Hey friends,

This week, we are looking at the critical difference between marketing a mission and executing one. Our latest case study on Aspiration serves as a sobering reminder that even the most celebrated impact models can be undone by poor governance and a lack of transparency.

As impact moves from a niche interest to a primary driver of global capital, the rigor of our claims must match the scale of our ambitions.

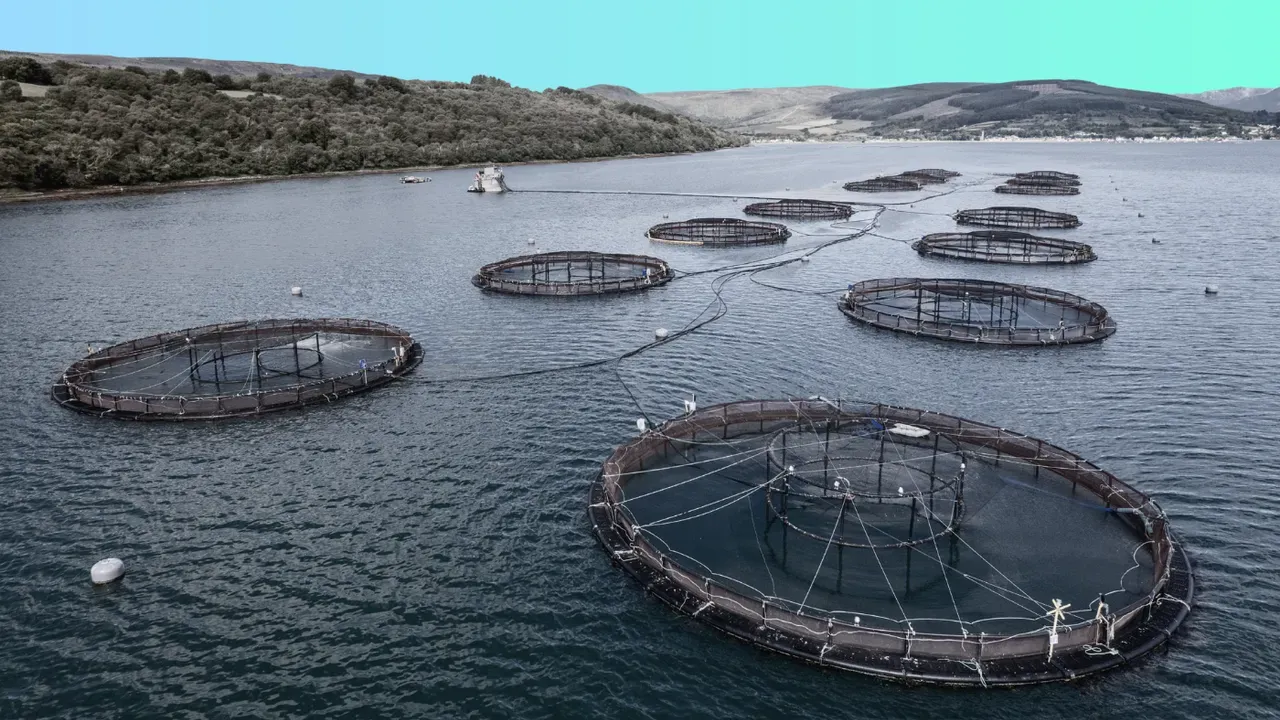

We also see a major shift in the blue economy, with Lukas Walton’s Builders Vision taking a significant stake in Hatch Blue.

This isn't just a win for one firm; it is a clear signal that aquaculture has matured into a core pillar of the global food system.

From AI-driven education grants to circular materials in the defense sector, the focus this week is on infrastructure, the invisible systems that make long-term impact possible.

Let's get to it.

— Grant

Featured Podcast

Inside Mural Pay’s Mission to Redefine Global Payments and Financial Inclusion

Mural Pay’s founder, Sinclair Toffa, joins Disruptors for GOOD to share how stablecoins and programmable payments can rewire cross-border money movement for businesses, creators, and marketplaces.

From early inspiration in West Africa to on-the-ground deployments with global platforms, Sinclair explains why faster settlement, lower fees, and end-to-end transparency are changing what is possible for millions of people who work and sell across borders.

When a “Sustainable” Neobank Breaks Trust: Case Study: Aspiration

Aspiration was once the poster child for sustainable banking, attracting millions of users and nearly $900 million in funding with a promise to fight climate change through everyday deposits. However, federal investigations and internal failures have since revealed a significant gap between the company’s marketing and its operational reality.

Key Takeaways:

- Execution Integrity: Aspiration’s "Pay What Is Fair" model and tree-planting promises resonated with consumers, but the company struggled to reconcile rapid growth with verified outcomes.

- Governance Matters: Despite B Corp status and celebrity backing, a lack of internal controls allowed for catastrophic financial misrepresentation.

- Sustainable Demand: While the company faced failure, the demand for fossil-fuel-free banking remains high. The lesson for the sector is that mission-driven finance requires even more rigorous transparency than traditional banking.

🗞️ News and Headlines

Builders Vision Takes Large Stake in Hatch Blue to Scale Sustainable Aquaculture

Builders Vision, the investment platform founded by Lukas Walton, has acquired a minority General Partner (GP) stake in Hatch Blue. This move deepens a partnership that began in 2017 and signals a massive vote of confidence in aquaculture as a scalable, investable sector.

As farmed seafood production surpasses wild-capture fisheries, this investment highlights the need for specialist platforms that combine capital with deep technical expertise in the blue economy. Read More

🌎 Fellowships, Grants, and Accelerators

- IBM Impact Accelerator: AI for Education & Workforce: IBM has opened a global RFP for its next cohort, offering two-year pro bono technology grants. Nonprofits and government entities can access IBM watsonx, Granite AI models, and consulting support to build solutions for teaching, learning, and career navigation.Deadline: March 25, 2026. Learn more

- Accelerate: 2026–27 Call for Effective Technology: Offering grants of $150,000–$250,000 for AI-driven edtech tools. The program focuses on evidence-based tools already in use with students, providing funding for implementation and rigorous external evaluation to inform state policy.Deadline: February 20, 2026. Learn More

💰 Funding and Capital Watch

- Avalo | $11M Series A: Developing an AI-powered platform to design climate-resilient crops. By helping breeders rapidly identify traits that withstand drought and heat, Avalo is scaling R&D and commercial partnerships to secure resilient food systems.

- Enerlink | $3.1M: Secured early-stage funding led by Kayyak Ventures and Dalus Capital to expand its EV charging management software and infrastructure across Latin America, specifically targeting Brazil.

- Unergy | $4M: Raised seed funding to scale its "minigranjas" (mini solar farms). The company uses a decentralized model to provide affordable clean energy to off-grid communities, with a goal of reducing CO2 emissions by 50,000 tons annually.

- ReForest Latam | $1M: Obtained capital to scale biodiversity-focused reforestation projects. The startup uses technology for real-time monitoring and carbon sequestration, generating high-integrity carbon credits.

- Rainbow Weather | $5.5M: Closed a Seed round to advance its AI-driven, hyper-local weather forecasting. The platform provides minute-by-minute precipitation data, helping the agriculture and energy sectors mitigate weather-related financial losses.

- Uplift360 | €7.4M: Led by Extantia Capital with the NATO Innovation Fund, this startup is recycling critical minerals and advanced composites (like carbon fiber) from aerospace and defense waste, cutting supply chain emissions by an estimated 40%.

Grant Trahant

Founder | Causeartist | Causeartist Studio

Host | Disruptors for Good + Investing in Impact

Venture Partner | Pay it Forward Ventures

Connect: LinkedIn | X