Eileen Fisher is an American fashion brand founded in 1984 by designer Eileen Fisher, known for its minimalist women’s apparel and pioneering commitment to ethical and sustainable practices.

Over four decades, the company has grown from a small startup (launched with just $350) into a medium-sized global enterprise with hundreds of millions in annual sales.

The brand is particularly recognized for its use of organic and natural fibers, timeless designs, and innovative programs that promote circular fashion and social responsibility.

Uniquely, Eileen Fisher (the person) still owns about 60% of the privately held company, while roughly 770 employees own the remaining 40% through an employee stock ownership plan.

This shared ownership structure reinforces the company’s people-centered ethos. In 2015, Eileen Fisher became a certified B Corporation, voluntarily meeting high standards of social and environmental performance; as of 2025 it has been recertified four times, reflecting continuous improvement in its sustainability score.

This case study examines how Eileen Fisher has integrated sustainable and ethical practices into its business model, its expansion beyond the U.S., and the latest developments up to 2025 that position the brand as a leader in responsible fashion.

Global Apparel Market Context and Responsible Fashion Outlook

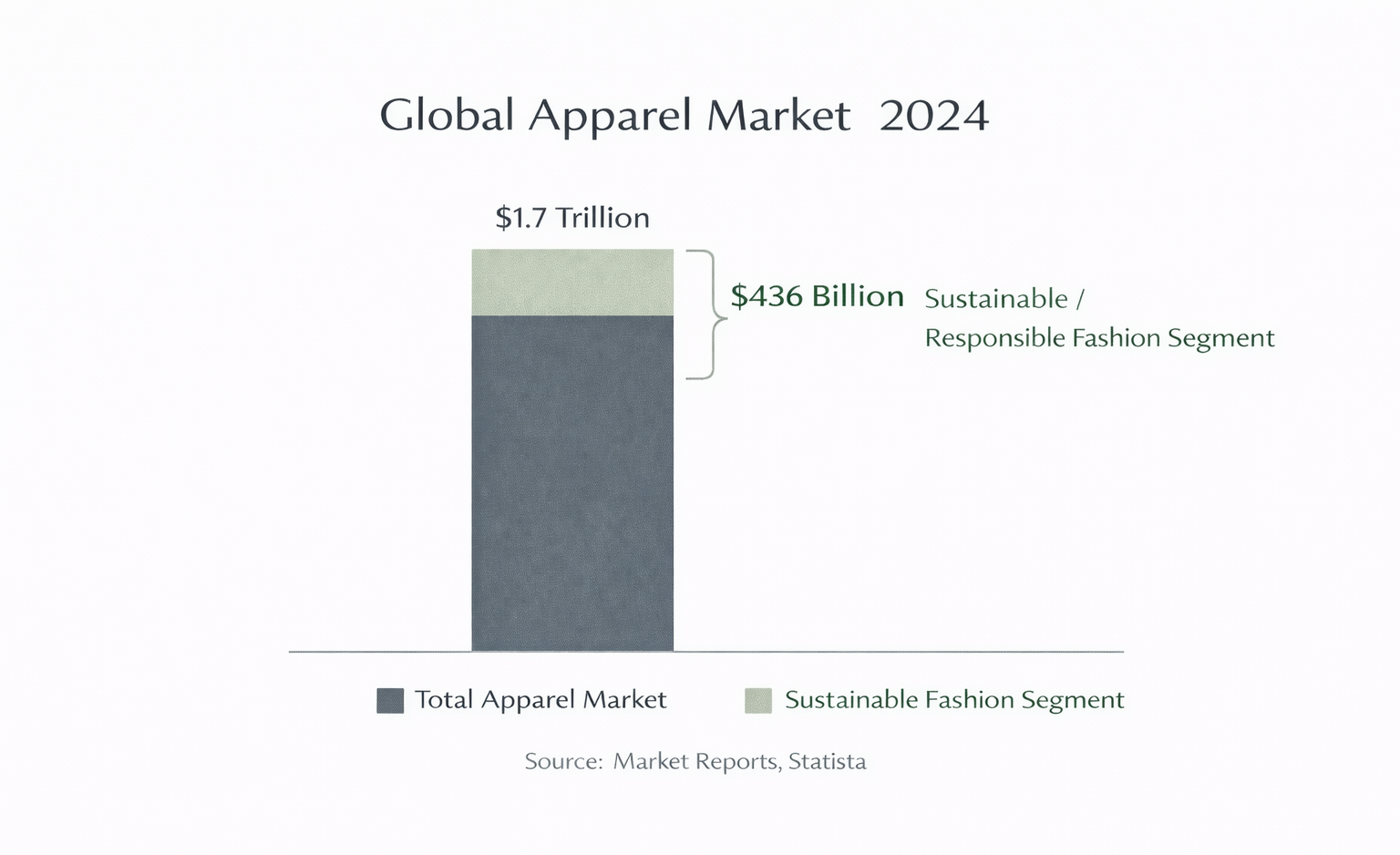

The global apparel industry remains one of the largest consumer markets in the world. In 2024, total global apparel sales are estimated at approximately $1.7 trillion, spanning mass-market fast fashion, premium brands, luxury houses, and specialty labels.

Despite periodic downturns tied to inflation, supply chain disruption, and shifting consumer confidence, apparel remains structurally resilient due to its role as a recurring household purchase.

Within this broader market, responsibly produced and sustainability-oriented apparel now represents a meaningful and growing segment.

Current estimates place this segment at roughly $436 billion, accounting for approximately 25 percent of the total global apparel market.

While definitions vary across research firms, this category generally includes brands that emphasize durable construction, ethical sourcing, safer materials, transparent supply chains, and longer product lifecycles.

Market Growth Dynamics

Over the past decade, the responsible fashion segment has consistently grown faster than the overall apparel market. While global apparel growth has averaged low single digits annually, sustainability-oriented brands have seen mid to high single digit growth in many regions, particularly in North America and Western Europe.

Key drivers include:

- Rising consumer awareness of environmental and labor impacts tied to apparel production

- Increased demand for higher-quality garments with longer usable life

- Growth of resale, repair, and circular business models

- Regulatory pressure in Europe around supply chain transparency and material disclosure

- Cultural shifts away from trend-driven consumption toward intentional purchasing

Importantly, this growth has not been uniform across all brands that market themselves as sustainable. Companies with superficial claims or limited operational follow-through have struggled to retain trust, while brands with long-standing commitments and measurable practices have gained share.

Forecast Through the Late 2020s

Looking ahead, most industry forecasts project the responsible fashion segment to continue expanding faster than the overall market through at least 2030. Conservative projections suggest the segment could approach $600–700 billion globally by the end of the decade, driven by a combination of consumer demand, regulatory changes, and operational necessity.

However, growth is expected to moderate from early surge levels as the category matures. This favors companies with durable business models, strong balance sheets, and integrated operating systems rather than trend-dependent positioning.

Implications for Eileen Fisher

Within this context, Eileen Fisher operates as a scaled specialist rather than a mass-market player. The company’s estimated annual revenue of roughly $250–300 million represents a small fraction of the overall market, yet its influence and brand equity far exceed its size.

Several structural factors position Eileen Fisher favorably within the responsible apparel segment:

- A multi-decade track record of material stewardship and ethical production, predating market demand

- A customer base aligned with durability, repair, and reuse rather than seasonal turnover

- An operational model that already incorporates resale, take-back, and material recovery

- Pricing power rooted in quality and trust rather than trend cycles

Unlike newer entrants that must retrofit sustainability into an existing fast-growth model, Eileen Fisher built its business around restraint, longevity, and accountability.

As the broader apparel industry faces pressure to internalize environmental and labor costs, this positioning shifts from niche advantage to structural resilience.

Strategic Relevance of the Market Context Chart

The chart illustrating the $1.7 trillion global apparel market with a $436 billion responsible segment serves an important analytical purpose.

It demonstrates that sustainability-focused apparel is no longer marginal, yet still leaves substantial headroom for growth.

It also underscores why Eileen Fisher’s approach, while not designed for hypergrowth, aligns well with long-term market direction.

The takeaway is not that Eileen Fisher needs to capture a larger share of the overall apparel market, but that the market itself is gradually moving closer to the principles the company has operated under for decades.

In that sense, Eileen Fisher is less a disruptor and more a preview of where durable apparel businesses are heading.

Company Overview and International Expansion

From its base in New York, Eileen Fisher steadily expanded across the United States, and eventually abroad. By the mid-2010s, the brand operated over 60 of its own retail stores across the U.S., Canada, and the U.K., in addition to selling through major department stores and its online site.

For example, the company opened its first two London stores in 2011 (on Marylebone High Street and in Covent Garden), marking its entry into the U.K. market.

These U.K. boutiques were carefully launched after four years of research and local partnership-building – an approach that underscored the brand’s patient, “do it right, not fast” philosophy.

Executives worked with British consultants and even sent teams to walk the streets of London’s shopping districts to understand local consumer tastes.

The result was a tailored retail experience that resonated with U.K. customers, featuring the brand’s hallmark welcoming service and simplified store layouts.

Despite this international foray, Eileen Fisher’s brick-and-mortar footprint outside the U.S. remained relatively limited (primarily Canada and the U.K.), and the company has not aggressively penetrated other regions like continental Europe or Asia.

Instead, it focused on deepening its connection with core markets and leveraging e-commerce to reach global customers (through an international shipping partner).

The brand’s measured approach abroad mirrors its overall ethos of sustainable, steady growth rather than rapid mass expansion.

Even as a niche international player, Eileen Fisher has an outsized reputation worldwide for its values-driven business model, often cited as a model for ethical fashion in industry discussions.

Sustainable and Ethical Practices at the Core

Sustainability isn’t an add-on for Eileen Fisher – it is built into the DNA of the company’s strategy and operations. In 2013, Eileen Fisher boldly declared a vision of becoming “100% sustainable,” an aspirational goal that galvanized the organization to scrutinize every aspect of its supply chain and product lifecycle.

While acknowledging that total sustainability is an evolving journey, this commitment has yielded concrete results.

As of 2023, over 80% of the brand’s raw materials meet third-party sustainability criteria, and about 70% of materials are processed using “safer” chemicals and dyes (e.g. bluesign®-approved processes).

For instance, Eileen Fisher was one of the first fashion brands to use wool certified to the Responsible Wool Standard and has steadily increased its use of organic fibers like organic cotton and linen.

In fact, by 2020 the company achieved its goal of using only organic cotton and linen, and committed to sourcing wool from humanely raised sheep and swapping rayon for the more eco-friendly TENCEL™ fiber.

These material choices significantly reduce water usage, chemical pollution, and carbon footprint in the product creation stage.

Another pillar of the company’s ethical approach is fair and transparent supply chain management.

Eileen Fisher has a global supply chain – its clothes are manufactured by partner factories in various countries (including the U.S., China, Vietnam, Indonesia and more).

To ensure high labor and environmental standards, the company rigorously vets and collaborates with suppliers. Since 2014, Eileen Fisher has been mapping its entire supply network “from field to factory” to maintain full visibility into how its products are made.

The company participates in the Open Apparel Registry, publishing its list of factories and mills in a publicly searchable database, a level of transparency still rare in the fashion world.

Eileen Fisher also asks suppliers to undergo regular audits and assessments.

Many factories participate in the Higg Index Facility Social & Labor Module, or in the International Labour Organization’s Better Work program for higher-risk countries like Vietnam and Indonesia, which provides independent compliance reports on working conditions.

As a member of Cascale(formally Sustainable Apparel Coalition), Eileen Fisher collaborates with other brands to reduce “audit fatigue” and instead invest in long-term improvements for workers.

Notably, the company created an internal Social Consciousness team over two decades ago, led by a senior executive whose sole focus is ensuring fair labor practices and environmental stewardship throughout the business.

This proactive governance (essentially an early form of what is now termed ESG oversight) has helped Eileen Fisher earn and maintain its B Corp status, scoring highly on measures of social impact.

Perhaps Eileen Fisher’s most acclaimed initiative is its circular economy programs, which aim to extend the life of garments and reduce waste.

The company launched a take-back and resale program back in 2009 – long before “circular fashion” became a buzzword – under the name “Green Eileen.”

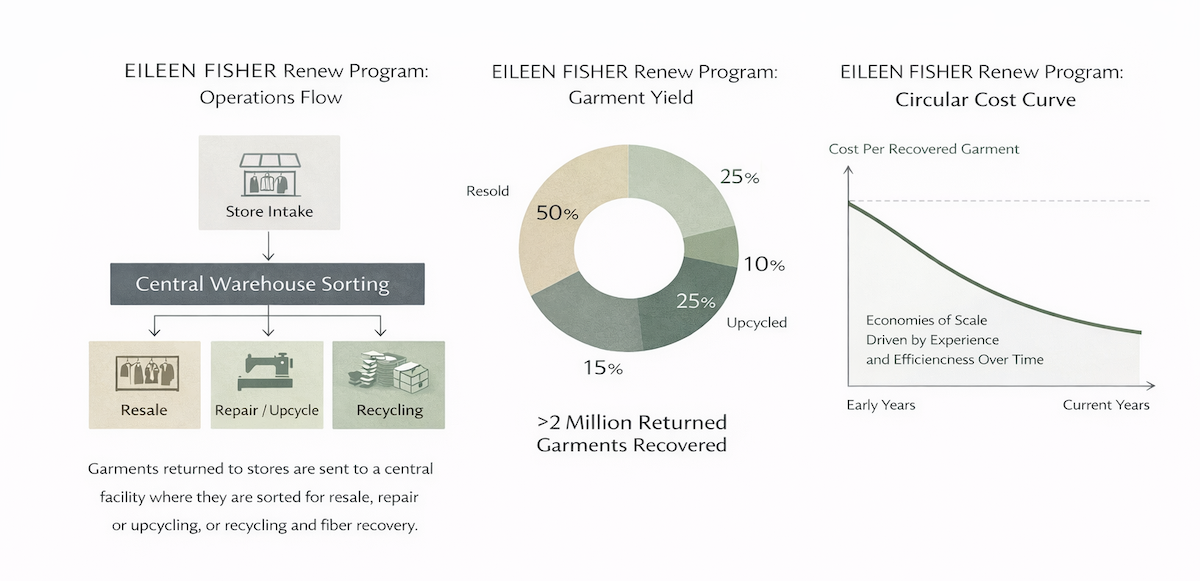

Now called Eileen Fisher Renew, the program invites customers to return any pre-worn Eileen Fisher clothing in exchange for a small store credit (typically $5 per item).

Returned items are then sorted and either resold as second-hand pieces, upcycled into new designs, or recycled into raw material if too damaged to wear. Over the years this program has grown tremendously.

By 2023 it had collected over 2 million garments, with more than 1 million of those pieces resold, donated, or remade into new products.

This equates to significant waste diverted from landfills, though still “only scratching the surface” (about 5% of all the clothes the brand produced in its history, as one executive noted).

The Renew initiative includes dedicated operations: a specialized warehouse in Seattle handles intake and processing of used clothing, functioning almost like a mini-startup within the company to innovate on cleaning and repair techniques.

What can be mended is restored to “good as new” condition and sold through Renew channels; what cannot be wearable is transformed through the “Waste No More” program into artful textiles, pillows, or raw fiber for new fabric.

Eileen Fisher even opened stand-alone “Renew” stores (sometimes branded as Fisher Found) to sell these gently used garments, targeting younger and eco-conscious consumers with more affordable options.

The ethos is that “we find a way to do something with every single garment that comes back to us”, ensuring nothing goes to waste if possible.

In addition to recycling products, Eileen Fisher has pursued innovations in design and retail to further its sustainability mission.

The design team has dramatically simplified the product line to reduce excess and focus on longevity – five years ago, the brand was using over 1,000 different fabrics, but by 2023 that was pared down to ~200 core fabrics that designers love and that meet stringent sustainability guidelines.

This simplification helps with quality control and recyclability (fewer material types make it easier to repurpose garments).

The company also emphasizes a “system of dressing”: timeless separates in coordinating color palettes, intended to mix-and-match across seasons so that customers can build a lasting wardrobe rather than constantly chasing trends.

Eileen Fisher’s marketing often educates consumers on investing in a few high-quality pieces and styling them in versatile ways. In fact, both the founder and the current CEO have openly urged consumers to buy fewer clothes overall – a bold stance for a fashion retailer, but one they believe is necessary for true sustainability.

Instead of encouraging excessive consumption, the brand focuses on helping customers be more deliberate and informed about their purchases (e.g. offering free repairs, guiding on garment care, and highlighting cost-per-wear value).

This approach has helped Eileen Fisher cultivate a loyal customer base that values the company’s honesty and purpose, spanning from its core demographic of middle-aged women to younger Gen Z shoppers who discover the brand via its sustainable practices.

Latest Developments (2020–2025)

The period from 2020 to 2025 has been transformative for Eileen Fisher, marked by leadership changes, adaptation to global challenges, and continued innovation in sustainability.

In 2020, the company wrapped up its ambitious Vision2020 campaign – a five-year roadmap that set targets such as reducing carbon emissions, ensuring fair wages in the supply chain, and achieving “100% sustainability” in materials and operations.

By 2020, Eileen Fisher had met or made significant progress on many of these goals: all U.S. operations were made carbon-neutral (even aiming for carbon-positive), all cotton and linen were organic, 30% of products were bluesign® certified for chemical safety, and the clothing take-back program hit its target of 1 million recycled items (on its way to 2 million shortly after).

The company also mapped virtually its entire global supply chain and made the data public, increasing accountability for its manufacturing partners.

These efforts earned accolades, for example, Eileen Fisher consistently ranks among the highest-scoring apparel companies in independent sustainability ratings (such as the Stand.earth “Fossil-Free Fashion” scorecards) and has maintained its B Corp certification with an improved score in 2024 (marking ten consecutive years as a B Corp).

The COVID-19 pandemic in 2020–2021 posed serious challenges to the retail sector, and Eileen Fisher was not immune.

The company temporarily closed stores during lockdowns and had to rethink its operations during that “intense year,” as Eileen Fisher described it.

However, the crisis also became an “opportunity to rethink and reorganize the business”. The brand doubled down on its online channels and found that its Resale/Renew offerings resonated even more with consumers seeking affordability and meaningful purchases during uncertain times.

One experimental concept, the Lab Store, proved particularly resilient through the pandemic. Lab stores (such as one in Irvington, NY and later ones in Brooklyn and Great Barrington) are hybrid spaces that blend education, community, and shopping.

They host workshops on topics like repair or styling, showcase the Renew line and other sustainable innovations, and allow customers to engage more deeply with the brand’s mission.

Eileen Fisher noted that even in tough times, there remained a “pretty committed” contingent of customers who value the in-store experience – touching fabrics, trying on clothes – especially when the stores emphasize connection and learning, not just selling.

A major development came in 2022: after nearly 40 years at the helm, Eileen Fisher decided to step down as CEO of her namesake company. She initiated a search for a new chief executive who could continue the brand’s multichannel growth and sustainability leadership.

In September 2022, Lisa Williams, a former Patagonia executive with deep expertise in sustainable outdoor apparel, was hired as the new CEO.

Williams spent her first year (2023) immersing herself in the Eileen Fisher culture, and has publicly affirmed her commitment to balancing “business, people, and planet” in line with the founder’s vision.

Eileen Fisher (the founder) remains involved as Chairwoman and also contributed to design direction, ensuring a smooth transition and mentoring Lisa Williams in the brand’s values.

Under the new leadership, the company has continued to pursue “mindful growth” rather than aggressive expansion.

For example, Williams has indicated she is fine with the idea of customers buying fewer, better garments, echoing Fisher’s philosophy, as long as Eileen Fisher remains their go-to source for those wardrobe staples.

Early in her tenure, Eileen Fisher Inc. also joined The Fashion Pact, a global coalition of fashion companies committed to climate and biodiversity goals, signaling its intention to collaborate industry-wide on sustainability (Williams was directly involved in this initiative, given her Patagonia background).

Financially, the company navigated the pandemic and subsequent supply chain turbulence relatively well by staying true to its niche. Its annual sales were about $267 million in 2022, which, while not huge, is solid for a privately owned specialty brand and reflects its loyal customer base.

The brand operates around 57 stores in North America as of 2025 (mostly in the U.S., with a handful in Canada). The decision to maintain a moderate store count, favoring street-level boutique locations in communities (over mall stores), aligns with the emphasis on quality over quantity and community engagement.

In August 2025, Eileen Fisher opened a new Lab store in Great Barrington, Massachusetts, only the second of its kind, to serve as a testing ground for sustainable retail concepts.

This store features experimental garments made from innovative recycled fibers, exclusive upcycled pieces, as well as racks of Renew second-hand clothing – effectively blending new and used fashion in one shopping experience.

On opening day, enthusiastic customers emptied the Renew racks multiple times, demonstrating the demand for circular fashion when presented in a stylish, accessible way.

The Great Barrington Lab also partnered with local artisans and held a “cloth-cutting” (instead of ribbon-cutting) ceremony, reflecting the company’s community-centric approach to expansion.

These types of initiatives underscore Eileen Fisher’s ongoing evolution: even after 40 years, the brand continues to push the envelope in sustainable design and retail, serving as a living case study of how a fashion company can grow responsibly.

Challenges and Outlook

While Eileen Fisher’s sustainability achievements are notable, the company faces ongoing challenges common to ethical fashion enterprises. Cost and scalability remain key hurdles, eco-friendly materials like organic cotton or regenerative wool are often more expensive than conventional alternatives, which can pressure profit margins and lead to premium pricing for consumers.

The brand’s clothes are indeed priced in the luxury contemporary range (e.g. dresses $200–$300), which can be a barrier for some shoppers.

Balancing growth with integrity means Eileen Fisher must continue to convince customers that the higher cost reflects greater value (through quality, longevity, and positive impact).

Another challenge is scaling the circular model.

Despite collecting millions of garments, the Renew program still recovers only a single-digit percentage of all items sold.

To truly “close the loop,” Eileen Fisher and others will need to dramatically increase customer participation in take-back programs and invest in textile recycling technologies that can handle larger volumes economically.

Supply chain oversight is another perpetual challenge.

As Eileen Fisher’s supply chain spans numerous countries and suppliers, ensuring consistent adherence to its strict standards requires constant vigilance, audits, and partnerships on the ground.

Issues like labor violations or environmental non-compliance can still arise deep in the supply network (an industry-wide problem), so the company must keep investing in transparency tools (like blockchain tracking, which it has explored) and in supplier training and development.

On the marketing front, one challenge is how to attract younger consumers without losing the brand’s identity.

Eileen Fisher’s minimalist aesthetic and “buy less, buy better” mantra run counter to the fast-fashion culture. However, there are encouraging signs: many Gen Z shoppers are increasingly eco-conscious, and Eileen Fisher’s authentic long-term commitment resonates with them.

Looking ahead, Eileen Fisher’s outlook remains optimistic yet realistic. The founder herself, now freed from daily management, continues to advocate for systemic change in fashion, collaborating with other brands and policymakers to improve industry standards.

Meanwhile, CEO Lisa Williams is steering the company into its next chapter with an eye on innovation in materials (e.g. regenerative agriculture, circular textiles) and possibly new business models (such as rental or further resale partnerships) to expand the reach of sustainable fashion.

The company’s recent Benefit Corporation reports set targets for 2025 and beyond, such as cutting greenhouse gas emissions (Scope 1 and 2) by 100% from 2017 levels and reducing Scope 3 (supply chain) emissions by 25%.

Overall Lessons Learned

The Eileen Fisher case offers several enduring lessons for companies operating in consumer goods, retail, and brand-led industries. These lessons are not dependent on fashion cycles or sustainability trends. They reflect disciplined operating choices, long-term thinking, and an uncommon level of internal alignment.

1. Long-Term Consistency Builds Strategic Optionality

Eileen Fisher’s most significant advantage is not a single initiative or program, but four decades of consistent decision-making. The company adopted responsible sourcing, fair labor standards, and durable design long before they were demanded by consumers or regulators.

As a result, Eileen Fisher now operates with strategic flexibility. Practices that other brands are scrambling to retrofit are already embedded in its supply chain, product design, and culture. This reduces execution risk as regulations tighten and consumer scrutiny increases.

Lesson:

Companies that align operations early with long-term structural shifts gain optionality later, while late adopters incur higher costs and credibility risk.

2. Restraint Can Be a Competitive Advantage

Eileen Fisher deliberately avoided rapid expansion, excessive SKU proliferation, and trend-driven growth. It limited store count, simplified materials, and focused on a repeatable system of products rather than seasonal reinvention.

This restraint lowered operational complexity and improved margin stability over time. It also enabled the company to experiment thoughtfully with resale, take-back, and lab-store concepts without jeopardizing the core business.

Lesson:

In consumer markets, disciplined growth often outperforms aggressive expansion when viewed over a full business cycle.

3. Authenticity Cannot Be Replicated Quickly

Many brands now market themselves as responsible or sustainable, but Eileen Fisher’s credibility is rooted in behavior, not messaging. Programs like Renew were launched years before resale became commercially fashionable, and the company openly acknowledges the limits of its impact rather than overstating progress.

This transparency has strengthened trust with customers, employees, and partners. It also reduces reputational risk in an era when greenwashing claims face increasing scrutiny.

Lesson:

Credibility compounds slowly and cannot be manufactured on demand. Brands that treat values as operating principles rather than marketing inputs are more resilient.

4. Circular Models Are Operational, Not Just Conceptual

Eileen Fisher demonstrates that circularity is not a brand narrative, it is an operational system. The take-back program required investment in logistics, warehousing, sorting, repair labor, and new pricing models. It also required cultural buy-in across the organization.

While resale currently represents a modest share of revenue, it provides learning, customer engagement, and future optionality as circular models scale.

Lesson:

Circular business models require infrastructure and patience. Companies must treat them as operational capabilities, not side projects.

5. Leadership Transitions Matter More Than Strategy Documents

The transition from founder-led management to a new CEO was handled deliberately, with continuity emphasized over disruption. The founder remained involved, institutional knowledge was preserved, and the incoming CEO was selected for alignment rather than novelty.

This avoided the common pitfall of post-founder identity drift and ensured that strategy evolved without abandoning core principles.

Lesson:

Leadership transitions are inflection points. Cultural continuity can be as important as strategic change.