Lemonade, Inc. is a U.S.-based digital insurance company founded in 2015 and headquartered in New York City, New York. Its core proposition is offering renters, homeowners, car, pet, and life insurance products via an app/web-first user experience, leveraging artificial intelligence (AI), machine learning and behavioral economics, while also adopting a social-impact orientation (e.g., certified B-Corp).

Growth trajectory & market position

Lemonade has grown from modest beginnings in 2015 into a public company (IPO in 2020) and has crossed key milestones such as more than $1 billion of “in-force premiums” (IFP) by 2025. Revenue has grown rapidly: for example from about $128 million in 2021 to about $430 million in 2023.

The company has sought to position itself as a challenger to incumbent insurers by emphasising speed, digital-first service, minimal paperwork, and younger customer segments.

Company Background & History

Founding story

Lemonade was founded in 2015 by Daniel Schreiber and Shai Wininger. Their vision was to solve what they saw as a broken and bureaucratic insurance industry: high friction, slow claims processing, distrust between insurers and policyholders, and agents/brokers as intermediaries.

By building a full-stack digital carrier (rather than just a marketplace), they aimed to streamline product design, underwriting and claims via chatbots and AI, reducing paperwork and improving customer experience.

Timeline of major milestones

- 2015: Founded in April.

- 2016-17: Raised seed and Series A/B funding; early focus on renters and homeowners insurance.

- 2017: Larger funding rounds including $120 million Series C led by SoftBank.

- 2020: IPO on the New York Stock Exchange under ticker “LMND”.

- 2020-21: Geographic expansion into Europe (Netherlands, France) and product expansion (car, pet, life).

- 2024: Investor Day presentation laying out a growth plan (“10x” ambition) for multi-billion premium scale.

- 2024-25: Continued scale of in-force premiums (IFP) beyond $1 billion.

Evolution of leadership, ownership, pivots

The founders remain key leaders, with Schreiber as CEO and Wininger as President/Co-CEO (depending on structure). The company went from a startup funded by venture capital to a publicly traded company.

It has gradually expanded beyond its initial renters/homeowners niche into auto, pet and life insurance. One pivot (or extension) has been using AI/ML for underwriting and claims (rather than simply being a digital broker).

It also built its own carrier licenses in the U.S. and Europe rather than being a pure aggregator. Ownership has transitioned from private VC investors (Sequoia, GV, SoftBank, Thrive Capital) to a broad public shareholder base post-IPO.

Industry & Market Analysis

Industry landscape

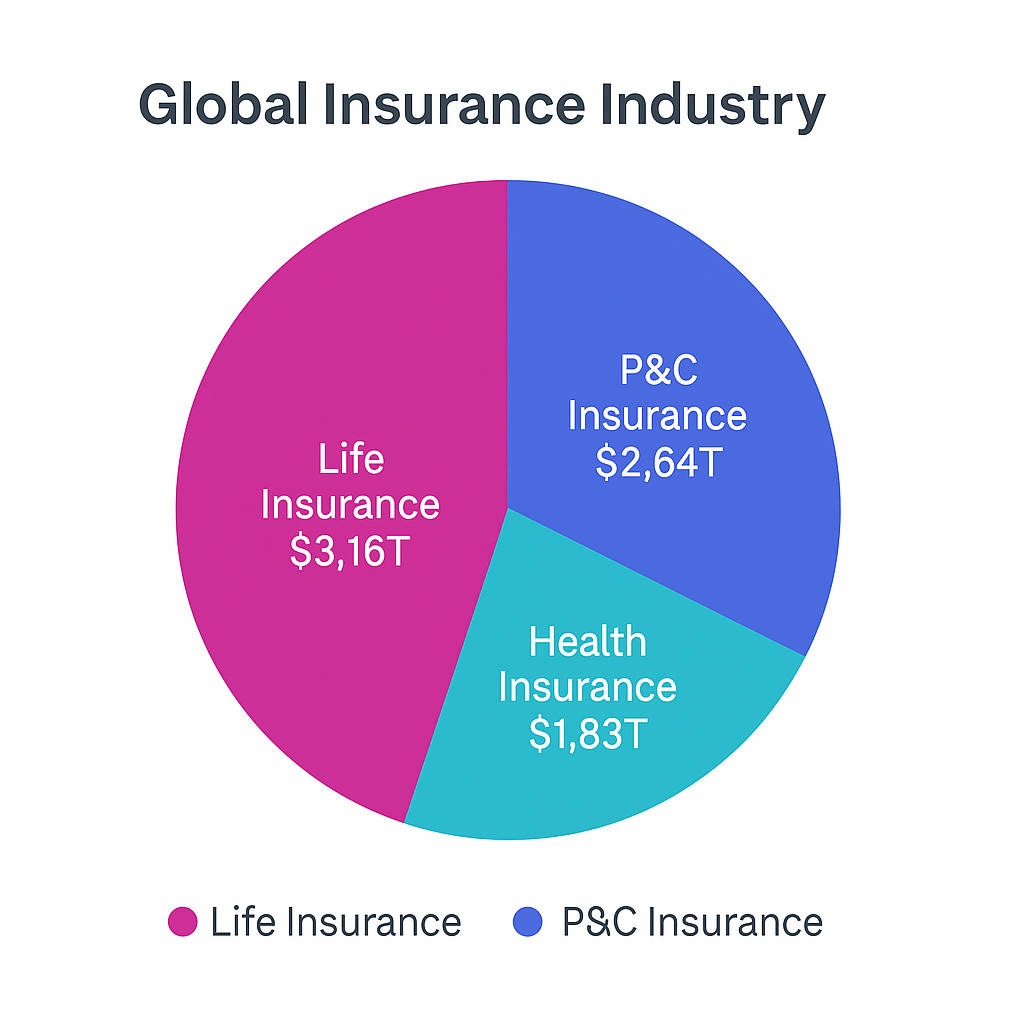

The global insurance industry remains one of the largest and most resilient sectors in the financial world, with steady growth across life, property and casualty (P&C), and health segments. According to the Allianz Global Insurance Report 2025, the industry expanded by +8.6% in 2024, outpacing the already exceptional +8.2% growth in 2023.

Worldwide, insurance companies recorded an increase of roughly $607 billion in total premiums, bringing global premium income to approximately $7.6 trillion.

Life insurance remains the largest segment, generating an estimated $3.16 trillion in premium income, followed by P&C insurance at $2.64 trillion and health insurance at $1.83 trillion.

In the P&C sector—where Lemonade operates—global growth reached +7.7% in 2024, slightly below the +8.3% recorded in the previous year.

The North American market remained the dominant force, expanding by +8.2% and accounting for over half of all global P&C premiums. Western Europe grew by +6.0%, while Asia expanded by +4.0%, maintaining a smaller overall market size compared to Europe.

The life insurance segment was the fastest-growing category, expanding +10.4% in 2024, up from +8.2% in 2023. Growth was led by North America (+14.4%), fueled by a surge in demand for annuities as higher interest rates made guaranteed-income products more attractive.

Western Europe also benefited from higher yields with +7.1% growth, while Asia, led by China (+15.4%), recorded some of the world’s strongest life-insurance expansion. Unlike the U.S.-dominated P&C sector, global life insurance premiums are more evenly distributed, with Asia contributing more than one-third of total life premiums.

The health insurance market grew by +7.0%, with demand especially strong in Asia (+12.6%), reflecting low insurance penetration and evolving public-health systems. In most Asian markets, health-insurance premiums remain below 1% of GDP, except in Taiwan, signaling substantial long-term upside potential.

While the outlook remains positive, geopolitical instability, trade tensions, and financial fragmentation could restrain future premium growth by dampening global economic activity.

Target market segments & customer personas

Lemonade’s target customer segment is younger, digitally native, first-time insurance buyers (especially renters, small homeowners, pet owners) who prefer online/mobile experiences, fast claims processing, transparent pricing and socially conscious companies.

For example, the Q3 2025 investor-letter noted that “younger, first-time insurance buyers” were a key segment. The company is also expanding into auto insurance (especially new-to-insurance or digitally-driven drivers) and into European markets where digital penetration is lower.

Key drivers of demand

- Digital convenience and mobile-first behavior: younger consumers expect fast, app-based insurance.

- Underwriting/distribution cost advantages via AI and bots (reducing traditional agent overhead).

- Changing consumer attitudes: more focus on purpose, transparency, fairer pricing — appeals to Lemonade’s “Giveback” model (unused premiums donated to charity).

- Usage-based or embedded insurance: for auto, micro-segments, etc. Lemonade acquired Metromile, Inc. (pay-per-mile auto insurance specialist) as part of this.

- Regulatory and macro-trends: more severe weather and catastrophes (CAT events) increase losses in P&C insurance, creating both risk and opportunity for digital insurers that can price dynamically and manage costs. Lemonade cites diversification of its book into less CAT-exposed lines (pet, car, Europe) to improve performance.

Market sizing & growth projections

While precise market sizing for Lemonade’s target niche is not always published, some useful data points:

- Lemonade’s revenue grew from ~USD 94 million in 2020 to ~USD 430 million in 2023.

- The company passed USD 1 billion of in-force premiums (IFP) by early-to-mid 2025.

- In the Q4 2024 shareholder letter the company reported IFP at USD 944 million (growth of 26 % year-on-year) and revenue growth of 29 %.

- As a rough proxy, if the U.S. homeowners/renters/auto insurance market is several hundred billion dollars annually, then Lemonade has only a small share today but a large potential runway.

Competitive Landscape

Top 3-5 direct competitors

- Progressive Corporation – Large incumbent U.S. auto and homeowners insurer with strong brand, wide distribution and agent/broker and direct channels.

- GEICO (part of Berkshire Hathaway) – Direct-to-consumer auto insurance leader, strong cost management and technology usage.

- Root Insurance Company – A U.S. insurtech startup specialising in usage-based auto insurance. (Note: Root has had financial and regulatory challenges, but still represents a digital native competitor.)

- Metromile, Inc. (now part of Lemonade) – Originally a pay-per-mile auto insurance start-up; as a competitor prior to acquisition it targeted usage-based auto.

- Hippo Insurance – A U.S.-based digital homeowners insurance company that uses smart-home data and AI to prevent losses and streamline claims. Hippo targets property owners looking for proactive, tech-driven risk management.

- Next Insurance – Focused on small businesses and entrepreneurs, Next provides digital-first general liability, workers’ comp, and professional liability policies. Its API-driven platform and self-service model mirror Lemonade’s approach to simplicity and automation.

- Clearcover – A digital auto insurance carrier that leverages AI to reduce overhead and provide cheaper, faster coverage through mobile-first experiences and embedded distribution.

- Kin Insurance – Specializes in homeowners and catastrophe-prone property insurance, particularly in coastal U.S. states like Florida and Louisiana. Kin’s tech-enabled underwriting makes it a close P&C competitor in climate-exposed regions.

- Branch Insurance – A full-stack insurer bundling auto, home, and renters coverage instantly via API integrations. Branch competes directly with Lemonade on bundling simplicity, digital onboarding, and transparent pricing.

Competitive advantages & disadvantages

Advantages

- Proprietary AI-enabled underwriting/claims engine, which can scale and reduce costs. For example, Lemonade cites improving gross loss ratio via AI/feedback loops.

- Digital-first model, enabling faster onboarding and claims handling, which appeals to younger customers.

- Social-impact branding (e.g., giving back unused premiums) may enhance customer loyalty and brand differentiation.

- Focus on cross-selling and diversifying into car/pet/life and European markets, increasing addressable market.

- Recently improving underwriting results (e.g., loss ratio improvements) which suggests maturation of model.

Disadvantages / Risks

- Still a relatively small scale compared to major incumbents; lacked profitability historically and remains exposed to underwriting risk and catastrophic events.

- Customer acquisition cost (CAC) may be high, especially as it expands product lines and geographies.

- Regulatory and licensing complexity in insurance across states and countries.

- Insurance is a low-margin, capital-intensive business; if loss ratios worsen (e.g., due to CAT events) digital players can be exposed. Lemonade itself cites CAT volatility as risk.

- Brand trust and reliability matter in insurance; new entrants must build reputation and claims credibility.

SWOT analysis

Strengths

- Rapid growth of in-force premiums (IFP) and revenue (e.g., IFP $944 million in Q4 2024, up 26% YoY).

- Digital platform and AI-enabled operations reducing friction and overhead.

- Social-impact orientation may enhance brand and appeal to younger customers.

Weaknesses

- Ongoing net losses (the company has yet to reach consistent profitability).

- Exposure to catastrophe (CAT) losses and regulatory risk.

- Relatively small market share compared to incumbents; still building scale and cross-sell depth.

Opportunities

- Expansion into auto insurance (large market, recurring revenue potential) — the company states car segment is a key growth driver.

- International expansion into Europe (Germany, UK, France, Netherlands) gives new growth markets.

- Embedded insurance / usage-based insurance opportunities.

- Cross-sell existing customers to multiple product lines (renters → homeowners → auto → pet → life).

- Improving underwriting and loss ratios could unlock profitability and margin expansion.

Threats

- Increased competition from incumbents accelerating digital transformation and new insurtech entrants.

- Catastrophe risk (climate change) leading to spikes in claims and worse loss ratios. Lemonade noted CAT exposure in Q3 2024.

- Regulatory changes or capital requirements in insurance markets.

- Macro-economic risks (inflation, asset yields, interest rates) that affect investment income and loss reserve adequacy.

Business Model & Revenue Streams

How Lemonade generates revenue

Lemonade generates revenue primarily through insurance premiums collected from customers for its various insurance policies (renters, homeowners, auto, pet, life).

A portion of the premiums is used to pay claims and operating expenses; the remainder constitutes gross profit. In addition, Lemonade invests (in cash/invested assets) and may earn investment income.

The company also benefits from reinsurance partnerships (ceding some risk) and uses technology to reduce cost of acquisition and servicing.

Breakdown by segment (where available)

- In-force premium (IFP) is a metric tracking the annualized value of all active policies: in Q4 2024 IFP was $944 million.

- Revenue (top line) was ~$430 million in 2023.

- The company reports geographic segmentation (U.S. vs Europe) and product lines (home/renters, auto, pet, life) but detailed breakdowns by product/region in public summaries are limited.

- For example, the Q3 2024 shareholder letter notes that the share of IFP from less CAT-exposed business (pet, car, Europe) had roughly doubled in ten quarters from ~23% to ~44%.

Unit economics / margins

- Gross loss ratio is a key underwriting metric: in Q4 2024 the gross loss ratio was 63% for the quarter (its best result), and the TTM (trailing twelve months) gross loss ratio was 73%.

- The company reports gross profit (non-GAAP) improvements: for example, at Q3 2024 gross profit grew 71% year-on-year to $38 million and gross profit margin increased by 8 points to 27%.

- Adjusted EBITDA losses have been shrinking: at Q1 2025 the adjusted EBITDA loss was $47 million (net loss $62 million) in line with guidance.

Recurring or predictable revenue: Insurance premiums are recurring (renewals) and in-force premiums provide predictability.

The company emphasises cross-selling and upselling (e.g., adding auto or pet policy to an existing customer) to raise Annual Dollar Retention (ADR).

For example, 2022 Q4 shareholder letter reported ADR of 86% (i.e., customers increasing policies/premiums over time).

Financial Performance

Key financial metrics (last 3-5 years)

In Q4 2024 the company disclosed IFP at $944 million (growth 26% YoY) and revenue growth 29%. The Q3 2024 shareholder letter reported net cash flow of USD 48 million positive for the quarter.

Drivers behind growth or decline

- Growth in in-force premiums as Lemonade expanded product lines (auto, pet, life) and geographies (Europe) helped scale.

- Improvement in gross loss ratio (underwriting improvement) helps margin expansion. For example, gross loss ratio improved to 63% in Q4 2024, down from higher levels previously.

- Digital cost efficiencies (AI, automation) help reduce expense ratio.

- On the other hand, exposure to catastrophe (CAT) events, underwriting losses, regulatory rate lag or inflation in claims/repairs can drive losses. The company noted in earlier letters that they filed many more rate changes due to inflation and CAT.

Stock performance vs relevant indices or peer group

As a public company (NYSE: LMND), Lemonade’s share price has exhibited high volatility given its growth orientation and unprofitable status. For example, an article in May 2024 observed that the stock had fallen more than 70% since its IPO in 2020.

Product or Service Offerings

Core products / services

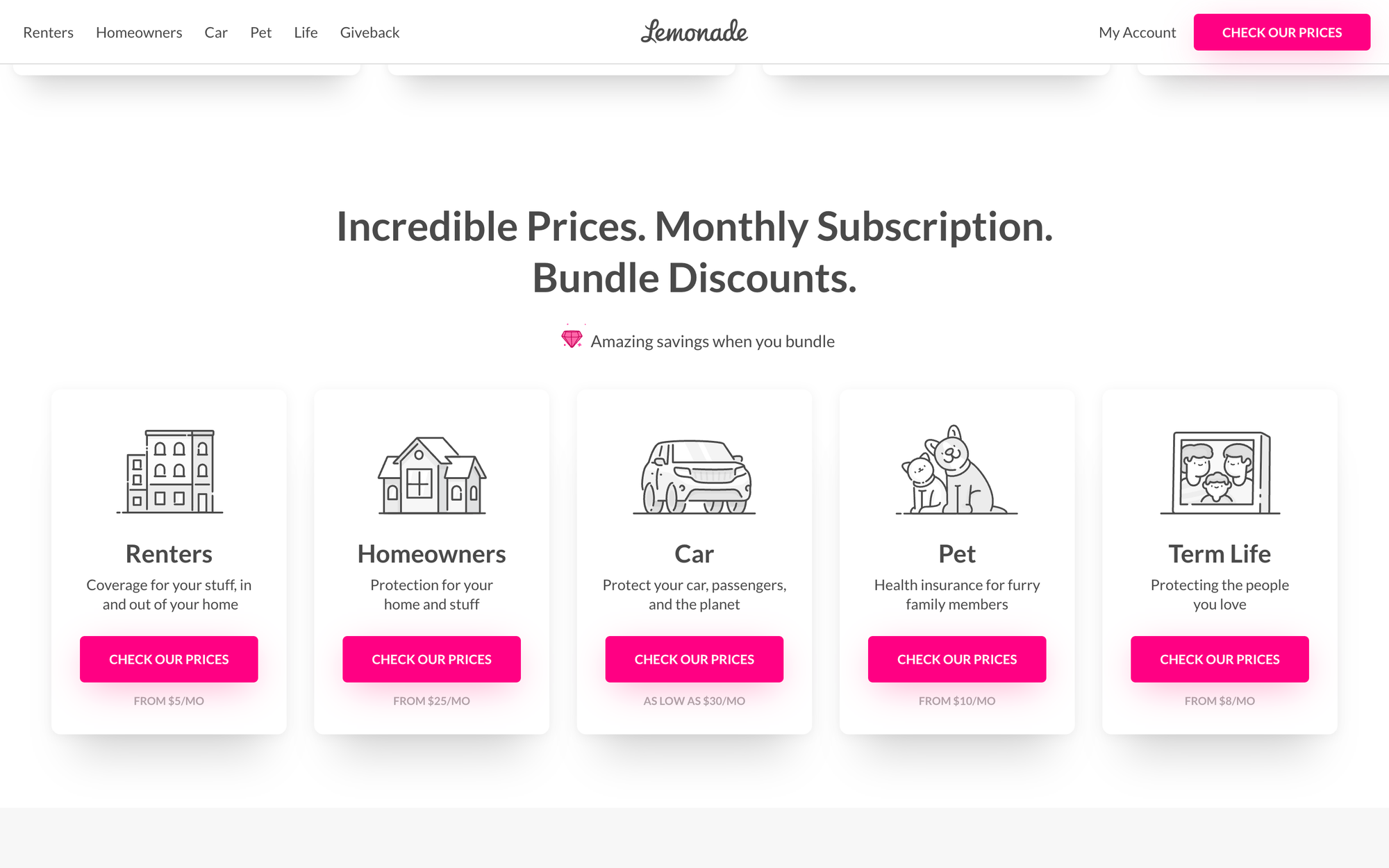

- Renters insurance: Lemonade’s initial product line, targeting tenants with simple digital process.

- Homeowners insurance: For homeowners and landlords, multi-peril property coverage.

- Car insurance (auto): A major growth engine; Lemonade emphasizes car as “key driver of accelerated growth”.

- Pet insurance: Coverage for pets (pets product is less exposed to CAT risk).

- Life insurance (term life): Add-on product, further broadening portfolio and recurring revenue base.

Unique value propositions & feature evolution

- Fast claims: Use of chatbots/AI to handle onboarding, claims and renewals with minimal human intervention, delivering speed and convenience (e.g., claims paid in minutes for simple cases).

- Transparent pricing and usage of technology to reduce friction.

- Social impact “Giveback” model: any leftover premium after claims and expenses is donated to charities chosen by customers (consistent with B-Corp orientation).

R&D / innovation pipelines, partnerships

- The company highlights its proprietary AI/ML underwriting/claims engine and tele-metrics usage (particularly for auto insurance).

- The acquisition of Metromile provides usage-based auto insurance capabilities (pay-per-mile model) and telematics data.

- Investor presentations (Investor Day 2024) outline expectations for improved efficiency, lower expense ratios, improved loss ratios and scaling of the model.

- The company may partner with reinsurers (ceding portions of risk) and with tech / data providers although specific public disclosures are more limited.

Go-to-Market & Marketing Strategy

Customer acquisition (channels)

- Direct-to-consumer via mobile app and website: the primary channel.

- Digital marketing (social media, online ads) targeted at younger customers seeking convenience and purpose-driven brands.

- Cross-sell existing customers: as existing renters/homeowners customers become eligible for auto, pet or life policies, the company can sell additional products. The 2022 Q4 letter said cross-sell and upsell (ADR) is a lever to profitability.

- Geographic expansion (entering Europe) to increase addressable market.

Here are historic figures for Lemonade, Inc.’s Sales & Marketing expenses drawn from its public filings Note: these figures cover all marketing, advertising, branding, etc., not only social media or online ads (which Lemonade does not break out separately).

| Year | Sales & Marketing Expense (USD millions) | Source/Notes |

|---|---|---|

| 2021 | 141.6 M (increase of 61.2 M or +76% over 2020) | 2021 Annual Report, page “Sales and Marketing” note. |

| 2022 | ? (exact full-year figure not in this summary) | The 2022 10-K indicates sales & marketing includes “third-party marketing, advertising, branding, public relations and sales expenses.” |

| 2023 | ~101.9 M (TTM figure as of Dec 31 2023) | Source: “Operating Expense Breakdown” from StockAnalysis for TTM as of Dec 31 2023. |

| 2024 | 166.3 M (increase of 64.4 M or +63% over prior year) | 2024 Annual Report 10-K. |

Operations & Organizational Structure

Operational footprint

- Headquarters: New York City, New York.

- The company operates in the U.S. and across Europe (Germany, Netherlands, France, UK) for certain lines.

- Employee count: According to recent reports ~1,235 employees in 2024.

Social Impact and Public Benefit Model

Public Benefit Corporation and B Corp status

Lemonade is incorporated as a Public Benefit Corporation and is also a certified B Corp, which means the company is legally committed to pursuing a positive social and environmental impact alongside financial returns.

The B Corp certification is awarded to businesses that can demonstrate they balance profit with purpose across governance, workers, community, and environment, and Lemonade is reassessed every three years.

From an impact and governance perspective, this formal structure:

- Locks in stakeholder orientation at the corporate level, not only at the marketing level

- Signals to customers and investors that social outcomes are part of Lemonade’s long term mandate

- Creates external accountability through the recurring B Lab assessment and public reporting

For impact-oriented investors, this moves Lemonade beyond traditional ESG integration and into the category of mission-anchored business models.

The Giveback mechanism

Giveback is the core social impact feature of Lemonade’s insurance model. When customers buy renters, homeowners, car, or pet insurance, Lemonade takes a fixed fee to run the business, uses the remaining premiums to pay claims, and then donates any leftover amount to nonprofit partners selected by customers.

Mechanically, the model works as follows:

- Customers choose a nonprofit at the time of policy purchase

- Lemonade groups customers who chose the same cause into a “Giveback pool”

- Once a year, Lemonade tallies unclaimed premiums for each pool after paying claims and expenses

- Surplus funds go directly to the nonprofit partner rather than to underwriting profit

This structure attempts to reduce the perceived conflict of interest between insurer and policyholder, since Lemonade’s fixed fee does not increase if claims are denied, and any unclaimed surplus helps a cause chosen by the customer instead of remaining as profit.

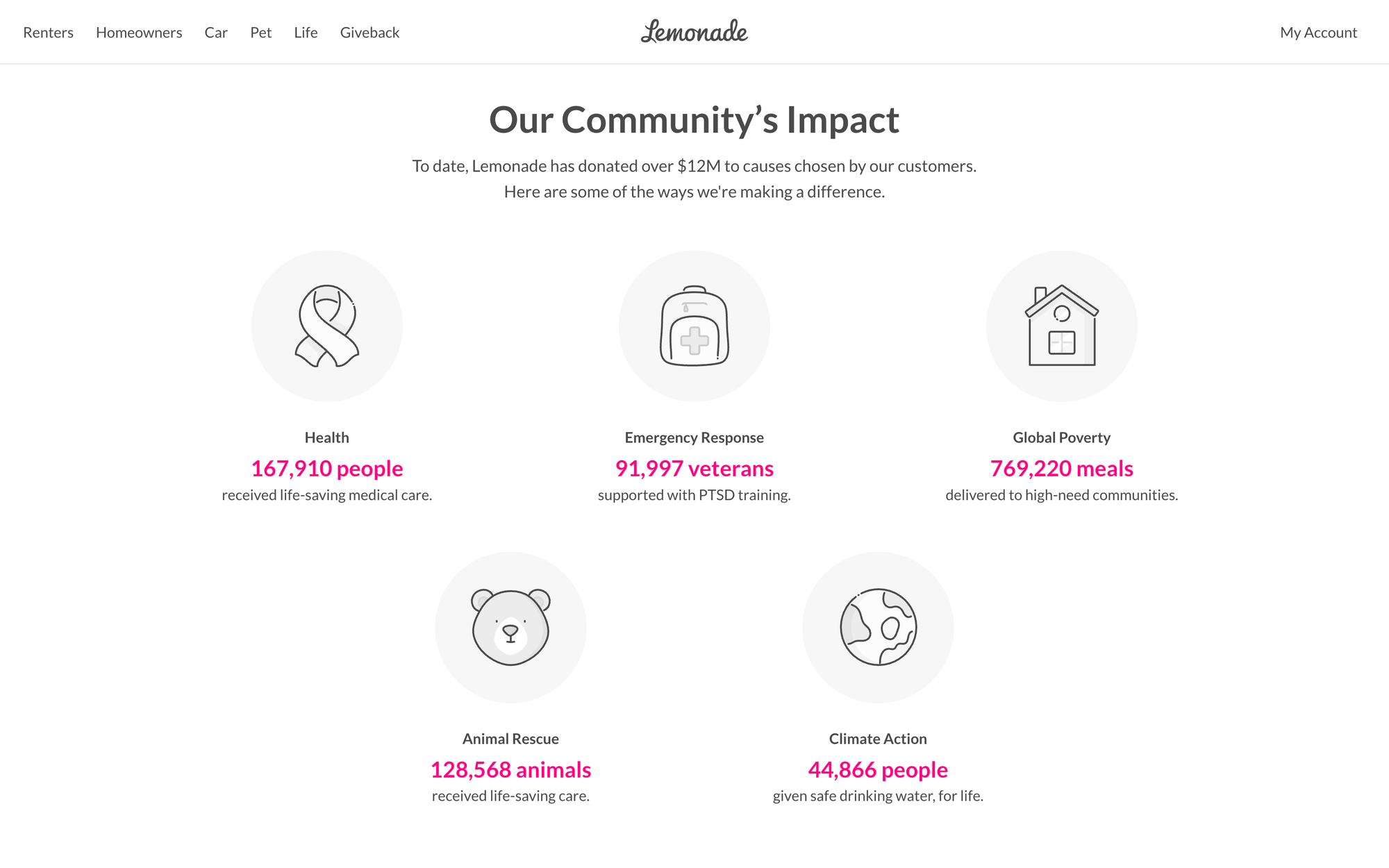

Scale and distribution of impact

Since 2017 Lemonade reports that it has donated over 12 million dollars through Giveback to causes including housing, clean water, education, animal welfare, health, and poverty reduction.

The company provides granular outcome metrics that illustrate the breadth of this impact across sectors. Examples from its Giveback reporting include:

- Health

- 167,910 people received life saving medical care

- Emergency response and veterans support

- 91,997 veterans supported with PTSD training

- Global poverty and food security

- 769,220 meals delivered to high need communities

- 152,320 meals distributed to food insecure families in the United States

- 13,000 nourishing meals delivered to low income families in New York City

- Animal welfare

- 128,568 animals received life saving care

- Climate and water

- 44,866 people granted safe drinking water for life

- 4,000 people in Uganda given lifelong access to clean water through Charity: water

- Multiple tree planting programs, for example 1,100 trees planted in 2025 and 15,600 trees planted via American Forests to support a multi million tree goal across North America

- Education and youth opportunity

- 294,200 students supported by 4,509 teachers and 262 Ignite Fellows across 1,717 high need schools

- 1,500 female headteachers trained to support education for 150,000 girls through the Malala Fund

- 3,525 homeless youth receiving STEM and college preparation support

- 21 underserved students enrolled in a three year tech and entrepreneurship program

- Social justice, gender equity, and mental health

- 250 mental health workshops funded for young girls from underserved communities

- 1,200 LGBTQ+ youth provided with free 24/7 mental health crisis counseling through The Trevor Project

- Three months of anti-trafficking hotline operations funded in South Africa

- Housing and community resilience

- 50 underserved families supported to achieve land and home ownership

- 30 families in the United States assisted with the construction of safe, affordable homes through Habitat for Humanity

In 2025 alone Lemonade expects to support 45 nonprofit organizations through Giveback, spanning health, education, climate, refugee support, plastic pollution, and more.

Challenges & Crisis Management

Significant challenges or setbacks

- Profitability and underwriting risk – As with many insurance start-ups, Lemonade had net losses and still needed to improve underwriting metrics (loss ratios) and expense ratios before reaching profitability. For example, the Q1 2025 results showed a net loss of USD 62 million and adjusted EBITDA loss of $47 million (including $22 million impact of California wildfires).

- Catastrophe risk and inflation – The company has explicitly flagged that inflation in claims (repairs, replacement costs) and catastrophic weather events increase loss ratio and underwriting risk. The 2022 Q4 letter noted that across the book gross loss ratio in Q4 2022 was 89% (down from 96% prior year) but still high.

- Market skepticism and share price volatility – The company’s share price dropped significantly (more than 70% since IPO) as investors questioned the path to profitability, growth spending and risk exposure.

Leadership response & strategic pivoting

- On profitability: The company has set a target for adjusted EBITDA profitability by 2026 and emphasised improvement in underwriting (loss ratio) and expense base. For example, the Q3 2024 letter reaffirmed sustainable net cash-flow positivity exiting the year.

- On underwriting risk: The company diversified its product mix (more pet, car, Europe) to reduce CAT exposure and strengthen underwriting feedback loops (AI/ML).

- On growth and investor confidence: The company raised its guidance periodically (e.g., Q2 2025 letter) and emphasized its growth engines (car, Europe) and improved economics.

- On brand/trust: The company continues to emphasize transparency, B-Corp status, giving back and digital-first experience to build credibility in a traditionally cautious industry.

Outcomes & long-term impact

- The underwriting improvements are measurable: e.g., gross loss ratio in Q4 2024 hit 63% (its best ever) and TTM 73%.

- The company is generating positive net cash flow for a quarter (Q3 2024 generated $48 million).

- Growth continues albeit with vigilance: The company’s IFP and revenue expansion show that the strategy to scale is working, though profitability remains a goal rather than a fully achieved state. The actions taken to reduce risk exposure and improve economics strengthen its long-term viability.

Key Takeaways & Lessons Learned

Here are several major insights other businesses (especially impact-driven and digital challengers) can apply from Lemonade’s experience:

- Purpose can be a differentiator but must be backed by operational excellence

Lemonade’s “giveback” model and B-Corp status help appeal to younger, socially-conscious customers. Yet the business still must perform on fundamentals (underwriting, cost, growth) to be viable long-term. - Digital and AI-enabled models can enable scale in traditional industries

By building AI/ML underwriting, chatbot claims, and direct-to-consumer distribution, Lemonade has grown rapidly from $94M revenue in 2020 to $430M in 2023. That shows the potential of leveraging technology in a legacy sector. - Cross-sell and customer lifetime value matter in subscription/recurring revenue models

Lemonade emphasises increasing Annual Dollar Retention and cross-selling multiple products to the same customer (renters → homeowners → auto → pet → life). This raises LTV and reduces marginal CAC. The Q4 2022 letter cited ADR of 86%. - Risk and capital intensity cannot be ignored—digital insurgents in insurance must manage underwriting, loss ratios and exposure to catastrophes

For example, in 2022 Q4 Lemonade had a gross loss ratio of 89% and highlighted the need to file rate changes due to inflation and CAT events. - Scaling an impact-oriented startup to profitability in a mature industry takes time and discipline

Lemonade’s journey shows that while growth and impact branding matter, reaching profitability and scale takes focus on unit economics, risk management and operational leverage. The company targets adjusted EBITDA profitability by 2026.