whether you’re an impact investor, a philanthropist, a corporate leader, or a conscious consumer, there are myriad ways to support this movement.

It could be by investing in or mentoring an inclusive fintech in your region, advocating for fairer financial policies, or simply using and promoting services that align profit with purpose.