Mural Pay’s founder, Sinclair Toffa, joins Disruptors for GOOD to share how stablecoins and programmable payments can rewire cross-border money movement for businesses, creators, and marketplaces.

From early inspiration in West Africa to on-the-ground deployments with global platforms, Sinclair explains why faster settlement, lower fees, and end-to-end transparency are changing what is possible for millions of people who work and sell across borders.

Subscribe on Apple Podcasts

Subscribe on Spotify

Subscribe on Amazon Music

Episode highlights

- Why high-speed, programmable rails make payouts and treasury simpler for platforms and marketplaces

- How creators and contractors receive earnings instantly, with fewer failures and lower fees

- The role of clear policy in unlocking bank participation and enterprise adoption

- How forward-deployed engineering compresses time to value for complex launches

- A vision for accounts that are global by default, portable, and compliant

Practical use cases to spark ideas

- Creator and freelancer platforms paying out at scale in Africa and Latin America

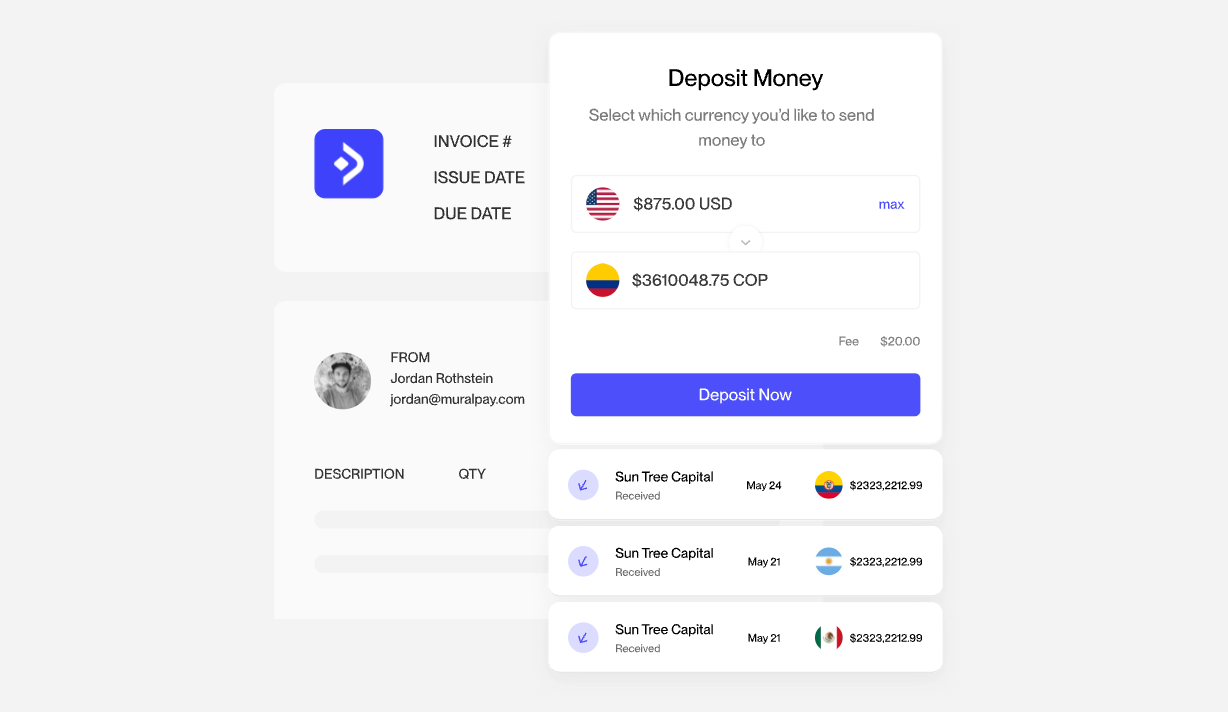

- Artisan marketplaces issuing dedicated accounts for each seller and releasing escrow instantly on delivery

- SaaS platforms embedding cross-border collections and payouts without rebuilding core banking

- Royalty distributors consolidating multi-platform streams and paying artists same week

Mural Pay origin story

Growing up between Colorado and France, Sinclair saw cross-border payments up close, often through cash pickups and wire services that were slow and expensive.

A formative trip to Togo highlighted how limited access to dollars restricts families and small businesses.

After shipping large-scale data systems as a forward-deployed engineer at Palantir, he set out in 2022 to rebuild the money stack with stablecoin rails, starting Mural Pay to make real-time, compliant, and affordable international payments usable for mainstream businesses.

Stablecoins, Explained Simply

A stablecoin is a type of digital currency designed to maintain a stable value, typically pegged to a traditional currency like the U.S. dollar or the euro.

Unlike cryptocurrencies that fluctuate in price, stablecoins are backed by real-world assets or reserves, allowing them to combine the reliability of fiat money with the speed and flexibility of blockchain technology.

Think of blockchains as high-speed highways and stablecoins as the cars driving on them. Traditional payment routes can feel like crowded side streets, full of delays, retries, and unclear tracking.

Stablecoins solve that problem by enabling three key benefits that matter most to global operators:

- Speed – near-instant settlement

- Lower fees – especially when sending large volumes or frequent payments

- Transparency – clear visibility while funds are in transit

Here’s a simple example: imagine a marketplace in the U.S. paying hundreds of artisans in Mexico and Colombia. Instead of wiring money through multiple banks and waiting days for clearance, the company can use stablecoins to send digital dollars instantly at a fraction of the cost.

Mural Pay abstracts all that complexity.

Finance and product teams interact with normal-looking accounts, invoices, and APIs rather than crypto wallets or blockchain commands.

To the end user, it just feels like a dollar account that can send and receive money globally—fast, affordable, and borderless.

Where this hits real workflows

Marketplaces and platforms - Opera uses Mural Pay to pay thousands of creators across Africa in minutes, not days, while reducing failure rates and reconciliation effort.

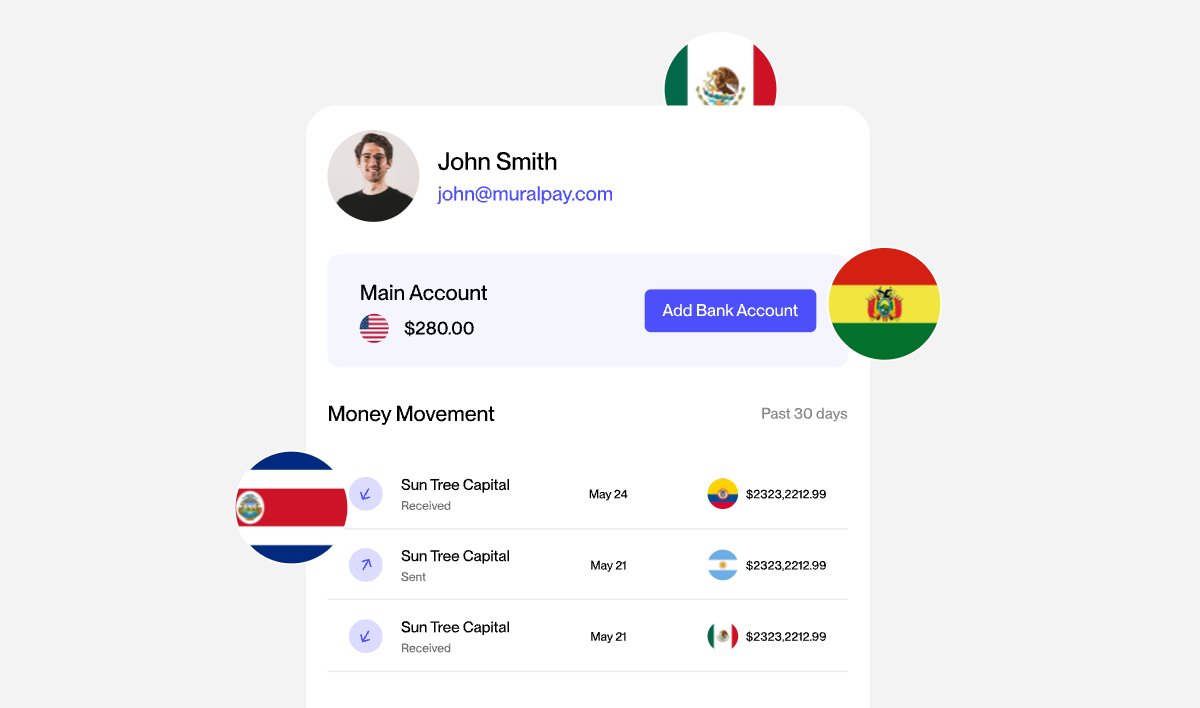

Marketplaces can spin up dedicated accounts for each seller, hold funds in escrow, and release payouts programmatically.

Sellers can cash out to bank accounts or wallets, or keep balances in dollar-denominated accounts, with the option to earn yield.

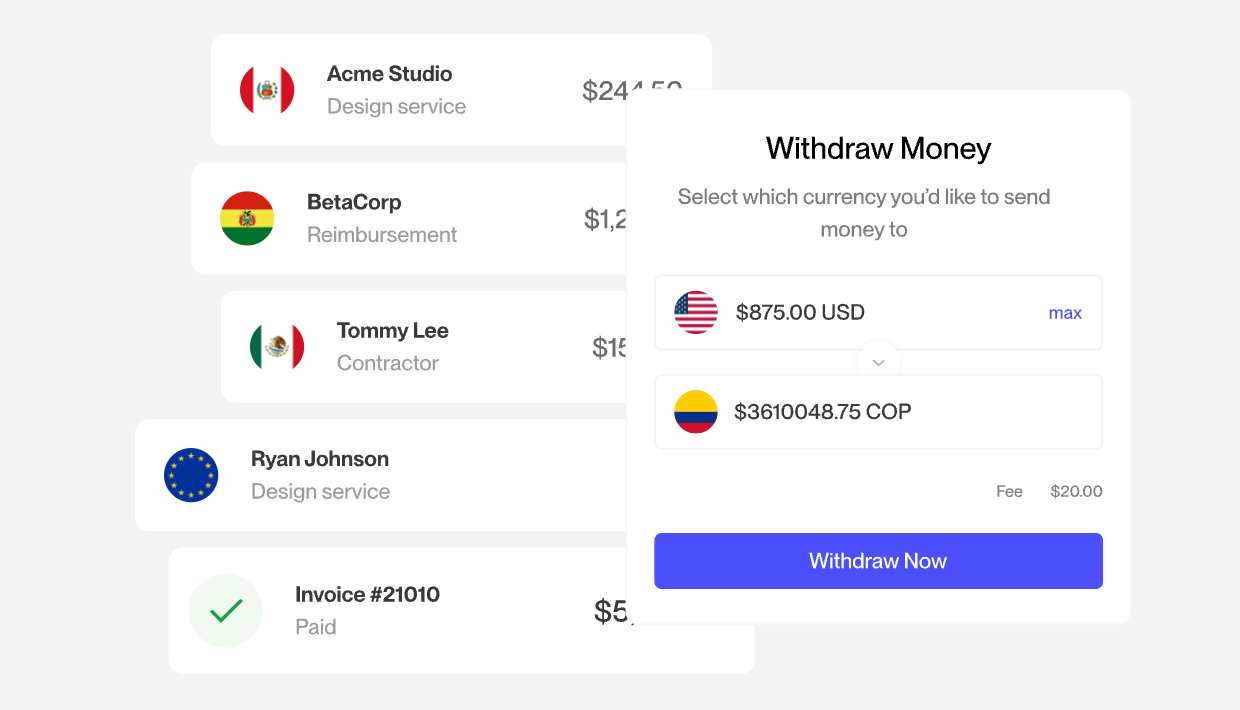

Fintechs and SaaS - Platforms like TaxBit integrate Mural’s pay-in and payout rails to settle invoices across multiple countries, without building local banking stacks market by market.

Banks and financial institutions - Banks can accept stablecoin deposits on behalf of customers, offer dedicated stablecoin accounts, and route funds out to local payment methods such as ACH, SEPA, SPEI, and PIX.

Why it matters for inclusive finance

For teams operating in high inflation markets, a dollar-based account stabilizes earnings and planning. Programmable, low-fee payouts help creators, contractors, and small businesses keep more of what they earn.

As more local-currency stablecoins emerge, a Colombian or Mexican business can hold balances in digital local currency and interoperate with dollar flows, all inside one account experience.

“In ten years most people will not talk about stablecoins, the rails will fade into the background and money will just move in real time.”

Compliance as a feature

Mural Pay treats trust and access as core product. The team is pursuing full money transmission licenses across states, with robust KYC and KYB, multi-signature approvals, and biometric authentication.

That posture opens doors with large enterprises and banks that need controlled, auditable flows.

Policy momentum and the GENIUS Act

The policy landscape around stablecoins has entered a transformative phase. Just a few years ago, many banks and regulators viewed digital assets with caution.

Today, that narrative has flipped from avoidance to active adoption, thanks in part to the GENIUS Act, a new piece of legislation that gives banks in the United States clear authority to hold and transact in stablecoins.

This clarity is accelerating real-world adoption.

Financial institutions and platforms can now integrate stablecoin technology into their infrastructure with confidence, fueling faster settlement, greater liquidity, and more transparent global transactions.

For companies like Mural Pay, this policy progress means opportunity. With compliance at the center of its model, Mural can now scale partnerships with major banks, fintechs, and payment platforms, strengthening the network effects that drive cheaper, faster, and more inclusive money movement worldwide.

A portable account that travels with you

One of the most powerful yet overlooked advantages of stablecoins is financial portability. In the traditional system, moving to a new country often means starting over, opening new bank accounts, navigating local regulations, and rebuilding access to financial tools.

Stablecoin accounts change that dynamic.

With a global stablecoin account, users can hold and manage funds that move with them wherever life or work takes them.

Whether relocating for business, studying abroad, or expanding a company into new markets, the same account can send, receive, and store value across borders without interruption.

For individuals, this means retaining control of their money no matter where they live. For businesses, it means reducing operational friction and offering workers, creators, and partners a truly global financial experience.

In essence, stablecoins make money as mobile as the people who earn and use it—bringing financial continuity to a world that’s constantly on the move.

The road ahead

Mural Pay aims to become a household name in modern payments, working with the largest platforms, fintechs, and banks.

Expect continued expansion of supported currencies, deeper connections to local payment networks, and more capabilities around invoicing, receipts, reconciliation, and automated compliance reviews, all delivered through developer-friendly APIs.

Podcast Q&A Transcript

Grant

Great to have you, Sinclair. You and the team were building long before stablecoins were mainstream. Before Mural Pay, tell us about your journey and why you started it.

Sinclair

Thanks for having me, Grant. I was born in Colorado and grew up between the U.S. and France, so cross-border life is part of my story. As a kid I used Western Union with my grandmother. At 14 I visited family in Togo and saw how hard it was to access dollars. That limits growth for families and small businesses.

After working at Palantir as a forward-deployed engineer and tech lead, I wanted to build something with deep, global impact. In 2021 I started exploring how to rethink money movement, then launched Mural in January 2022 to make global payments fast, affordable, and transparent.

Grant

For people who know Western Union but not stablecoins, compare the two, and explain what Mural Pay does.

Sinclair

Western Union connects cash pickup points worldwide. Stablecoins make money move like Venmo or Revolut, but across borders and at scale. Businesses need programmatic payouts, speed, lower fees, and clear tracking. Stablecoins provide all three.

Think of blockchains as high-speed highways and stablecoins as the cars. We connect those highways so the “cars” move quickly with fewer failures. We avoid crypto jargon and focus on real-time payments and digital assets. Most users just see a dollar account that sends and receives globally.

Grant

Give us tangible use cases.

Sinclair

We serve three groups, platforms, fintechs, and banks.

Platforms, Opera pays thousands of creators across Africa instantly. Funds arrive as digital dollars, then creators can withdraw to a bank account or wallet. This replaces slow wires and reduces failure rates.

Fintechs, TaxBit integrates our rails to settle invoices across countries and to collect and receive cross-border funds.

Banks and FIs, they accept stablecoin deposits, open dedicated stablecoin accounts for customers, and send out via ACH, SEPA, SPEI, PIX, or on-chain.

Grant

Consider a marketplace with artisans worldwide. Could each seller have a stablecoin account and get 99 to 99.5 percent of earnings instantly on a phone?

Sinclair

Yes. The marketplace integrates our API, spins up dedicated accounts per seller, holds funds in escrow, then releases on completion. Sellers sign up with phone or email, then withdraw to a bank account or another stablecoin account. They do not need to know it is a stablecoin account, it feels like a dollar account. Marketplaces can even offer yield on balances, so they can provide bank-like value without being a bank.

Grant

Stablecoins feel like an API for the U.S. dollar.

Sinclair

Exactly. It is one of the best ways to describe what is happening.

Grant

In high inflation markets this is life changing.

Sinclair

It is. In Argentina I saw menus with taped over prices changing weekly. One customer pays virtual assistants there in stablecoins. Workers preserve value, bring in friends and family, and start thinking about saving and supporting schools and communities. The ripple effects are real.

Grant

People need to spend locally too.

Sinclair

Right. Like at Palantir, we bridge new systems with old. Funds must move into bank accounts, onto cards, or into digital wallets. We build many routes so money flows in and out quickly. Over time the tech fades into the background, like card networks today.

Grant

Policy is moving. Thoughts on the GENIUS Act and adoption?

Sinclair

In 2022 banks avoided the space. By 2025 the conversation flipped. The GENIUS Act gives U.S. banks clear authority to hold and transact in stablecoins, which unlocks pilots and production rollouts. We now see adoption across banks, fintechs, marketplaces, even music royalty distributors where complex, cross-platform payouts resemble marketplace models.

Grant

When you pitch outside the U.S., is it always dollar stablecoins?

Sinclair

We start with USD stablecoins like USDC or USDT. Demand is rising for local currency stablecoins too. Fintechs ask for accounts that can hold digital Colombian pesos or Mexican pesos. Collecting in local stablecoins inside the same account avoids opening local bank accounts, which is slow and complex. With us it is a switch you can turn on.

Grant

What is the business model?

Sinclair

Three parts,

- FX spread when converting between stablecoins and local currencies,

- usage based SaaS for accounts and verifications,

- forward-deployed engineering that sits with the customer to ship the right integration and feed features back into the core product.

Customers often save 20 to 95 percent versus legacy providers, for example moving from 5 percent fees to 0.2 to 0.5 percent depending on corridor.

Grant

What does the next three to five years look like?

Sinclair

We want an experience where funds clear in seconds, invoices are scanned and understood, compliance checks happen behind the scenes, and artists or sellers get paid same day. People in places like Togo or Argentina can open a dollar based account, save, and plan.

To reach that future we are earning trust, pursuing full money transmission licenses, and working with the largest platforms and institutions. The goal is to make Mural a household name for real-time, compliant global payments.

Grant

One last idea, the account that moves with you.

Sinclair

Yes. I lived in multiple countries and opening accounts each time was painful. With stablecoin accounts your money and access travel with you. That portability is powerful.

Grant

Thanks, Sinclair. Where can people learn more?

Sinclair

muralpay.com, and you can reach me on LinkedIn or email. We want to work with people building for impact at global scale.