In episode 201 of the Disruptors for Good podcast, I speak with Kendrick Nguyen, co-founder of Republic, on building the financial infrastructure to create equal access to assets for everyone.

Listen to more Disruptors fro GOOD episodes.

Disclosure: This content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Kendrick Nguyen is the Co-founder and CEO of Republic, a pioneering platform dedicated to democratizing investing and making it universally accessible.

Kendrick Nguyen is the Co-founder and CEO of Republic, a pioneering platform dedicated to democratizing investing and making it universally accessible.

Under his leadership, Republic has emerged as an innovative force in the investment sector, boasting a community of over 2.5 million members worldwide, supporting over 2,000 ventures and deployed over $2 billion in investments.

Kendrick’s entrepreneurial spirit has also led him to co-found two fintech startups and offer strategic advice to numerous investment funds, startups, and blockchain initiatives.

His professional journey spans from business management and product strategy to investing, with significant roles in both New York City and Silicon Valley, notably at AngelList.

Before embarking on his entrepreneurial path, Kendrick started his career as a litigator and served as a Stanford Law Fellow, experiences that laid the groundwork for his legal expertise.

Today, he continues to leverage this expertise through a semi-active pro bono practice, demonstrating his commitment to giving back to the community.

At the heart of Kendrick’s work with Republic is a mission to enable everyone to invest in the future they envision, fostering a world that is diverse, sustainable, and interconnected.

Through his dedication and innovative approach, Kendrick Nguyen is not just leading an investment platform; he is shaping the future of accessible investment opportunities for individuals around the globe.

Takeaways

- The company’s mission is to provide equal access to financial opportunities for everyone.

- Equity crowdfunding allows individuals to invest in private securities and share in the success of companies.

- Expanding a startup globally comes with regulatory challenges that vary in each country.

- The rise of crypto has the potential to transform the financial industry and increase liquidity.

- Leadership requires a positive mindset, resilience, and gratitude for the opportunities ahead.

- Republic aims to become a global platform for ownership, allowing individuals to invest in companies they care about.

Chapters

Following the editing process, there may be discrepancies in the timing of the chapters.

00:00 Introduction and Mission of Republic

03:01 The Catalyst for Starting Republic

05:19 Understanding Equity Crowdfunding

08:01 Expanding Republic Globally

12:38 Explaining the Breadth of Republic’s Offerings

16:05 Challenges of Growing a Startup Globally

19:43 The Rise of Crypto and its Impact on Republic

24:59 Current Hurdles and Goals for Republic

28:13 Leadership Advice for Founders

32:29 Future Goals and Successes for Republic

About Republic

The company was born out of a simple yet profound vision: to make private investing accessible to everyone, not just the affluent or the well-connected.

By leveraging technology and regulatory advancements, the company has created a user-friendly platform that allows people to invest in a wide array of opportunities, from startups to real estate, cryptocurrencies, and even video game financing.

A Diverse Investment Ecosystem

What sets Republic apart is not just its mission but its execution. The platform offers a curated selection of investment opportunities, each vetted for potential and impact.

This diversity ensures that investors can find ventures that resonate with their passions and financial goals.

Whether it’s a groundbreaking tech startup, a sustainable real estate project, or an innovative music or film venture, Republic brings the future of investment to the present.

The Process

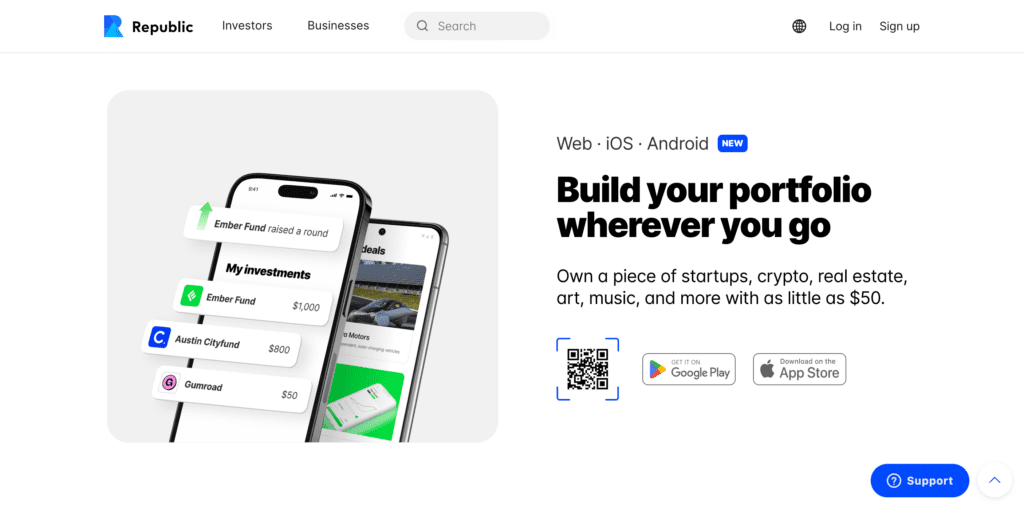

Download on Apple – Download on Android

- Discover Opportunities

Explore a variety of companies by browsing through categories, standout deals, and more. Interested in supporting climate technology or entrepreneurs from underrepresented groups? Customize your alerts to stay informed about new opportunities that match your interests. - Invest According to Your Criteria

Take the initiative to conduct your research directly on the platform. Examine financial statements, company valuations, and feedback from fellow investors. Start your investment journey with as little as $50, becoming a stakeholder in the process. - Expand and Balance Your Investment Portfolio

Easily monitor your investments through the app or website, keeping an eye on how they contribute to your overall portfolio diversity. Enjoy real-time updates from the founders themselves, keeping you connected to the progress of your investments.

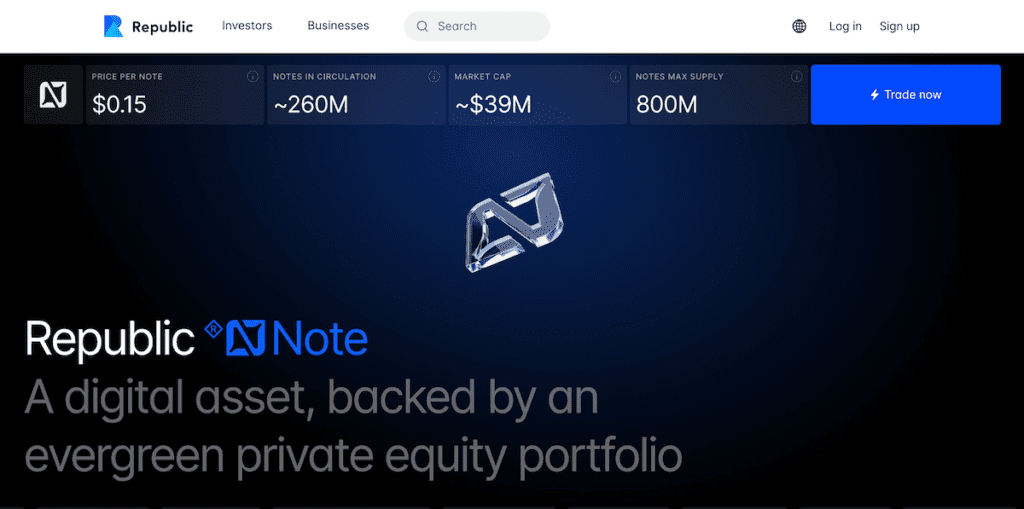

The Republic Note

The Republic Note is a digital profit-sharing token designed to distribute proceeds to its holders when startups and other private equities in the ecosystem achieve liquidity events, such as acquisitions or initial public offerings (IPOs).

As a financial instrument, the Republic Note aims to reward investors for participating in the platform’s success, aligning the interests of Republic, its investors, and the companies it helps fund.

Holders of the Republic Note can potentially receive payouts when successful exits occur within the portfolio of companies that have raised funds through Republic’s platform.

This innovative approach to profit-sharing is part of the company’s broader mission to democratize investing, making it possible for a wider audience to benefit from the financial returns typically reserved for venture capitalists and accredited investors.

Disclosure: This content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.