Chobani is a food company best known for pioneering Greek yogurt in America. Founded in 2005 by Hamdi Ulukaya and headquartered in New York, Chobani’s mission is to make high-quality, nutritious food accessible to all while using “food as a force for good”.

The company’s first product hit shelves in 2007, and within five years Chobani had become a billion-dollar brand and the #1 yogurt in the U.S.

Chobani grew rapidly by offering a richer, protein-packed yogurt that disrupted a market long dominated by sweet, low-fat styles.

Today its core products include Greek yogurt, yogurt-based snacks, and an expanded portfolio of oat milks, coffee creamers, and ready-to-drink beverages.

The privately held firm has scaled to over $2.5 billion in annual sales as of 2023 , while staying true to a socially responsible ethos through initiatives like employee ownership and refugee hiring.

Key Highlights

- Chobani’s growth trajectory saw it capture roughly 20% of the U.S. yogurt market,dethroning established giants in just a decade.

- Strategic reinvestment in innovation (e.g. plant-based products and new categories) has driven recent sales surges.

- Chobani’s founder-led culture emphasizes community impact – from giving 10% equity to employees to challenging industry norms with an “anti-traditional” approach.

- Key lessons from Chobani’s story include the power of identifying unmet consumer needs, the importance of agile scaling and quality control,,and the value of aligning business growth with social good.

- The company’s experience demonstrates how a mission-driven brand can disrupt incumbents, navigate crises, and sustain competitive advantage through continuous innovation and principled leadership.

Company Background & History

Chobani was founded by Hamdi Ulukaya, a Turkish immigrant who noticed a gap in the U.S. dairy market for the thick, tangy yogurt of his homeland .

In 2005, Ulukaya took a bold step by purchasing a defunct 90-year-old Kraft yogurt plant in New Berlin, New York, using a Small Business Administration loan.

Starting with just five employees from the old factory, he spent two years perfecting a “Greek-style” strained yogurt recipe in small batches.

The first cups of Chobani yogurt were sold in 2007 at a Long Island grocery, where they quickly sold out, validating Ulukaya’s vision of a better-tasting, high-protein yogurt without excessive sugar.

Chobani (which means “shepherd” in Turkish) was built on the principle of using only natural ingredients and real fruit, filling a quality void in the American yogurt aisle.

Ulukaya’s early insights, such as offering fruit flavors in nonfat yogurt when competitors only did full-fat, helped differentiate the product.

Instead of starting small, he took the risky route of distributing through national supermarket chains from the outset, even offering to pay slotting fees in yogurt (and pledging his factory as collateral if the yogurt didn’t sell).

This gamble paid off as word-of-mouth spread and major retailers embraced the new category.

Timeline of Milestones:

- 2005: Company founded as “Chobani” (then operating as Agro Farma) after Ulukaya buys the Kraft plant in upstate NY.

- 2007: First Chobani Greek yogurt cups hit store shelves; strong sales prompt rapid reorders.

- 2009–2010: Explosive growth as Greek yogurt gains popularity; Chobani expands distribution nationwide.

- 2011: International expansion begins – Chobani acquires Bead Foods in Australia and launches locally, where it quickly amasses ~20% market share.

- 2012: Opens a second, state-of-the-art yogurt plant in Twin Falls, Idaho – a $450 million facility that became the world’s largest yogurt plant. Chobani is the U.S. team’s yogurt sponsor at the London Olympics.

- 2013: Faces a major setback with a voluntary recall of mold-contaminated yogurt from its Idaho plant; 95% of affected product was swiftly removed and CEO Ulukaya issued a public apology, saying “I’m sorry we let you down”. Also that year, a UK court bans Chobani from using the term “Greek yogurt” in Britain (as it’s not made in Greece), forcing the brand to withdraw from the UK – highlighting challenges in global expansion.

- 2014: Secures a $750 million private investment from TPG Capital (structured as a loan with warrants) to support growth and new product lines. Terms of the deal included potential TPG ownership >20%, pushing Ulukaya to professionalize operations during a cash crunch.

- 2015: Rebounds from the recall crisis, reaching approximately $1.6 billion in sales and overtaking Yoplait as the top-selling yogurt brand in the U.S. by market share.

- 2016: Implements a groundbreaking employee ownership program – granting ~10% of the company’s equity to 2,000 employees as share awards. This year Chobani also invests $100 million to expand the Twin Falls plant for new production lines and launches innovative products like “Flip” yogurt snacks and drinkable yogurts.

- 2017: Opens a 70,000 sq. ft. R&D and Innovation Center at Twin Falls, underscoring commitment to product development and giving employees a collaborative campus with amenities like a fitness center. Chobani fends off defamatory attacks from Alex Jones, who falsely linked the company’s refugee hires to crime; Chobani sued and won a public retraction and apology, reinforcing its values.

- 2018: TPG exits its investment; ownership is restructured with a Canadian pension fund (HOOPP) taking a minority stake as Chobani continues to remain private.

- 2019–2020: Chobani broadens beyond yogurt – introducing oat-based milks, nondairy yogurt alternatives, coffee creamers, and ready-to-drink cold brew coffee. These moves align with shifting consumer tastes (plant-based, functional drinks) and re-position Chobani as a “food maker” rather than just a yogurt brand.

- 2021: Files confidentially for an IPO, revealing in an SEC filing that 2020 net sales were $1.4 billion with Chobani holding just over 20% U.S. yogurt market share. The filing highlights Chobani’s intent to “recreate the way food is made and consumed, and operate responsibly” as an “anti-traditional” CPG company challenging legacy competitors.

- 2022: Amid market volatility and management changes, Chobani postpones its IPO plans. Longtime President/COO Peter McGuinness departs (joining Impossible Foods) and is replaced by former COO Kevin Burns. Despite the delay, Chobani’s revenues surge ~27% in 2022 to $2.1 billion, thanks to new product growth, and the company refocuses on “driving profitable growth” in the private arena.

- 2023: Chobani reaches an estimated $2.53 billion in net sales (12% YoY growth) according to bond sale documents. It also makes bold strategic acquisitions outside yogurt – purchasing La Colombe Coffee (specialty coffee/RTD brand) in late 2023 and Anchor Brewing (craft beer) in 2024.

- These moves signal a diversification into a broader food & beverage “house of brands.” To fund expansion and liquidity for investors, Chobani raises $650 million in a junk bond offering, using proceeds to buy back preferred shares from the pension fund and consolidating Ulukaya’s control (~78% ownership post-deal). Today, Hamdi Ulukaya remains at the helm as CEO, and Chobani stands as a case study in how a values-driven startup can scale into a market leader while mostly retaining private ownership and its original mission.

Impact

Chobani frames its mission as “food as a force for good,” and it operationalizes that through programs tied to community wellness, inclusion, food security, and environmental responsibility.

The company’s impact work is not an adjunct to marketing, it is built into product development, philanthropy, hiring, and long term partnerships.

Core pillars

- Community wellness and food security. Chobani donates products year round to local organizations and food pantries, and runs volunteer initiatives like Let’s Eat Week to mobilize employees around hunger relief. The company describes donating “millions of pounds” of food annually, with hands-on service in the communities where it operates.

- Inclusion and belonging. Chobani’s public impact commitments emphasize inclusion as foundational to policy and culture, reflected in hiring practices at its plants and in its corporate programs.

- Sustainability. The firm positions environmental responsibility as a business obligation, linking supplier standards, packaging work, and operations to its impact agenda.

Signature initiatives

- Impact Batches. Limited-edition “Impact Batch” products direct proceeds and awareness to specific causes, including a Child Hunger Batch developed with No Kid Hungry. These SKUs combine cause marketing with measurable support for partner nonprofits.

- Super Milk. Chobani Super Milk is a shelf-stable, high protein, high fiber dairy beverage produced specifically for disaster relief and food bank distribution. It is distributed nationally through the American Red Cross and through food banks near Chobani’s plants in Twin Falls, Idaho, and Central New York, addressing protein gaps during emergencies and in everyday food access programs.

- The Good Food Fight. Launched in 2023, this program organizes employee volunteering around hunger relief activities such as meal packing and community distribution, reinforcing a service culture across sites.

- Global community partnerships. Through the Partnership for Central America, Chobani is extending its incubator model to Guatemala to support local food entrepreneurs, tying economic inclusion to regional stability and food access.

People first practices

- Employee ownership. In 2016, Chobani granted roughly 10 percent of the company’s equity to about 2,000 employees, aligning wealth creation with long term value and signaling an ownership culture uncommon in large food manufacturing.

- Standing up for inclusive hiring. When conspiracy outlets attacked the company’s refugee hiring in Twin Falls, leadership brought and won a defamation case that resulted in a public retraction and apology, reinforcing a commitment to facts and to employee dignity.

Industry & Market Analysis

Industry Landscape

Chobani operates in the dairy foods industry, specifically the yogurt segment, which has undergone significant change over the past 15 years.

In the early 2000s, U.S. yogurt consumption was dominated by traditional flavored yogurts (often high in sugar) marketed mainly to women as a diet food.

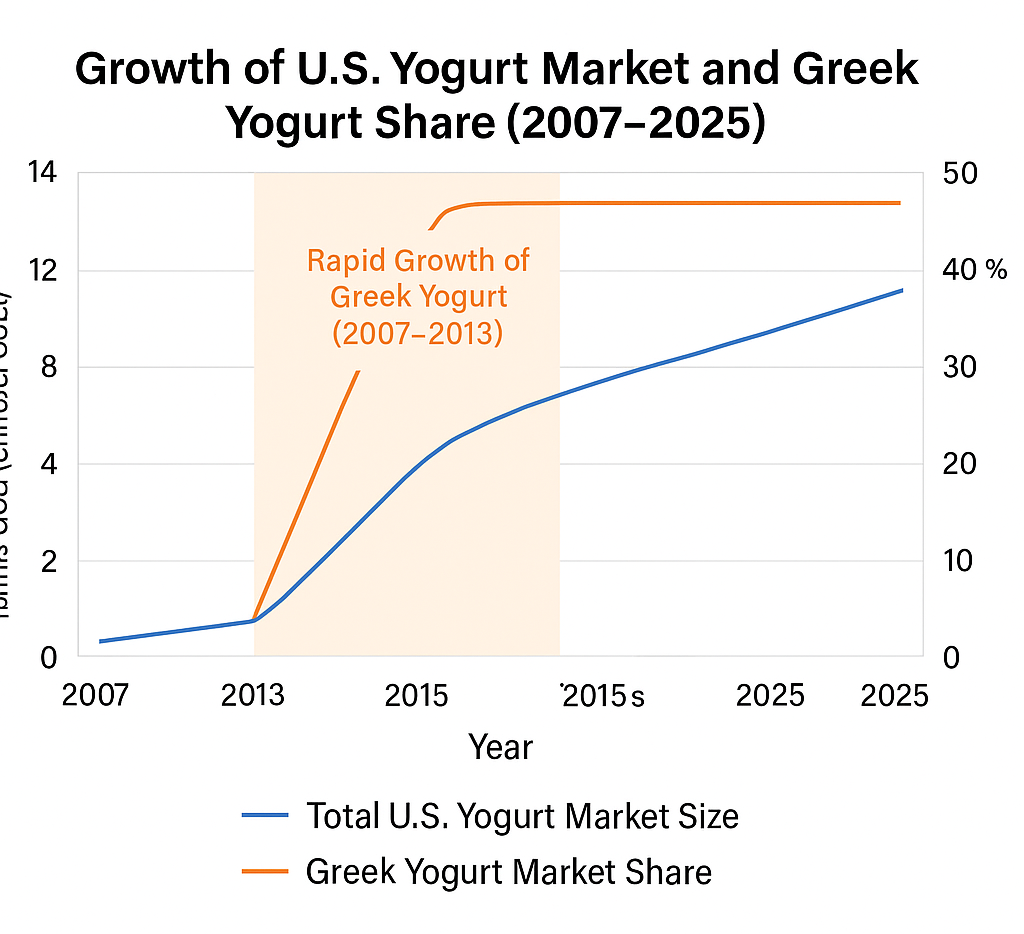

The industry’s transformation began with the “Greek yogurt revolution” in the late 2000s. Greek yogurt, a thicker, strained yogurt high in protein, grew from virtually nothing to nearly 50% of the U.S. yogurt market by 2013, up from only 1% in 2007.

This enormous growth, largely fueled by Chobani’s success, expanded the overall U.S. yogurt market to around $6–7 billion annually by the mid-2010s.

In recent years, industry growth has leveled off, with U.S. yogurt sales growing modestly (low-to-mid single digits) as Greek yogurt’s novelty waned and competition intensified.

Nevertheless, the category remains sizable. The U.S. yogurt market is projected to reach roughly $12–13 billion by mid-decade, growing in line with population and health trends.

Globally, yogurt (including drinkable forms) is an even larger market, exceeding $100 billion, with growth hotspots in Asia and Latin America.

Major trends shaping the industry in the past 5–10 years include a consumer shift toward higher-protein and lower-sugar options, the rise of organic and probiotic-rich yogurts, and a proliferation of international styles (Greek, Icelandic skyr, French, Australian, etc.) that followed Greek yogurt’s lead.

More recently, plant-based dairy alternatives (almond, coconut, oat yogurts) have emerged, addressing demand from vegan or lactose-intolerant consumers.

While nondairy yogurts still represent a small fraction of sales, they are growing in niche natural food channels and aligning with environmental and wellness concerns.

Established dairy companies have responded by launching their own plant-based lines (e.g. Yoplait’s Oui Dairy-Free, siggi’s plant-based skyr) .

Target Market & Demand Drivers

Traditionally, yogurt makers targeted women and mothers (for family/kids consumption) with messages around health and convenience.

Chobani and the Greek yogurt wave broadened the audience by attracting health-conscious adults, including fitness enthusiasts drawn by the high protein content.

Today, Chobani’s customer base spans multiple segments:

- Nutrition-minded consumers (both men and women) who seek a convenient snack that is rich in protein and natural ingredients. Greek yogurt’s positioning as a filling, post-workout food or meal replacement resonated with this group, especially during the 2000s protein craze. Chobani’s marketing explicitly moved yogurt beyond its prior “for women on a diet” stereotype, even adopting bold packaging and sponsorships to court male consumers and athletes.

- Families and everyday snackers looking for a healthier alternative to desserts or junk food. Chobani’s flavored cups and “Flip” snacks target those who want a treat that still offers protein and probiotics.

- Lifestyle and foodie consumers who value authenticity – this grew in the 2010s “artisanal yogurt” era, with people trying Icelandic skyr, Australian yogurt. Chobani’s origin story and simple recipe appeal to those interested in where their food comes from.

- Plant-based adopters and flexitarians (a newer segment) who might choose Chobani’s oat-based or lactose-free products. This group is concerned with dairy sensitivities, sustainability, or variety.

Key drivers of demand in the yogurt industry have included: health and wellness trends, as yogurt (especially Greek and skyr) is high in protein and calcium yet low in calories, fitting high-protein and low-carb diets.

Additionally, growing awareness of gut health and probiotics has bolstered yogurt’s image as a functional food. Yogurt has benefited from periods of dietary trends (e.g. the popularity of the Mediterranean diet and low-sugar, high-protein regimens in the 2010s).

Convenience is another driver – single-serve cups and tubes make yogurt an easy on-the-go breakfast or snack. On the supply side, innovation in processing and packaging allowed Greek yogurt to be produced at scale and in appealing formats (Chobani’s use of efficient straining equipment and creative packaging helped lower costs and broaden appeal ).

Regulatory factors have been less central, though dietary guidelines promoting lower-fat dairy intake provided an implicit tailwind, and trade agreements influenced the ability to expand (as seen in labeling rules abroad).

Overall, yogurt consumption has become a staple in the U.S., with per-capita intake rising significantly from the early 2000s to mid-2010s, though leveling off more recently.

Market projections foresee moderate growth, with pockets of faster growth in high-protein variants, drinkable yogurts (for convenience), and plant-based alternatives, while traditional sugary yogurts face decline as consumer preferences shift toward healthier options.

Competitive Landscape

Chobani competes in a crowded yogurt market against both legacy food conglomerates and nimble new entrants.

Its top competitors include:

- Danone S.A. (Dannon/Oikos) – The French dairy giant Danone owns the Dannon brand in the U.S. and launched Oikos Greek yogurt to counter Chobani. Danone also owns Activia and Light & Fit yogurts, and has acquired plant-based brands like Silk and So Delicious, leveraging a broad portfolio. Danone’s U.S. Greek yogurt (Oikos) was a fast follower to Chobani and heavily marketed (even with NFL endorsements) to recapture market share. Danone competes on its scale in distribution and marketing, but Chobani often led in product simplicity and brand authenticity.

- General Mills (Yoplait) – Yoplait was the longtime U.S. market leader pre-Greek. General Mills, which licenses Yoplait from a French cooperative, was slower to embrace Greek yogurt and saw its share decline sharply around 2010–2015. They eventually introduced Yoplait Greek and Oui (French-style) yogurt. Yoplait still has strength in kids’ yogurts (Go-GURT) and traditional flavors, but Chobani eclipsed it by capturing health-focused consumers.

- FAGE – An authentic Greek company, Fage (pronounced “fa-yeh”) was selling Greek yogurt in the U.S. before Chobani (gaining a cult following in specialty stores). However, Fage’s premium price and limited marketing kept it niche. Chobani’s entry at lower price points “democratized” Greek yogurt. Fage remains a competitor in the plain Greek segment and has a loyal base for its thick texture, but its U.S. share is much smaller than Chobani’s.

- Lactalis (Stonyfield and siggi’s) – Lactalis, a global dairy firm, owns Stonyfield Farm (known for organic yogurt) and siggi’s, the Icelandic skyr brand. Siggi’s (founded 2005) gained traction with an even lower-sugar, high-protein product, positioning itself as an artisanal alternative. Both brands appeal to health-aware consumers (organic or low-sugar niches) that overlap somewhat with Chobani’s target.

- Emerging Brands: Smaller players like Noosa (Australian-style yogurt), Icelandic Provisions (skyr), and various plant-based startups (e.g. Kite Hill for almond yogurt) also compete for shelf space. While individually their shares are modest, they contribute to fragmentation of the market. Chobani has also faced indirect competition from protein-rich foods like cottage cheese and new protein shakes vying for the same health-snacking occasions.

Comparative Strategies

Chobani’s rise forced companies like Danone and Yoplait to reformulate or acquire brands to stay relevant. Pricing-wise, Chobani and competitors price Greek yogurts at a premium (~$1–1.5 per cup) versus traditional yogurt often <$1.

Chobani’s strategy emphasized accessible pricing with quality, which helped undercut earlier Greek options like Fage.

Distribution and go-to-market are similar across big players – heavy reliance on supermarket and big-box retail channels, with frequent promotions.

One differentiator was packaging innovation: Chobani’s bright, modern packaging and later, its flip-cup format, stood out. Meanwhile, Noosa carved a niche with indulgent flavors in tub formats, and siggi’s used austere design to signal purity.

Chobani’s competitive advantages include its strong brand story and customer loyalty, vertical integration in manufacturing, and product innovation pipeline.

As an independent company, it cultivated an image of authenticity and community engagement that resonates with consumers (in contrast to billion-dollar multinationals).

This helped Chobani attain over 20% U.S. yogurt market share as the category leader. Chobani also built a broad distribution network (95,000+ U.S. retail locations) and invested in capacity early (its Idaho plant) to ensure supply when Greek yogurt demand exploded.

Additionally, Chobani has diversified its portfolio faster than some rivals – moving into coffee creamers, probiotic drinks, and plant-based milks, creating new revenue streams.

However, Chobani faces challenges too. Its weaknesses include a historically narrow focus (for years, the majority of sales came from one product type – yogurt – exposing it to category swings) and lack of a global footprint relative to multinational rivals.

About 90% of Chobani’s sales are still in North America, whereas Danone and others leverage worldwide distribution.

Chobani also lacks the deep pockets of conglomerates for advertising; it often must rely on creativity and earned media over sheer ad spend.

Brief SWOT analysis

- Strengths: A highly recognizable brand with a quality reputation in Greek yogurt (the company is the U.S. category leader at ~21% share ). Strong innovation record – e.g. successfully launching products beyond yogurt (oat milk sales grew 42% in 2022 ). A mission-driven culture that engenders customer goodwill and employee commitment (e.g. employee ownership, refugee hiring). Vertical integration and modern production facilities enabling cost control and consistency.

- Weaknesses: Heavy reliance on U.S. yogurt sales (90%+ of revenue ), meaning limited geographic diversification. Competition has eroded the once-unique Greek yogurt edge (“virtually everybody’s copied us” noted Chobani’s CMO ), leading to a period of slower growth mid-2010s. As a private company, Chobani carried substantial debt from expansion (e.g. TPG financing) and doesn’t have access to equity markets for easy capital. Operational hiccups like the 2013 recall exposed quality control risks in scaling up production.

- Opportunities: Expansion into adjacent markets – e.g. plant-based dairy alternatives and functional beverages – to leverage brand trust (Chobani’s oat milk and creamer entries already outpace category growth ). Geographical expansion in high-growth regions (Asia or Latin America) either via exports or local partnerships, building on the playbook from Australia. Continued innovation in healthy snacking (high-protein, low-sugar products) to ride wellness trends. Also, M&A opportunities to acquire complementary brands (as seen with coffee and brewing acquisitions) present a chance to diversify.

- Threats: Intense competition from food giants that can use pricing promotions and shelf-space clout (e.g. Danone’s diverse yogurt portfolio) – a 2017 report noted Greek yogurt’s “novelty wore off” and Chobani’s sales began to slip as competitors flooded the market. Changing consumer preferences, such as a swing toward dairy-free diets or new fad diets, could dampen traditional yogurt demand. Input cost volatility (milk prices) and supply chain disruptions can squeeze margins – dairy is commodity-sensitive. Finally, any reputational hit (safety issues or public relations crises) is a threat, though Chobani’s proactive crisis handling has mitigated this in the past.

Business Model & Revenue Streams

Chobani’s business model is centered on the development, production, and sale of packaged food products – primarily dairy (and recently plant-based) products – through retail grocery channels.

The company generates revenue by selling its yogurt and other products to a wide range of retailers, including supermarkets, mass merchandisers (Walmart, Target), club stores (Costco, Sam’s), convenience stores, and foodservice distributors.

Net sales are earned from product sales shipped to these customers; unlike some tech or service firms, Chobani does not operate on subscriptions or advertising but on repeat consumer purchases of consumables.

Product Revenue Streams

Chobani’s revenue can be segmented by product category as follows (2020 figures from SEC filings):

- Yogurt (Core Business): Approximately 85–90% of net sales. In 2020, yogurt products contributed about $1.2 billion of Chobani’s $1.4B revenue. This includes all forms of Chobani Greek yogurt cups, tubs, and drinks. Greek yogurt has historically been the cash cow, with strong margins due to its premium pricing and efficient scale of production.

- Other Products: Roughly 10–15% of net sales (and growing). In 2020, Chobani’s non-yogurt products – such as coffee creamers, oat milks, ready-to-drink coffees, and probiotic beverages – generated ~$158 million. By the first nine months of 2021, these newer segments were already exceeding the prior full year, reflecting rapid growth. While still a minority of revenue, these lines are strategically important for diversification and future growth.

Channels & Unit Economics

The company sells directly to retail chains or via wholesalers, typically using distributors for smaller accounts. Volume discounts and trade promotions are part of the model to secure shelf space.

Chobani’s unit economics hinge on achieving high throughput at its plants (yogurt is relatively low cost-per-unit but requires scale to be profitable).

Key metrics would include the gross margin on yogurt (in dairy, often 30–40% range for branded products) and the contribution margin after trade spending.

While detailed unit economics are proprietary, some indicators emerged during the IPO filing: cost of goods (milk, fruit, packaging) plus manufacturing overhead was about 74% of revenue in 2018, and SG&A about 21%, implying mid-single-digit operating margins historically.

However, as newer products ramp up and efficiency improves, margins have been increasing.

Chobani’s strategy emphasizes high-volume, repeat sales – yogurt is a frequently purchased grocery item, so generating recurring revenue depends on brand loyalty and continual shelf presence.

The revenue is largely transactional (each retail sale), but the business benefits from a quasi-subscription behavior among loyal consumers who eat yogurt daily.

There is also some customer concentration: the company revealed that two large retail customers account for about 10% of net sales (likely Walmart and Costco, for example).

This concentration means Chobani’s revenue is somewhat tied to the fortunes and negotiation terms of key grocers.

In terms of segments or divisions, Chobani hasn’t publicly broken out revenue by sub-brand, but we can infer segments:

- By product line: e.g., Greek yogurt cups vs. Flip snack cups vs. drinks. Flip (yogurt with mix-ins) became a significant sub-line, appealing as a dessert alternative. Yogurt drinks and the newer lactose-free “Complete” line are smaller segments.

- By customer type: retail vs. foodservice. Most revenue is retail. Chobani did push into foodservice (e.g., providing bulk yogurt for cafeterias, or co-branded offerings in college dining halls and airlines), but that’s not a major segment in disclosures.

- By region: U.S. vs International (with U.S. dominating as noted).

A notable aspect of Chobani’s model is its focus on innovation to drive repeat sales. The company has increasingly invested in R&D (opening an innovation center in 2017 ) to develop new products that can be sold through the same retail channels.

Successful innovations (like introducing oatmilk or high-protein yogurt drinks) can leverage Chobani’s existing distribution to generate incremental revenue per customer.

This also adds more predictability to revenue if consumers start to buy multiple Chobani products (e.g., a shopper might buy Chobani yogurt and Chobani creamer each week, increasing lifetime value).

Regarding recurring revenue, while not contractual, the perishable nature of yogurt (short shelf life) and habitual consumption pattern mean Chobani’s sales have a recurring quality – customers need to restock weekly.

This gives the business a stable base of demand, provided brand loyalty remains high. In fact, by 2021, Chobani’s sales growth outpaced its increase in losses as it reinvested, indicating improving economies of scale.

The company’s long-term goal is clearly to build multiple strong product lines to smooth out reliance on any single category.

For example, plant-based milks (oat) and dairy yogurts have different demand cycles and competitors, so success in both can make overall revenue more resilient.

In summary, Chobani’s revenue model is a classic fast-moving consumer goods (FMCG) model: invest up front in product development and branding, sell high volumes through retail partners, and earn margins on efficient production.

Its growth from startup to a multi-billion-dollar enterprise was driven by dominating a niche (Greek yogurt) and then extending into adjacent niches, all sold to a common customer base (grocery shoppers).

Maintaining shelf space and brand preference in a competitive market is critical to sustaining these revenue streams.

Financial Performance

Chobani has seen robust revenue growth since its inception, though profitability has fluctuated due to heavy reinvestment and market dynamics.

Below is a summary of key financial metrics over recent years, drawing on available reported figures:

Revenue Growth:

Annual net sales grew from roughly $1.3 billion in 2019 to $1.4 billion in 2020, a +5.2% increase despite a pandemic year. By 2022, net sales had accelerated to about $2.1 billion (a 27% jump in that year alone). Most impressively, 2023 net sales reached $2.53 billion , up ~12% from 2022.

This recent growth spurt is attributed to Chobani’s successful expansion into new products and strong execution in its core business. Earlier in the mid-2010s, sales plateaued around the mid-$1 billion range (Euromonitor estimated $1.6B in 2015 after the company recovered from the recall).

The plateau corresponded with Greek yogurt maturing as a category and increased competition. Chobani’s resurgence in the late 2010s and early 2020s shows its pivot to a broader portfolio paid off: in the first nine months of 2021 alone, sales ($1.2B) nearly matched full-year 2020, indicating double-digit growth going into 2022.

Market Share & Volume:

As of 2020–2022, Chobani has held the #1 position in U.S. yogurt market share (~20–21%). This share was achieved even as overall category growth was slow, implying Chobani stole share from rivals.

Volume-wise, Nielsen data cited by the company showed total Chobani retail sales (in $) up 16% in 2022 vs the category up only single digits. The oat milk line’s 42% sales growth in 2022 and creamer’s 82% growth boosted overall performance, albeit from smaller bases.

Profitability:

Chobani has operated near break-even or at a modest loss in recent years, as it prioritized expansion. In 2020, the company posted a net loss of $58.7 million , which was triple the prior year’s loss, owing largely to heavy investment in new product launches.

By 2021, losses were narrowing: the first nine months of 2021 saw a $24 million loss on $1.2B sales , indicating improving margins. The focus turned toward profitable growth by 2022.

According to a 2024 Bloomberg report, Chobani’s earnings (likely EBITDA) in 2023 were $404 million, up 96% as the company “cut costs and streamlined its supply chain”.

This suggests a significant profitability improvement, as $404M would represent a healthy ~16% of net sales. The turnaround in profitability is attributed to operational efficiencies and scaling of newer, higher-margin products, as well as price increases to counter inflation.

It’s worth noting that as a private company, Chobani doesn’t publicly release full P&Ls, but the IPO filing and bond prospectus provide glimpses. The presence of net losses in 2019–2020 indicates that, while operating cash flows might have been positive, accounting for expansion costs and interest on debt pushed net income slightly negative until recently.

Margins:

Gross margin trends haven’t been disclosed in detail, but dairy input costs (milk) and logistics costs can affect margins year to year.

The company has mentioned facing higher shipping and dairy costs in certain periods, but has offset these with scale and cost initiatives.

The doubling of “a measure of earnings” by 2023 implies margin expansion.

For instance, if EBITDA nearly doubled, it means Chobani managed to grow revenue while keeping cost growth in check – possibly through more efficient manufacturing (e.g., better utilization of plants) and rationalizing SKUs (they actually discontinued an underperforming Ultra-Filtered Milk line in 2022 to focus on winners ).

Cash Flow & Investment:

Chobani has continually invested in capacity and R&D. Capital expenditures included the Idaho plant ($450M in 2012) and its expansions ($100M in 2016), plus the new R&D center (2017).

These were funded by reinvested earnings in early high-growth years and by external financing (the 2014 TPG $750M loan was partly used for expansion).

In 2018, Chobani took on a preferred equity investment from HOOPP (the Canadian pension fund) when TPG exited.

By 2023, the company was strong enough to raise debt to buy out investors, indicating healthy cash flows and confidence from creditors. The $650M bond in 2024 was rated as junk but attracted buyers, showing belief in Chobani’s earnings trajectory.

If Public – Stock Performance:

Chobani remains private, so there is no stock price history.

However, it flirted with going public; it filed for an IPO in 2021 with speculative valuations around $7–10 billion.

The IPO was shelved in 2022 due to market conditions.

Had it listed at, say, a ~$10B valuation, that would be ~5x 2020 sales. By 2023, given improved sales and earnings, a similar multiple would value it even higher. Instead, Chobani effectively tapped the debt market to provide liquidity and may revisit an IPO when markets are favorable.

Financial health:

Chobani’s balance sheet details are private, but the bond sale and investor exits hint at a manageable debt load and strong equity base. The 2024 bond prospectus indicates the company used proceeds to redeem preferred shares, simplifying its capital structure.

The fact that a pension fund and earlier TPG were willing to sell stakes suggests they realized gains, and Ulukaya increased his ownership to ~78%, a sign of his confidence.

Liquidity appears sufficient, as the company continues to fund new projects (like the La Colombe acquisition in 2023 for $900M, which likely involved external financing combined with equity swap).

In summary, Chobani’s financial performance can be characterized by strong top-line growth (especially recently, outpacing many food industry peers) and a deliberate trade-off of short-term profits for long-term expansion.

Now that it has achieved scale, the company is demonstrating improved profitability, putting it in a solid position to either go public or continue private expansion.

Investors and analysts often cite Chobani as an example of a unicorn in the food sector – rapid growth to multi-billion revenue while still founder-controlled and mission-focused.

Most of the financial data above are sourced from company filings.

Product or Service Offerings

Chobani has evolved from a single-product company into a multi-category food and beverage producer. Below are its core product and service offerings, along with their value propositions and evolution:

Chobani Greek Yogurt (Core Line):

This is the flagship product that made the brand famous. Chobani’s Greek yogurt is a strained yogurt available in various flavors and styles. Key sub-variants include Fruit on the Bottom (fruit purée at cup’s bottom), Blended (fruit or flavor mixed in), and Plain (often used for cooking or as a high-protein ingredient).

The unique value proposition is a thick, creamy texture with roughly twice the protein of regular yogurt, without artificial ingredients or preservatives.

All Chobani yogurts are made with live and active probiotic cultures and real fruit, appealing to health-conscious consumers. Over time, Chobani expanded this line to include whole milk versions (with a creamier taste) and low-fat versions, as well as different fat levels (0%, 2%, etc.) to cater to dietary preferences.

Chobani “Flip” Yogurt Snacks:

Introduced around mid-2010s, Chobani Flip is a dual-compartment yogurt cup with Greek yogurt on one side and mix-ins (like nuts, granola, chocolate bits) on the other. Consumers “flip” the sidecar into the yogurt.

This product marries indulgence and health – offering flavors reminiscent of desserts (e.g., Key Lime Crunch, Almond Coco Loco) but with the protein benefit of Greek yogurt.

Flip targets snackers and has been a major hit, at one point becoming one of the fastest-growing yogurt product lines. Its value proposition is fun, convenience, and a healthier indulgent treat.

Chobani Simply 100 and Less Sugar:

In response to sugar-conscious consumers, Chobani launched Simply 100 (a 100-calorie Greek yogurt with natural sweeteners) and later Chobani Less Sugar Greek yogurt.

These have reduced sugar (using ultrafiltered milk or stevia for sweetness) while retaining protein content. Although Simply 100 was eventually phased out, the company continues to offer lower-sugar options in its lineup – addressing the increasing demand for low-sugar dairy.

Drinkable Yogurts and Beverages:

Chobani extended into drinks with products like Chobani Drink (a smoothie-like yogurt drink) and probiotic tonics. For example, they have a line of Chobani Probiotic drinks – fruity beverages packed with probiotics and botanical ingredients, tapping into the kombucha-type trend.

These offer convenience (on-the-go nutrition) and appeal to those who prefer to drink their yogurt (common in some cultures and gaining popularity in the U.S.).

The company also launched Chobani Greek Yogurt Drink in flavors like strawberry or mango, providing an option for consumers who want the benefits of yogurt without a spoon.

Plant-Based Dairy Alternatives:

Recognizing the growing plant-based movement, Chobani ventured beyond traditional dairy:

- Chobani Oat Milk: Debuting in 2019, Chobani Oat is a line of oat-based milk alternatives (in carton form) as well as oat-based yogurt cups. The oat milks come in flavors (plain, vanilla, chocolate) and are positioned as a creamy non-dairy milk with a simple ingredient list, often fortified with calcium and vitamins like a regular milk. Chobani leveraged its dairy know-how to ensure a taste and texture competitive with leading oat milk brands. By 2022, Chobani Oatmilk sales were growing 42% YoY, outpacing the overall oat milk category , highlighting its success.

- Non-Dairy Chobani Yogurt: Made from coconut purée (initially) or oat base, these yogurt alternatives mimic the texture of yogurt but are vegan. Chobani’s non-dairy cups (launched ~2019) come in flavors like blueberry, slightly differentiating by using probiotics and natural ingredients without lactose. While not as big a seller as dairy yogurt, it broadens Chobani’s reach to vegan consumers.

Coffee and Creamers:

Chobani extended its brand into the coffee segment with two approaches:

- Chobani Coffee Creamers: Launched in 2019, these are dairy-based creamers (made with milk and cream) intended to replace artificial creamers. They come in flavors like vanilla, hazelnut, etc., and emphasize real milk and sugar (no oils or thickeners found in some competitor creamers). The value prop is a more natural creamer that pairs with coffee – leveraging Chobani’s dairy expertise. This segment has grown quickly (82% in 2022 ) and gives Chobani a foothold in the refrigerated section beyond yogurt.

- Ready-to-Drink Coffee: In early 2020, Chobani introduced Chobani Coffee, a line of premixed cold brew coffee beverages. These are essentially grab-and-go coffees with milk (or oat milk) and flavors (like Chobani Oat Barista Blend used to make a latte in a can). It was a notable step “outside of dairy yogurt” for Chobani, using its brand to enter the breakfast/energy drink space. By acquiring La Colombe in 2023 (known for premium canned draft lattes and coffee), Chobani significantly bolstered its offerings in this arena. We may see co-branding or distribution synergies from that acquisition going forward.

Go-to-Market & Marketing Strategy

Chobani’s go-to-market strategy combines broad retail distribution with savvy marketing that highlights the brand’s authenticity and values.

Here’s how the company acquires and retains customers:

Sales Channels:

Chobani primarily uses indirect distribution through retailers. Early on, Ulukaya made the pivotal decision to go straight to national supermarket chains rather than small stores.

This aggressive approach got Chobani products into high-traffic retailers (like ShopRite, Kroger, Walmart) quickly, fueling its explosive growth.

Today, Chobani yogurts and drinks are ubiquitous in U.S. grocery stores, big-box retailers (Walmart, Target), club stores (Costco), and many convenience stores.

The company ensures strong relationships with grocery buyers by driving category growth – for instance, yogurt aisle sales jumped when Chobani was introduced, a win-win for retailers.

Chobani does not have its own stores (aside from the one NYC café experiment) and thus relies on these partners for consumer access.

It also leverages e-commerce to a degree: Chobani products are sold via online grocery platforms (like Walmart.com, Amazon Fresh, Instacart), and the brand has its own website that at times offered DTC packages (such as sampler packs of new products).

Within stores, Chobani’s strategy has been to secure prominent shelf placement. It often negotiated for eye-level shelf space in the yogurt aisle and invested in branded refrigerators or displays.

Since Chobani became a top brand, it often occupies a large section, including secondary placements for novel items (e.g., a separate rack for Chobani drinks or Flip near the dairy aisle).

Marketing Channels:

Chobani’s marketing has spanned traditional advertising, digital media, PR, and grassroots efforts:

Television and Print:

As it grew, Chobani invested in mass advertising. Notably, it ran a high-profile Super Bowl commercial in 2014 featuring a rogue bear seeking wholesome food (and finding Chobani yogurt) – the ad reinforced the tagline “How Matters,” emphasizing natural ingredients. Chobani has also advertised on primetime TV and in health magazines, focusing on messages of purity and authenticity.

Sports and Event Marketing:

Chobani has aligned with sports as a way to reach a broad audience and emphasize nutrition. It was an official sponsor of the U.S. Olympic Team for multiple Games (2012, 2014) and launched campaigns highlighting Olympians who eat Chobani. These sponsorships built brand credibility as a protein-rich performance food. The company also sponsored local events and fitness initiatives, bolstering its image among active lifestyle consumers.

Public Relations & Storytelling:

Hamdi Ulukaya’s personal story (an immigrant entrepreneur who revived a local factory and created jobs) has been a PR focal point.

Chobani leaned into this narrative, getting coverage in outlets like The New York Times, Forbes, and even a Harvard Business Review piece by Ulukaya. Such earned media magnified the brand’s authenticity.

When Ulukaya gave 10% of the company to employees in 2016, it garnered massive positive press, effectively marketing Chobani as a compassionate brand.

Similarly, Ulukaya’s advocacy for refugees and the company’s legal battle against misinformation (e.g., the Alex Jones saga) became part of its brand identity, often covered in news that indirectly marketed Chobani’s values.

In-Store Marketing:

Chobani uses packaging as a marketing medium, the clean design and visible fruit imagery attract consumers.

It also runs in-store promotions like coupons, aisle end-cap displays, and sampling programs. In the early years, Chobani famously sent teams to grocery stores to do taste-test samplings, an effective tactic to introduce Greek yogurt’s unfamiliar texture to Americans.

This helped convert many new customers. They also implemented “Chobaniacs” teams that gave out free cups at events or to store dairy managers, fostering goodwill.

Partnerships:

Chobani’s marketing has included co-branding or partnerships, for example:

- Teaming up with Disney in 2019 to launch Chobani Gimmies (a kids’ yogurt line) featuring Disney characters on packaging, tapping into the children’s market.

- Collaboration with recipes/cookbook authors to promote yogurt as a versatile ingredient (for instance, partnering with famous chefs or food bloggers who create recipes like yogurt-marinated chicken, smoothies, etc., broadening usage occasions).

- Working with fitness brands or events (providing yogurt at marathon finish lines or CrossFit games) to reinforce the protein messaging.

Upselling and Cross-Selling:

As Chobani’s portfolio grew, the marketing strategy evolved to cross-promote products. For instance, a digital ad might show a family using Chobani yogurt for breakfast, a Chobani Flip as an afternoon snack, and pouring Chobani Oat milk into their coffee, subtly suggesting a Chobani product for multiple occasions in a day.

In stores, Chobani’s products are mostly in the dairy case, but sometimes secondary placements (like oat milk in the plant-based milk section) and similar branding help remind consumers of the connection.

They also educate consumers: e.g., using their website and social channels to explain the benefits of probiotics in their drinks or the recipe inspiration for using their plain yogurt as sour cream substitute, thereby increasing usage frequency.

Operations & Organizational Structure

Chobani’s operations span manufacturing, supply chain, and a corporate structure that supports its growth and mission.

Key aspects of its operations and organization include:

Manufacturing Footprint:

Chobani produces the majority of its products in-house, which has been a cornerstone of its quality and scalability strategy.

The company operates two major U.S. production facilities:

- New Berlin, New York Plant: This is the original facility (the former Kraft plant) where Chobani began production in 2007. It has been modernized and expanded over time, though it’s smaller than the Idaho plant. This plant sources milk from local dairy farms in New York’s Chenango County, supporting the regional agriculture. It continues to produce a significant volume of yogurt, especially to supply the Eastern U.S. market.

- Twin Falls, Idaho Plant: Opened in late 2012, this plant was a $450 million investment and at 1 million square feet became one of the world’s largest yogurt factories. Located in the Magic Valley dairy region, it was strategically placed near abundant milk supply and for efficient distribution to the West Coast. The Idaho plant ramped up quickly to meet explosive demand and also produces Chobani’s newer products (like oat milk and creamers, since it has multiple production lines). In 2016, Chobani invested another $100 million to expand this facility for new product lines and to increase capacity for international distribution. The plant is highly automated and was designed with open, sunlit architecture to reflect transparency and to provide a pleasant environment for workers.

Additionally, Chobani has a manufacturing presence in Australia. After acquiring Bead Foods in 2011, it uses a facility in Dandenong, Victoria to produce yogurt for the Australian market. This allowed Chobani Australia to quickly gain a local supply chain and reach ~20% market share down under.

The company announced further expansion in Australia with a new plant build in 2023, reflecting continued international ambitions.

Chobani’s supply chain sources raw milk from networks of dairy farmers near its plants. The company prides itself on sourcing high-quality milk and has likely implemented stringent quality tests (the 2013 mold issue was linked to a specific type of mold in the plant environment, which they addressed thoroughly ).

Fruit and flavorings are another key input, Chobani works with suppliers for things like blueberries, cocoa, coffee, etc., aiming for natural sources. Its procurement emphasizes non-GMO and local where possible.

Employees and Culture:

As of the mid-2020s, Chobani employs an estimated 2,000–2,500 full-time employees in the U.S., plus a few hundred in international operations, though the exact current count is not publicly stated (2,000 employees were referenced in 2016 when the ownership awards were given, and the number likely grew with new product lines and acquisitions).

The workforce spans factory workers (who operate yogurt production 24/7 in shifts), corporate staff (marketing, R&D, sales at its offices), and field sales reps or brand ambassadors.

The organizational structure has evolved: it’s a private company with Hamdi Ulukaya as Founder, Chairman, and CEO. Ulukaya is very hands-on and is known to know workers on the factory floor by name.

Supporting him, Chobani built a senior leadership team which has included positions like President/COO, CFO, Chief Marketing Officer, Chief Innovation Officer, etc.

The company’s ownership structure now includes majority ownership by Ulukaya (~78%) and the rest by investors (HOOPP with ~7.6%, employees ~10%, and possibly other small stakeholders).

Employees receiving stock units mean there’s an effective Employee Stock Ownership-like element, though not publicly traded. This broad equity distribution is unusual in food manufacturing and is a deliberate cultural choice to align employees with company success.

Chobani’s culture is often described as entrepreneurial, fast-paced, and inclusive. Ulukaya espouses a “people first” philosophy in what he called an Anti-CEO Playbook – prioritizing workers, communities, and accountability over short-term profits. Concrete examples include:

- Implementing a 6-week fully paid parental leave policy for all employees (salaried and hourly) in 2016, which was almost unheard of in U.S. manufacturing at the time .

- Hiring from diverse communities: in Twin Falls, Chobani has hired hundreds of refugees and immigrants, making its workforce a mosaic of ~20 nationalities and languages. They provide language classes and transit for refugee employees as needed, integrating them into the community.

- Offering above-average wages and benefits for factory jobs in its rural plant locations, which boosts retention and local goodwill.

- Safety and quality culture: after the recall incident, Chobani doubled down on quality controls and empowered any employee to “stop the line” if something seemed off.

Major Suppliers and Logistics:

Milk is the lifeblood of yogurt production. Chobani’s plants receive tankers of fresh milk daily. Having plants in dairy-rich regions (Upstate NY, Idaho’s Magic Valley) means there’s a reliable supply nearby.

The company likely has multi-year agreements or partnerships with farmer cooperatives. During Greek yogurt production, a byproduct called acid whey is generated; Chobani has to manage this environmentally.

They have provided whey to local farms for use in cattle feed or fertilizer, turning a waste issue into a community benefit (and avoiding disposal costs).

For distribution, Chobani uses refrigerated trucking to move products from its plants to distribution centers nationwide.

It ships to retailer DCs and some direct-to-store deliveries for big chains. An efficient cold chain is crucial since yogurt is perishable (shelf life ~50 days). Chobani has invested in systems to track inventory and ensure fresh product rotation.

Operational Challenges and Practices:

- Chobani encountered a challenge with its rapid growth when demand outpaced production around 2011. The Idaho plant construction was an operational feat achieved in mere months to catch up with demand. This aggressive scaling tested the company – for instance, the 2013 mold recall at Idaho highlighted the need for robust quality systems when scaling quickly . Chobani responded by upgrading its sanitation and microbial testing protocols and consulting dairy scientists to prevent recurrence.

- Supply chain resilience: The company’s decision to maintain two U.S. plants provides redundancy. When the Idaho plant had issues, the NY plant could compensate to some extent. Similarly, during COVID-19, having multiple plants and automated lines helped maintain production continuity while implementing worker safety measures (split shifts, protective equipment, etc.). Chobani actually saw increased retail demand in 2020 as more people ate at home, and it managed to meet it without major disruption – a testament to solid operations.

- Technology and Innovation: The new Twin Falls Innovation Center physically houses R&D, but it’s also an operational symbol: cross-functional teams (product developers, product testers, marketers) work there to speed up innovation from concept to factory line. It’s likely outfitted with pilot plant equipment to test new yogurt cultures, plant-based formulations, etc., before scaling up. By investing in such facilities and talent (food scientists, nutritionists), Chobani institutionalized its innovation process rather than relying on ad-hoc development.

- Management practices: The leadership encourages a flat-ish hierarchy. Ulukaya is known to be approachable. Town hall meetings are common (the Innovation Center even has a big gathering space for these) . The company emphasizes internal promotion – many plant managers started on the factory floor. It also brings in outside experts when needed (e.g., the COO from the beverage industry to help with scaling, a new CFO prior to the IPO filing to handle financial rigor).

Challenges & Crisis Management

Like any rapidly growing company, Chobani has faced a number of significant challenges and setbacks. Here we examine a few major challenges, how leadership responded, and the outcomes:

Quality Crisis – 2013 Yogurt Recall:

In August 2013, Chobani confronted its first major product crisis when customers reported bloated and foul-smelling yogurt cups. The issue was traced to a batch contaminated with Mucor circinelloides, a common dairy mold, at the new Idaho plant.

This triggered a voluntary recall of roughly 5% of Chobani’s output. It was a pivotal moment: as a brand built on purity, a contamination incident could severely damage trust.

CEO Hamdi Ulukaya took personal responsibility, Chobani quickly issued public apologies on social media and its website.

Ulukaya stated, “I’m sorry we let you down” in a heartfelt note to consumers, explaining that while the mold was common and not a major health threat, the company was recalling out of an abundance of caution.

Internally, Chobani halted production on the affected line, collaborated with FDA regulators, and intensified sanitation and testing procedures. They also improved their tracking system to identify and remove 95% of affected products from shelves by the time of the formal recall, a relatively swift action that likely prevented more illnesses (some customers did report feeling sick, though no severe outbreaks).

The outcome: In the short term, Chobani took a sales hit and incurred costs (destroying product, logistics of recall). Competitors tried to seize shelf space during the recall.

However, the transparent handling mitigated reputational damage.

Many consumers appreciated the forthrightness.

By the next year, Chobani’s sales were rebounding, indicating trust was largely restored. A lesson learned was that scaling production so fast requires equally scaled-up quality oversight.

Chobani hired additional quality control experts and redesigned parts of the plant to prevent moisture build-up (which had allowed mold growth).

This crisis reinforced Chobani’s commitment to not use preservatives (which could have inhibited mold) while ensuring such an incident wouldn’t recur. In crisis management terms, Chobani scored well by acting fast, communicating openly, and centering the consumer.

Competitive and Market Challenges – Mid-2010s Slowdown:

After its meteoric rise, Chobani encountered a more gradual challenge: sustaining growth amid fierce competition and a plateauing Greek yogurt craze.

By around 2015, every big dairy player had a Greek yogurt on the market, often discounting heavily. The “Greek yogurt wars” led to an oversupply and some fatigue among consumers as the novelty wore off.

Chobani’s growth slowed and it even lost some market share as newcomers like Yoplait Greek and store brands undercut prices.

Additionally, Chobani was largely a one-category company, so the overall yogurt category’s low growth limited its expansion. This was a strategic challenge requiring a pivot, not an acute crisis, but it was critical for Chobani’s trajectory. Leadership’s response was multifaceted:

- Innovation: Chobani doubled down on new product development to differentiate itself again. It launched Chobani Flip to offer a unique snack, introduced savory and kids’ yogurts, and crucially, started R&D on non-yogurt products (plant-based lines, drinks). This was essentially a bet to transform into a broader food company, addressing the weakness that “virtually everybody’s copied us” in Greek yogurt. The 2017 opening of the Innovation Center in Idaho was a concrete step showing Chobani’s commitment to ongoing innovation and “expanding the brand” .

- Rebranding and Marketing: Chobani refreshed its brand image in 2017, with a new logo and packaging inspired by 1960s Americana, and messaging focusing on nutritional value and community. This helped rejuvenate consumer interest. The company started highlighting that it was more than Greek yogurt – emphasizing oat milks, etc., in marketing by 2019.

- Operational Efficiency and Funding: Facing thinner margins in a competitive market, Chobani sought external capital in 2014 (TPG’s $750M) to bolster its balance sheet. As part of that deal, Ulukaya even agreed to consider stepping back as CEO if needed, showing how seriously he took ensuring the company’s survival (ultimately he remained CEO, but brought in professional managers). They used funds to streamline operations, automate more, and expand wisely (e.g., not overproduce yogurt beyond demand, focusing on right-sizing output).

- Category Management: Chobani worked closely with retailers to manage the yogurt category, advocating for expanding shelf space for Greek and eliminating underperforming SKUs. By leading category management, Chobani ensured its products were favored in assortments, which helped weather the competitive onslaught.

The outcome of these efforts became evident by 2018–2019: Chobani regained momentum, regained the #1 overall yogurt spot (knocking Yoplait out), and then achieved new highs in revenue by diversifying.

The lesson from this period is the importance of continuous innovation and adaptation.

Chobani recognized that what disrupted the market in 2007 had become the new normal by 2015, so they had to disrupt themselves next. This proactive pivot prevented Chobani from falling into the “one-hit wonder” trap and instead set it up for a second growth act.

Reputational Attack – 2016/2017 Defamation Incident:

Chobani’s values, particularly its practice of hiring refugees in its Twin Falls plant, unexpectedly became a target of conspiracy theorists.

In 2016, amid a charged U.S. political climate, some blogs and commentators (most prominently Alex Jones of InfoWars) began spreading false stories accusing Chobani and Ulukaya of “importing refugees” who committed crimes, and so on.

This was a shocking challenge because it attacked the company’s social responsibility efforts and had nothing to do with product quality.

The situation escalated in April 2017 when InfoWars published videos alleging a connection between Chobani’s refugee employees and a local crime case – completely baseless and inflammatory.

This was a reputational crisis that could alienate customers and incite boycotts.

Chobani’s leadership responded firmly and swiftly: they filed a defamation lawsuit against Alex Jones in Twin Falls, ID, where the harm was felt directly.

This legal offensive was notable – few large companies publicly take on media personalities due to the potential protracted battle. But Chobani stuck to its principles and community, with Ulukaya defending his employees and company integrity.

The suit was settled in May 2017 with a victory for Chobani: Jones retracted his false statements and issued an apology on-air, expressing regret.

By forcing a public retraction, Chobani not only cleared its name but also sent a message that it would not tolerate hate or lies.

The outcome was largely positive for Chobani’s image.

The incident garnered national news, with many outlets sympathetic to Chobani’s stance. Consumers who might not have known about Chobani’s inclusive hiring now learned of it in a positive light.

The attempted smear was turned into a story about Chobani’s courage and values. Internally, it also likely boosted employee morale, workers saw that the company would stand up for them against bigotry.

The long-term impact on sales was negligible; if anything, some consumers rallied to support Chobani because of this challenge. The lesson here is that living by your values can also mean defending them.

Chobani’s handling showed alignment between its public messaging (“food for good”) and actions (legal action to do right by its people). In an era where brands are often expected to take stands, Chobani’s decisive response enhanced its credibility.

Leadership Transition and Strategic Refocus – 2022 IPO Delay:

A more recent challenge has been navigating leadership changes and strategic pivots amid external economic pressures. In 2021, Chobani geared up for an IPO, hiring executives and filing the paperwork.

However, by early 2022, markets became volatile (inflation, war in Europe, etc.), and simultaneously Chobani saw turnover in top executives: its President/COO and other C-suite members departed around March 2022.

This convergence forced Chobani to press “pause” on going public and deal with internal reorganization. For a company that had been in high-growth mode, delaying the IPO and losing a key leader could be seen as setbacks.

Chobani’s response was to stabilize internally and prioritize fundamentals.

Ulukaya personally communicated that given market conditions, waiting was prudent and that focus would remain on “strong execution and driving profitable growth” as a private entity.

He quickly filled the leadership gap by bringing back a trusted former executive (Kevin Burns) as COO to ensure continuity.

The strategy shifted from expansion-at-all-costs to profitable expansion – essentially, proving they can thrive without immediate IPO cash.

They also likely adjusted spending, delaying some non-critical projects to conserve cash. By pivoting strategy, Chobani turned this challenge into an opportunity: 2022 and 2023 became years of improving margins and making the business more attractive for a future IPO window.

Indeed, by late 2023, Chobani’s financials were stronger (as evidenced by the successful bond raise and earnings growth) .

The IPO delay challenge taught Chobani to be nimble with timing and not overextend.

Many startups go public too early and suffer; Chobani chose to step back and only proceed when conditions are right.

In the interim, they utilized the private markets (debt) to achieve some liquidity for investors.

The lesson: keeping control of your destiny (Ululaya’s majority stake allowed this flexibility) and not being forced into suboptimal timing is valuable.

And culturally, despite leadership departures, Chobani’s strong mission and internal talent pool allowed it to promote or rehire experienced leaders, minimizing disruption.

Other challenges:

We should note that Chobani faced other tests, such as the UK market failure in 2013 (when legally they couldn’t call it “Greek yogurt” in the UK, they chose to exit rather than dilute the brand).

That shows that not all expansions work, and Chobani learned to pick battles (they later re-entered UK in 2019 with “Greek-style” labeling on a small scale).

Also, the COVID-19 pandemic was a challenge (sudden shifts in demand from foodservice to retail, and the need to protect plant workers).

Chobani managed through it by redirecting inventory to retailers and taking care of employees (they provided bonuses to frontline workers during the pandemic). The outcome was that yogurt sales actually rose during lockdowns, and Chobani benefitted.

In summary, Chobani’s trajectory has not been without bumps – contamination scares, competitive slumps, public attacks, and strategic U-turns.

In each case, the company’s approach was proactive and principle-based:

- Confront the issue head-on (be it recall or lawsuit).

- Communicate clearly and honestly (with consumers, media, or investors).

- Lean on its core values (quality, community, integrity) to guide decisions, which in turn often turned challenges into brand-building moments.

Strategic Initiatives & Future Outlook

Chobani stands at an inflection point, transitioning from a single-category disruptor into a diversified food and beverage enterprise.

Several strategic initiatives are underway or on the horizon that will shape the company’s future:

Broadening Product Portfolio (“Beyond Yogurt”):

Chobani’s most significant ongoing strategy is to continue expanding into adjacent categories. Having successfully launched oat milks, coffee creamers, and ready-to-drink coffees, Chobani is effectively transforming into a “nutrition-focused food platform.”

This initiative means developing new products that leverage Chobani’s strengths (brand trust, distribution, R&D in dairy and plant bases) in high-growth areas.

For instance, the plant-based trend still has legs – Chobani could extend into other nondairy categories such as plant-based cheese or butter alternatives, or even into snack bars or refrigerated protein snacks (areas that align with healthy eating).

The acquisition of La Colombe in 2023 signals a bold push into the coffee sector , which might foreshadow Chobani integrating those products (or co-branding, like “Chobani Oat Draft Latte”) to capture more of the breakfast/beverage occasion.

We can expect Chobani to invest in making these non-yogurt lines as core to its business as yogurt is. By 2030, Chobani could very well be known as much for its oat milk or coffee drinks as for Greek yogurt if these bets pay off.

Geographic Expansion:

International growth remains a partially tapped opportunity. Chobani will likely revisit expanding its global footprint.

After its strong showing in Australia (where it became the fastest-growing yogurt brand), Chobani might use Australia as a springboard to Asia (e.g., exploring markets like China where yogurt consumption is rising, though taste preferences differ).

The company’s 2016 Twin Falls expansion explicitly mentioned supporting international distribution, suggesting plans were in place.

One challenge abroad is differing dairy regulations and local competition, as seen in the UK setback. But Chobani could approach new markets via joint ventures or local production under license to get around those issues.

The Middle East is another region that might welcome a brand like Chobani, given yogurt’s cultural relevance there – perhaps Turkish roots of Ulukaya could be leveraged in branding. Overall, global yogurt market growth (projected ~5% CAGR in many emerging markets) offers Chobani room to grow beyond the maturing U.S. market.

Ongoing Innovation & Health Focus:

Strategically, Chobani will continue to center innovation on health/wellness and natural ingredients. The company’s vision is to “recreate the way food is made and consumed… operate responsibly”, implying future products might push boundaries in nutrition (like gut-health beverages, high-protein snacks, low-sugar treats).

We may see Chobani delve into functional foods – perhaps products fortified with vitamins, or foods targeting specific diets (keto-friendly yogurt, etc.).

They already have the incubator to source new ideas; some alumni of the incubator could become acquisitions if they fit (for example, a plant-based protein snack startup could be bought to expand Chobani’s offerings).

Supply Chain & Sustainability Initiatives:

Given rising importance of sustainability, Chobani is likely to double down on environmentally friendly practices. They’ve made strides (e.g., exploring renewable energy at plants, reducing plastic in packaging).

Future initiatives might include: converting whey waste to biofuel or incorporating more sustainable packaging (maybe moving to recyclable or bio-based yogurt cups entirely).

These efforts not only reduce cost in the long run but also align with consumer expectations and could be a marketing differentiator (yogurt industry has been criticized for plastic waste from cups; Chobani could lead with a solution).

Digital and Direct Engagement:

While Chobani’s model is retail-centric, the future might hold more direct-to-consumer or digital engagement strategies.

Subscriptions for monthly yogurt boxes or a Chobani online store with exclusive flavors could deepen customer relationships.

Also, leveraging data analytics (possibly via a loyalty app or etc.) to personalize promotions can help drive consumption. This is a more minor point but part of staying modern in go-to-market.

Major Partnerships and Collaborations:

We might see Chobani form partnerships to accelerate some initiatives. For example, partnering with a fast-food chain to feature Chobani yogurt parfaits or oat milk lattes could expand reach.

Or partnering with dairy co-ops on sustainability. Another possibility is a strategic alliance with a large distributor (like how Oatly partnered with Starbucks for adoption – Chobani could try similar with its oat milk or coffee).

In Closing

Chobani’s case teaches that combining product excellence, strong values, and agility is a potent formula for success.

It demonstrates that even in a commodity food category, innovation and branding can create a defensible moat.

Other businesses can learn from Chobani the importance of staying true to your mission (especially in tough times), of never getting complacent with a winning product, and of treating stakeholders (customers, employees, communities) in a way that turns them into partners in your growth.

As Chobani’s own trajectory from startup to industry leader shows, businesses that adapt and uphold their principles can achieve not just market success, but also leave a positive mark on their industry and society.

Causeartist BackOffice

Your Mission-Aligned Operations Team

From investor-ready financials to growth strategy, HR, compliance, and custom software—Causeartist BackOffice is your all-in-one operational partner. Built for impact startups, funds, and nonprofits, and powered by our experts.

Let us handle the back office—so you can stay focused on impacting the world.