Beyond Meat, Inc. (NASDAQ: BYND) is a Los Angeles–area food tech company founded in 2009 that builds plant-based meat alternatives. Its stated mission is to “build meat directly from plants,” offering beef, pork- and poultry-like products that match the taste and texture of animal meat while improving health and sustainability.

Leading products include the Beyond Burger (launched 2016) and Beyond Sausage (2018), with global retail and foodservice distribution in tens of thousands of outlets.

Beyond Meat’s innovative plant-protein technology helped it capture early adopters and investors: it became the first plant-based meat company to IPO (May 2019, raising $240M), and BYND stock tripled on its first day.

Through 2021, annual revenue grew rapidly, from $298M in 2019 to $465M in 2021, making Beyond Meat a poster child for the alt-protein boom.

However, BYND’s trajectory has since cooled.

Category demand has softened due to high prices, inflationary pressures, and lingering doubts over taste and health trade-off. After peaking in 2021, revenues fell to $326M in 2024 while losses deepened; share price declined 90% from its peak by late 2024.

Key lessons include the importance of cost discipline and product-market fit: despite strong brand recognition, Beyond Meat’s premium pricing and heavy R&D/marketing spend meant it remains unprofitable.

More recent management actions – recipe reformulations, price adjustments, and cost cuts – are aimed at returning to sustainable growth.

Company Background & History

Founding (2009–2012)

Beyond Meat was founded in 2009 by Ethan Brown, a former clean energy investor who wanted to mitigate climate change by replacing animal agriculture.

Brown licensed extrusion technologies from University of Missouri researchers to create plant protein “meat” analogs.

The first product was Beyond Chicken Strips (2012), sold at Whole Foods and targeted at “vegancuriosity.”

From day one, the company positioned itself not as a niche vegan brand but as a mainstream protein alternative: it insisted its products go in supermarket meat cases rather than a specialty vegan aisle.

Growth and Milestones

In 2014 Beyond Meat introduced Beyond Beef Crumbles and began developing a burger patty. The breakthrough came in May 2016 with the launch of the Beyond Burger, a plant-based beef patty that “cooks like a burger and looks like one”.

Strategic partnerships followed: Subway tested Beyond Meatballs, Dunkin’ launched a Beyond Sausage breakfast sandwich (promoted by investor Snoop Dogg) in 2019, and fast-food chains (e.g. Carl’s Jr.) ran Beyond-meat commercials (the first plant-based Super Bowl ad in 2019). By late 2019 Beyond Meat had distribution in ~35,000 outlets and was valued at ~$1.5 billion at IPO.

IPO and Expansion (2019–2021)

The May 2019 IPO raised $240M. Initial investor enthusiasm saw BYND’s share price surge over 160% on its first day, catalyzed by impressive revenue growth (2018: $87.9M; 2019: $298M) and positive narrative about health and sustainability.

However, the company remained unprofitable, losing $29M in 2018 and widening losses thereafter. In 2020–21, Beyond Meat expanded overseas (entering Asia and Europe) and launched new SKUs (e.g. Beyond Sausage 2.0, Beyond Steak in 2022).

A peak of $465M revenue in 2021coincided with 75+ countries served and products in 65 countries.

Leadership and Ownership

Ethan Brown has remained CEO/Board Chair since inception; his vision and charisma have been central to marketing and fundraising.

Early investors included Kleiner Perkins and Bill Gates, and in 2016 Tyson Foods took a 5% stake (sold in 2019 pre-IPO).

Celebrity investors (Leonardo DiCaprio, Snoop Dogg, NBA players Chris Paul and Kyrie Irving) also promoted the brand.

Post-IPO, Brown still owns a single-digit share (4.6% in 2024) but controls strategy through his leadership role.

The company’s ownership structure is now public (BYND).

In finance/executive ranks, Beyond has seen turnover: its CFO left in 2022, and senior marketing head was trimmed as part of cost cuts.

Pivots and Reorganizations

After 2021, Beyond Meat implemented several strategic shifts. It re-focused on core products (beef/pork alternatives) and streamlined operations: in 2022 it cut ~19% of staff (≈200 employees) amid weaker sales.

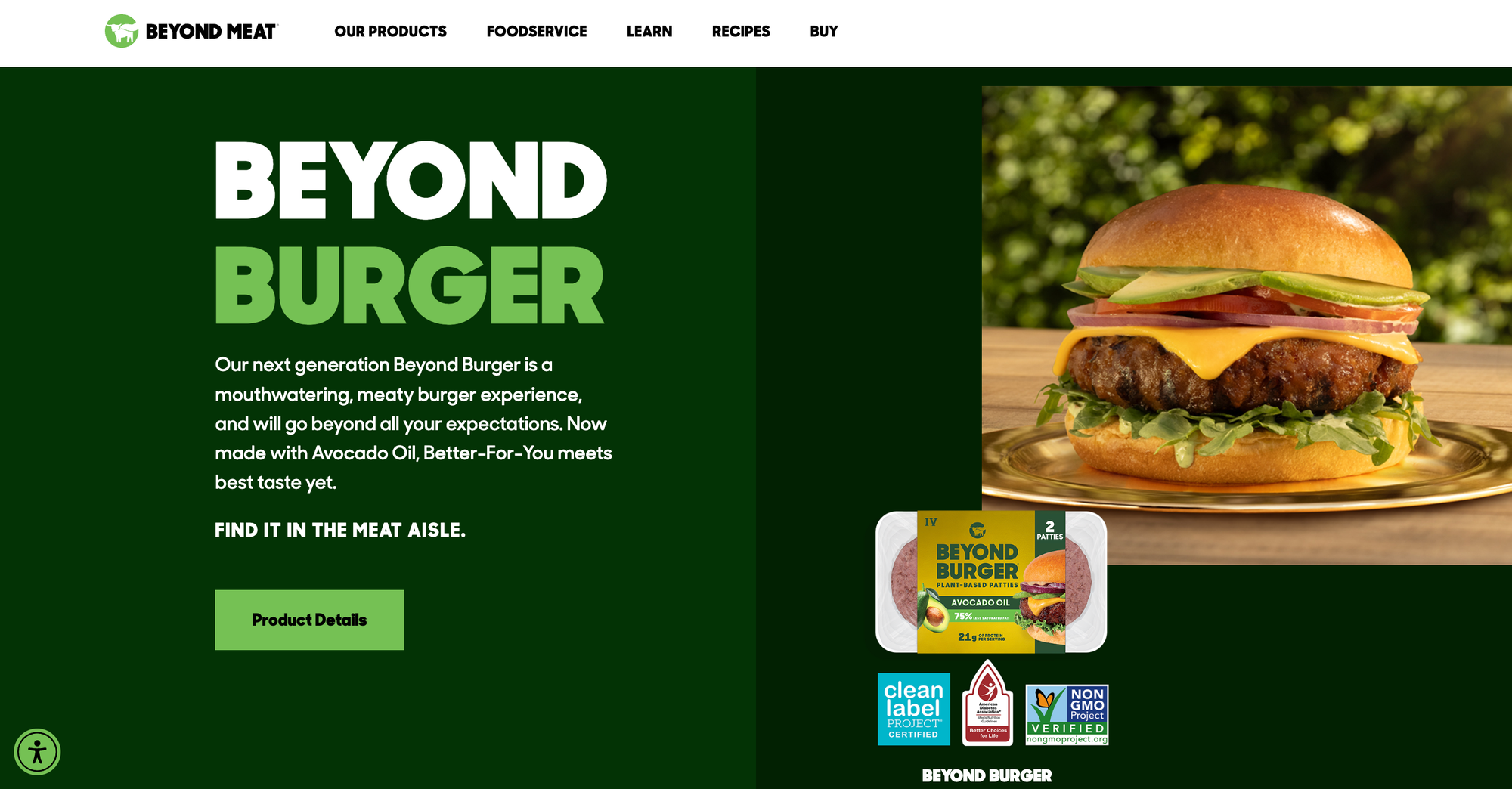

Productwise, management iterated its flagship burger recipe to improve health credentials (launching “Beyond Burger 2.0” in 2019, 3.0 in 2021, and a 4th-generation formula in 2024 that replaced coconut oil with avocado oil.

It also pulled back on weaker projects: for example, in 2024 Beyond terminated its PepsiCo jerky joint venture and certain R&D efforts to conserve cash.

Beginning in 2023–25, Beyond announced multiple rounds of layoffs (additional reductions in Nov 2023, Feb 2025 and Aug 2025 for a total of ~25% staff cut) as revenue declined.

These moves – along with price increases on its products – reflect a pivot from rapid expansion to sustainable profitability.

Industry & Market Analysis

Market Size and Growth

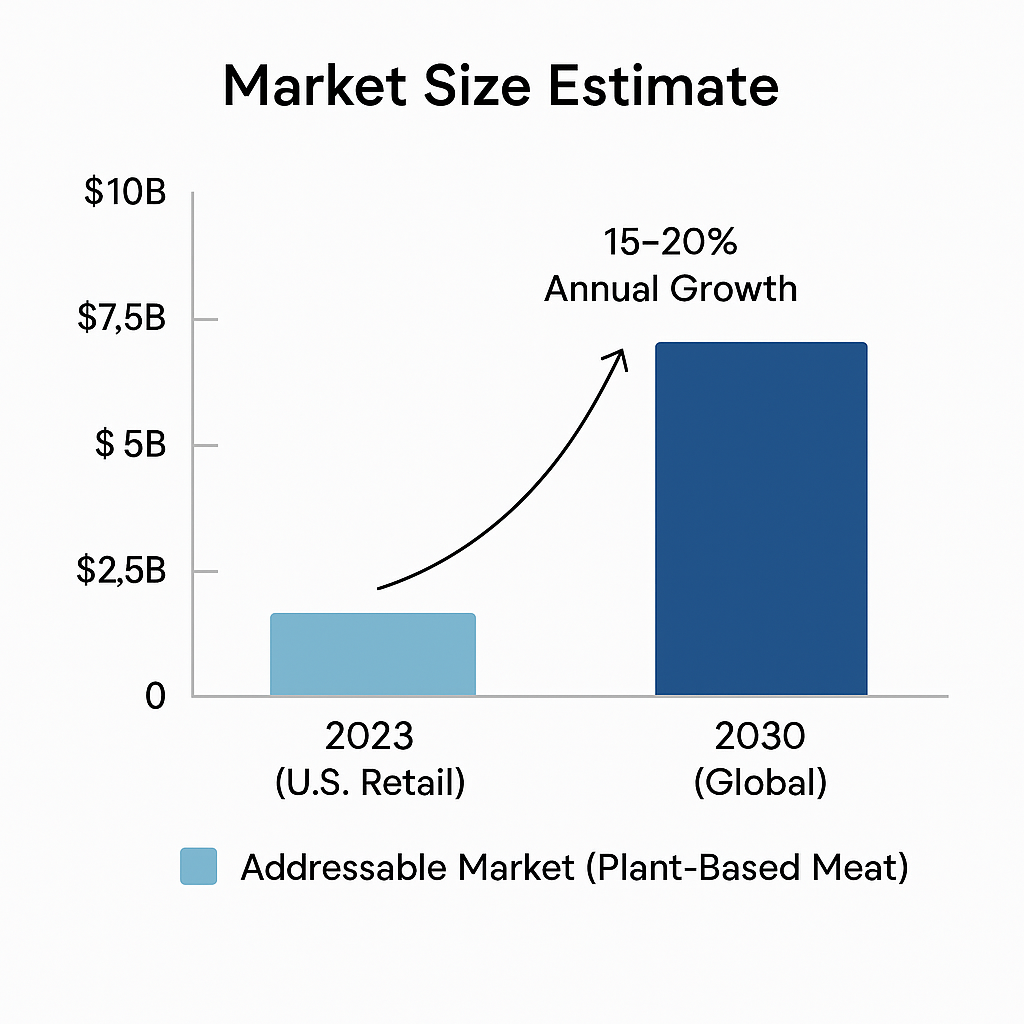

Beyond Meat operates in the global plant-based meat sector. According to market-research firm Grand View, the global plant-based meat market was worth about $7.17 billion in 2023 and is forecast to grow at ~19.4% CAGR through 2030 (to $24.8B).

The U.S. market alone was roughly $3.21B in 2024 with ~18% projected CAGR to 2030. That said, category growth has recently plateaued.

In 2024, U.S. retail sales of refrigerated plant-based meats declined ~2.3% year-over-year, and by mid-2025 sales had fallen more steeply (refrigerated alt-meat down 17.2%, frozen down 8.1%).

Overall, plant-based proteins still represent a small share of total meat consumption: NielsenIQ estimates plant-based meat is only ~1.7% of U.S. retail meat dollar sales (0.8% of total meat).

Key Trends and Drivers

Early growth in the industry was driven by health, environmental and animal-welfare concerns. Consumers (especially millennials and Gen Z) have shown interest in “flexitarian” diets to reduce red meat intake, and beyond-meat products are often marketed as lower in cholesterol/fat (Beyond products carry no cholesterol or antibiotics) and with lower carbon footprint.

Technological improvements (e.g. heme proteins, novel legumes) have made flavors more meat-like. However, several headwinds have emerged: plant-based products generally carry a price premium.

In 2021 a GFI survey noted a 21–28% higher cost than conventional meat, leading many consumers to revert to cheaper animal proteins.

Inflation in 2022–24 further squeezed household food budgets; industry analysts note consumers cite “cost” and concerns over ultra-processed ingredients as reasons to cut back.

Regulatory trends also play a role. In the U.S., some state legislatures (backed by meat industry lobbying) have moved to restrict the use of terms like “meat” or “sausage” on plant-based products.

Conversely, growing climate policies and labeling initiatives (e.g. carbon labels) could, in theory, favor eco-friendly proteins in the long run.

The plant-based category continues to innovate not only with legumes (peas, soy, lentils) but also cell-based meat development, keeping competitive pressure high.

Target Customer Segments

Beyond Meat primarily targets “flexitarian” consumers – those who want to reduce meat intake without sacrificing taste or convenience. This includes health-conscious individuals, environmentally minded eaters, and some vegetarians/vegans seeking more realistic meat analogs.

Its branding (“Eat What You Love®”) and marketing (placing products in the meat aisle) are aimed at mainstream omnivores rather than niche vegans.

Key demographics have skewed younger and urban; for instance, early adopters were often educated consumers in coastal states.

However, beyond initial pioneers, the broader “flexitarian” market has proven price-sensitive. A NielsenIQ report noted that by 2024, 73% of U.S. adults were at least open to plant-based proteins, but actual trial and repeat purchase has been limited when budgets tighteng.

Market Size Estimate

Based on 2023 data, Beyond Meat’s total addressable market (plant-based meat) is under $1B in annual U.S. retail sales (since plant-based meats are <2% of a $60B+ US meat market). Globally, the category may approach $7–10B today.

Industry forecasts still call for ~15–20% annual growth globally through 2030, assuming technology improves and prices fall.

In the short term, however, most analysts note growth will be slower than the hype years, as evidenced by the recent sales declines.

Competitive Landscape

Beyond Meat faces competition from both other plant-protein brands and traditional meat companies moving into alternatives.

Its chief direct rival is Impossible Foods, famous for its Impossible Burger (soy-based with heme). Impossible has strong restaurant partnerships (e.g. Burger King) and also emphasizes taste and texture, but it uses soy and genetically engineered heme rather than pea protein.

Other established plant-based brands include Nestlé’s Sweet Earth and Vegetarian Butcher lines, Conagra’s Gardein/Lightlife, and Kellogg’s MorningStar (though MorningStar split off).

Each has its own technology (fungi-based mycoprotein, textured soy, etc.) and price points. Emerging startups (e.g. Good Catch for seafood analogs, ‘culture-cultured’ ventures like UPSIDE Foods) also crowd the space.

Importantly, major meat incumbents are now direct competitors: Tyson Foods, Perdue and JBS have launched their own plant-based lines (e.g. Tyson’s “Raised & Rooted” products.

These legacy players benefit from massive scale and distribution networks.

Business Models and Go-to-Market

Beyond Meat has historically sold frozen and refrigerated products to retailers and foodservice operators. It forges national retail chains (e.g. Whole Foods, Kroger, Walmart) and quick-service restaurant deals (e.g. Taco Bell, KFC, Starbucks) as sales channels.

In contrast, Impossible Foods has focused heavily on the foodservice segment (creators of Burger King’s Impossible Whopper) and licenses its heme tech; Nestlé and Tyson leverage grocery store and deli placements.

Pricing strategies differ: Beyond Meat’s retail products have often been priced at a substantial premium per pound over meat, whereas Tyson’s in-house brands or lower-end plant proteins come in cheaper.

Marketing approaches vary: Beyond Meat invested in mainstream branding (Super Bowl ads via Carl’s Jr., Dunkin’ partnership, celebrity ambassadors like Snoop Dogg), whereas some competitors pitched explicitly on health or environmental credentials (e.g. Tofurky, Quorn, etc.).

Competitive Advantages

Proprietary Technology:

Beyond Meat’s formulations (bleeding pea-protein patty, high moisture extrusion) are patent-protected. Its 4th-gen burger with avocado oil and high protein (21g) is a unique product iteration.

Brand Reputation:

It was an early mover with strong consumer awareness (coined a “better-burger”). Endorsements by athletes and celebrities built buzz.

Strategic Partnerships:

Alliances with major chains (e.g. Starbucks breakfast bowls, Dunkin’ sandwiches) and global distributors (Dot Foods is the largest single customer at 12% of revenue widen its reach.

Competitive Disadvantages

High Cost Structure:

Beyond Meat’s products are often more expensive than competing proteins. Industry data shows price is a pain point for consumersg.

Profitability & Scale:

It operates below economies of scale of meat giants; gross margins have been low (turning negative during growth years).

Product Consistency:

While taste improved over time, early versions drew mixed consumer reviews, forcing multiple reformulations.

SWOT Analysis

- Strengths: Technological edge in plant-protein textures; strong brand identity and message; global distribution footprint (products in ~65 countries); diversified partnerships (retail and foodservice).

- Weaknesses: High price point and ongoing unprofitability; reliance on specific ingredient supply (chiefly pea protein from Roquette) posing sourcing risk; limited product variety relative to large competitors (e.g. no own dairy analog line).

- Opportunities: Expanding into growing markets (e.g. EU demand remains strong); leveraging its R&D pipeline (new products like Beyond Steak, sun-dried sausage); capitalizing on rising flexitarian trends if price can be lowered.

- Threats: Intensifying competition from entrenched food giants (Tyson, Nestlé, etc.) bringing their own scale and marketing; possible regulatory actions on labeling or supply chains; potential further downturn in category as consumers revert to traditional meat.

Business Model & Revenue Streams

Beyond Meat’s revenue comes almost entirely from sales of its plant-based food products. It does not have subscription or licensing revenue models of note; rather, it sells directly to wholesale customers (grocery chains, foodservice distributors) who then retail to end consumers.

Its two main segments are Retail (grocery, club stores, e-commerce) and Foodservice (restaurants, food service providers, institutional).

Each of those is further split geographically (U.S. vs International). For example, in Q3 2024 its quarterly revenue ($81M) broke down into roughly 60% U.S. Retail, 15% U.S. Foodservice, 21% International Retail and 15% International Foodservice.

Historically, retail sales have formed the majority of revenue, with foodservice more volatile (restaurant usage spiked then plunged in COVID years).

By product lines, Beyond Meat does not publicly break out sales of specific items. It’s known that the Beyond Burger patty and sausage links account for the bulk of sales, while newer formats (meatballs, chicken strips) are smaller.

Unit Economics

Gross margins have historically been low due to high ingredient and manufacturing costs. In mid-2024, Beyond Meat reported gross margin around 14–15% (up from near-zero the prior year), far below typical food-brand margins.

Efforts to improve unit economics include raising retail prices and reducing promotions (Beyond IV launch was accompanied by higher list prices).

The company has not disclosed customer acquisition cost (CAC) or lifetime value (LTV) since it operates B2B, but heavy marketing and trade spending suggest CAC for in-store end-consumers is nontrivial.

Recurring Revenue

Beyond Meat has minimal recurring revenue streams. It does have some fixed contracts with large chains and distributors, which provide predictable order volume, but these are standard supplier agreements.

Absent a subscription or consumables model, its revenues fluctuate with consumer demand and ordering cycles. Notably, it has no franchise or licensing revenues.

Breakdown Highlights

For fiscal year 2024 (annual net revenue $326.5M), roughly two-thirds came from U.S. sales and one-third international. The retail channel has gradually overtaken foodservice as lockdowns ended; in Q4 2024, U.S.

Retail was 38% of revenue and U.S. Foodservice only 22%.

However, foodservice remains strategic (partnerships with chains, stadiums, schools). The average selling price per pound (realized price) has increased year-over-year as Beyond cut discounts, aiding per-unit revenue even as overall volume lagged.

Financial Performance

Beyond Meat’s financials reflect boom-and-bust. After explosive growth, its top line has recently stalled and profits remain elusive. Annual revenues were $407M in 2020, $465M in 2021, then fell to $419M in 2022, $343M in 2023 and $326M in 2024.

The Company has never turned an annual profit; cumulative net losses reached $-366M in 2022 and $-338M in 2023, before narrowing to about $-160M in 2024.

Gross margin swings explain much of this: losses on commodity inputs dragged gross margin as low as -24% in 2023, but aggressive cost cuts and price rises have brought it to low double digits by 2024.

Key drivers of revenue change include: the COVID-19 pandemic (2020 saw a temporary bump in retail demand even as foodservice plunged, which skewed 2021 growth); introduction of new products (Beyond Sausage and extended distribution) in 2019–21; and then a market correction from 2022 onward as consumers pulled back.

The contraction in 2022–23 was partly due to weak same-store sales in the U.S. and the loss of institutional accounts, partly due to the exit of China and some grocery accounts in late 2023.

On the expense side, R&D and SG&A are high: Beyond Meats spent nearly half its revenue on these overheads in the past, though it has since scaled back hiring and marketing.

Since Beyond Meat is publicly traded, its stock performance is also telling.

Its 2019 IPO pop (163% on Day 1) was followed by years of volatility.

After reaching all-time highs (> $200/share in mid-2019), BYND fell consistently in 2020–23. By late 2024 it was trading around $10–15 (over 90% below peak).

This downturn broadly tracked negative earnings revisions and sector rotation.

For context, BYND underperformed both the S&P 500 and a peer basket (e.g. Tyson, Nestlé ADRs) over the same period, reflecting investor re-pricing of growth stocks.

Detailed stock charts are publicly available (BYND vs peers), but in general the takeaway is that Beyond Meat’s stock boomed on future expectations, then corrected as profits remained distant.

Product or Service Offerings

Beyond Meat’s core product portfolio is all food items, primarily in frozen or refrigerated form. The flagship category is plant-based beef substitutes:

- Beyond Burger: The patty launched in 2016. It has since gone through four generations: 1.0 (2016 original beef-style), 2.0 (2019 “meatier” with less fat), 3.0 (2021 leaner yet), and 4.0 (2024 formula using avocado oil). Each update reduced saturated fat and refined the texture. The patty ingredients include pea protein, rice protein, red lentil protein, faba bean, and starches, with beet juice providing a “bleeding” effect.

- Beyond Stack Burger: Thin, craveable burger patties designed to be eaten as single patties or stacked to create a diner-style double or triple burger. These savory patties cook quickly, offering convenience and customizable portion sizes.

- Beyond Beef: Plant-based ground beef made for tacos, chili, pasta sauces, and other recipes. The latest formulation includes avocado oil for better nutrition and a richer, beefier flavor. Designed as a versatile base for any dish that traditionally uses ground meat.

- Beyond Steak: Introduced in 2022, Beyond Steak offers tender, juicy plant-based steak bites made primarily from fava bean protein. Ready to eat in minutes, they’re designed for stir-fries, salads, or grain bowls. In 2025, Beyond launched new seasoned varieties, including Korean BBQ-Style and Chimichurri, expanding the line.

- Beyond Sausage: Plant-based pork-style sausage links launched in 2018, available in Original Brat, Hot Italian, and Sweet Italian varieties. Made with pea, fava bean, and rice proteins, these sausages are high in protein and designed for grilling or breakfast sandwiches.

- Beyond Breakfast Sausage: A breakfast-ready line offering Classic and Spicy Patties in the frozen section and Classic Links in the meat aisle. Each option delivers the flavor and sizzle of breakfast sausage while being entirely plant-based.

- Beyond Chicken Pieces:Plant-based chicken-style chunks made with avocado oil and pea protein. These versatile, high-protein pieces can be used in salads, stir-fries, wraps, or bowls. Designed for easy, nutritious meal prep and quick cooking.

- Beyond Chicken Nuggets: Crispier, golden-brown plant-based nuggets created to match the flavor and crunch of traditional chicken nuggets. Quick to prepare and family-friendly, these are ideal for kids, snacks, or quick meals.

Found in the frozen aisle. - Beyond Meatballs: Plant-based Italian-style meatballs crafted with a blend of pea and rice proteins. Fully seasoned and ready to cook, they can be served over spaghetti, in subs, or as appetizers. First introduced in 2019 and now a grocery staple.

Each product’s unique value proposition is to mimic the taste, texture and cooking experience of the animal meat equivalent.

For example, Beyond Burger patties brown and sizzle like beef, and Beyond Sausage links snap and juicily grill. All products are non-GMO, no cholesterol, no hormones or antibiotics.

Prices are premium, reflecting R&D and ingredient costs; retail Beyond Burgers often sell near $6–7 for a two-pack (over twice the price of ground beef).

Beyond Meat maintains an active R&D and innovation pipeline. It holds multiple patents worldwide (24 patents filed as of 2025, mostly in the U.S.) covering its extrusion processes and formulations.

The company has a test kitchen and R&D center developing new formulations (e.g. plant-based chicken nuggets trialed at Starbucks) and novel proteins.

Strategic collaborations also fuel products: for instance, a joint venture with PepsiCo funded development of beef jerky (later cancelled).

Beyond Meat continues to monitor trends (alternative grains, legume proteins, fermentation techniques) to spawn new offerings, though no new product outside its meat analog lines has been announced publicly yet.

Go-to-Market & Marketing Strategy

Beyond Meat’s customer acquisition is largely business-to-business. It sells through two main channels:

- Retail Grocery/E-commerce: It partners with supermarket chains (e.g. Whole Foods, Kroger, Walmart) and online grocers. Early on, it secured placement in the meat case (Whole Foods led the way in 2016) to reach omnivores. Its branding emphasizes versatility (“fry it, grill it, crumble it”) with minimal vegan imagery.

- Foodservice/Restaurants: Beyond Meat has deals with quick-service and casual chains. For example, Taco Bell uses Beyond Burger meat in some menu items, and KFC offers Beyond nuggets. Starbucks features Beyond Sausage in some breakfast items, and sports arenas/universities now use Beyond Meat for vegetarian options. These partnerships give scale (feeding thousands daily) and brand visibility.

Marketing and Promotions

Beyond Meat has been aggressive and creative with marketing. It has run high-profile ad campaigns and partnerships to build awareness. For instance, in Super Bowl 2019 Carl’s Jr. aired a humorous commercial for its “Beyond Famous Star” burger.

The company also enlists celebrity endorsers: rappers (Snoop Dogg, an investor) have starred in ads (e.g. working the counter at Dunkin’ for a Beyond Sausage sandwich), and NBA stars (Kyrie Irving, Chris Paul) have acted as brand ambassadors.

Digital marketing leverages social media, and Beyond frequently touts positive press coverage (e.g. TIME “Best Inventions”). It sponsors events and uses PR to highlight its climate/health story.

Notable Campaigns

Whole Foods Meat Case (2016): A landmark marketing move was refusing to sell in a dedicated vegan aisle. When Whole Foods agreed to stock Beyond Burger in the meat section, it was covered as a breakthrough for mainstream positioning.

Fast-Food Partnerships: The Beyond Burger became available nationwide at Carl’s Jr. (2019) with major advertising, and Beyond Sausage sandwich launched at Dunkin’ (2020) with Snoop Dogg ads. Each partnership generated earned media.

Retention & Upselling

Beyond Meat has limited direct-to-consumer loyalty programs (no subscriptions). Retention efforts focus on trade promotions (coupons, buy-one-get-one offers) and retailer co-marketing (e.g. in-store demos).

The strategy is more on broad adoption than individual LTV. Bundling and multi-pack pricing offer some value (e.g. mix-and-match meat and sausage packs), and occasional line extensions (e.g. Beyond “Good Morning” breakfast patties) encourage cross-selling.

Operations & Organizational Structure

As of 2024 Beyond Meat had ~808 employees (754 full-time plus 54 contractors) globally. The company is headquartered in El Segundo, California.

It maintains corporate offices for R&D, finance, and marketing in the U.S., as well as likely smaller offices or representatives in key markets (e.g. Europe and Asia) to manage local partnerships and regulatory affairs.

Manufacturing & Supply Chain

Beyond Meat does not own its factories; it relies on contract manufacturers (co-packers) to produce its products under license.

It sources key ingredients from suppliers: notably pea protein (its primary protein) is procured mainly from Roquette Frères, along with other starches and oils from multiple vendors.

In 2019, Beyond Meat scaled up production by adding facilities overseas (a plant in the Netherlands) to serve European demand.

By late 2023, management noted it was streamlining its manufacturing network – consolidating facilities and exiting some co-manufacturing contracts to match actual demand.

It also wound down operations in China (amid low sales there) by early 2025.

Logistically, distribution is global.

By late 2024, Beyond Meat products were in ~27,000 retail stores in the U.S. and 38,000 internationally, plus 38,000 U.S. foodservice outlets (with the largest presence in North America and parts of Europe).

Major distributors like Dot Foods handle bulk shipments to foodservice clients and retailers.

Organizational Structure and Culture

Beyond Meat’s management structure centers on functions (R&D, operations, sales/marketing) and regions. CEO Ethan Brown oversees the overall company and often serves as chief spokesperson. Direct reports include heads of technology, supply chain, and global sales.

The culture is entrepreneurial and mission-driven (“climate-friendly protein”), but has had to adapt to cost-conscious management. In layoffs, Beyond emphasized retaining R&D talent to continue innovation.

The company emphasizes sustainability internally (sourcing, waste reduction) and has adopted standard public-company governance (independent board members, audit committees, etc.).

Challenges in Operations

Supply Constraints:

Early on, Beyond Meat faced tight supplies of pea protein and packaging which slowed rollouts. Volatile pea prices can swing ingredient costs.

Production Scaling:

Its heavy manufacturing equipment has required depreciation adjustments; in Q1 2023, for example, extending useful life estimates freed $4.4M in costs.

Quality Control:

Maintaining consistent product texture across multiple co-manufacturing sites is complex. There have been occasional recalls (e.g. for contamination) and product batch issues (not detailed in sources).

COVID Disruptions:

The pandemic initially disrupted restaurant orders but increased retail demand. Supply chains (shipping, ingredients) saw global strain, impacting cost and availability in 2020–21.

Regulatory Compliance:

With operations in multiple countries, Beyond must adhere to various food safety and labeling laws (e.g. EU plant-based labeling rules) – a complex task for new product introductions abroad.

Challenges & Crisis Management

In Beyond Meat’s history, several major challenges emerged:

- Demand Slowdown (2022–present): After early growth, Beyond Meat has faced persistently weak demand. In 2022 and 2023, U.S. plant-based meat sales fell year-over-year. This triggered cuts: in October 2022 Beyond laid off ~19% of staff (200 jobs) following a revenue decline. By late 2023 and early 2025, further rounds of layoffs (additional 6% in Aug 2025) and contraction of operations (exit from China) were announced.

- Financial Losses and Cash Burn: Despite cost-cutting, the company continued losing money (net loss of $160M in 2024). In late 2024 it trimmed guidance and warned investors, which pressured the stock and liquidity. It is reportedly in discussions with bondholders to restructure $1.1B of debt, aiming to extend maturities. It also explored raising equity (a 2024 filing mentioned up to $250M new stock) as a backstop. Operationally, the company restructured by further consolidating manufacturing and reducing overhead. By cutting costs faster than sales decline, Beyond narrowed its quarterly losses (e.g., Q4 2024 loss was $37.8M vs $160.8M prior year).

- Regulatory and Public Perception Issues: Beyond Meat has had to navigate labeling debates and public skepticism. In some U.S. states, attempts were made to ban calling plant products “meat”. Media narratives have at times criticized plant-based meats as “ultra-processed.” Beyond’s CEO has publicly blamed a “misinformation campaign” by the animal-protein industry for hurting sales. Beyond Meat has tried to address health perceptions head-on: its 2024 avocado-oil burger was explicitly marketed to counter “misperceptions around health”. It also ramped up educational marketing (nutrition comparisons, sustainability stats) to counteract negative PR.

- Product Missteps: There have been few high-profile product failures, but one cautionary episode was its brief venture into plant-based jerky with PepsiCo (2022–24). Despite significant investment, the jerky line never caught on with consumers. The company quietly scrapped this product in 2024 to stop losses. This reflects a broader lesson: even as Beyond innovates, management says it will “continue to focus on core, well-established products” and cut unsustainable experiments.

Strategic Initiatives & Future Outlook

Ongoing Initiatives:

Beyond Meat has articulated several near-term strategies. It is strengthening its core by doubling down on best-selling products (burgers and sausage) and optimizing costs.

The company is also actively pursuing Europe and new segments: CEO Brown noted continued product launches in Germany, Belgium and other EU markets (e.g. Beyond Steak in grocery, new burger flavors in foodservice).

It introduced a new “sunflower veggie sausage” product (Beyond Sun Sausage) for morning meal occasions, diversifying away from pure-meat substitutes. Beyond Meat’s R&D will likely continue improving nutrition (lower fat, no animal inputs) and shelf life to meet retailer demands.

Strategic Partnerships

The firm remains engaged with major food companies. It has ongoing deals with Yum Brands, McDonald’s (McPlant trials), and others, though some of these have been scaled back if underperforming.

On the supply side, it may seek joint ventures or factory investments to secure capacity: earlier reports hinted at plans for new plants. Management has indicated it will continue global expansion via local partners, especially in Asia-Pacific markets (after suspending China, it is eyeing markets like Japan, South Korea, and possibly India).

Future Positioning

Analysts’ forecasts for plant-based foods remain cautiously optimistic: many expect moderate growth (~5–10% annually) as the market matures.

Beyond Meat’s positioning will depend on execution: if it can sustain its role as an innovator (new recipes, category “premium” brand) and manage costs, it could remain a top player.

However, competition is increasing and consumer trends are in flux. Its 2024–25 actions (e.g. price hikes, leaner cost structure) suggest management expects the short-term to remain tough, but with the belief that former customer trends will return.

Key Takeaways & Lessons Learned

- Emphasize Mainstream Appeal: Beyond Meat has shown that marketing plant-based alternatives as mainstream protein (not just a niche vegan option) can drive interest. Its early strategy, placing products in the regular meat aisle and avoiding the “V-word”, helped broaden the customer base.

Lesson: Align branding with consumer identity (health/environment reasons can be benefits, but taste/protein promise should come first). - Innovation Must Meet Demand: Rapid product innovation (new recipes, textures, formats) was a strength for Beyond Meat, but it needed to align with consumer needs. The switch to “Beyond Burger IV” (avocado-oil recipe) exemplifies this: CEO Brown acknowledged that negative health perceptions (“misperception around saturated fat”) were holding the category back, so the 4th-gen burger addresses that head-on.

Lesson: Use customer feedback and market signals to guide R&D priorities. A great idea still needs an audience willing to pay for it. - Growth and Profit Must Balance: Beyond Meat’s history highlights the perils of prioritizing growth over unit economics. After years of double-digit sales increases, the company faced deep losses and had to retrench. As one analyst noted, consumers had already “tried these products and didn’t have a good experience,” and the high price point further limited repeat purchasing.

Lesson: Scale operations carefully and manage costs aggressively, especially in a new category. Achieving profitability should not lag too far behind expansion. - Adapt Quickly to Market Signals: The company’s turn toward cost-cutting and efficiency (e.g. workforce reduction, exiting unprofitable lines) was necessary after sales dipped. For example, Brown pivoted sharply in 2024 by raising prices, cutting promotions, and consolidating production.

Lesson: In fast-changing markets, agile strategic pivots (even tough ones like layoffs) can stabilize a business. Hindsight suggests Beyond Meat might have moved earlier on such measures, but its willingness to do so ultimately helped reduce losses (e.g. Q4 2024 loss shrank vs prior year). - Leverage Strategic Partnerships: Early on, landing distribution through Whole Foods and marketing tie-ins with large chains (Subway, Dunkin’, Starbucks) gave Beyond Meat credibility and scale. Beyond used partners’ platforms (e.g. Snoop’s Dunkin’ ad) to reach millions.

Lesson: When entering new markets or launching products, align with established players to gain instant reach. However, also learn to exit partnerships that don’t perform (e.g. ending the Pepsi jerky JV when it became a drain). - Brand vs. Reality: One of the firm’s greatest successes was building a “cool” brand around plant-based meat. But brand hype must be backed by consumer satisfaction. Surveys and sales show that after initial trials, if a product is too expensive or doesn’t meet taste expectations, repeat rates fall off.

Lesson: Maintain honesty in marketing, a lesson beyond the sugarcoating (e.g. the “beyond” messaging was clever, but the products must consistently deliver). Management’s own mantra that “protein is protein” highlights that consumers ultimately want value, whether from plants or animals.

Final Thoughts

Beyond Meat’s experience offers a rich case: it demonstrates how to launch an innovation-driven food brand at scale, but also how quickly and strategically one must adapt when market conditions change.

Careful listening to both market data and consumer behavior, as evidenced by Beyond’s recent moves (healthier recipes, focus on cash flow) – is crucial.

Other businesses can learn from its successes (rapid innovation, marketing savvy) as well as its challenges (overestimated demand, high burn rate).

Beyond Meat’s journey underscores that disrupting an industry requires not just bold vision, but rigorous execution and willingness to course-correct in real time.