Impact investing is a strategy where investments are made in companies, organizations, and funds with the intent to generate a measurable, beneficial social or environmental impact alongside a financial return.

This approach to investing marks a shift from traditional investment strategies that focus solely on financial gains, without considering the social and environmental consequences.

Key Features of Impact Investing

- Dual Objectives: Impact investments aim to achieve both financial returns and positive social or environmental outcomes. Investors are not just concerned with what profits a venture can generate, but also how it benefits the planet and its people.

- Measurement of Impact: Unlike traditional investments, impact investing requires the measurement and reporting of both financial performance and social/environmental results. This transparency ensures accountability and the genuine pursuit of dual objectives.

- Diverse Sectors and Geographies: Impact investments can be made in a variety of sectors such as renewable energy, sustainable agriculture, healthcare, education, microfinance, and affordable housing. These investments are global, spanning both developed and developing countries.

- Range of Asset Classes: Impact investing can occur across all asset classes, including but not limited to venture capital, private equity, debt, and fixed income.

The Growth of Impact Investing

The impact investing market is still relatively small, but it is growing rapidly. In 2017, impact investing was estimated to be a $228 billion market.

This is expected to grow to $1 trillion by 2025.

The growth of impact investing has been driven by increasing interest from individuals, institutions, and governments.

There are a number of different ways to measure impact. The most common approach is to use the United Nations Sustainable Development Goals (SDGs) as a framework.

The SDGs provide a comprehensive and globally-agreed upon set of targets for sustainable development. Many impact investors measure their impact against one or more of the SDGs.

The concept of impact investing has gained significant momentum over the past decade, reflecting a growing recognition that capital can and should work for more than just profit.

This trend is driven by:

- Increasing Awareness: More investors are aware of global challenges like climate change, inequality, and resource scarcity, and want their money to work towards solving these issues.

- Investor Demand: A substantial number of individual investors, particularly millennials, demand investment opportunities that align with their values.

- Evidence of Effectiveness: There is increasing evidence that suggests that impact investing can compete with or even exceed the returns and stability of traditional investments.

Investing in Impact Podcast: Our podcast interviews impact investors and VC’s from around the world to connect impact entrepreneurs with insight into funding, scalability, and company structure to inspire more impact companies around the world. Subscribe on Apple Podcasts | Spotify

Impact Investing Examples

- Renewable Energy: Investing in renewable energy projects, such as solar or wind farms, to reduce reliance on fossil fuels and combat climate change.

- Affordable Housing: Investing in affordable housing initiatives to address housing shortages and improve access to safe and affordable homes for low-income individuals and families.

- Microfinance: Providing capital to microfinance institutions that offer financial services, such as small loans and savings accounts, to empower entrepreneurs and individuals in underserved communities.

- Regenerative Agriculture: Supporting regenerative farming practices and agricultural technologies to enhance food security, promote organic farming, and reduce the environmental impact of agriculture.

- Education: Investing in education-focused initiatives, such as schools, vocational training programs, or educational technology platforms, to improve access to quality education and skill development, particularly in disadvantaged communities.

- Impact Bonds: Investing in social impact bonds, also known as pay-for-success bonds, which fund social programs aiming to achieve specific social outcomes. Investors receive returns based on the success of the program in achieving predetermined objectives.

- Healthcare: Investing in healthcare startups and companies or healthcare infrastructure projects to improve access to quality healthcare services, particularly in underserved regions or low-income communities.

- Clean Technology: Investing in companies developing innovative clean technologies and solutions for energy efficiency, waste management, water conservation, and pollution reduction.

- Social Enterprises: Investing in businesses that have a primary social or environmental mission, such as fair trade enterprises, sustainable fashion brands, or organizations providing employment opportunities to marginalized communities.

- Impact Funds: Investing in specialized impact funds that pool capital from multiple investors to finance a diverse portfolio of impact-focused companies and projects across various sectors.

Benefits of Impact Investing

- Social and Environmental Impact: Provides capital to address pressing global challenges.

- Financial Returns: Offers competitive returns to investors, which can be comparable to traditional investments.

- Market Growth: Contributes to the growth of sectors that are crucial for sustainable development.

- Innovation Promotion: Encourages innovation in areas critical for social and environmental progress.

Challenges Facing Impact Investing

- Measurement Standards: There is a need for standardized metrics to measure and compare the impact of investments.

- Market Size: The market is growing but is still relatively small compared to traditional investment vehicles.

- Perception of Risk: Some investors perceive impact investments as riskier than conventional options.

Below are financial ventures changing the world through social impact investing.

Whether they are investing in organic farmland, fintech, innovative entrepreneurs, or sustainable energy, these companies, entrepreneurs and organizations are using their funds to create a better, more sustainable world.

Impact Investing Firms and Ventures Changing the World Through Finance

Lowercarbon Capital

Lowercarbon Capital supports innovative companies that generate substantial revenue while significantly reducing CO₂ emissions, capturing carbon from the atmosphere, and helping mitigate climate change.

While activists play a vital role, Lowercarbon Capital believes that the path to a brighter and cooler future lies in market-driven solutions rather than relying on shame and guilt.

This approach is not about charity; it's about recognizing that environmental sustainability is sound business practice.

Lowercarbon Capital is ready to provide initial funding and continue investing as your company grows. If you are developing a startup that aims to combat global warming while achieving financial success, consider reaching out to them.

Pay it Forward Ventures

Pay it Forward invests in source-solving rather than symptom-solving. They fund and found ventures creating new paradigms. And we donate 20% of GP profits to philanthropy, because we believe in paying it forward.Build better lives for billions

The portfolio selects investments based on their potential to create new paradigms and bring them to market, emphasizing strong business fundamentals, strategic planning, and favorable market conditions.

Gratitude Railroad

At its core, Gratitude Railroad is a community-driven impact investment firm. The organization invests in early-stage companies and emerging fund managers that are working at the intersection of planetary health, social well-being, and equitable innovation.

Over the past decade, the firm has helped catalyze hundreds of millions of dollars into the impact economy, building a robust portfolio of ventures tackling urgent global challenges—from climate change to economic inequality.

But Gratitude Railroad is more than just a capital allocator. It’s a community—a collective of investors, entrepreneurs, and change agents who bring not only financial resources but also intellectual and social capital to the table.

Backstage Capital

Backstage Capital is a venture capital firm dedicated to addressing the funding inequities in the startup ecosystem. Founded by Arlan Hamilton, Backstage Capital has positioned itself as a crucial player in supporting underrepresented founders.

The firm's focus is on providing capital to startups led by women, people of color, and LGBTQ+ individuals.

Since its inception, Backstage Capital has invested in over 200 companies across various sectors, demonstrating a firm commitment to fostering diversity and inclusion in the venture capital space.

One of the core principles of Backstage Capital is the belief that diversity not only enhances creativity and innovation but also drives better financial returns.

This conviction has propelled the firm to not only invest but also to actively engage in building a supportive ecosystem for its portfolio companies.

Backstage Capital offers extensive support to its investees, ranging from mentorship and networking opportunities to strategic advice, underscoring its dedication to ensuring the success of its founders.

The firm's impact extends beyond financial investment, as it continually seeks to break down barriers and create a more inclusive industry.

Grantham Foundation

The Grantham Foundation’s impact investing arm focuses on identifying and funding early-stage climate innovations that have the potential to reshape critical sectors, particularly those that are often overlooked or considered too risky by traditional venture capital.

With a strong emphasis on environmental sustainability, the foundation supports ventures that aim to redesign energy systems, enhance soil health, protect oceans from acidification, and develop solutions for direct carbon capture.

These investments target some of the most pressing environmental challenges, offering innovative technological solutions to create a more sustainable future.

Through its environmental venture capital vehicle, Neglected Climate Opportunities LLC, the Grantham Foundation invests in areas that lack significant funding, often stepping in as the first capital provider to promising startups.

These investments range from companies improving carbon storage and agricultural sustainability to those advancing renewable energy technologies and carbon sequestration.

Global Ventures

Global Ventures is a growth-stage venture capital firm based in the United Arab Emirates, focused on supporting mission-driven founders building transformational technologies in emerging markets.

The firm invests in sectors critical to the region’s future—including digital health, fintech, climate, logistics, and enterprise software—and works closely with founders to navigate the complex challenges of scale, market access, and infrastructure constraints.

Since its founding, Global Ventures has backed over 60 companies across 10 countries, with a commitment to investing in resilient business models capable of delivering both financial performance and social value.

Breakthrough Energy

Breakthrough Energy is dedicated to advancing the global transition to clean energy and achieving net-zero greenhouse gas emissions by 2050.

Recognizing the urgency of addressing climate change, Breakthrough Energy invests in innovative technologies and policies that transform how we power our lives, produce goods, and move around.

Their initiatives, including Breakthrough Energy Ventures, BE Fellows, and BE Catalyst, support cutting-edge research and emerging climate solutions to reduce the “Green Premium” and accelerate global adoption.

Through collaboration with policymakers, industry leaders, and innovators, Breakthrough Energy is driving solutions for a healthier, more sustainable, and equitable future powered by clean energy.

Mission Driven Finance

Mission Driven Finance is a private impact asset management firm redefining how capital flows to underserved communities. By pioneering a financial model that bridges the gap between philanthropy and traditional investments, the firm is dedicated to making community-centered investing both accessible and transformative.

With a focus exclusively on private market impact transactions, Mission Driven Finance addresses the funding gaps often overlooked by traditional lenders. This approach empowers bold visions, innovative enterprises, and high-potential community initiatives to achieve sustainable growth and lasting impact.

The firm collaborates with a diverse network of partners, including foundations, health organizations, banks, and community development institutions, to build an integrated ecosystem of support.

Among its notable supporters are The California Endowment, Conrad N. Hilton Foundation, Surdna Foundation, and the San Diego Foundation, all of which share a commitment to fostering equitable economic opportunities.

Norrsken VC

Established in Sweden in 2017 by a group of forward-thinking impact capitalists, Norrsken VC serves as the venture capital division of the Norrsken Foundation.

Its mission is to direct more capital towards entrepreneurs dedicated to building impactful businesses.

A prominent player in Europe’s venture capital scene, Norrsken VC holds the designation of an SFDR Article 9 or "Dark Green" fund.

This status underscores its commitment to sustainability, with each investment directly contributing to at least one of the United Nations' 17 Sustainable Development Goals (SDGs).

The team is dedicated to working closely with every startup in the portfolio, assisting them in defining, measuring, and amplifying their impact.

LeapFrog Investments

LeapFrog Investments is a private investment firm founded in 2007 by Dr. Andy Kuper with a bold mission: to deliver "Profit with Purpose."

Specializing in emerging markets across Asia and Africa, LeapFrog backs high-growth companies that provide essential services such as healthcare, financial inclusion, and climate solutions — transforming the lives of underserved consumers while generating strong financial returns.

Today, LeapFrog’s portfolio companies serve over 537 million people, including 359 million emerging consumers gaining access to critical services for the first time. Collectively, these investments have supported more than 241,000 jobs and livelihoods across 37+ countries.

With nearly $3 billion in capital commitments from top global institutions, LeapFrog typically invests between $20–75 million per company, achieving an impressive average annual growth rate of 23% across its portfolio. Recognized by Fortune as one of the Top 5 Companies to Change the World, LeapFrog is redefining the role of private capital in creating systemic, sustainable impact.

LeapFrog is also a global leader in impact measurement and accountability. As a signatory of the UN Principles for Responsible Investment (with an A+ rating) and a founding Investors Council Member of the GIIN, the firm sets a high bar for transparency and real-world results.

Looking ahead, LeapFrog aims to impact one billion lives, proving that capital markets can be a powerful force for inclusive growth, resilience, and opportunity—especially where it is needed most.

Astanor Ventures

Astanor is an impact investor, delivering financial, social and environmental returns in equal measure.

They believe in the future of an agrifood system that provides affordable nutrients for 10 billion people, preserves and regenerates natural resources, actively contributes to decarbonization and protects land and ocean biodiversity.

Astanor is driven by a pressing urgency to combat climate change, biodiversity loss and improve the health of humanity and the planet.

Sustainability and impact were part of the firm’s founding principles and remain an area they are committed to excel in.

The mission as impact investors is to find, support and scale the most disruptive, impactful solutions to accelerate progress towards global sustainability targets.

Regeneration.VC

Regeneration.VC is a venture capital firm focused on investing in early-stage Consumer ClimateTech innovations that aim to transform consumption patterns and regenerate value chains in alignment with planetary boundaries.

The firm recognizes the urgent need to reduce humanity's environmental footprint, as we currently consume nearly double what the Earth can sustainably replenish.

By supporting circular and regenerative innovations, Regeneration.VC helps businesses that are developing groundbreaking solutions to help humanity thrive within the Earth's natural limits.

Their portfolio includes pioneering companies in areas like sustainable materials and AI-driven waste recovery.

Rubio Impact Ventures

Since its inception in 2014, Rubio Impact Ventures has been one of the first and largest impact funds in Europe, with currently EUR 150 million AuM across Fund I and II.

They have the highest Phenix Impact GEMS Score thanks to their unique and strict procedure to set and trace impact targets, their independent Impact Advisory Board and 100% impact linked carry structure.

Every year, Rubio publishes an impact report showing the social and environmental value they are creating with portfolio companies.

New Climate Ventures

New Climate Ventures is an early-stage venture capital firm that invests in innovative companies focused on reducing and avoiding carbon emissions.

The firm adopts an active and diversified investment approach, leveraging its extensive experience across energy, food/agriculture technology, climate technology, traditional technology, finance, regulatory affairs, market analysis, and investing.

New Climate Ventures partners with entrepreneurs to help them navigate the early stages of company development and growth.

By applying its operational, investment, team-building, and mentoring expertise, along with providing access to its global network of investors, startups, and corporations, the firm aids founders in achieving success.

Working Capital Fund

The Working Capital Fund is on a mission to improve the lives of marginalized workers, catalyzing economic justice by investing in innovative solutions that address the deep-seated challenges of global supply chains.

Global supply chains are enormous, involving millions of workers across thousands of businesses. On average, a Fortune 500 company works with over 10,000 suppliers, producing the goods that consumers rely on daily.

However, these supply chains are often associated with some of the most pressing challenges humanity faces, including forced labor, unfair wages, and environmental degradation.

Annually, over $354 billion worth of goods are at risk of being tainted by forced labor, with more than 17 million workers trapped in modern slavery conditions.

These challenges are often hidden deep within supply chains, making them difficult to detect and resolve. Moreover, supply chains are a primary contributor to greenhouse gas emissions, exacerbating the climate crisis.

Achieve Partners

Achieve Partners is a private equity firm that focuses on investing in companies that align with its mission to address the skills gap and promote workforce development.

The firm specializes in industries where there is a critical need for skilled workers and partners with companies that are committed to providing high-quality training and education to meet these demands.

Achieve Partners’ investment approach combines financial growth with social impact, particularly in education and workforce readiness.

The De-Carceration Fund

The U.S. criminal justice system affects over 6.6 million people and costs the nation more than $80 billion per year.

The De-Carceration Fund is unique in its mission to support and invest in enterprises that directly address the failings of the U.S. criminal justice system.

The fund’s multipronged strategy includes backing companies that work in areas such as:

- Preventing Entry: Advocating for reforms in gun control, cash bail, foster care, law enforcement, and domestic violence to reduce the number of individuals who enter the criminal justice system.

- Reducing Suffering: Supporting efforts in juvenile justice, legal costs, prison programming, family support, and sentence reduction to ease the burdens placed on those within the system.

- Ending the Cycle: Addressing recidivism by promoting reform and rehabilitation that help formerly incarcerated individuals reintegrate into society and avoid re-incarceration.

Acre Venture Partners

Acre Venture Partners is focused on transforming the food and agriculture sectors by investing in companies that are driving large-scale, sustainable changes to address issues related to human and environmental health.

The firm partners with businesses that develop breakthrough technologies and critical infrastructure aimed at creating a more efficient and sustainable food ecosystem, where profitability and convenience are balanced with positive outcomes for people and the planet.

With a deep understanding of the food system, Acre Venture Partners leverages the expertise of its team, which includes operators, entrepreneurs, policy makers, sustainability experts, and investors.

Their unique approach allows them to collaborate with companies across agtech, food production, and consumer sectors to shape meaningful outcomes.

The firm’s investment strategy focuses on supporting technologies and infrastructure that can make systemic changes in areas such as population health, planetary well-being, responsible production and consumption, and climate solutions.

Through this approach, Acre Venture Partners is helping to drive the future of food and agriculture while delivering sustainable and scalable returns.

Transformational Capital

Transformation Capital is a digital health growth equity firm dedicated to supporting commercial stage companies focused on improving people’s health and the sustainability of the healthcare system.

The firm was founded on the premise that investing in healthcare requires both a sophisticated understanding of the healthcare system, including the prevailing market forces and resulting opportunities, as well as deep connections with decision makers across key providers, payers and digital health innovators.

Transformation Capital has invested in digital health companies across the ecosystem, including Datavant, Apree, Capital RX, Health Catalyst, Sword, Grow, Jeenie and Groups.

Mercy Corps Ventures

Mercy Corps Ventures is a venture capital firm that focuses on investing in and promoting venture-led solutions to enhance the resilience of underserved communities and individuals.

Since its establishment in 2015 as the impact investing arm of Mercy Corps, the firm has facilitated the scaling up of 43 early-stage ventures, helping them raise over $396.7 million in follow-on capital.

The firm’s portfolio concentrates on solutions in adaptive agriculture and food systems, inclusive fintech services, and climate-smart systems and tech infrastructure.

Its goal is to enable those living in frontier markets to withstand disruption and plan for the future by catalyzing the ecosystem towards smarter and more impactful investments.

Fresh Ventures

Fresh Ventures is a venture building program and startup studio based in The Netherlands. They co-found companies with experienced professionals and entrepreneurs to address systemic challenges in the food system.

Are you motivated to transform the food system? And looking for ways to put your talent and time to work?

Join Fresh Ventures, find a co-founder and start building solutions with a systemic impact. You will have the opportunity to meet an exceptional, complementary co-founder that is equally passionate and mission driven.

You’ll be submerged in the challenges, opportunities and key players within the regenerative food system.

At the end, investable ventures will be introduced to core-investors and invited in the Fresh Ventures studio to accelerate the venture and your impact.

Azolla Ventures

Azolla Ventures partners with visionary founders to accelerate transformative climate solutions. Their mission is clear: to invest in breakthroughs that can avert catastrophic climate change and return our world to balance.

Azolla Ventures was founded by Prime Coalition in 2021 as an independent venture capital management company. Azolla Fund I began active investing following its first close in October 2021, with a final close in June 2023 at $239 million.

Catalytic capital, in this context, is provided by philanthropic asset owners who prioritize impact, emphasize additionality, and understand that commercial success is key to achieving significant impact.

In contrast, impact-aligned capital focuses on both commercial and impact potential, without necessarily requiring additionality.

By focusing on ventures at the earliest stages, where risk and reward are highest, Azolla Ventures prioritizes impact above all, ensuring that each investment holds the potential for large-scale greenhouse gas reductions and a more just climate for all.

Social Impact Capital

Social Impact Capital specializes in early-stage investments, placing its focus on what it deems the "best ideas in impact."

The firm adheres to Khosla's Instigator Hypothesis, which asserts that a handful of individuals—about 12-15 entrepreneurs—developing transformative technology can address the world's most pressing issues, such as the climate crisis.

This venture capital firm is research-driven and targets investments in projects that aim to tackle significant global challenges, steering clear of lesser, localized "backyard problems." Social Impact Capital is committed to funding and assisting founders who are dedicated to solving some of the most difficult problems globally.

As the initial backers of mission-driven entrepreneurs, Social Impact Capital supports these founders until their enterprises reach a stage that attracts top-tier venture capitalists.

In their first fund, Social Impact Capital reported a 71% follow-on investment rate by top-tier firms and maintained a 100% follow-on rate overall.

Good Fashion Fund

The Good Fashion Fund (GFF) is the first investment fund focused solely on driving the implementation of innovative solutions in the fashion industry.

Currently, apparel supply chains are plagued by negative environmental and social impacts. While sustainable solutions exist today, there is a lack of capital available to scale these technologies within the supply chain.

The Fund was created to address this gap – connecting the most promising technologies to the industry, to collaboratively tackle its challenges.

The Good Fashion Fund invests in the adoption of high impact and disruptive technologies and circular innovations in the textile & apparel production industry in Asia (India, Bangladesh, Vietnam).

They help manufacturers and operators to implement these technologies, to significantly improve the positive impact of apparel manufacturing.

This means the use of recyclable and safe materials, clean and less energy, closed-loop manufacturing and the creation of fair jobs and growth.

Transition

Transition collaborates with Seed and Series A founders to make the climate transition a reality.

Climate change transcends traditional sector boundaries, acting as a driving force across all industries with its complex and interconnected nature.

Transition's interdisciplinary team embodies this perspective, blending optimism and pragmatism to bridge the gap between traditional technology, climate science, the corporate sector, and policy.

The team at Transition is composed of founders, investors, operators, engineers, and scientists from around the world, united by a single mission: to build an abundant and resilient society that can thrive within the confines of our finite planet.

This mission represents the defining challenge of our era. The stakes are high, the need is urgent, the foundational elements are established, and the opportunity is exceptionally vast.

SIMA Funds

Established in 2016 by seasoned impact investment pioneers Asad Mahmood and Michael Rauenhorst, SIMA Funds is a SEC-registered investment and advisory firm at the forefront of innovation and forward-thinking.

With a combined experience exceeding two decades, SIMA’s leadership has successfully directed over $2 billion towards 250+ social enterprises across 50 countries.

As a field builder and double-bottom-line firm, SIMA operates through three core areas:

- Asset Management: Offering customized investment solutions tailored to individual, institutional, and philanthropic investors.

- Advisory and Philanthropic Services: Providing expert guidance and support to clients seeking to achieve their impact goals.

- Establishment of Social Businesses: Creating and nurturing ventures that address critical social and environmental challenges.

Recognized for its commitment to excellence, SIMA was selected for the Impact Assets 50 (IA 50) in 2021 and 2022.

SIMA’s core focus lies in promoting impact investments that align financial objectives with social and environmental goals.

The firm collaborates with diverse investors to develop market-based opportunities that balance risk and reward, ultimately driving positive economic, social, and environmental impacts.

The Beacon Fund

Despite gender bias and limited access to investor networks, the inadequate funding received by women-owned businesses cannot be solely attributed to these factors.

The team behind the Investing in Women Fund gained insights by investing in 14 women-owned companies over the past three years.

They discovered that these businesses have diverse profiles and ambitions, with many exceptional entrepreneurs not necessarily seeking an exit strategy.

The current financing options in the market primarily revolve around venture capital and private equity, focusing on high-growth companies and binary outcomes.

In 2019, private equity and venture capital funds invested around $8 billion in Southeast Asia, with a focus on companies with “explosive” growth potential but often following cash-incinerating business models.

To address this issue, the Beacon Fund was established to shed light on alternative models of entrepreneurial and investing success.

Instead of expecting women-owned businesses to conform to the existing system, they aim to transform the system to better cater to the needs of female entrepreneurs.

Their focus lies in supporting moderate growth companies that often face neglect from traditional venture capital and private equity firms.

These small and medium-sized enterprises (SMEs), sometimes dismissed as “lifestyle” or “micro-businesses,” have been found to be profitable, have positive cash flow, and grow at healthy rates.

Challenges in securing external funding, including gender bias and limited access to collateral, have led women to gravitate towards businesses with strong unit economics, allowing profits to fuel organic growth.

The Beacon Fund is committed to bringing about change in finance for women-owned businesses.

They believe in treating entrepreneurs with respect, fostering transparency in the fundraising process, and transforming it into a positive and empowering experience.

Their long-term commitment involves focusing on debt products that align with the moderate growth and positive cash flow characteristics of their target businesses.

They have moved away from the conventional venture capital fund structure, which mandates fixed exit timelines, and adopted an evergreen structure to better suit the time horizon and financing requirements of their portfolio companies.

Ultimately, their mission is to be an investment firm that effectively serves women by remaining adaptable and continuously iterating on their approach.

Citizen Mint

The Citizen Mint platform connects investors with private market opportunities that aim for both impact and financial return.

It could be the building of a solar panel farm, new affordable housing, or funding a community health center. Each project is different and a direct investment in change for the better.

Recognizing the lack of access most investors have to private market impact investments – Citizen Mint was founded and built on accessibility and impact.

The team handpicks and deeply researches each investment for both positive impact and financial return.

Fig Loans

Fig changes the way people with bad credit experience banking. They offer emergency loans and financial stability products to get individuals through unpredictable financial challenges.

Fig stands behind a commitment to offer financial products to customers in a socially responsible way. Figs fees are designed only to cover the costs of serving the Fig Loan — that’s it.

Their loans provide customers with the most affordable product when they need it most. Fig does not look at a traditional credit score when making loan decisions. Instead the company looks at your ability to repay the loan based on account age, income, and existing or previous loans.

Obvious Ventures

Obvious Ventures was founded on a simple belief that the most valuable companies of our time will be the ones solving humanity’s biggest problems.

The funds purpose is to support the world positive entrepreneurs building these disruptive solutions.

Ultimately, they see profit and purpose as a virtuous circle. In the right combination they form a flywheel that will deliver enormous financial returns while transforming capitalism in a world positive way.

King Philanthropies

King Philanthropies is dedicated to solving some of the world’s toughest challenges by backing high-performing ventures that create transformative climate solutions.

Through its impact investments, the organization strategically invests in equity, debt, and project finance to support ventures that have the potential to create significant and lasting environmental and social impact.

King Philanthropies focuses on funding the most innovative and impactful solutions in the fight against climate change.

In addition to its investment strategy, King Philanthropies also awards grants to a select group of high-performing organizations.

These grants are directed toward organizations that demonstrate strong leadership and the ability to drive meaningful, scalable change in areas aligned with the foundation’s mission.

Whether through investments or grants, King Philanthropies is committed to advancing solutions that address critical global challenges and create a more sustainable and equitable world.

Responsibly Ventures

Responsibly is a Pre-Seed VC Impact Fund that stands behind its Founders, promoting the optionality needed to reach venture scale, while reducing impact-risk, being Founder friendly, with support from our networks.

The emergence of new forms of Social and Sustainable Tech will disrupt society in a good way. The fund actively seeks to discover exciting visions, steered by remarkable teams gearing toward Venture Scale Positive Impacts.

They actively promote all forms of positive impact as a value driver–e.g., diversity, empathy, social responsibility, ethics, customer love, humane actions, a focus on both people & planet, and away from obvious vice.

They believe that Sustainability must be open to adaptation, and the fund seeks opportunities with multiple Sustainable Development Goals (SDG) factors per deal, as a guidepost in the decision making process.

Aqua-Spark

Aqua-Spark is a global investment fund based in Utrecht, the Netherlands that makes investments in sustainable aquaculture businesses that generate investment returns, while creating positive social and environmental impact.

The fund invests in small to medium enterprises that are working towards the production of safe, accessible aquatic life, such as fish, shellfish and plants, in a way that does not harm the health of the planet

Aqua-Spark believes that committing to a long-term vision is the way to realize effective and lasting impact results.

When it comes to investments, they do not seek quick exits; instead, they look for entrepreneurs who strive to build and scale toward the future, who see their business as major economic opportunities that can also help solve looming environmental and food security challenges over the long-term.

New Profit

New Profit is a venture philanthropy organization that backs breakthrough social entrepreneurs who are advancing equity and opportunity in America.

New Profit was founded in 1998 to help catalyze the nascent social entrepreneurship movement.

Since then, they have backed and partnered with more than 150 social entrepreneurs who created powerful ideas, tools, organizations, and movements to turn the tide on entrenched social problems, advancing opportunity for millions of underserved people and communities.

Tin Shed Ventures

Tin Shed Ventures is Patagonia’s corporate venture capital fund, launched in May 2013. The fund draws its name from the blacksmith shop where Yvon Chouinard, the founder of Patagonia, originally forged pitons.

Committed to reducing human impact on natural spaces, Chouinard made a pivotal decision to stop producing a best-selling product and instead developed the first removable hardware that spearheaded the clean-climbing revolution.

The original tin shed, where these innovations took place, still stands in Ventura, California, next to the corporate headquarters where Tin Shed Ventures is based.

Global Good Fund

The Global Good Fund identifies high-potential leaders and accelerates their success through a year-long, virtual Fellowship focused on leadership development.

They support global social entrepreneurs with proven methods, such as executive mentorship, leadership coaching, and access to capital, to accelerate their growth and impact.

The Global Good Fund believes investing in leadership development is the best tool for enterprise growth and achieving global good.

Since 2013, the signature Global Good Fund Fellowship has developed 105 entrepreneurs who are now accelerating their enterprise growth in 30 countries and beyond.

Over 2,400 high-potential entrepreneurs from more than 100 countries applied for one of 12 Fellowship positions in 2018.

Impact Engine

The mission of Impact Engine is to bring more capital to a market where financial returns are linked to positive social and environmental impacts.

The team manages funds for institutions and individuals that invest in for-profit, positive-impact businesses in private markets, and bring community together in service of building the impact investing field.

New Age Capital

New Age Capital is a seed stage venture capital firm and lifestyle company investing in tech and tech-enabled startups founded and led by black and latino entrepreneurs.

Their mission and vision is to create and support a world where people of all races, ethnicities, cultures, lifestyles and environments are exposed to new ideas, democratized information and boundless opportunities through the use of technology.

Zouk Capital

Zouk's investment strategy centers on the convergence of infrastructure, technology, and sustainability, targeting the emergent opportunities that respond to critical environmental and social challenges.

The firm's focus on infrastructure involves active investments in environmental infrastructure and renewable energy sectors, emphasizing platform-based investments over individual assets.

Zouk is proactive in launching new businesses or supporting early-stage companies, with primary interests in the decarbonization of transport and power networks, sustainable home infrastructure, electrification of industry, recycling, the circular economy, and smart agriculture, primarily within Europe and the UK.

PurposeTech

PurposeTech is a pre-seed fund that provides support to purpose-driven technology startups in the CEE region.

The organization empowers purpose-driven founders by acting as their initial investor and a highly regarded partner throughout their quest to make a positive impact on the world.

The inception of PurposeTech came about through the collaboration of Zdenek Fred Fous and David Kovalsky, both accomplished serial entrepreneurs, alongside the Impact Hub.

The Impact Hub, a global network dedicated to fostering innovation, entrepreneurship, and creators driven by making a difference, played a significant role in the co-founding of PurposeTech.

Reach Capital

Reach Capital invests in educational startups that strengthen communities. Their portfolio is made up of more than companies.

Itʼs made up of people bold enough to build something for the betterment of others, the ideas big enough to change the way we learn, and the imagination, commitment and audacity to challenge the status quo.

Every team member at Reach sees education as a transformative part of our lives. This deep connection to education has brought them together.

Access Ventures

Access Ventures strives to build a more inclusive and creative economy that functions for all people, ensuring that everyone has the financial freedom and mobility to pursue any opportunity they desire.

They believe that a thriving economy is one that is equitable, dynamic, and resilient, and achieving this goal leads to increased economic prosperity, opportunity, and participation.

Vulnerable individuals face systemic challenges, and it is not sufficient for Access Ventures to simply foster a functioning economy. They aim to create an economy that not only serves as an engine for industry but also upholds the inalienable dignity of all individuals, making it more inclusive and fostering creativity.

When the economy becomes more equitable, dynamic, and resilient, the results are profound:

- More individuals can access the economy and participate as workers and business owners.

- The focus shifts from merely creating jobs to creating quality jobs.

- Social and economic well-being is increasingly sustainable over time.

- There is a reduction in inequality and a boost in economic prosperity.

Access Ventures' approach involves ensuring that all assets reflect the organization's values. Every opportunity is first evaluated for alignment with their mission and then assessed for financial viability, prioritizing both ethical impact and financial fit.

CNote

CNote is an award-winning financial platform that makes it easy to invest with impact. Every dollar you invest with CNote helps fund female and minority-led small businesses, affordable housing development, and financially underserved communities across America.

In the last year, CNote’s members invested millions into local communities, creating and/or maintaining over 1,400 jobs.

CNote was founded on two core principles. That financial products should not just serve a wealthy few, and that financial prosperity doesn’t have to be a zero sum game; you can make money and do good at the same time.

1863 Ventures

1863 Ventures accelerates black and brown entrepreneurs from high potential to high growth, through rigorous leadership training and strategic market access.

The thesis is that entrepreneurship is becoming an increasingly viable pathway for the New Majority to build wealth.

The goal of 1863 Ventures is to facilitate this trend by reducing barriers and risk for these founders across the nation.

Over the past several years, 1863 Ventures has had the honor of working with over 2,500 early-stage and growth-stage founders through our formal programs across a multitude of sectors and industries.

With a membership representing nearly $300M and several thousand jobs, 1863 is fortunate to have crossed paths with some of the best and brightest founders in the nation.

Hopelab Ventures

Hopelab is a transformative social innovation lab and impact investor dedicated to supporting the mental well-being of adolescents ages 10-25, with a special focus on BIPOC and LGBTQ+ young people.

Through philanthropic funding, collaborations, and intergenerational partnerships, Hopelab operates at the intersection of technology and mental health alongside entrepreneurs, funders, researchers, and young change-makers to foster systemic change and cultivate a thriving future for underserved young individuals.

Future Planet Capital

Future Planet Capital is the global impact-led venture capital firm built to back growth companies from the world’s top universities and research ecosystems.

They were an early adopter in the impact space, launching our first fund as the SDGs were agreed. They are now one of the largest impact-VC groups in Europe, managing $400m for institutional investors, governments, and families.

Future Planet Capital focuses on Seed to Series B stage tech and life science companies from the world’s top universities and research ecosystems, where impact and innovation go hand in.

The team has invested in over 300 companies, with 60 profitable exits to date and manage an active portfolio of breakthrough technology businesses solving global challenges in Climate, Health, Education, Sustainable Growth and Security.

Better Ventures

Better Ventures backs entrepreneurs building a better world. They provide funding and support to early-stage technology companies pursuing social and environmental objectives with high-growth business models.

Better Ventures typically invests $100-250k at the seed stage, get actively involved with the founders to help them build successful companies, and provide larger follow-on investments through Series A and beyond.

Collab Capital

Collab Capital is a $50mm fund that helps Black founders build sustainable businesses. Collab Capital creates a growth solution for Black founders seeking capital, who value profitability, ownership, and optionality.

A key pillar to solving the growing US racial wealth gap is business formation and growth in the Black community.

In order to ensure more Black founded businesses have the resources they need to be successful, the ability to maintain majority ownership, and increase revenue, we’ve designed a new investment model which aligns our interests with those of the founders we support

REDF

REDF (The Roberts Enterprise Development Fund) is a venture philanthropy that advises and invests exclusively in social enterprises that employ and empower people overcoming barriers to work.

REDF creates jobs and transforms lives like no other organization in America.

They are the leader of a national movement of jobs-focused social enterprises, the successful brand of businesses that invest the money they make into helping their employees get a lasting shot at a better life.

FullCycle

FullCycle invests to accelerate the deployment of technologies that address the greenhouse gases with the highest warming potential in the first 20 years of emission (GWP20).

These high-impact climate pollutants (CH4, HFC, N2O, etc) make up 24% of atmospheric greenhouse gases, while being responsible for close to 50% of global warming.

FullCycle developed a unique investment model, specifically designed to accelerate the deployment of the climate critical technologies.

These technologies must exceed our threshold for Carbon Return on Investment (CROI-20) and deliver above market returns on a risk adjusted basis.

Big Path Capital

A certified B-Corp, Big Path Capital is built with a team of innovative leaders expanding the path for business interests seeking multiple bottom line interests, taking the new economy from the margins to the mainstream, seeing the financial world generate good as it generates returns.

As a global firm, Big Path Capital is advancing a sustainable economy connecting mission-driven companies and fund managers with mission-aligned investors.

The Reinvestment Fund

The Reinvestment Fund (TRF) is a national leader in rebuilding America’s distressed towns and cities, through the innovative use of capital and information. TRF achieves its mission through investing, housing development as well as data and analytical services.

TRF’s investing activity creates affordable homes, quality educational opportunities, access to healthcare and healthy food, jobs and thriving businesses in neighborhoods that need them most.

TRF’s housing development activity is concentrated in distressed markets, where TRF uses a “build from strength” strategy that reinforces local assets to create healthy communities.

Planet A Ventures

Planet A Ventures is a venture capital firm that invests in climate tech startups. The firm was founded in 2022 and has raised €160 million for its first fund, which it plans to invest in early-stage startups that are developing solutions to climate change.

Planet A invests in climate tech startups that are working to decarbonize the economy. The firm’s investment thesis is based on the following pillars:

- Science-based targets: Planet A only invests in startups that have set ambitious science-based targets to reduce their emissions.

- Impact: Planet A measures the impact of its investments on the environment.

- Diversity: Planet A is committed to investing in a diverse set of startups, including those founded by women and people of color.

Acumen Fund

Acumen's mission is to change the way the world tackles poverty by investing in companies, leaders, and ideas. They raise charitable donations to invest patient capital in business models that deliver critical goods and services to the world’s poor.

Since 2001, Acumen has globally invested more than $83 million in 73 companies. Acumen also works to build a global community of emerging leaders that believe in creating a more inclusive world through financial and operational expertise combined with moral imagination.

Dream Labs

Dream Labs operates with a distinctive mindset. As a small fund with substantial aspirations, it doesn't claim to suit everyone.

With a capital of $100 million, Dream Labs is established to invest in companies, leaders, and ideas that have a positive impact on people's lives.

The fund aims to collaborate with entrepreneurs who are driven to invent new market categories or transform and disrupt existing ones.

Dream Labs primarily focuses on ideas that have the potential to scale, prioritizing investments in entrepreneurs whose concepts are expected to yield both strong social and financial returns.

While alignment with the fund's vision is crucial for its portfolio companies, Dream Labs acknowledges that exceptional companies often stand as exceptions—and it remains open to considering such outliers as well.

Deetken Impact

Deetken Impact invests in emerging economies to generate long-term returns while contributing to sustainable growth and prosperity. The firm prioritizes returns and capital preservation, strategically selecting and rigorously assessing a limited number of investees.

As impact investors, Deetken Impact maintains high standards for sustainability and financial performance, which leads to attractive and previously unexplored avenues of growth.

Impact is integral to Deetken Impact’s investing approach. The firm invests in businesses across Latin America and the Caribbean that significantly improve lives in underserved communities, vitalize economies, advance gender equality, and strengthen climate resilience.

Deetken Impact goes beyond merely providing capital by accompanying investees through strategic advice and customized engagement.

The Ecosystem Integrity Fund

The Ecosystem Integrity Fund is focused on identifying promising solutions to key threats to the ecosystem, from the perspective of both investment value and environmental benefit.

The partners have the diverse and complementary skills and backgrounds needed to invest in clean technology enterprises, platforms, projects, and project developers.

Together, the partners have expertise in commercial finance, investment evaluation, and research consulting across a wide array of sectors related to clean technology and natural resources.

Additionally, the leadership of Ecosystem Integrity Management bring senior-level operating experience to the management of the Fund’s portfolio investments.

Beyond investment management skills and clean technology expertise, the team has a robust network of venture capitalists, family office investors, public corporations, entrepreneurs, research labs, technology specialists, and consultants that are active in environmental sustainability.

Root Capital

Across the developing world, the rural poor—approximately 75 percent of the 2.6 billion people living on less than $2 a day— are marginalized from the formal economy.

Most of these people depend on agriculture as their primary source of income. Without access to capital and viable markets for their crops, millions of small-scale farmers in the developing world are trapped in a cycle of poverty.

Root Capitital is a nonprofit social investment fund that grows rural prosperity in poor, environmentally vulnerable places in Africa and Latin America by lending capital, delivering financial training, and strengthening market connections for small and growing rural businesses.

Root Capital’s lending is directed towards businesses that are too big for microfinance, but generally unable to secure credit from conventional commercial banks – “the missing middle” of developing-world finance.

Human Ventures

Human Ventures is a business creation platform. The firm goes beyond the business model to build and invest in Model Businesses with ambitious founders who are innovating around Human Needs.

By unlocking access to a powerful network of founders, investors and corporate partners, Human Ventures is creating a blueprint for the future of business to be built on purpose.

The SDG Impact Fund develops sustainable financial resources to fulfill its mission, and to ensure the continuity of charitable organizations supported by our donors and their families.

The SDGIF develops and manages endowments, planned giving, private-label DAFs, and donor advised philanthropic funds.

The grants are provided for innovative programs, domestic/international development, domestic and foreign crisis, and securing the operational activities of charitable organizations for generations to come.

Vital Capital

Vital Capital is a leading social impact investment, private equity fund focused on improving the well-being of underserved sub-Saharan African communities while generating market rate returns for its investors.

Since the inception of its 1st fund (US$350M) in 2011, Vital has been demonstrating its No Trade-Off approach, by investing at-scale in the most impactful sectors across sub-Saharan Africa such as affordable housing, healthcare, water, agriculture and renewable energy.

By systematically utilizing proprietary and industry standard impact metrics, rigorous financial underwriting and ongoing hands-on operational oversight, Vital is demonstrating the achievement of significant and tangible quality of life improvements for large local populations, while on-track for delivering risk-adjusted returns for its investors.

Domini

The firm is specializing exclusively in social impact investing. They manage mutual funds for individual and institutional investors who wish to integrate social and environmental standards into their investment decisions.

When you invest with Domini, you as a shareholder are making an impact. As a shareholder you will invest in companies that are solving major issues such as global warming, sweatshop labor, and product safety.

Revitalizing distressed communities. Bringing new voices to the table. Redefining corporate America’s bottom line. Invest for your future while helping to build a world of peace and justice.

Global Partnerships

Global Partnerships is a nonprofit impact investor whose mission is to expand opportunity for people living in poverty.

GP creates opportunity for people living in poverty to earn a living and improve their lives by investing impact-led capital in social enterprises that bring sustainable opportunity to millions.

Since inception, GP has invested $190 million in 89 partners across 14 countries. To date their work has impacted over 4.1 million lives.

Alterfin

Alterfin’s shareholders consist of non-governmental development organisations, banks and over 5.000 individuals. Alterfin invests in microfinance institutions, producers’ organisations and SMEs involved in smallholder agriculture in Latin America, Africa and Asia.

Their mission is to achieve human dignity in developing countries by promoting individual and collective economic activities.

Alterfin aims to link people in the North willing to invest their money in a sensible way to organizations in the South that extend credit to local entrepreneurs and farmers who can use such a loan to build a better future.

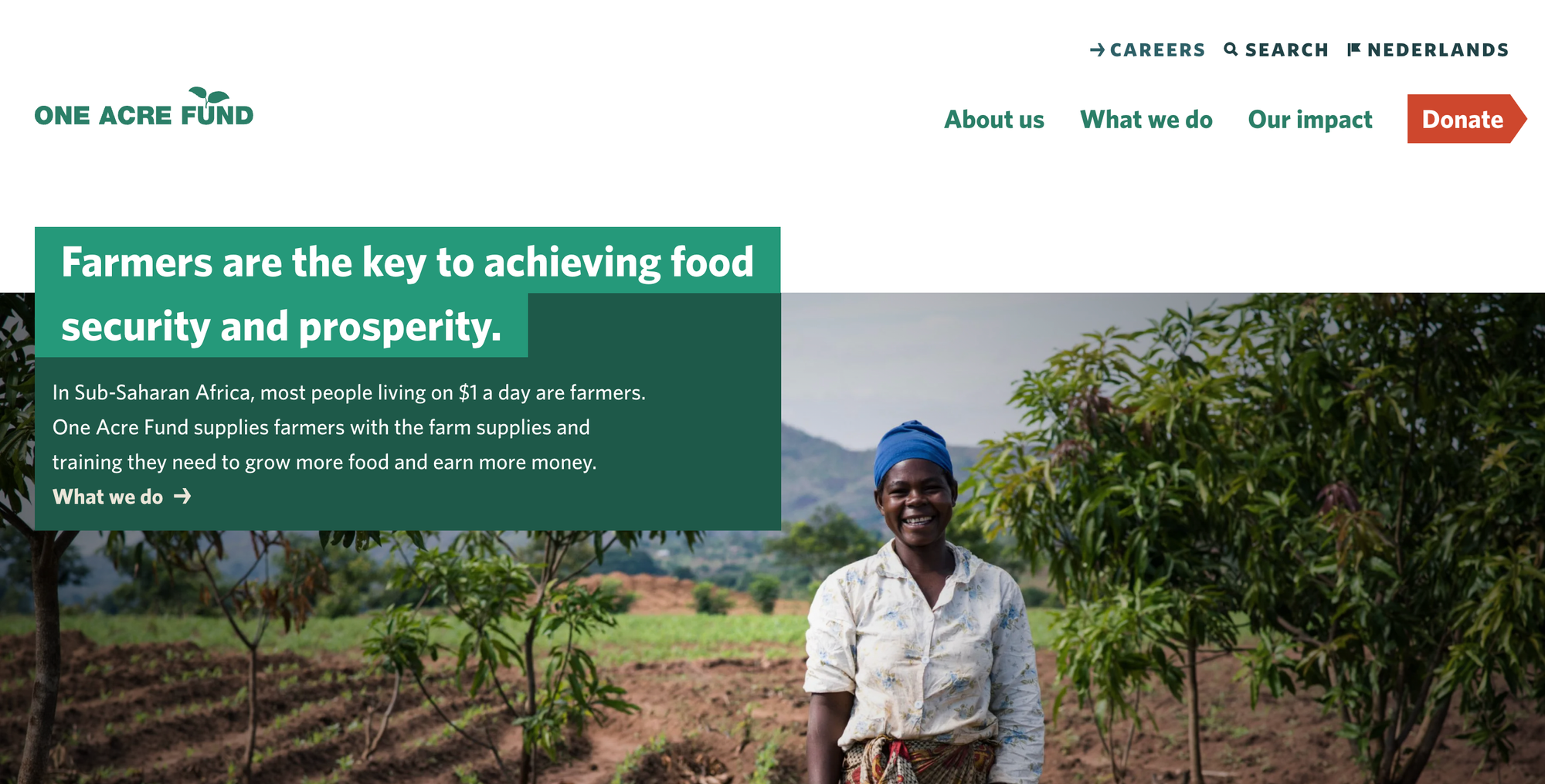

One Acre Fund

One Acre Fund supplies smallholder farmers with the financing and training they need to grow their way out of hunger and poverty. Instead of giving handouts, One Acre Fund invests in farmers to generate a permanent gain in farm income.

They supply a complete service bundle of seeds and fertilizer, financing, training, and market facilitation—and deliver these services within walking distance of the 400,000 rural farmers they serve.

One Acre Fund began in East Africa, and now currently serves farmers in Kenya, Rwanda, Burundi and Tanzania.

Media Development Loan Fund

The Media Development Investment Fund invests in independent media around the world providing the news, information and debate that people need to build free, thriving societies.

Timely, accurate, relevant information is critical to free societies, enabling fuller participation in public life, holds the powerful to account and protects the rights of the individual.

The MDIF has investments in more than 100 media companies in 38 countries.

They have provided more than $134 million in financing, including $117 million in debt and equity investments.

MDIF has received $63 million in recovered principal, earning almost $40 million in interest, dividends and capital gains, and returned $28 million to investors.

Bamboo Capital Partners

Bamboo Capital Partners is an impact investing platform which provides innovative financing solutions to businesses in emerging markets serving the needs of low- and middle income populations, thus catalyzing lasting impact.

They bridge the gap between seed and growth stage funding through a full suite of finance options – from debt to equity – which we activate unilaterally or through strategic partnerships.

Accion

The Accion Frontier Inclusion Fund is the first global emerging markets fintech fund for the financially underserved.

The Fund invests in innovative financial technology and services companies that promote financial inclusion for the two billion people around the world who lack access to savings accounts, checking, insurance, credit, and other basic financial services.

Accion is striving to reach the nearly three billion people worldwide who still seek these crucial financial services.

In the area of investing, Accion provides equity, quasi-equity, and loan guarantees to help grow companies sustainably and support a financial ecosystem that will radically enhance the efficiency, reach, and scope of financial services at the base of the economic pyramid.

SustainVC

SustainVC is the manager of a series of early-stage impact investing venture capital funds that makes market-rate equity investments into early-stage companies creating meaningful social and/or environmental impact.

Led by a deep team with more than 100 years of investing, startup, and consulting experience, SustainVC has built a 10-year track record of demonstrated, measurable impact as well as proven financial returns.

Farmland LP

Farmland LP is a U.S. real estate fund that acquires conventional farmland and converts it into Organic, sustainably managed farmland. They specialize in enhancing soil fertility and productivity through science-based livestock and crop rotations.

They currently own and manage 6750 acres of farmland currently valued at $50 million in the San Francisco Bay Area and Oregon’s Willamette Valley. More than 10% of our acreage is certified Organic and the rest is in transition.

Through expertise in agriculture, soil biology, real estate, and farm management, they have forged a new model for how farmland is owned and managed.

The model benefits farmers, investors, the environment, and consumers. Investors benefit from the security of owning farmland while participating in the growth and profitability of local, organic food markets.

The fund intends to demonstrate that sustainable agriculture at-scale is more profitable today than chemical-dependent commodity agriculture.

Community Reinvestment Fund

Community Reinvestment Fund(CRF) fills a gap in community development funding by bringing a larger amount of capital to the communities that need it most.

This has a powerful impact, creating a huge ripple effect and improving more lives of disadvantaged people in distressed neighborhoods all across the country.

Together with lending partners, they provide small business loans not found elsewhere for people living in underserved communities so they can.

CRF has provided more than $1.5 billion to finance small businesses, affordable housing and community facilities in 47 states and more than 750 communities.

These loans have improved the lives of more than 613,000 people by creating jobs, funding small business growth, affordable housing, community facilities, and by providing highly personalized loan servicing for low-income homeowners.

CRF blends philanthropic giving with socially motivated investments from foundations and market rate investments from institutional investors that otherwise would not invest in community development in low-income communities.

Kinara Capital

Armed with a mission to empower the 70 million small business entrepreneurs in the country, Kinara Capital addresses the significant credit gap for MSMEs by offering swift and adaptable collateral-free business loans.

With AI/ML-powered data analytics driving credit decisions, the myKinara App provides a one-minute eligibility check and can finalize the loan process within 24 hours.

The company has disbursed more than $ 811 million to over 77,000 small business entrepreneurs ushering thousands into the realm of financial inclusion.

This transformative journey has not only spurred economic growth but has also been instrumental in supporting over 400,000 jobs in local economies.

NESsT

Since its inception in 1997, NESsT has been investing in front-line entrepreneurs, catalyzing impact-driven enterprises, and shaping sustainable and equitable futures, especially in emerging market countries.

A significant portion of the global population still grapples with extreme or moderate poverty, while nearly half face low incomes and challenging working conditions.

NESsT recognizes the inherent dignity in providing access to good jobs and reliable income, not just as a means of sustenance but as pathways to empowerment and community upliftment.

The Grassroots Business Fund

The Grassroots Business Fund (GBF) is a global impact investment organization whose mission is to grow viable businesses that generate sustainable earnings or cost-savings for people with low incomes in Africa, Asia, and Latin America.

Companies in developing economies often face financing constraints and lack sources of business advice.

The GBF establishes innovative financing vehicles that provide long term, risk sharing capital to these businesses, while its not-for-profit component crafts incremental business advice programs to help strengthen companies’ operational fundamentals.

Since 2011, The GBF’s first private investment fund has invested over $30M and conducted over 200 advisory projects with businesses that benefit 1.7 million people per year.

Calvert Impact Capital

Over the course of their 25 year history, Calvert Impact Capital have raised more than $2 billion from over 18,000 investors to more than 520 mission-driven organizations across the U.S. and around the world.

- They have a 25-year track record of portfolio management with 100% repayment to all investors;

- Calvert Impact Capital raises capital from a diverse group of investors, including individuals, institutions, and financial advisors in amounts as low as $20 to over $20 million;

Calvert’s portfolio partners reach all 50 states plus DC and Puerto Rico, as well more than 100 countries and organize their portfolio across nine sectors: affordable housing, community development, education, environmental sustainability, health, microfinance, renewable energy, small business and sustainable agriculture.

In 2018, Calvert Impact Capital disbursed $100.4 million in new and renewed loans to 100 borrowers. Collectively, those 100 borrowers made nearly $4.7 billion in loans to their clients.

In 2018, the portfolio partners collectively served over 72 million clients (60% women) and created or retained more than 500,000 jobs.

Renewal Funds

Renewal Funds provides an opportunity for investors to participate in the development of business at the forefront of social and environmental innovation.

Renewal Funds invests in change by supporting businesses at the forefront of social and environmental innovation.

They believe that there must be a fundamental reinvention of where and how capital is deployed.

The Renewal Funds model is to deliver above market returns by investing in businesses in Canada and the US that provide the finest sustainability solutions.

Alante Capital

Alante is a venture capital fund investing in innovative companies that enable a resilient, sustainable future for apparel production and retail.

Over the past decade, clothing prices have hit record lows while production continues to soar, resulting in an exponential increase in environmental and social costs.

The challenges of managing opaque supply chains have allowed for forced labor, unsafe working conditions and toxic dumping to be outcomes of the clothes we wear.

Companies are actively developing and integrating new solutions to make the lifecycle of apparel safer, cleaner, more efficient and more sustainable.

Brand and consumer demand, alongside supply chain pressures, are rapidly driving a shift towards sustainable apparel.

Alante partners with brands to understand their sustainability bottlenecks and requirements, informing our process to invest in companies that provide viable solutions.

Illumen Capital

Only 1.4 % of $82 trillion in capital is managed by women and people of color led funds.

Illumen Capital, an impact-focused fund of funds, is on a mission to challenge the status quo. By reducing racial and gender bias in financial decision-making, Illumen Capital aims to create a more inclusive and optimized asset management industry—one that not only drives equity but also enhances financial performance.

Illumen Capital partners with institutional investors to empower the next generation of diverse-led venture and private equity fund managers.

Their mission is rooted in the belief that an equitable asset management industry will be the cornerstone of a more just and prosperous future.

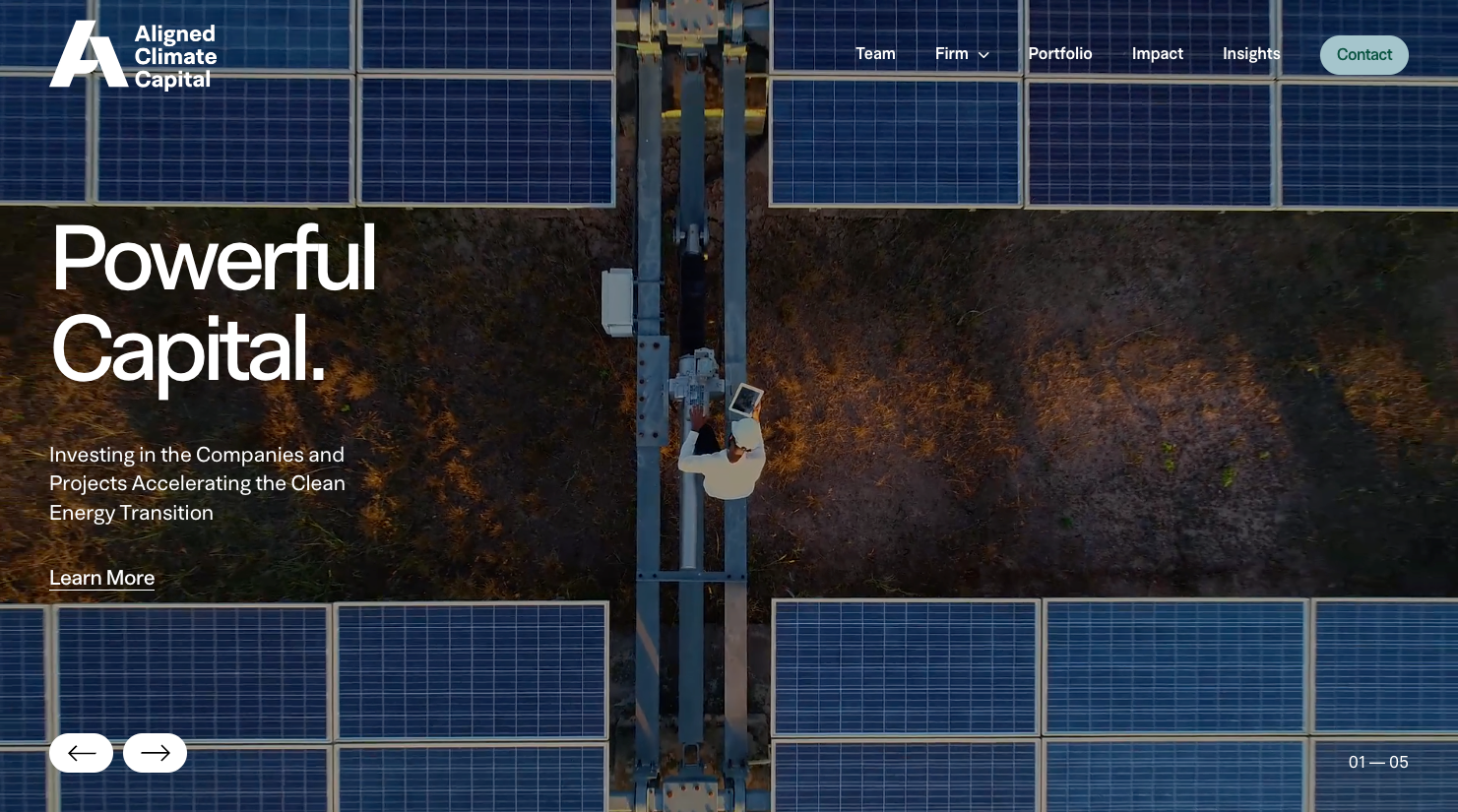

Aligned Climate Capital

Aligned Climate Capital is an investment firm focused on accelerating the transition to a low-carbon economy by investing in the people, companies, and real assets driving decarbonization.

With a mission to deliver strong financial returns alongside measurable environmental and social impact, Aligned operates at the intersection of finance, technology, and public policy.

This multidisciplinary approach enables the firm to anticipate trends, navigate a rapidly evolving market, and invest with both precision and purpose.

Guided by a vision in which the success of the firm, its investors, partners, and the planet are all aligned, Aligned Climate Capital is building a more sustainable and resilient future through strategic, impact-driven investments.