Born from the 2024 acquisition of Aspiration's consumer fintech division, GreenFi emerges as an independent brand backed by a $17 million seed round led by Mission Financial Partners (MFP). The company is led by CEO Tim Newell, former Tesla executive and head of Aspiration’s consumer fintech unit.

About GreenFi

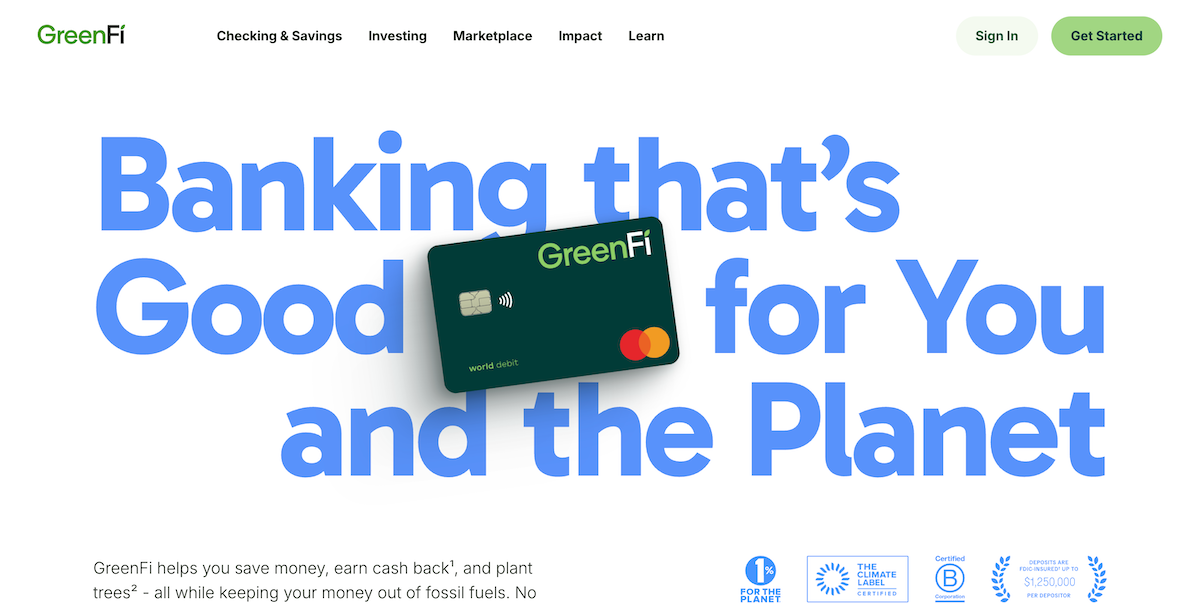

GreenFi is a climate-first fintech company offering checking, savings, credit, and investing tools for people who want their money to reflect their values.

GreenFi is not a bank; banking services are provided by Coastal Community Bank, Member FDIC.

Causeartist BackOffice

Your Mission-Aligned Operations Team

From investor-ready financials to growth strategy, HR, compliance, and custom software—Causeartist BackOffice is your all-in-one operational partner. Built for impact startups, funds, and nonprofits, and powered by our experts.

Let us handle the back office—so you can stay focused on impacting the world.

A Fresh Start for Sustainable Banking

GreenFi builds upon the legacy of Aspiration with a sharpened focus: providing everyday consumers with financial products that align with climate-friendly values.

With the transition, GreenFi offers account migration for former Aspiration users—ensuring that all checking, savings, and investment accounts remain fully intact and continue to operate without fossil fuel ties.

“GreenFi is about aligning your money with your values,” said Tim Newell. “Every dollar you save, spend, or invest with us supports a healthier planet—without sacrificing financial returns.”

Funding the Future of Green Finance

The $17 million seed investment will accelerate the development of GreenFi’s next-generation offerings, including:

- High-Yield Sustainable Savings Accounts

- Climate-Conscious Credit Cards

- Impact Investment Portfolios

- Green Loan Products for Home and Auto

These tools aim to give customers more control over their environmental impact—right from their wallets.

🌱 Real-World Impact with Every Transaction

GreenFi users aren’t just banking; they’re participating in a global reforestation effort. In 2024 alone, customers helped fund the planting of more than 4.3 million trees—roughly one tree every 7.3 seconds. That’s enough to reforest more than two and a half football fields per day.

“We all have power to shape a sustainable future simply by choosing where we bank,” said Newell.

Trust, Transparency, and Transition

In light of past legal controversies involving Aspiration’s original leadership (which are not connected to GreenFi or its current team), GreenFi has taken proactive steps to ensure transparency and trust.

As an independent company, GreenFi offers FDIC-insured banking services through Coastal Community Bank, with coverage up to $1.25 million per account.

What Customers Can Expect

Here’s what’s staying the same—and what’s new:

✅ No fossil fuel investments

✅ Same checking, savings, and investment accounts

✅ Seamless transition from Aspiration

✅ New tap-to-pay GreenFi cards coming soon

✅ Expanded climate-focused financial products launching this year