Ben & Jerry’s is often celebrated as the blueprint for socially conscious capitalism, a company that set out to prove business could serve both profit and purpose.

Founded in 1978 in Burlington, Vermont by Ben Cohen and Jerry Greenfield, the brand grew from a local scoop shop into a global symbol of activism wrapped in indulgence.

Its mission, famously defined as a three-part balance between product quality, economic sustainability, and social justice, positioned the company decades ahead of mainstream corporate responsibility trends.

But behind the lighthearted flavor names and progressive branding lies a far more complicated story. Over the past four decades, Ben & Jerry’s has struggled to reconcile its idealism with industrial reality, and its activism with corporate ownership.

The 2000 acquisition by Unilever(SEC Filing) marked a turning point, one that gave the brand global reach but also sparked ongoing tension over how far a subsidiary can push social and political boundaries inside a multinational conglomerate.

The company’s evolution highlights both the potential and the pitfalls of value-driven business. Its impact programs, from Fairtrade sourcing and regenerative agriculture to refugee employment and racial equity initiatives, have made real contributions to ethical commerce.

Yet, the same mission has exposed Ben & Jerry’s to accusations of hypocrisy and partisanship. The gap between its public commitments and operational constraints has grown increasingly visible as global scrutiny around corporate activism intensifies.

Today, Ben & Jerry’s stands as both a pioneer and a cautionary tale.

Its enduring popularity and strong brand equity demonstrate the power of purpose-driven storytelling, while its public controversies and internal governance conflicts reveal the structural limits of idealism in a profit-driven system.

The lessons drawn from its trajectory extend well beyond ice cream, they speak to the broader tension facing any brand that dares to mix business with belief.

Company Background & History

Founding story

In 1978, Ben Cohen and Jerry Greenfield opened their first ice-cream shop in a renovated petrol station in Burlington, Vermont. They had taken a $5 correspondence course in ice-cream making, and invested about $12,000 (including some borrowed) to start.

The original vision: offer quality ice-cream in a fun environment, while doing business in an ethical, socially engaged way. They had no major ice cream industry background but cared about flavor, community and values.

Timeline of major milestones

- 1978: First scoop shop opens (May 5) in Burlington, Vermont.

- Early 1980s: Expansion into grocery-store pints (the move from scoop shop to retail).

- 1989: Began to publicly adopt progressive business practices (for example early same-sex partner benefits).

- 1990s: Introduction of major flavors (“Cherry Garcia”, “Chocolate Chip Cookie Dough”) and expansion into European markets.

- August 3, 2000: Acquisition by Unilever for about US$326 million.

- Post-2000: Operated as a wholly-owned subsidiary under Unilever but with an independent board to uphold its social mission.

- 2020s: Emphasis on non-dairy innovation, sustainability efforts (low carbon dairy pilot, racial equity framework) via Social & Environmental Assessment Reports (SEARs).

- 2024-25: Unilever announced a spin-off of its ice-cream business (including Ben & Jerry’s) into a separate entity (The Magnum Ice Cream Company) as part of restructuring.

Industry & Market Analysis

Industry landscape: size, growth rate, major trends

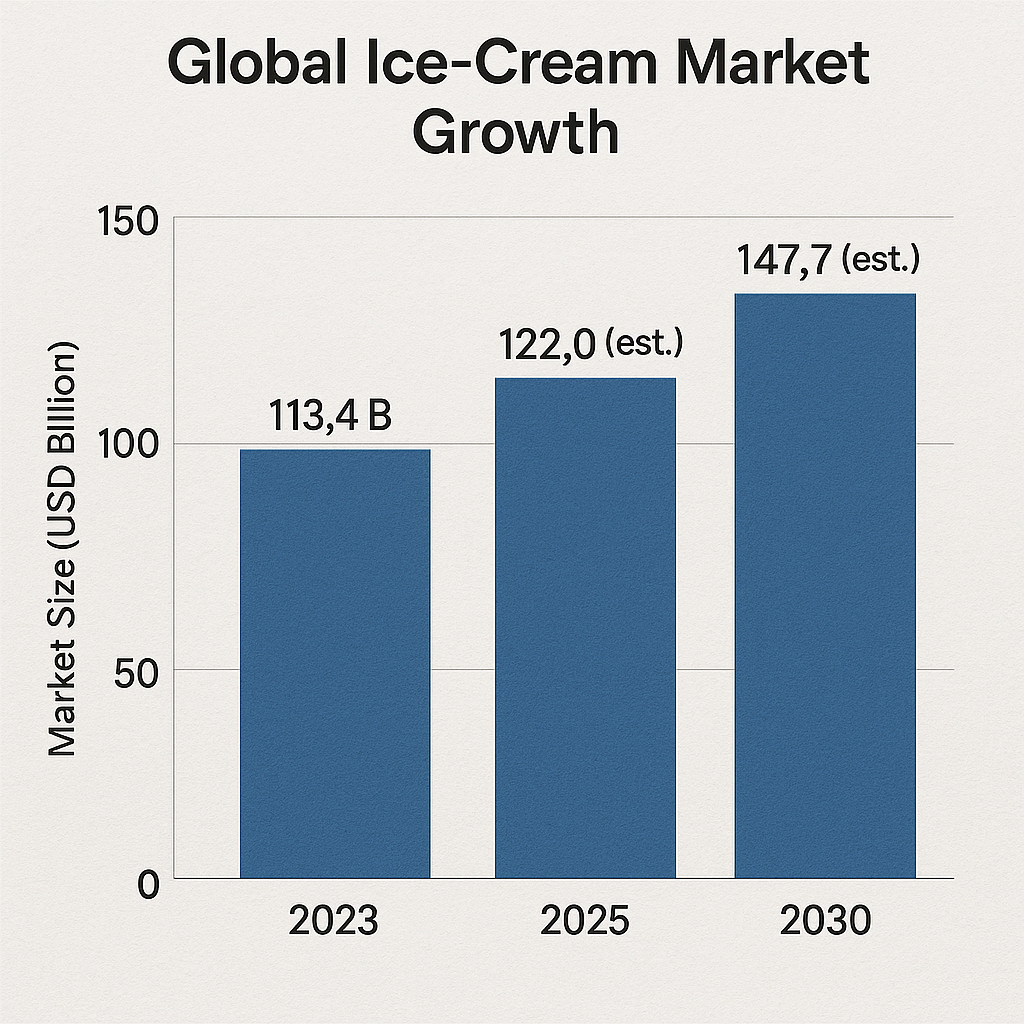

The global ice-cream market (including frozen desserts) was estimated at USD 113.4 billion in 2023 and is projected to reach USD 147.74 billion by 2030, growing at a CAGR of ~3.9% from 2024-2030.

One estimate puts the U.S. premium/gelato/ice-cream market as also growing (for example U.S. CAGR ~3.8% for ice cream).

The premium segment (which B&J occupies) is a key driver, as consumers increasingly favor indulgence, novel flavors, ethical sourcing, non-dairy/plant-based alternatives, and convenient formats.

A report by Future Market Insights notes that premium ice-cream, including brands like B&J’s and Häagen-Dazs is dominant in the ice-cream-parlor/retail arena and uses differentiation to command higher margins.

Company’s target market segments and customer personas

- Premium/indulgence seekers: Customers who are willing to pay more for high-quality ingredients, strong flavor profiles, additional chunks/swirl, novelty.

- Values-driven consumers: People who care about ethics, sustainability, fair trade sourcing, social activism, brand values. B&J’s brand identity strongly appeals here.

- Non-dairy/plant-based consumers: With the rise of vegan, lactose-intolerant, or flexitarian consumers, B&J’s non-dairy line appeals to that segment.

- Impulse/trial shoppers: Limited-edition flavors, collaborations, novelty formats drive trial among younger consumers (millennials, Gen Z).

Customer personas might include:

- “Indulger Irene”, age 30-50, urban, income above average, treats ice cream as an occasion.

- “Ethical Ethan”, age 20-40, cares about social justice and sustainability, aligns with B&J’s mission.

- “Plant-based Paula”, age 25-45, lactose‐intolerant or vegan, seeks non-dairy indulgence.

Key drivers of demand

- Premiumization trend: Consumers upgrading from value brands to premium frozen desserts, seeking novel flavors or indulgent textures.

- Health/alternative diet trends: Growth of non-dairy, low-sugar, functional frozen desserts.

- Ethical sourcing & brand values: Growing demand for fair trade ingredients, sustainable packaging, social activism.

- Innovation in flavors and formats: New product launches, collaborations, limited editions drive excitement and differentiation.

- Global expansion and emerging markets: Rising disposable incomes in Asia-Pacific drive growth of frozen dessert consumption.

Competitive Landscape

Top direct competitors

- Häagen‑Dazs – Owned by a joint venture of Nestlé / Froneri depending regionally. Positions as a premium ice-cream brand, focusing on classic flavors and premium positioning globally.

- Breyers – Also under Unilever, older brand, positioned more in the mainstream premium/lower-premium tier. Offers broad range including classic, “better for you” and value elements.

- Halo Top – A newer entrant (founded 2012) focused on low-calorie, high-protein ice cream, aimed at health-conscious consumers, disruptive to traditional premium players.

- Blue Bell – Regional U.S. brand (South) but strong in its territory; competing in product quality albeit with less national footprint.

- Various artisan/specialty frozen dessert brands – e.g., local craft makers, plant-based frozen desserts, which increasingly challenge premium incumbents.

Comparison of business models, product features, pricing, go-to‐market

- Häagen-Dazs: Focuses on premium, classic flavors, high margin. Distribution: national retail, food-service, global. Pricing high.

- Breyers: Broader range including value and premium, pricing more moderate, broad distribution.

- Halo Top: Differentiated on health credentials (low calorie) rather than flavor/traditional premium. Target niche.

- Ben & Jerry’s: Premium price, strong flavor innovation (chunks & swirls), high brand equity, strong values messaging. Distribution: grocery, convenience, food-service, global. Also strong flavor limited editions and social cause tie-ins.

Competitive advantages & disadvantages

Advantages

- Strong brand reputation for quality and values.

- Flavor innovation: large library of iconic flavors (e.g., “Cherry Garcia”, “Chocolate Chip Cookie Dough”, etc.).

- Mission/values differentiation: sourcing, activism, social mission resonates with a segment of consumers.

- Global distribution (via Unilever) enabling scale and reach.

- Ability to command premium pricing.

Disadvantages

- Premium price limits accessibility in cost-sensitive markets.

- Tension between social mission and corporate ownership (which can slow decision-making or lead to conflict).

- Flavor novelty may require continuous innovation (cost) and risk of flavor fatigue.

- Cost structures for premium ingredients and social sourcing may reduce margin flexibility versus value brands.

- In emerging markets, competition from local/regional players with lower cost base may challenge.

SWOT Analysis

Strengths

- Brand equity and customer loyalty strong.

- Distinguished flavor portfolio and premium positioning.

- Clear values/mission-orientation differentiator.

Weaknesses

- Premium cost structure reduces flexibility in budget segment.

- Dependence on parent/distribution network means less nimble than independent brands.

- Some recent mission/ownership conflicts can distract (and risk brand reputation).

Opportunities

- Growth in non-dairy/plant-based frozen desserts.

- Expansion into emerging markets (Asia, Latin America) where premium frozen desserts are growing.

- Direct-to-consumer, ecommerce/online frozen dessert delivery channels.

- Innovations in sustainable sourcing, packaging which may appeal to values-led customers.

Threats

- Intensifying competition from both premium incumbents and disruptive entrants (e.g., low-calorie, plant-based).

- Cost inflation (dairy, ingredients) affecting margins.

- Saturation in developed markets, slower growth.

- Potential brand misalignment or backlash if social mission is perceived as compromised.

Business Model & Revenue Streams

Revenue generation

Ben & Jerry’s revenue is generated primarily via:

- Retail sales of packaged pints in grocery/retail stores and convenience channels.

- Food-service/ice-cream scoop shops (company-owned and franchise/licensed).

- Licensing/merchandising and international distribution partnerships.

- Specialty limited-editions and collaborations (which may carry premium pricing).

- Non-dairy/plant-based product lines (emerging).

Revenue by segment

Precise breakdown by product line or geography is not publicly disclosed by the brand (as it is a subsidiary of Unilever and now part of a spin-off). Some publicly available estimates:

- A franchise disclosure document indicates that an average Ben & Jerry’s franchise location in the U.S. generates approximately $612,000 in annual revenue (average unit volume) per SharpSheets blog review of FDD item 19.

- Third-party data from Zippia estimates B&J’s annual revenue ~USD 450 million in 2024; however this is not audited.

- The Ice-cream business of Unilever (including B&J’s) is estimated to hit $9.2 billion sales in 2025.

Financial Performance

Key financial metrics

Because B&J’s is a brand inside a larger corporate (Unilever) and now part of a spin-off, standalone audited full financials are limited. Some available data:

- According to Barron’s, Unilever’s ice-cream business (including B&J’s) was estimated to reach USD 9.2 billion of sales in 2025, margin ~12.5% EBIT. Barron's

- Zippia estimates public revenue of B&J’s at USD 450 million in 2024. Zippia

- Franchise average unit revenue ~USD 612,000. SharpSheets

Given the limited data, a precise 3‐5 year trend table cannot reliably be produced.

Major drivers behind revenue growth or decline

- Growth drivers: flavor innovation, premiumisation, non-dairy diversification, global expansion, values branding.

- Cost pressures: inflation in dairy and ingredients, distribution/logistics costs, trade-spend pressures.

- The acquisition by Unilever (2000) provided scale and distribution that enabled growth.

- In the mature U.S. market, incremental growth is harder; hence emphasis on premium and value segmentation, and export.

- The upcoming spin-off of Unilever’s ice-cream business (including B&J’s) may change cost structure and focus (see Strategic Initiatives).

Stock performance versus relevant indices or peer group

As a brand, Ben & Jerry’s is not publicly listed independently (until/if the spin-off completes) so no standalone stock exists. Its performance is embedded in Unilever’s stock (ticker ULVR). Comparisons would require dissecting the Ice-Cream division which is not broken out fully publicly.

Product or Service Offerings

Core products & value propositions

- Premium ice-cream pints: large scoop-friendly textures, richness, innovative “chunks & swirls” flavors.

- Non-dairy/plant-based frozen desserts: launched 2016 with almond-milk base, keto or vegan options.

- Food-service scoop-shops: unique experience in branded retail outlets (though less central since retail freeze channels dominate).

- Limited-edition and collaborative flavors: e.g., flavors tied to activism, special causes, brand collaborations.

- Values & mission as part of offering: B&J’s often communicates its social mission (fair trade, environmental, social justice) as part of brand appeal.

Key features, pricing tiers, evolution

- Pricing: Premium relative to mainstream mass-market ice-cream; large pints in retail at higher price point.

- The flavor portfolio has evolved: from classic flavors in the 1980s/90s (vanilla, chocolate, Cherry Garcia) to progressive exotic flavors, non-dairy lines, snack-sized formats (e.g., pint slices) etc. See for example in 2017 “Pint Slices” format.

- Format innovation: snack size, non-dairy, frozen yogurt variations, etc.

- R&D/innovation pipeline: While specific patents are not widely publicised, the company invests in values-led sourcing, low-carbon dairy pilot (2022) and supply-chain innovation.

Go-to-Market & Marketing Strategy

Customer acquisition and sales channels

- Sales channels: grocery stores/retail (primary), convenience stores, food-service/scoop shops, international retail/distribution partnerships.

- E-commerce/delivery: increasingly relevant (frozen direct-to-consumer, subscription boxes) though specific data for B&J’s limited.

- Marketing channels: digital advertising, social media, in-store promotions, limited-edition launches, cause-related marketing. The brand uses its social mission as key marketing differentiator.

- Notable marketing campaigns/partnerships: e.g., “Free Cone Day” (historical), activism-based flavor launches (e.g., “Pecan Resist”, “Justice ReMix’d”) tied to social causes.

Retention, upsell/cross-sell tactics and community/ecosystem initiatives

- Limited edition flavor drop culture drives repeat purchase, trial and brand loyalty.

- Non-dairy line upsell existing customers and gain new customers.

- Community & ecosystem: The brand’s social mission (fair trade, activism, environmental sourcing) builds community affiliation, brand ambassadors and higher retention among values-aligned consumers.

- Franchise partners: The average unit revenue and franchise network help maintain brand presence and loyalty.

Operations & Organizational Structure

Operational footprint

- Headquarters: Vermont, United States.

- Manufacturing: The brand describes a 13-step production process including farms, blending, pasteurizing/homogenizing, flavor vats, freezing, chunk feeder etc.

- Suppliers: Dairy farms (traditional and low-carbon pilot), flavor and ingredient vendors (fair trade cocoa/vanilla).

- Employees: Ben and Jerry's has approximately 1.7K employees as of September 2025.

Organizational structure, divisions and culture-building

- As a subsidiary of Unilever (and now part of the spin-off entity), governance includes a brand/independent board (for social mission) plus integration with parent company functions (finance, logistics, sourcing).

- Culture: Emphasis on values, mission-led business, employee engagement with activism and sustainability (e.g., racial equity framework, supply-chain diversity).

- Operational challenges: For example, sourcing premium ingredients and maintaining premium cost structure, managing global supply chain while upholding values. The company addressed these via goals in SEAR reports (e.g., low-carbon dairy pilot).

Challenges & Crisis Management

Significant challenges or setbacks

- Acquisition & Mission Tension: After the 2000 Unilever acquisition, there has been a recurring tension between maintaining Ben & Jerry’s independent social mission and the corporate imperatives of a large parent company. This structural tension led to board conflicts and public scrutiny.

- Market Saturation / Cost Pressures: The premium ice-cream segment in developed markets is mature; growth pressure, cost inflation (dairy/ingredients/logistics) and trade spend squeeze margins.

- Mission-related Backlash/Brand Risk: Because of its activism, the brand has attracted both positive and negative publicity. For instance, its stance on Israel/Palestine triggered controversy and legal/board disputes with Unilever’s management.

Leadership responses and outcomes

- On mission tension: The 2000 acquisition included the establishment of an independent board to protect the brand’s social mission. More recently, Unilever’s spin-off of its ice-cream business (including B&J’s) into a separate entity may allow greater focus on the brand’s values and reduce parent-company friction.

- On cost pressures: B&J’s published low-carbon dairy pilot, racial equity supply-chain programs and internal operational reviews in its SEAR report (2022) demonstrate attempt to address structural cost/sustainability issues.

- On brand/backlash: The company maintained its activism stance, but faced internal conflict; founders publicly criticized parent company for limiting activism (see founder departure in 2025). The outcome risks brand trust erosion among value-led consumers.

Long-term impact

- The acquisition and subsequent tension highlight the complexity of integrating a mission-driven brand into a large corporate structure.

- The brand has kept a premium positioning and strong identity, which continues to drive loyalty.

- But brand risk from activism/backlash may affect broad market appeal. The spin-off may create opportunity for renewed focus.

- The shift toward sustainability and non-dairy may position the brand for future growth, though competition in plant-based frozen dessert is intense.

Social Impact and Activism at Ben & Jerry’s

Ben & Jerry’s is widely recognized not just as a premium ice cream brand, but as one of the earliest and most enduring examples of a “social enterprise”, a company built on the belief that business can and should be a force for good.

Since its founding, Ben & Jerry’s has embedded social and environmental values into every layer of its operations, aligning its business growth with what it calls a philosophy of “linked prosperity.”

The Philosophy of Linked Prosperity

At the heart of Ben & Jerry’s mission is the concept of linked prosperity, which means that as the company prospers, everyone connected to the business, from farmers and suppliers to employees and communities, should share in the benefits.

The company’s structure, codified in its three-part mission statement, ensures balance between Product, Economic, and Social Missions:

- Product Mission:

To make, distribute, and sell the finest quality ice cream and euphoric concoctions using natural ingredients and environmentally responsible business practices. - Economic Mission:

To operate on a sustainable financial basis of profitable growth, increasing value for stakeholders, and expanding career opportunities for employees. - Social Mission:

To use the company in innovative ways to make the world a better place, improving the quality of life locally, nationally, and globally.

This integrated mission was groundbreaking in 1988 and remains the foundation for Ben & Jerry’s continued social impact today.

Values-Led Sourcing and Supplier Diversity

Ben & Jerry’s leverages its global supply chain to drive social change, intentionally choosing suppliers that align with its ethical principles:

- Fairtrade Partnerships: The company sources Fairtrade-certified cocoa, vanilla, sugar, bananas, and coffee, ensuring that smallholder farmers receive fair prices and labor conditions. Farmers have a voice in governance through organizations like Fairtrade International, where they make up half of the general assembly.

- Supplier Diversity: Ben & Jerry’s has committed to year-over-year increases in procurement from Black-owned and Black-led suppliers. This intentional investment aims to help close the racial wealth gap and support equitable economic development.

- Social Enterprise Partners:

- Greyston Bakery (Yonkers, NY) provides brownies for several Ben & Jerry’s flavors through its pioneering open-hiring program, which offers jobs without background checks or interviews.

- Rhino Foods (Burlington, VT) supplies cookie dough chunks and is known for its inclusive hiring of refugees and profit-sharing programs.

Regenerative Agriculture and Environmental Stewardship

Ben & Jerry’s promotes regenerative agriculture, which focuses on rebuilding soil health, enhancing biodiversity, and reducing greenhouse gas emissions. The company’s environmental programs include:

- Low-Carbon Dairy Pilot: Working with Vermont dairy farms to lower emissions and improve animal welfare.

- Methane Digesters: Converting waste from farms and production facilities into renewable energy.

- Cleaner, Greener Freezers: Energy-efficient “Lean & Green” freezers that minimize climate impact.

- Sustainable Packaging: Using Forest Stewardship Council (FSC)-certified paperboard to protect forest biodiversity and ensure responsible sourcing.

These initiatives align environmental sustainability with social equity, acknowledging that climate change disproportionately impacts vulnerable communities.

Certified B Corporation: Accountability and Transparency

In 2012, Ben & Jerry’s became the first wholly owned subsidiary in the world to achieve B Corp certification, a status awarded to companies meeting rigorous social, environmental, and governance standards.

This certification holds Ben & Jerry’s accountable to measurable impact goals in areas such as:

- Environmental performance

- Employee benefits and equity

- Supply chain ethics

- Community engagement

The company publishes an annual Social & Environmental Assessment Report (SEAR) detailing its progress toward sustainability and justice metrics.

Criticisms and Controversies Surrounding Ben & Jerry’s

While Ben & Jerry’s is celebrated for pioneering values-led business and social activism, it has also faced notable criticism and controversy over the years.

These critiques often center on the tension between its ethical image and corporate reality, the complexity of its political activism, and supply chain or labor concerns that challenge its claims of fairness and sustainability.

Below is a detailed, objective review of the major areas of criticism that have emerged.

Corporate Ownership and Mission Integrity

After Ben & Jerry’s was acquired by Unilever in 2000 for approximately $326 million, critics questioned whether a large multinational corporation could truly preserve the brand’s social mission.

- Mission dilution concerns: Although the founders negotiated an independent board to safeguard Ben & Jerry’s social and environmental commitments, consumer advocates and watchdog groups have argued that corporate oversight from Unilever sometimes compromises these values.

- Profit vs. Purpose tension: Some critics assert that the company’s activism functions as “ethical branding” for Unilever, which has faced controversies over environmental and labor practices in other divisions.

- Governance conflicts: Over the years, disagreements between Ben & Jerry’s independent board and Unilever have surfaced publicly. For example, in 2022–2023, a dispute erupted over the company’s operations in Israel and the occupied Palestinian territories, illustrating how corporate control can clash with activist principles.

Political Activism and Polarization

Ben & Jerry’s is one of the most outspoken corporations in the world, often taking firm stances on racial justice, climate policy, refugee rights, and foreign affairs. While these campaigns have earned praise from progressive movements, they have also sparked backlash.

Israel–Palestine Controversy (2021–2023)

The company announced it would stop selling products in Israeli-occupied territories, citing alignment with its human rights values.

This triggered significant political backlash in the United States and Israel, accusations of antisemitism, and legal action from its Israeli distributor.

In 2022, Unilever overruled Ben & Jerry’s board by selling its Israeli business to a local licensee, reigniting debate about corporate interference in social mission governance.

U.S. Political Statements

The brand has supported movements like Black Lives Matter, criticized police brutality, and campaigned for progressive political causes.

Critics, including some consumers and media outlets, have accused the company of partisanship and “virtue signaling.”

Others argue that its political activism may alienate customers who prefer companies remain neutral.

Supply Chain and Labor Rights Critiques

Despite its commitment to Fairtrade and ethical sourcing, Ben & Jerry’s has faced scrutiny over the years regarding farmworker conditions and supply chain transparency.

Vermont Dairy Worker Conditions

Investigations by The New York Times (2017) and labor organizations highlighted poor working conditions and low wages among dairy workers supplying Vermont milk.

Critics argued that the company had been slow to ensure labor rights compliance despite its public commitments.

In response, Ben & Jerry’s joined the Milk with Dignity program, a farmworker-led initiative that improved oversight and worker protections, but some activists claim implementation remains uneven.

Environmental Impact of Dairy Production

Climate activists have pointed out that dairy production remains a significant source of methane emissions, questioning whether Ben & Jerry’s low-carbon and regenerative agriculture initiatives can offset its overall environmental footprint.

Accusations of “Woke Washing” and Hypocrisy

As corporate activism has become a mainstream marketing strategy, Ben & Jerry’s has faced accusations of “woke washing”, using social justice rhetoric for branding while benefiting from systemic issues it claims to oppose.

- Business Ethics vs. Marketing:

Critics argue that some of the company’s campaigns (e.g., climate or racial justice ads) overlap heavily with marketing efforts, blurring the line between genuine advocacy and profit-driven branding. - Parent Company Contradictions:

While Ben & Jerry’s promotes environmental and social justice, Unilever, its parent company, has been criticized for alleged greenwashing, plastic pollution, and controversial sourcing in other brands. This raises questions about the sincerity of mission alignment at the group level. - Labor Practices Abroad:

Some NGOs have called attention to inconsistencies between Ben & Jerry’s U.S. social initiatives and the broader Unilever supply chain, which has faced criticism for factory conditions in Asia and Africa.

Product Health and Ethical Marketing

Although Ben & Jerry’s champions environmental and social causes, health advocates have criticized its nutritional profile and marketing ethics.

- Sugar and Fat Content:

The brand’s products are high in sugar, saturated fat, and calories — some pints exceeding 1,000 calories — which public health advocates argue contradicts the brand’s “ethical” image. - Marketing to Youth:

Some critics have questioned whether the company’s lighthearted branding, playful flavors, and cartoon imagery indirectly appeal to children despite being an adult-oriented product.

Strategic Initiatives & Future Outlook

Ongoing or planned strategic initiatives

- Expansion of non-dairy/plant-based product line (e.g., almond milk base, vegan options) to capture growth in that category.

- Low-carbon dairy pilot (2022) and supply chain sustainability initiatives (racial equity framework for sourcing) per SEAR reports.

- Global expansion via the spin-off entity (The Magnum Ice Cream Company) which may allow faster agility and focused investment in ice-cream brands.

- Continued flavor innovation and limited-edition drops to stimulate consumer interest.

- Potential expansion of direct-to-consumer channels or subscription models (though specific announcements limited).

Evaluation of positioning for future growth

Given the industry forecasts (global ice-cream market projected to grow at ~3.9–6.5% CAGR depending on source) and the brand’s premium/values positioning, B&J’s is reasonably well placed.

Their strengths in flavor innovation, brand equity and values alignment are assets.

However, competitive pressure from other premium and plant-based players, margin pressures, and brand-mission tension pose risks. The spin-off gives an opportunity to sharpen focus and reduce parent-corporate friction.

In emerging markets, premium frozen dessert growth offers a runway, but requires localization, cost adaptation and channel expansion.

Key Takeaways & Lessons Learned

Ben & Jerry’s remains one of the most visible examples of a mission-driven brand attempting to balance activism, ethical sourcing, and commercial success at global scale.

Its story offers not only inspiration, but also a clear-eyed look at the risks, contradictions, and trade-offs that come with being a social enterprise under corporate ownership.

1. Values can differentiate a brand, but they also expose it to risk.

Ben & Jerry’s long-standing social mission helped it stand out in a crowded ice cream market, but that same outspokenness has also made it a target of criticism and political backlash.

Taking stances on divisive issues, from climate justice to international conflicts, can alienate large segments of consumers and create repetitional risk.

The lesson: mission-driven branding attracts loyalty from some audiences while pushing others away, and over time, the balance between advocacy and market growth becomes harder to sustain.

2. Corporate ownership complicates mission integrity.

The 2000 Unilever acquisition provided global distribution and resources, but it also diluted operational independence. Despite the existence of an “independent mission board,” real control ultimately sits with the parent company, leading to repeated tension over values versus profitability.

The Israel-Palestine controversy made those fractures public, proving that governance structures are only as strong as the corporate leadership’s willingness to honor them. Social enterprises that sell to large corporations risk losing both narrative control and ethical credibility.

3. Activism without operational consistency risks being dismissed as performative.

Ben & Jerry’s vocal advocacy on human rights, racial justice, and climate change contrasts with persistent issues in its own supply chain, including worker rights, dairy emissions, and packaging waste.

These contradictions feed perceptions of hypocrisy and “woke washing.” The reality is that public activism must be matched with internal alignment; otherwise, even well-intentioned campaigns can erode trust and weaken long-term impact.

4. Innovation is essential, but it’s an expensive necessity in a mature category.

Continuous flavor experimentation and product variety keep Ben & Jerry’s culturally relevant, yet they also inflate R&D costs, inventory complexity, and marketing overhead. Limited editions and novelty launches create short-term buzz but can distract from core margin management.

The premium ice cream segment grows slowly, so innovation becomes less about expansion and more about maintaining share, an expensive treadmill few brands can afford indefinitely.

5. Ethical sourcing adds credibility but increases structural cost pressures.

Fairtrade and social enterprise partnerships align with Ben & Jerry’s mission but come with higher input costs and supply volatility. Inflation in dairy and sugar, coupled with regulatory changes and sustainability standards, compresses margins.

Programs like “Milk with Dignity” and “Low-Carbon Dairy” signal progress, but they also reveal how difficult and expensive, it is to operationalize ethics within a global commodity system.

6. The gap between global marketing and local accountability is widening.

Operating under Unilever’s international structure has amplified Ben & Jerry’s reach but complicated its cultural positioning.

The brand’s U.S.-centric activism often doesn’t translate abroad, creating friction in markets with different political climates or social norms.

Balancing a consistent ethical voice with regional sensitivities remains a growing challenge. The spin-off of Unilever’s ice cream division may bring more focus but won’t automatically solve governance and cultural alignment issues.

7. Transparency doesn’t guarantee trust.

Ben & Jerry’s annual Social & Environmental Assessment Reports (SEAR) show an unusual level of disclosure, but transparency can cut both ways. Publishing data on climate impact, equity programs, and supply sourcing invites scrutiny from watchdogs and exposes slow progress.

The company’s willingness to self-report is commendable, but it also highlights how far it remains from its own ambitious goals. Transparency without rapid results risks fatigue among consumers who expect visible, measurable change.