Carbon Equity, known as the world’s first climate venture capital and private equity fund investing platform, has recently announced its success in securing €6 million in its Series A funding round.

This round is led by BlackFin Capital Partners, with the added participation of existing investor, 4impact, contributing to a total funding of €9 million for the company.

About Carbon Equity

Carbon Equity’s mission is to unlock capital from individual investors on a global scale to address some of the world’s most pressing challenges, commencing with the issue of climate change.

By facilitating small-ticket access to premier climate venture capital and growth equity funds, Carbon Equity empowers investors to partake in diverse portfolios of transformative climate technology companies, spanning from large-scale batteries to carbon-free cement.

To date, Carbon Equity has garnered trust from over 550 investors who have collectively invested over €150 million through its platform.

A Platform for Climate Tech Investment

The primary objective of Carbon Equity’s platform is to provide individuals with a unique opportunity to support groundbreaking climate technology companies.

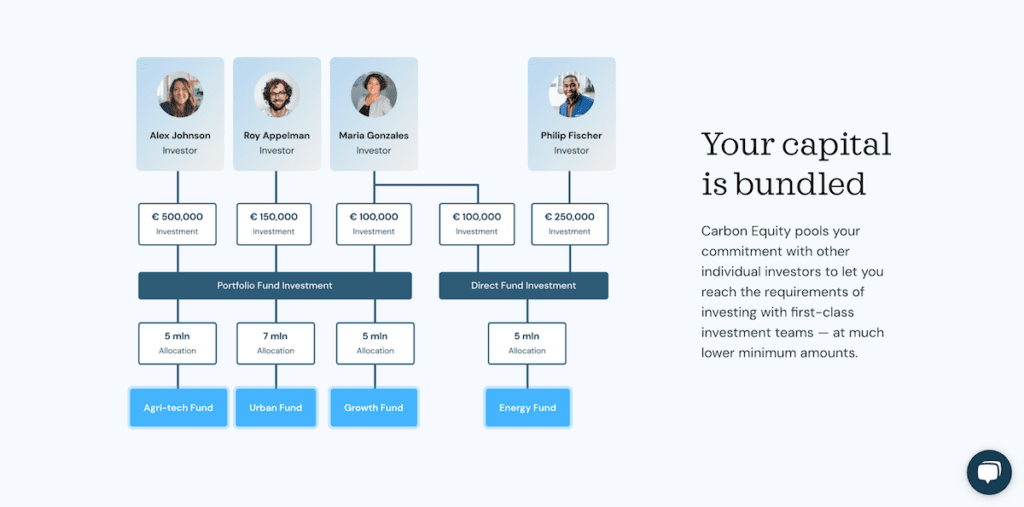

It does so by offering a low minimum investment access to premier climate venture capital and private equity funds, thereby democratizing climate-focused investments and making them more accessible.

“We are seeing a generational shift in our perspective on money — from money purely as a goal in itself to money as a means to help solve global challenges and generate financial returns. Carbon Equity unlocks the capital of individuals so they can help fund the innovations needed to solve climate change and become part-owners of the net zero economy.” – Jacqueline van den Ende, Co-founder and CEO of Carbon Equity

The Investing in Impact podcast featuring Jacqueline van den Ende, Co-founder of Carbon Equity, on enabling access to alternative investments such as Climate Venture Capital, Climate Private Equity, and other asset classes.

Impressive Growth Trajectory

Carbon Equity has been on a remarkable growth trajectory, marked by a substantial increase in its assets under management (AUM) by a staggering 300%.

Moreover, the company’s user base has grown by an impressive 100% since its last funding round in 2022.

This influx of fresh capital is expected to serve multiple purposes, including fueling the company’s expansion into the European market, strengthening distribution channels, and laying the foundation for its inaugural ELTIF fund, which will be accessible with a minimum investment of €25,000.

Meeting Investor Demand

Private market and sustainable investments are currently in high demand. According to insights from Bain & Company, individual investors collectively hold approximately $150 trillion, representing 50% of the global AUM.

However, their presence in alternative investment funds remains relatively low, standing at less than 16%. This is often due to the high capital requirements, typically ranging from €2-10 million, and various regulatory barriers that hinder participation.

A Growing Interest in Sustainable Investments

Despite these challenges, there is a growing appetite for alternative investments. In fact, 69% of the mass affluent category express a strong interest in exploring alternative investment opportunities.

Simultaneously, there has been a surge of interest in sustainable investing. Notably, a study by Morgan Stanley found that 85% of individual investors and a remarkable 95% of millennial investors are actively exploring sustainable investment options.

“At BlackFin, we’ve been following Jacqueline and the team from day 1 and were highly impressed by their vision and execution skills. As strong believers that democratization of investments in alternative assets is part of the future of asset management, we are pleased to be leading Carbon Equity’s Series A and support the company in its growth journey to bring impact investment products to a broader audience.” – Pauline Brunel of BlackFin Capital Partners

Unlocking Climate Impact Investments

With over 40 years of collective investment expertise, Carbon Equity employs a meticulous approach to select funds that are designed to provide tangible climate impact and attractive risk-adjusted returns.

Through Carbon Equity, investors gain access to leading climate funds that contribute to authentic climate solutions, including investments in companies such as Koloma, Form Energy, and Woltair.

Expanding Investor Access

The infusion of new capital empowers Carbon Equity to introduce highly curated investment products, expand its presence across Europe, and debut its ELTIF fund, providing opportunities for minimum investments as low as €25,000.