In simplest terms, a plant-based meat alternative aims to replicate or mimic the taste, texture, aroma, and culinary function of animal-derived meat, but made without raising and slaughtering animals.

Because meat is complex (muscle fibers, fat, connective tissue, blood, etc.), creating convincing substitutes requires bridging multiple dimensions: protein structure, fat and flavor systems, moisture, binding, and cooking behavior.

Key technical approaches include:

- Protein isolates & concentrates — Extracted from plants (peas, soy, wheat, etc.) and recombined with fats, binders, and flavors.

- Texturization / extrusion / fiber spinning — Processes to align proteins into fibrous structures that approximate muscle (e.g. extrusion, shear cell technology, fiber spinning).

- Mycoprotein / fungal biomass — Using fungi or filamentous microorganisms (such as Fusarium venenatum, or species of mycelium) to generate a meaty texture.

- Precision fermentation / engineered microbes — Engineering microorganisms (yeast, bacteria) to produce specific proteins, fats, or flavor molecules (e.g. heme) which are then incorporated into plant-based matrices.

- Hybrid / “enhanced” ingredients — Mixed systems combining plant proteins with fermentation-derived ingredients or even small amounts of cultured fat to boost realism.

The goal is to deliver sensory acceptability (taste, texture) while retaining or improving the environmental, health, or ethical advantages over conventional meat.

Types & Examples of Plant-Based Meats

Here are common categories and real-world examples to ground the concept:

| Type / Approach | Example Brands / Products | Notes |

|---|---|---|

| Soy / pea protein burgers, “ground” | Beyond Meat’s burger, Impossible Foods “Impossible Burger” | Among the most familiar to consumers |

| Chicken substitutes, strips, nuggets | Oumph!, Gardein, Quorn | Focused on poultry analogues, often in processed form |

| Mycoprotein / fungal | Quorn (fungal origin), Prime Roots (formerly Terramino) | Uses filamentous fungi or fermentation to mimic muscle texture |

| Mushroom / mycelium cuts | Meati (mycelium-based steaks & cutlets) | Mycelium offers fibrous structure, faster growth cycles |

| Fiber-spun structured meat cuts | Tender (formerly Boston Meats) | Uses spinning technology (somewhat like cotton candy style fibers) to produce structured cuts (short rib, pulled pork, etc.) |

| Multi-layer / marbled analogues | UNLIMEAT | Works on low-moisture / high-moisture meat analogues and custom extrusion for layered structure |

| 3D-printed / biomimetic | NovaMeat (3D printed plant-based meat) | Pushing into “whole cut” and fine structure territory |

Legacy / large-scale names

It’s also worth acknowledging the scale players because they anchor the ecosystem:

- Beyond Meat — One of the earliest plant-based meat brands with wide retail and foodservice presence. Read our Beyond Meat Case Study.

- Impossible Foods — Known for engineering a heme-like molecule via fermentation to replicate meat “juiciness”

- Quorn — Early mover in fungal-based protein

- Gardein, MorningStar Farms, Tofurky — more commodity / accessible players in the analog / meat substitute segment

- Nestlé (via acquisitions and alternative protein R&D), JBS (via stakes and acquisitions) — incumbents stepping into the space

Startups & Innovators to Watch

Here are some notable emergent and frontier startups:

- Tender — Using fiber-spinning of plant proteins to produce structured cuts like short ribs, pulled pork, chicken breast, and crab analogues.

- Meati — A mycelium-based company producing steaks and cutlets from fungal biomass.

- UNLIMEAT — Focused on creating low-moisture and high-moisture meat analogues, with custom extrusion to replicate marbling and layered structure.

- NovaMeat — 3D printing plant-based meat substituents (blurring into cultured meat territory)

- Prime Roots — Uses koji fermentation (fungal fermentation) to make deli-style meats and muscle-like alternatives.

- ENOUGH — Mycoprotein / fermentation-based protein platform.

Market Size & Growth Trends

Understanding the market landscape is crucial for entrepreneurs and investors. While projections vary, a few consistent themes emerge: strong compound growth, regional variation, and structural pressures to lower cost.

Global market size & forecasts

- According to IMARC, the global plant-based meat market was valued at USD 16.69 billion in 2024, and is projected to grow at a CAGR of 21.92% to reach USD 100.31 billion by 2033

- Roots Analysis estimates a base of USD 17.1 billion in 2024, rising to ~USD 18.7 billion in 2025, with further growth toward USD 54.8 billion by 2035 (CAGR ~11.35%)

- Other reports place the 2024 market lower (e.g. ~USD 7.17 billion) with a forecast to ~USD 24.8 billion by 2030 (CAGR ~19.4%)

- Another projection suggests the market could grow from USD 9.57 billion in 2024 to USD 21.81 billion by 2030 (CAGR ~14.7%)

Because of methodological differences (definitions, geography, what qualifies as “plant-based meat”), the range is wide — but all forecasts imply strong multi-year growth.

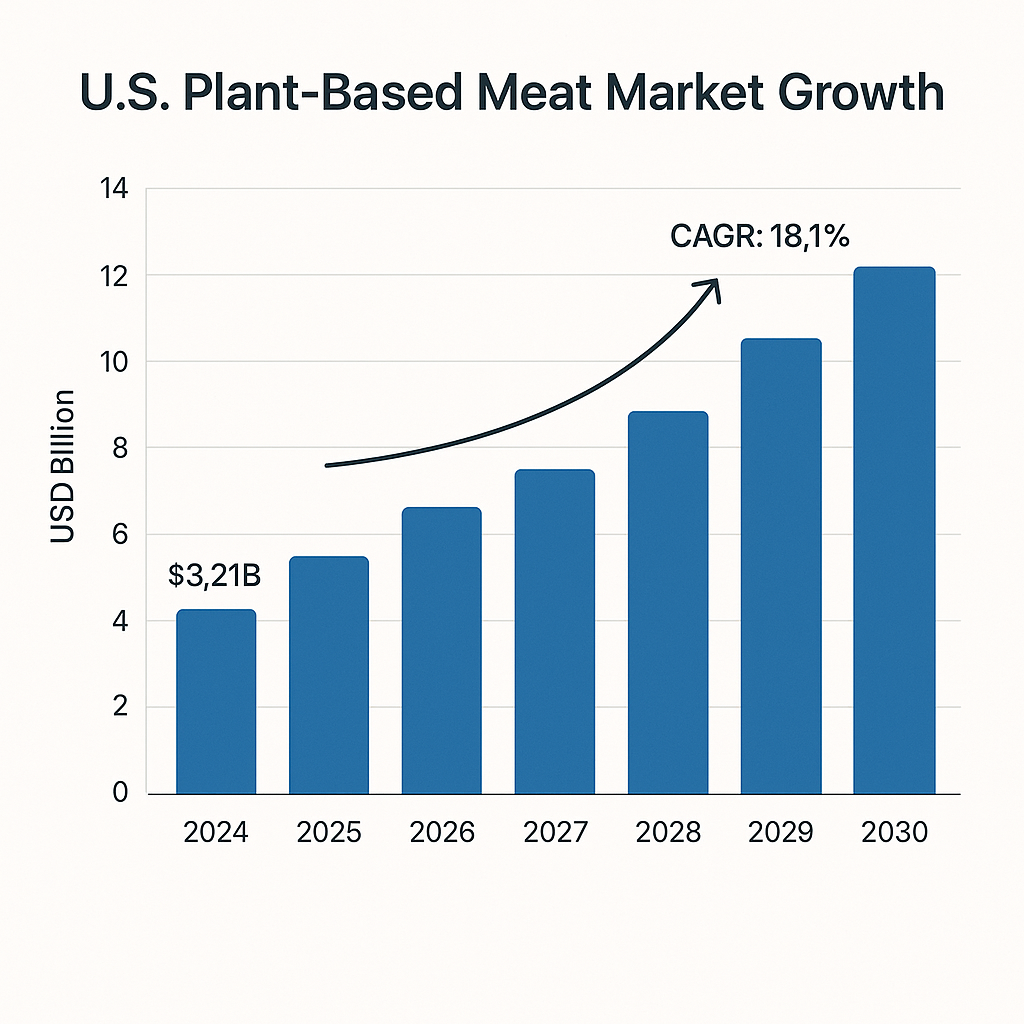

Regional and U.S. outlook

- In the U.S., the plant-based meat market was estimated at USD 3.21 billion in 2024, and expected to grow at a CAGR of ~18.1% through 2030.

- Another U.S. forecast from ResearchAndMarkets estimates growth from USD 2.99 billion in 2024 to USD 15.12 billion by 2033 (CAGR ~19.9%)

- North America currently captures ~36% of the global share per IMARC.

Drivers, tipping points & structural signals

Key forces fueling growth include:

- Rising environmental awareness, climate pressures, and regulatory interest in reducing livestock emissions

- Health, wellness, and dietary shifts (e.g. flexitarian consumers)

- Improvements in sensory properties and innovation in ingredients / processing

- Scale economies, ingredient sourcing, and operational efficiencies

- Entry of incumbent food companies (brands, supply chains, retail)

- Potential policy incentives, labeling rules, subsidies or carbon pricing

- Demand from foodservice / quick service restaurant (QSR) channels as well as grocery

But as with all nascent industries, actual adoption will hinge on cost parity, taste parity, regulatory clarity, and supply chain robustness.

Pros & Cons: Sustainability, Health, Economic, Scalability Tradeoffs

To assess where the real impact and opportunity lies, here is a breakdown of advantages and disadvantages — especially relevant to impact investors and startup founders.

Pros / Strengths

- Environmental Benefits

- Plant-based meat generally yields lower greenhouse gas emissions, land use, and water use compared to equivalent animal meat. Many lifecycle assessments confirm notable reductions (though results vary by system).

- By shifting protein sourcing away from conventional livestock, plant-based alternatives can reduce deforestation, soil degradation, and nitrogen runoff.

- Animal Welfare & Ethics

- Avoids the raising and slaughter of animals, aligning with ethical and welfare goals.

- Broad appeal to vegetarians, vegans, and ethically motivated flexitarians.

- Health & Nutrition Potential

- Opportunity to design for beneficial nutrition: lower saturated fat, higher fiber, elimination of certain contaminants (e.g. antibiotics, pathogens).

- But also opportunity to fortify with micronutrients like iron, B12, etc.

- Innovation & Value Creation

- Opens space for new ingredient technologies, fermentation, bioprocessing, supply chain re-architecture.

- High upside for startups that reach scale in cost-effective production, ingredient licensing, or enabling platforms.

- Market Differentiation & Consumer Demand

- Growing consumer demand for more sustainable, “better-for-you” choices.

- Food service and retail channels increasingly want “green” offerings to meet ESG goals and consumer trends.

Cons / Challenges & Risks

- Cost & Price Parity

- Many plant-based meats remain more expensive than conventional meat. Achieving cost competitiveness at scale is a steep technical and supply chain challenge.

- Ingredient, processing, and logistics inefficiencies still weigh heavily.

- Sensory / Acceptability Gaps

- Taste, texture, “bite,” juiciness, fat/flavor release still lag (especially in complex cuts).

- Many consumers are skeptical or have negative past experiences with "plant meat" and hence raise the bar.

- Nutrition & Tradeoffs

- Some formulations rely on heavy processing, sodium, additives, and may lack natural micronutrients (B12, bioavailable iron) unless fortified.

- Over-reliance on ultra-processed ingredients can invite health criticisms.

- Supply Chain Constraints & Ingredient Risks

- Scaling specialty proteins, fermentation inputs, fat systems, and novel ingredients reliably and sustainably is nontrivial.

- Risk of monocultures, crop dependency (e.g. pea, soy), and input volatility.

- Regulatory, Labeling & Consumer Perception

- Labeling (e.g. using terms like “meat,” “burger,” “sausage”) is under regulatory scrutiny in many markets (e.g. EU debates).

- Skepticism from consumers about “lab-style” foods, GMO/fermented inputs, “ultra-processed” stigma.

- Market Saturation & “Hype Cycle” Risk

- A glut of competing brands, “me too” products, marketing-driven competition may lead to margin pressure and consolidation.

- If expectations overshoot reality, there is a risk of investment pullback (as has happened in some alternative protein subsectors).

- Impact Dilution & Rebound Effects

- If the plant-based option is merely additive rather than substitutive, total meat consumption may not decline markedly.

- Without systemic shifts in food systems, supply chains, consumption patterns, carbon / land savings may be limited.

Challenges, Risks & Open Questions

Beyond the pros/cons, here are some higher-level, strategy and frontier challenges that I believe merit focus from founders, investors, and policymakers:

- Ingredient & cell-agnostic platforms — Can you build ingredient tools (enzymes, fermentation strains, fat analogues) that plug into multiple final products?

- Decentralized manufacturing & distributed models — Are there alternatives to large centralized plants (e.g. modular facilities, regional hubs) to reduce logistics and localization issues?

- Blending / hybrid models — What is the right mix of plant proteins, fermentation-derived molecules, and possibly cultured fat to maximize realism and cost?

- Consumer insights & segmentation — Which consumers will pay for premium plant-based meat, vs. who will adopt only when price parity arrives?

- Policy & regulation design — How can governments structure incentives (carbon credits, subsidies, labeling standards) to accelerate adoption without stifling innovation?

- Measuring and ensuring impact — How to quantify the actual environmental and social impact (e.g. avoided emissions, land spared, nutrition gains) in a credible way.

Outlook & Recommendations for Founders & Investors

- Focus on modules, ingredients, or enabling tech — not just “yet another burger”

The frontier of impact may lie in ingredients, fermentation platforms, fat emulsion systems, or fiber structuring tools. These upstream technologies can scale across multiple downstream brands. - Go for margin leverage, not just top-line growth

Competing purely on price is brutal. Brands that can command margins via formulation, branding, B2B licensing, or proprietary tech will be more durable. - Lean toward modular, scalable production approaches

Think about distributed manufacturing, vertical integration of inputs, or regional hubs to shorten the supply chain and reduce transport footprint. - Segment intelligently, don’t overgeneralize

Seek early success in niche or premium segments (e.g. high-end restaurants, specialty cuts, meat analogues for certain cuisines) before migrating to mass retail. - Partner with incumbents & leverage existing networks

Given the dominance of large food companies, building joint ventures, licensing deals, or supply partnerships with incumbents is often necessary rather than purely disruptive competition. - Rigorous impact measurement from Day 0

Integrate full lifecycle assessments, scenario modelling, and monitoring of avoided emissions, land use, and health outcomes — this is central to credibility for the impact space.

Conclusion

Plant-based meat alternatives are at a pivotal inflection point. Their promise — to deliver healthier, more ethical protein without overburdening Earth’s ecosystems, aligns directly with the mission goals of climate, health, and equity.

Yet the next decade will test which startups, technologies, and business models can survive the fierce competition, cost pressures, and consumer scrutiny.