Allbirds is a sustainable footwear and apparel company founded in 2015 and headquartered in San Francisco, California (though with roots in New Zealand).

Its mission centers on creating environmentally responsible apparel using natural materials, minimizing carbon footprint, and promoting sustainable consumer habits.

From its early viral growth and celebrity adoption to raising hundreds of millions and going public in 2021, Allbirds enjoyed momentum as a “sustainable darling.”

However, since its IPO, the company has struggled with declining revenues, losses, leadership turnover, over expansion, and brand fatigue. In 2024, revenues fell ~25 % year over year to ~$189.8 million, with net losses exceeding $93 million.

Key lessons include the hazards of rapid product-line expansion beyond core brand identity, balancing growth with profitability, and the challenge of proving sustainability claims under investor scrutiny.

The remainder of this case study dissects Allbirds’ journey across structural, financial, competitive, operational, and strategic dimensions, and concludes with forward-looking recommendations and lessons for other impact-driven companies.

Company Background & History

Founding Story

Founders & Vision - Allbirds was co-founded by Tim Brown (a former professional soccer player from New Zealand) and Joey Zwillinger (a biotechnology / environmental engineer) in 2015.

Tim Brown had begun creating wool-based footwear prototypes while in business school in New Zealand; he secured a grant from New Zealand’s wool industry when merino wool demand had declined, aiming to revitalize wool through the apparel/footwear value chain.

Brown’s vision was to build a simpler, low-impact shoe, using natural materials (especially wool) and design minimalism. Zwillinger brought technical and material development skills, enabling the creation of new “bio-based” materials and manufacturing processes.

Problem Being Solved - The founders positioned Allbirds to address multiple intertwined challenges: the environmental damage of synthetic / petroleum-based footwear materials, consumer demand for greener products, and the notion that sustainable goods could be functional, stylish, and commercially viable.

They aimed to make sustainable shoes more accessible and to build brand trust via transparency. From the start, Allbirds framed itself not just as a commercial brand but as a public benefit / mission-driven company.

Timeline of Major Milestones

Below is a high-level timeline of Allbirds’ key milestones:

| Year | Milestone / Event |

|---|---|

| 2014 | Tim Brown launches a Kickstarter campaign, raising ~$119,000; early prototypes and concept validation begin. |

| 2016 | Launch of the Wool Runner (first product) in March. |

| 2016 | Early seed and Series A investments, including ~$7.25 million raised. |

| 2017 | U.S. expansion, initial retail stores, push into international markets (Australia, South Korea). |

| 2018 | Series C funding (~$50 million) raising valuation to ~$1.4 billion. |

| 2018 | Launch of brick-and-mortar stores outside U.S., including the U.K. |

| 2020 | Series E funding (~$100 million); ~21 retail stores globally by this time. |

| 2020 | Collaboration with Adidas to produce a low-carbon sneaker; expansion into new materials (tree-based, sugarcane, etc.). |

| 2021 (Nov 3) | IPO on Nasdaq under ticker BIRD. Shares surged ~90% on opening day. |

| 2022–2023 | Signs of strain: slowing growth, inventory issues, overexpansion, discounting of apparel lines. |

| 2023 | Lawsuit by shareholders alleging misrepresentations (later dismissed / refiled). |

| 2024 (Mar) | Joey Zwillinger steps down; Joe Vernachio (former COO) becomes CEO, focus shifts back to core products. |

| 2024 (Apr) | Received Nasdaq non-compliance notice due to share price under $1 for > 30 days. |

| 2024 (Sept) | 1-for-20 reverse stock split to regain Nasdaq compliance; store closure rationalization underway. |

Over time, Allbirds pivoted away from sprawling apparel and accessory ambitions toward reinforcing their core footwear strengths. Leadership changes accompanied this retrenchment.

Evolution of Leadership, Ownership & Business Model Pivots

Leadership and Management Changes - For much of its public life, Allbirds was led by its cofounders, particularly Zwillinger. But as challenges emerged, governance shifts occurred: in 2024, Zwillinger stepped aside as CEO, and Joe Vernachio (COO) took over. Zwillinger remains on the board. There have also been changes in C-suite roles: e.g. CFO transitions and promotions (e.g. Annie Mitchell as CFO) and appointments of new design and marketing leads.

Ownership / Corporate Structure - As of 2024, Allbirds is a publicly traded company under ticker BIRD. Pre-IPO, it had raised >$200 million in venture funding across multiple rounds. After the IPO, the public float and institutional investors hold significant shares; insiders continue to hold nontrivial stakes.

Business Model Pivots

From pure DTC to hybrid channel: Allbirds began as a direct-to-consumer (DTC) brand (online), then gradually added brick-and-mortar retail and wholesale partnerships to broaden reach.

Product diversification: In its early growth phase, Allbirds attempted to expand into apparel, accessories, and varied footwear styles beyond wool runners (e.g. merino apparel, dresses, puffer jackets). Some expansions underperformed and were later retrenched.

Emphasis on sustainable materials innovation: The company has invested in novel materials (e.g. eucalyptus fiber uppers, sugarcane-based foams, plant-based leathers) to differentiate on environmental performance.

Rationalization strategy: More recently, under new leadership, Allbirds reversed course on aggressive expansion, closing underperforming stores, focusing on core footwear lines, scaling wholesale in selective markets, and optimizing inventory and marketing spend.

Industry & Market Analysis

Industry Landscape & Trends

Size and Growth - The footwear industry is large and mature, but the sustainable / eco-friendly footwear segment is a growing niche. According to one analysis, the sustainable footwear market is projected to reach US$12.3 billion in 2024, with compound growth of ~16.8 % annually.

In the U.S. context, sustainable shoes accounted for ~6.3 % of the 2022 footwear market. Overall, athleisure and performance footwear have seen robust growth over recent years, particularly driven by consumer interest in comfort, health, and hybrid daily-use.

Trends Over Past 5–10 Years

Several macro trends have influenced the space:

- Consumer sustainability awareness — more consumers (especially younger cohorts) demand environmental credentials, transparency, and traceability.

- Materials innovation — greater investment in bio-based, recycled, and low-carbon materials (e.g. sugarcane EVA, plant-based leathers).

- DTC disruption — digitally native brands entering footwear, bypassing traditional wholesale channels.

- Omni-channel retailing / experience — consumers expect seamless online-offline integration, experiential retail.

- Supply chain volatility — logistic disruptions, material cost inflation, and trade tariff pressures.

- Skepticism over greenwashing — increasing regulatory and public scrutiny over sustainability claims, carbon offsets, and reporting.

These dynamics create both opportunity and risk for a mission-driven footwear brand like Allbirds.

Target Market & Customer Personas

Primary Customers - Allbirds has historically targeted urban professionals, tech-forward consumers, millennials and Gen Z who favor minimalist aesthetics, comfort, and ecological values.

Early adopters included Silicon Valley employees, eco-conscious buyers, and “athleisure” consumers seeking everyday sneakers that are ethically made. Secondary segments: performance runners (with Allbirds’ push into running shoes), travelers (e.g. casual travel shoes), and moderate athleisure users.

Personas

- “Eco-conscious professional” — values sustainability, willing to pay a premium, uses sneaker in casual settings, expects comfort and low carbon footprint.

- “Everyday commuter / urban traveler” — looks for versatile, comfortable shoes usable in office / travel / urban walking.

- “Casual runner / fitness enthusiast” — interested in light performance sneakers with environmental credentials (a newer target).

- “Conscious gift buyer” — someone buying gifts (e.g. for sustainability-minded friends) who values story, branding, and aesthetic.

Key Demand Drivers

- Sustainability Preference Premium

Many consumers claim willingness to pay more for greener products. Some reports estimate 35 % of consumers would accept a premium for sustainable shoes. - Material Innovations / Differentiation

Novel materials that reduce carbon emissions or reliance on fossil inputs (e.g. sugarcane EVA, eucalyptus, plant-based leather) serve as differentiators. - Brand Trust & Transparency

In an era of greenwashing skepticism, credible metrics (e.g. third-party verification, carbon footprint disclosure) become critical for purchase decisions. - Retail & Channel Access

Physical stores may not be strictly necessary for footwear purchase, but presence in premium retailers (e.g. department stores) and showrooming can drive reach and trust. - Macro / Regulatory Factors

Policies that encourage circular economy, carbon taxes, or stricter reporting may create tailwinds for sustainable brands. Conversely, material import tariffs or logistic shocks can raise costs significantly. - Economic / Consumer Sentiment

As premium discretionary goods, demand for sustainable lifestyle brands is sensitive to broader economic cycles; in downturns, consumers may prioritize price over mission.

Market Sizing & Projections

Given the sustainable footwear segment size of ~$12.3B in 2024 and projected growth (~16.8 % CAGR), Allbirds’ ~US$189 million revenue in 2024 suggests a small share of the niche market.

If the sustainable footwear segment continues expanding, Allbirds’ addressable market (including adjacent apparel) could support multiples of its current scale—if it can execute effectively.

Competitive Landscape

Main Competitors

Below are some direct or adjacent competitors across sustainable and mainstream footwear:

| Competitor | Overview / Positioning | Business Model / Channels | Strengths / Differentiation | Challenges vs. Allbirds |

|---|---|---|---|---|

| Nike / Adidas / Puma / major sportswear | Global incumbents with scale, branding, R&D | Wholesale + direct + DTC | Deep technical capabilities, economies of scale, marketing muscle | Harder to brand exclusively on sustainability, structural incumbency constraints |

| Veja | French sustainable sneaker brand using ecological materials | Wholesale + DTC | Strong branding in sustainable fashion circles, distinct aesthetics, traceability | Less global reach, may lack performance strengths |

| Rothy’s | DTC sustainable footwear/apparel (knit constructions, recycled materials) | DTC / retail partnerships | High brand loyalty, circular return programs | Lower performance footwear penetration, premium price |

| Ons / On Running | Technical running footwear brand | Hybrid model (wholesale, DTC) | High performance, athletic credibility | Less emphasis on sustainability branding |

| Allbirds’ “lite” / eco sneaker startups (e.g. Atoms, Cariuma, Nisolo) | Smaller niche sustainable footwear entrants | Primarily DTC | Nimble, trendy, strong community appeal | Lower scale, constrained R&D budget, narrower distribution |

In some financial analyses, Allbirds’ competitors are listed more broadly under apparel / footwear peers such as lululemon, Levi’s, or generic apparel players.

Comparison of Business Model & Go-to-Market

Channels - Traditional incumbents rely heavily on wholesale and licensing; newer brands often adopt DTC-first models, then layer retail presence. Allbirds initially was DTC only, later adding retail and selective wholesale.

Product Differentiation / Features - Allbirds competes on natural materials, low-carbon footprint, and minimalist aesthetics. Mainstream incumbents lean on performance metrics, brand heritage, athlete endorsements. Innovative sustainable brands emphasize traceability, circular processes, or regenerated materials.

Pricing - Allbirds’ pricing is premium relative to mass-market sneakers—but competitive within premium / sustainable sectors. Their ability to command premium depends on credibility and customer willingness to pay for “green.”

Marketing / positioning - Allbirds has leaned heavily on mission branding, content, influencer/earned media, social proof, and viral “tech-bro” adoption early on. Others may use celebrity athletes (Nike), fashion influencers (Veja), or product innovation storytelling.

Competitive Advantages & Disadvantages

Advantages / Moats

- Brand identity & mission authenticity — strong early narrative around sustainability and minimalism

- Material & process IP / know-how — expertise in developing low-carbon foams, novel materials

- First-mover positioning in sustainable footwear space

- Direct consumer relationship & control over branding

- Cross-over appeal — being “performance-lite” but stylish enough for everyday wear

Disadvantages / Vulnerabilities

- Scale limitations / cost disadvantages relative to incumbents

- Overextension risk — diversifying too far from core product risks brand dilution

- Inventory, consumer trend volatility — fashion cycles, returns, discounting pressures

- Scrutiny of sustainability claims / credibility risk

- High fixed cost burden — retail lease costs, marketing spend, distribution

SWOT Analysis

Strengths

- Strong brand story anchored in sustainability and transparency

- Ability to innovate materials and processes (e.g. sugarcane-based foam, plant-based leather)

- Loyal early adopter community and social word-of-mouth

- DTC infrastructure enabling direct feedback, margins, and consumer data

Weaknesses

- Persistent unprofitability and negative operating leverage

- Brand stretch and product lines that underperformed (e.g. apparel, dresses)

- Overexpansion of physical footprint and inventory mismanagement

- Exposure to input cost volatility and supply chain disruptions

- Legal and reputational risk around environmental claims (greenwashing)

Opportunities

- Growth in sustainable consumer spending

- Expansion into selective wholesale, partnerships, or retail collaborations

- Adjacent markets: performance footwear, travel shoes, plant-based materials

- Circular economy initiatives, resale or rental models

- Geographic expansion into Europe, Asia with sustainability demand

Threats

- Larger incumbents launching credible sustainable lines

- Consumer skepticism or backlash if claims don’t hold up

- Macroeconomic downturns hitting discretionary premium categories

- Regulation tightening around sustainability disclosures

- Intensifying competition from upstart sustainable brands

Business Model & Revenue Streams

Revenue Model

Allbirds primarily generates revenue by selling physical products (footwear, apparel, accessories) via a combination of channels. Key revenue sources:

- Direct-to-consumer (DTC) online sales — original core channel

- Retail / brick-and-mortar — own stores, pop-ups - see store locations

- Wholesale / third-party distribution — partnerships with retailers or distributors

- Gift cards, licensing, and potential partnerships (minor)

Historically, the DTC channel conferred higher margins, but the push into retail adds visibility and customer acquisition benefits.

Revenue by Segment

Public filings do not fully break out revenue by product line or geography in great granularity. However, a few observations:

- The majority of revenue remains tied to footwear rather than apparel, especially as newer apparel experiments were scaled back.

- Geographically, most revenue is U.S. and developed markets, though international expansion is active (Europe, Asia-Pacific).

- Wholesale / distributor revenue is increasingly leveraged, especially for international markets, to lower fixed costs

Unit Economics

Detailed public data on metrics like Customer Acquisition Cost (CAC) or Lifetime Value (LTV) is scarce. But some proxy insights and challenges:

- A blog analysis estimated payroll cost as ~24 % of revenue for Allbirds (versus ~12 % for Nike), indicating relatively high personnel overhead burden.

- Operating margin historically negative — e.g., in 2021, Allbirds reportedly had an operating margin of –12 %.

- Gross margin has shown some improvement; in 2024, Allbirds reported a gross margin of ~42.7 % vs 41 % in 2023.

- The company has noted margin improvement was driven by lower freight and duty costs per unit, and fewer inventory adjustments.

- Recurring / predictable revenue is limited, as products are transactional. However, gift card breakage and repeat purchases provide some base.

Thus, scale and optimization are critical to move from negative leverage to a sustainable margin structure.

Recurring / Predictable Components

While Allbirds lacks a conventional recurring revenue model (e.g. subscription), a few elements aid predictability:

- Gift card breakage (unused balances) — used in guidance narratives.

- Repeat purchases / loyalty — building customer lifetime relationships, though turnover and fashion cycles limit predictability

- Wholesale orders — recurring orders from distributors/retailers can provide more predictable volume in established markets

Financial Performance

Key Financial Metrics (Recent Years)

Below is a synthesized summary of Allbirds’ recent financial performance (figures drawn from public filings, investor releases, and aggregate sources):

| Metric | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|

| Net Revenue (USD millions) | (pre-IPO year) | — | 254.1 | 189.8 |

| YoY Δ in Revenue | — | — | –14.7 % | –25.3 % |

| Gross Profit / Gross Margin | — | — | $104.2 m / ~41 % | $81.1 m / ~42.7 % |

| Net Income / Loss | — | — | –$152.5 m | –$93.3 m |

| Adjusted EBITDA Loss (2023) | — | — | –$78.4 m | — |

| Q1 2025 (most recent) | — | — | — | Revenue $32.1 m (–18.3 % vs prior year), net loss $21.9 m |

| Inventory (Q1 2025) | — | — | — | $42.9 m (down 29.3 % YoY) |

From these figures, we observe a clear and sharp decline in top-line growth starting in 2023 into 2024, with margin pressure reflecting both negative operating leverage and corrective measures.

Drivers of Revenue Growth / Decline

Growth Drivers (historical)

- Viral adoption and word-of-mouth scaling, especially in tech / urban markets

- Retail expansion and international presence

- Product line broadening (new styles, materials)

- Collaborations (e.g. Adidas) and media coverage

Decline / Pressure Drivers

- Overexpansion into apparel and accessory lines that underperformed, leading to discounting and write-downs (e.g. $13 m liquidation cost cited)

- Inventory mismanagement and obsolescence

- Retail stores underperforming, lease burden

- Declining consumer demand, macro headwinds, and greater competition

- Transition of international operations to distributor models, reducing direct revenue but lowering fixed costs

- Marketing spend and SG&A fixed costs despite declining revenues (leading to expense leverage issues)

Stock Performance (Post-IPO)

- Allbirds went public in November 2021; on opening day, shares soared ~90%.

- Over time, the stock price collapsed, prompting a 1-for-20 reverse split in September 2024 to maintain Nasdaq listing compliance (minimum $1 share price).

- Market capitalization and valuation remain modest compared to peers; as of some reports, trailing twelve-month revenue is ~$183 million and market cap ~ $84.6 million.

Given the steep decline, the stock’s performance underscores investor skepticism about Allbirds’ path to profitability and sustainable growth.

Product or Service Offerings

Core Products & Value Propositions

Allbirds focuses primarily on footwear, supplemented by selected apparel and accessories. Key offerings:

- Wool Runners — lightweight sneakers using merino wool for breathability, odor control, and comfort.

- Tree / Eucalyptus-based shoes — for warmer climates, less wool, more eucalyptus fibers.

- Tree Dasher / Tree Flyer — performance-oriented running shoes blending sustainability and technical features.

- Plant-based leather sneakers (e.g. Plant Pacer) — using Mirum, a plant leather alternative developed in partnership with Natural Fiber Welding (NFW). Unfortunately, the product is no longer on the Allbirds website, so it seems this collaboration has been discontinued.

- Socks, laces, insoles, basics — complementary accessories

- Limited apparel / clothing (merino wool sweaters, jackets) — though many of these lines were scaled back due to underperformance.

Unique value propositions include sustainable and natural materials, carbon footprint transparency, minimalist design, and consumer education on environmental impact.

Pricing & Evolution

- Pricing has remained at a premium level relative to mass-market sneakers, justified by materials, branding, and mission.

- Over time, Allbirds has refined its product mix, reducing peripheral apparel offerings and emphasizing core, higher-margin footwear.

- Product upgrades and iterative improvements (comfort, cushioning, weight) have been introduced in performance shoe lines.

- The introduction of plant-based leathers broadened material options to appeal to non-wool-preferers.

R&D, Innovation & Partnerships

Allbirds invests heavily in material science, developing proprietary blends such as its sugarcane-based SweetFoam midsoles and eucalyptus fiber uppers to reduce fossil dependence.

The company’s approach has always been to push beyond conventional materials and to collaborate with innovators who share its sustainability vision.

In August 2025, Allbirds expanded this innovation track with the launch of The Remix Collection, a groundbreaking initiative that literally turns waste into wearable performance.

In partnership with Blumaka, a leader in converting recycled foam into world-class footwear components, and Circ, a pioneer in textile-to-textile recycling, Allbirds unveiled two styles—the Runner NZ Remix and Cruiser Remix—made from manufacturing waste.

The shoes repurpose blended textile waste and foam scraps that would otherwise end up in landfills, giving them a second life as premium sneakers.

Blumaka’s midsoles, crafted from reclaimed foam scraps, use 99 percent less water and produce 65 percent fewer carbon emissions than traditional foam production, while exceeding expectations for comfort and durability.

Circ’s proprietary hydrothermal process separates and recovers cotton and polyester fibers from blended garments, producing new textile material that rivals virgin synthetics in look and feel.

Together, these innovations show how advanced recycling can meet performance without compromise.

Adrian Nyman, Allbirds’ Chief Design Officer, summarized the ethos behind the collection: “Remix is the next step in our innovation journey, delivering on sustainable design that enhances both look and feel.”

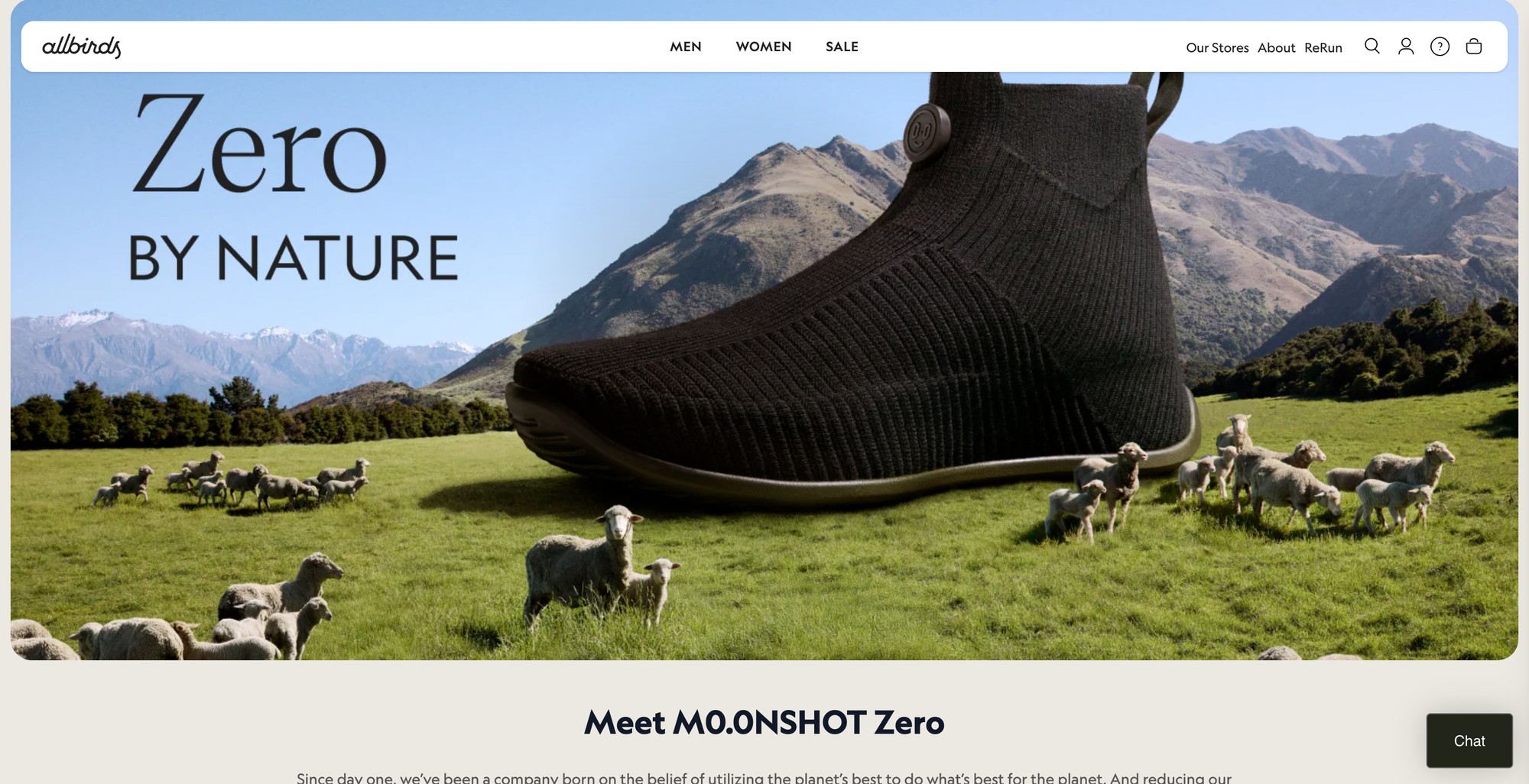

The Remix Collection follows a decade of material breakthroughs including the Futurecraft.Footprint low-carbon shoe with Adidas and M0.0NSHOT Zero, the world’s first net-zero carbon shoe made with carbon-negative regenerative wool.

Each project reinforces Allbirds’ broader mission to make “better things in a better way,” and positions the company as a continual innovator in circular material science.

While the degree to which these materials are patented or proprietary remains partially undisclosed, Allbirds’ collaborations in regenerative and recycled material technology remain a key differentiator—and an ongoing investment that defines its competitive edge.

Go-to-Market & Marketing Strategy

Customer Acquisition & Channels

- DTC E-commerce — all products available on Allbirds’ website, enabling full margin capture and direct consumer data.

- Own retail stores & pop-ups — to provide experiential brand presence, try-on access, and omnichannel integration.

- Wholesale / retail partnerships — selective presence in department stores or specialty retailers to broaden reach without burden of store operations.

- International distributor partnerships — particularly in regions where direct operations raise cost risk.

Marketing & Branding

Allbirds’ marketing strategy is heavily values-based, content-rich, and community-driven:

- Emphasis on sustainability story: carbon footprint disclosure, life-cycle impact, material sourcing transparency

- Viral / earned media: early adoption in tech circles, product reviews, media coverage

- Collaborations and limited editions (e.g. with Adidas, designers) to amplify reach

- Influencer / social content marketing rather than mass advertising

- Minimalist, clean aesthetic as part of brand identity

- Message of “light on the planet, light on your feet” has been central

- In times of downturn, Allbirds pulled back marketing spend (e.g. from $59 million to ~$49 million) while focusing on CRM and retention.

Retention, Cross-sell, Ecosystem

- Loyalty and repeat buyers: Encouraging recurring customers is critical; product quality and trust help.

- Upsell / cross-sell: Offering socks, accessories, and new models to existing customers

- Community-building efforts: Sustainability content, transparency blogs, carbon calculators, educational content

- Customer feedback loops: Leveraging DTC data to refine products and reduce returns

Overall, Allbirds’ marketing is less about discounting and more about narrative, mission, and selective growth.

Challenges & Crisis Management

Challenge 1: Overexpansion & Product Stretch

Situation: In the mid-2020s, Allbirds extended into apparel, dresses, puffer jackets, and other non-core lines. Many of these offerings did not gain traction with its core consumers. Some inventory had to be liquidated (reportedly ~$13 million).

Response: Leadership retrenched: scaling back fashion lines, closing underperforming stores, reducing new launches, refocusing on core footwear. Under the new CEO, Allbirds emphasized “the core that works.”

Outcome & Impact: These actions helped stabilize product focus and mitigate further losses, though at the cost of lower growth in the short term. The brand appears better positioned to rebuild from a more solid footing.

Challenge 2: Declining Sales & Negative Leverage

Situation: By 2023, Allbirds faced declining revenue growth, shrinking margins, and high fixed cost burdens. The economics of scaling became challenging with falling volume and continued investment in marketing, leases, and inventory.

Response: The company cut costs: reduced marketing spend, scaled down store footprint, restructured operations, and shifted international operations to distributor models to reduce fixed cost exposure.

Outcome: While losses persist, margin improvement in some quarters (e.g. gross margin of 42.7 % in 2024) suggests partial progress.

Challenge 3: Stock Decline & Nasdaq Non-compliance

Situation: The stock plunged to under $1 for over 30 consecutive days, triggering a compliance notice from Nasdaq in April 2024.

Response: Allbirds implemented a 1-for-20 reverse stock split in September 2024 to boost share price. They also redoubled efforts to improve operational metrics and focus on higher-margin products to rebuild investor confidence.

Outcome: The stock survived delisting, though investor sentiment remains fragile. The reverse split bought time; longer-term viability depends on execution.

These crises and responses illustrate the volatility of scaling a mission-driven consumer brand in a competitive, capital-intensive space.

Strategic Initiatives & Future Outlook

Ongoing / Planned Strategic Moves

- Retail rationalization

Allbirds plans to shutter 10–15 underperforming U.S. stores, and focus on high-performing locations. - Wholesale / distribution expansion (especially Europe)

To reduce fixed costs and scale internationally, Allbirds is signing more distribution deals in regions like Benelux and Scandinavia. - Focusing on core product lines

Doubling down on the most successful footwear models (Wool Runner, Tree Dasher), while scaling back peripheral apparel experiments. - Material innovation and sustainability deepening

Continued R&D in plant-based materials and carbon-reduction initiatives to preserve brand differentiation. - Inventory, cost, and supply chain optimization

Leaner inventory, improved forecasting, better supplier terms, and logistical efficiencies will be essential.

Positioning for Future Growth

Given current challenges, Allbirds is in a transitional phase. Its future will depend on:

- Whether it can convert its brand equity and sustainability narrative into profitable scale

- The ability to fend off competition from incumbents launching green lines and from agile sustainable upstarts

- Success in executing a more disciplined cost structure and operational model

- Maintaining consumer trust around environmental claims in an increasingly skeptical climate

If the sustainable footwear market continues to grow at ~15–20 % CAGR, there is room for Allbirds to recapture upside, but execution risk is high.

Recommendations / Next Steps

- Develop a subscription / circular model

Introducing repair, resale, or rental programs could increase customer lifetime value and stable revenue streams—strengthening loyalty and reducing waste perception. - Selective wholesale partnerships, not scale-out retail

Rather than owning more stores, partner with premium retail chains or concept shops to expand presence with lower capital burden. - Deepen credibility in sustainability through third-party verification

Invest in external audits, life-cycle assessments, carbon certification, and transparent reporting to reduce greenwashing risk and strengthen consumer trust. - Focus on high-margin models and discontinue weak SKUs

Permanently sunset underperforming apparel lines and reallocate resources to high-return footwear innovation. - Invest in data analytics and demand forecasting

To minimize inventory write-downs, optimize supply chain buffers, and better align production to real-time consumer trends.

Key Takeaways & Lessons Learned

- Strong mission helps attract early adopters but isn’t a substitute for operational rigor

Allbirds’ sustainability narrative drove attention and premium pricing, but scaling sustainably exposed the need for cost discipline and profit focus. - Be cautious of overextension beyond core strengths

Diversifying too far (into apparel, accessories) diluted brand identity and created financial drag; staying tightly aligned with core competencies is safer in early scaling phases. - Physical expansion must be carefully paced

Building retail presence is costly. Overopening stores before fully proving profitability can backfire. - Materials and supply chain innovation is both opportunity and risk

Proprietary bio-materials can distinguish brands but require sustained R&D investment and supply chain certainty. - Sustainability claims demand transparency and accountability

As consumer and regulatory scrutiny grows, brands must substantiate environmental claims or risk reputational damage. - Pivoting is inevitable—but timing and credibility matter

Allbirds’ pivot under new leadership rightly centered back to its core, but investor confidence hinges on execution and consistency.

Final Thoughts

Allbirds illustrates how a compelling mission can open doors, attract early adopters, and earn cultural relevance, yet still require disciplined execution to endure. The company proved that natural materials, life cycle thinking, and carbon transparency can resonate with mainstream consumers.

It also showed how quickly momentum can fade when product expansion, store growth, and cost structure outpace unit economics and clear product market fit.

The recent leadership transition and renewed focus on core footwear suggest that the brand understands where it wins and where it overreached.

For impact founders, three themes stand out.

First, sustainability can be a durable differentiator, but only when paired with measurable product value. Comfort, fit, and performance must equal or exceed conventional options, or the mission premium will erode in price sensitive markets.

Second, growth levers should be sequenced. DTC can validate products and messaging, but wholesale and distributor partnerships may offer a more capital efficient path to global reach than rapid store rollouts.

Third, inventory and SKU discipline are strategy, not just operations. Tight line editing, accurate demand planning, and decisive pruning of underperforming categories preserve margin and brand clarity.

Allbirds also underscores the new bar for credibility in climate claims.

Publishing per product carbon footprints, investing in verifiable materials, and inviting third party validation build trust.

As regulation and consumer scrutiny rise, brands that treat sustainability data like financial data will be better positioned with both customers and investors.

Looking forward, Allbirds’ prospects hinge on translating brand equity into profitable scale. A narrower product portfolio, selective wholesale, and leaner international models can improve cash conversion and reduce volatility.

Programs that extend the customer relationship, such as repairs, resale, and limited seasonal refreshes, can raise lifetime value without heavy acquisition spend. Continued material innovation, especially where it improves performance and reduces cost, can renew consumer excitement while supporting gross margin.

The broader lesson for mission driven companies is clear.

A powerful story can launch a brand, but durable businesses are built on repeatable economics, focused product roadmaps, and operating rhythm.

When strategy, operations, and impact move in step, the mission accelerates growth rather than substituting for it. Allbirds’ reset is a reminder that course correction is not failure. It is the method by which resilient companies align what they stand for with how they win.