Aspiration was a California-based neobank founded in 2013 that positioned itself as the sustainable alternative to traditional banking. The company built its value proposition around fossil fuel-free deposits, automatic tree planting for every transaction, and a "pay what is fair" pricing model that allowed customers to set their own fees.

At its peak in 2021, Aspiration claimed more than 5 million customer accounts, had raised over $870 million in funding from venture and celebrity investors including Leonardo DiCaprio, Robert Downey Jr., and Orlando Bloom, and announced a $2.3 billion SPAC merger.

The company earned B Corp certification and was named "Best for the World" five times between 2017 and 2022.

However, the company's trajectory took a dramatic turn when federal investigations revealed extensive fraud by co-founder Joseph Sanberg.

In March 2025, Aspiration Partners filed for Chapter 11 bankruptcy after Sanberg was arrested on wire fraud charges. He later pleaded guilty to defrauding investors of $248 million.

The consumer banking brand was spun off in 2024 and continues operating under new ownership as GreenFi, while the Aspiration story serves as a cautionary tale about governance failures in mission-driven companies.

Company History and Founding Story

Origins and Founders

Aspiration was founded in 2013 by Andrei Cherny and Joseph Sanberg, two figures with backgrounds that appeared well-suited to building a values-driven financial company.

Cherny had worked in politics for years, serving as a speechwriter for Al Gore during the vice president's early climate advocacy and writing speeches for President Bill Clinton.

He later helped Elizabeth Warren establish the Consumer Financial Protection Bureau and ran multiple political campaigns in Arizona.

Sanberg attended Harvard and worked on Wall Street before becoming an early investor in Blue Apron and founding CalEITC4Me, a California program helping low-income residents claim earned income tax credits.

The company officially launched to customers in February 2015.

Cherny and Sanberg saw an opportunity to combine digital banking innovation with growing consumer interest in sustainability and ethical consumption.

Their thesis: the four largest U.S. banks collectively lent more than $240 billion annually to fossil fuel projects, meaning consumers were unknowingly funding climate damage through their deposits.

Funding History

Aspiration raised a total of $870 million across seven primary funding rounds. The company's funding trajectory reflects the explosive growth of ESG-focused fintech during the 2020-2021 period before facing significant headwinds.

| Round | Date | Amount | Lead Investors | Valuation |

|---|---|---|---|---|

| Series A | 2014 | $12.5M | Undisclosed | N/A |

| Series B | 2015 | $15M | Bessemer Venture Partners | N/A |

| Series B Extension | 2017 | $30M | Allen & Company | N/A |

| Series C | May 2020 | $135M | Alpha Edison | N/A |

| Series D | Aug 2021 | $258.75M | InterPrivate III (SPAC) | $2.3B |

| Series D Extension | Dec 2021 | $315M | Oaktree Capital, Steve Ballmer affiliates | $2.3B |

Early investors included Allen & Company, Omidyar Network (Pierre Omidyar's impact investment firm), Alpha Edison, UBS O'Connor, DNS Capital, Radicle Impact, Sutter Rock, and Social Impact Finance.

Celebrity backers provided both capital and marketing value. Leonardo DiCaprio joined as an investor and advisor in 2019, bringing significant brand credibility given his environmental activism.

Other celebrity investors included Orlando Bloom, Cindy Crawford, Robert Downey Jr., Drake, and eBay co-founder Jeff Skoll.

Expansion and Peak

The company's growth accelerated dramatically between 2019 and 2021. The $135 million Series C round in May 2020 came despite reports in late 2019 that Aspiration was struggling to close the round amid a post-WeWork funding environment that had turned skeptical of money-losing startups.

Despite these challenges, Cherny reported that March and April 2020 were the company's "two biggest months ever" for debit card transactions as consumers shifted to digital banking during the pandemic.

In August 2021, Aspiration announced plans to go public through a SPAC merger with InterPrivate III Financial Partners at a $2.3 billion valuation.

The deal would have made Aspiration "the first ESG-driven fintech" to trade publicly and "the only publicly traded consumer financial institution that is a Public Benefit Corporation."

The company expected to list on the New York Stock Exchange under ticker symbol "ASP."

The December 2021 Series D extension of $315 million from Oaktree Capital Management and Steve Ballmer's investment affiliates represented the final major capital injection before the company's fortunes reversed. The SPAC merger deadline was extended multiple times before ultimately collapsing in August 2023.

Business Model and Strategy

Revenue Model

Aspiration operated an unconventional revenue model built around customer choice and sustainability services.

Consumer Banking (approximately 30% of reported revenue by 2021):

- "Pay What Is Fair" pricing allowed customers to pay anywhere from $0 to a chosen monthly fee for basic services

- Aspiration Plus subscription at $7 per month (or $5.75 annually) offered enhanced features including higher interest rates and better cashback

- Interchange fees from debit card transactions

- Asset management fees from the Redwood Fund (0.50% expense ratio)

Corporate ESG Services (approximately 70% of reported revenue by 2021):

- Carbon offset sales to businesses through tree planting programs

- Enterprise sustainability consulting via a three-step program covering Scope 1, Scope 2, and Scope 3 carbon emissions

- Carbon credit development and sales

The shift toward corporate ESG services accelerated under Cherny's leadership, eventually representing the majority of company revenue.

This pivot would later contribute to the company's challenges as many corporate contracts proved questionable.

Customer Segments

Primary consumer segment: Climate-conscious individuals, particularly millennials and younger consumers seeking alignment between their values and financial choices. The company targeted people who wanted to reduce their carbon footprint but did not know where to start.

Secondary enterprise segment: Corporations seeking carbon offset solutions and sustainability credentials. One of the most notable clients included the Los Angeles Clippers basketball team.

Banking Structure

Unlike traditional banks or typical neobanks, Aspiration originally operated as a registered broker-dealer through Aspiration Financial, LLC, using cash management accounts rather than traditional bank deposits.

Customer funds were swept to FDIC-insured partner banks.

In 2024, the consumer business transitioned to working directly with Coastal Community Bank, offering true checking and savings accounts.

This structural approach allowed Aspiration to operate without a bank charter while providing FDIC insurance coverage (eventually up to $1.25 million per depositor through multiple partner banks).

Competitive Landscape

Aspiration competed against multiple player categories:

Traditional banks: The company positioned itself directly against JPMorgan Chase, Bank of America, Wells Fargo, and Citibank by highlighting their fossil fuel lending. The "Banking on Climate Chaos" annual report provided ammunition showing these banks collectively funded trillions in fossil fuel projects since the Paris Agreement.

Other neobanks: Chime (the largest U.S. neobank), Current, Varo, and others competed for the same digital-native customer base. Aspiration differentiated through its environmental mission rather than on pure financial features.

Sustainable banking alternatives: Amalgamated Bank (the first union-owned publicly traded bank), Sunrise Banks, and various credit unions offered similar values-alignment but with different structures. Aspiration's fully digital approach and broader sustainability features distinguished it.

Products and Services

Spend and Save Accounts

The core offering combined checking and savings functionality in a single account structure.

Features:

- No monthly maintenance fees (or "pay what is fair")

- Free ATM access at 55,000+ AllPoint network locations worldwide

- Mobile check deposit and bill pay

- Up to 1.00% APY on savings (for Plus members on first $10,000)

- FDIC insurance up to $1.25 million through partner banks

Sustainability features:

- Deposits never used to fund fossil fuel exploration or production

- Aspiration Impact Measurement (AIM) score showing sustainability ratings of merchants where customers shop

- Cashback rewards (up to 10% for Plus members) at Conscience Coalition(now the Green Marketplace) partner merchants including TOMS, Warby Parker, and others

Plant Your Change

Launched in April 2020, this feature rounded up debit card purchases to the nearest dollar, using the difference to fund tree planting through partner organizations including Eden Reforestation Projects.

Within three months, customers had collectively funded one million trees.

The company claimed 35 million trees planted by 2024, though federal investigators later questioned whether those trees had actually been planted (Cherny acknowledged only 12 million in a ProPublica interview).

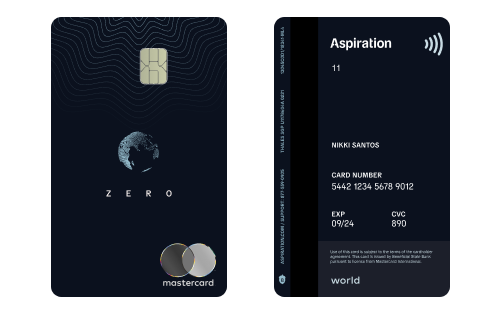

Aspiration Zero Credit Card

Launched in October 2021, this credit card was made from plant-based materials rather than plastic. Features included:

- Tree planted with every purchase

- Optional round-up for additional tree planting

- Cashback rewards

- Carbon offset for each transaction

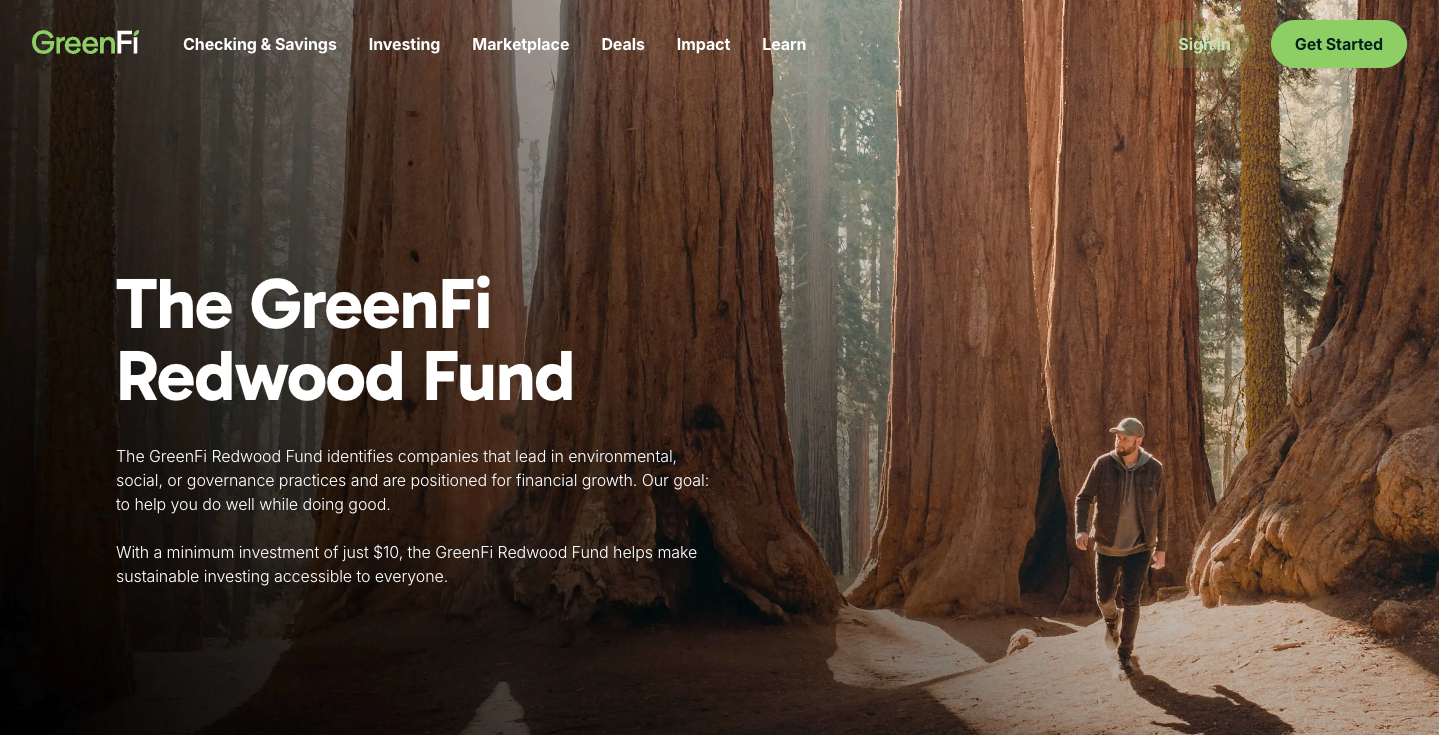

Redwood Fund

The Aspiration Redwood Fund (ticker: REDWX) launched in November 2015 as a sustainable mutual fund investing in large-cap stocks screened for ESG factors.

The fund was subadvised by UBS Asset Management and required only a $10 minimum investment ($100 standard minimum).

Performance: The fund returned 18.28% annually over five years at one point, outperforming the S&P 500 by 1.99% according to company materials. Morningstar awarded it five globes (the highest sustainability rating) for ranking in the top 10% of ESG risk in its category.

Here are the full list of holdings in the fund.

Holdings approach: The fund excluded companies in alcohol, tobacco, arms and military, nuclear power, gambling, pornography, and oil and gas industries.

Carbon Insights Acquisition

In January 2022, Aspiration acquired Carbon Insights, a climate technology software company with algorithms tracking spending behavior and transactions to determine individual carbon footprints. This technology extended the AIM program, allowing consumers and enterprises to better understand and reduce their environmental impact.

Social Impact

Theory of Change

Aspiration's core impact thesis held that consumer banking choices could meaningfully influence climate outcomes. The company cited research indicating that switching deposits from traditional banks to fossil fuel-free alternatives could have greater climate impact than buying an electric vehicle or making home energy efficiency improvements.

According to Project Drawdown's 2023 report "Saving [For] the Planet: The Climate Power of Personal Banking," every $1,000 deposited in a traditional bank carries approximately 0.183 tCO2e more carbon intensity than deposits in greener alternatives.

For the average American family with $62,410 in checking and savings (per the Federal Reserve's Survey of Consumer Finances), switching to green banking could avoid significant carbon emissions.

Populations Served

The company focused on climate-conscious consumers across all income levels and community types. A McKinsey study cited by the company found that nearly 40% of U.S. consumers expressed interest in climate-linked financial products.

By offering no-fee options and low minimums, Aspiration attempted to make sustainable finance accessible beyond wealthy environmentalists.

Quantified Outcomes (Claimed)

Tree planting: Company claimed over 28 million trees planted through customer round-ups and corporate programs, primarily in Africa and South America through partner NGOs. Federal investigators later questioned discrepancies between claimed and verified plantings.

Fossil fuel lending avoided: Aspiration estimated that every $1,000 customers transferred away from major banks had "the planet-saving climate impact of 6,000 fewer miles driven by the average car."

Customer scale: Over 5 million accounts at peak (2021), though the company did not use a traditional bank charter, making direct deposit comparisons difficult.

Charitable Giving

Aspiration pledged to donate 10% of its earnings to charities focused on microloans and mentoring for low-income Americans. This commitment was part of its B Corp and mission-driven positioning.

Certifications

B Corp Certification: Aspiration earned certification from B Lab and was named to the "Best for the World" list five times between 2017 and 2022, ranking in the top 5% of all B Corps for community impact.

1% for the Planet: The company committed 1% of gross sales annually to environmental nonprofit partners.

Green America Certified: Additional validation of environmental practices.

The Fraud and the End

The Revenue Fabrication Scheme

Between January 2021 and December 2022, while Aspiration was pursuing its $2.3 billion SPAC merger, co-founder Joseph Sanberg orchestrated an elaborate scheme to fabricate tens of millions of dollars in revenue.

According to court documents and SEC filings, the fraud operated through several interconnected mechanisms.

Fake Customer Contracts

Sanberg recruited friends, associates, small businesses, and even religious organizations to sign "letters of intent" (LOIs) promising to pay Aspiration between $25,000 and $750,000 per month for tree-planting and reforestation services.

However, these purported customers had no intention of paying for any services.

According to the SEC complaint, Sanberg explicitly told these LOI customers they would receive services "at no charge" and that either Aspiration or Sanberg himself would cover the costs.

He then used shell entities under his control to make payments, concealing that the funds originated from him rather than actual customers. Aspiration booked this as legitimate revenue between March 2021 and November 2022.

Separately, Sanberg and fellow Aspiration board member Ibrahim AlHusseini defrauded two investment funds of $145 million through falsified loan documents.

Federal Investigation and Criminal Charges

DOJ and CFTC Investigation (January 2024): The U.S. Department of Justice and Commodity Futures Trading Commission launched a formal investigation into whether Aspiration "misled customers about the quality of carbon offsets it was selling." This investigation also examined the discrepancy between claimed tree plantings (35 million) and actual plantings (12 million, according to Cherny's admission to ProPublica).

AlHusseini Arrest (October 2024): FBI agents arrested Ibrahim AlHusseini on securities fraud charges. Court documents alleged he had submitted falsified brokerage statements at least 24 times between April 2020 and February 2023.

AlHusseini Guilty Plea (March 2025): AlHusseini pleaded guilty to wire fraud, admitting to receiving approximately $12.3 million in ill-gotten gains. His sentencing is scheduled for February 2026.

Sanberg Arrest (March 2025): Joseph Sanberg was arrested on conspiracy to defraud charges. According to court documents, he had devised the scheme beginning in 2020 and continuing into 2025.

Sanberg Guilty Plea (August 2025): Sanberg agreed to plead guilty to two counts of wire fraud, each carrying a maximum 20-year prison sentence. The DOJ announced total victim losses exceeded $248 million. His formal guilty plea was entered in October 2025, with sentencing scheduled for April 2026.

Bankruptcy and Corporate Dissolution

Chapter 11 Filing (March 31, 2025): Aspiration Partners filed for bankruptcy protection in Delaware just weeks after Sanberg's arrest. The company reported $50-100 million in assets against $100-500 million in liabilities.

Asset Sale: The bankruptcy plan called for shedding most debt and selling the company to creditors through a Section 363 sale process within 55 days.

DIP Financing: Inherent Aspiration, LLC provided up to $18 million in debtor-in-possession financing to fund bankruptcy proceedings, including $4.2 million in new financing.

Creditors: Major creditors included the LA Clippers and Kia Forum ($40 million combined for contracted carbon credits), Kawhi Leonard's LLC ($7 million), and numerous other vendors and investors.

Dig deeper into the Clippers allegations.(Front Office Sports)

The Spin-Off: From Aspiration to GreenFi

Tim Newell and the Consumer Business Acquisition

While Aspiration Partners descended into scandal and bankruptcy, the consumer banking brand found new life through a spin-off transaction completed in early 2024.

The Acquisition

Tim Newell, who had served as Aspiration Partners' Chief Operating Officer and previously led consumer financial products teams at Tesla and SolarCity, reached an agreement to acquire Aspiration's consumer fintech division.

His company, Mission Financial Partners (founded in 2023), assumed operation of the Aspiration consumer brand in February 2024.

Newell did not disclose the purchase price, stating only that "we were able to reach an agreement that both sides felt good about."

GreenFi Launch and Rebrand

Brand Transition (2025): In April 2025, Mission Financial Partners announced the rebranding of the consumer platform from Aspiration to GreenFi. The new name was designed to "better reflect our mission of sustainable banking and investing" while creating distance from the scandal-tainted Aspiration name.

$17 Million Seed Round (April 2025): Simultaneously with the GreenFi launch, Newell announced a $17 million seed investment to accelerate development of new banking, credit, and investment products.

Customer Continuity: Existing Aspiration customers' accounts automatically transitioned to GreenFi with no disruption. Checking, savings, and investment accounts remained intact, and deposits continue to be free from fossil fuel funding.

What GreenFi Inherited vs. What It Left Behind

| Inherited by GreenFi | Remained with Aspiration Partners |

|---|---|

| Consumer brand and customer relationships | Corporate ESG/carbon credit business |

| Checking and savings account infrastructure | Enterprise carbon offset contracts |

| Redwood Fund | Catona Climate rebrand |

| Coastal Community Bank partnership | Celebrity investor relationships |

| Plant Your Change feature | Legal liabilities and lawsuits |

| Conscience Coalition merchant network | Bankruptcy proceedings |

| B Corp certification history | Criminal investigation targets |

The corporate ESG business was rebranded as "Catona Climate" and became the entity that ultimately filed for bankruptcy. This separation shielded consumer deposits and accounts from the bankruptcy proceedings.

Key Takeaways

1. Mission-driven positioning created powerful differentiation but required execution integrity

Aspiration successfully identified an underserved market: consumers who wanted their money to align with their climate values. The company's thesis that "changing banks is probably the single biggest thing [people] can do to lower their carbon footprint" resonated with millions.

However, the gap between marketing claims (35 million trees planted) and reality (12 million according to Cherny's admission) ultimately damaged credibility and triggered federal investigation.

Lesson for impact founders: Impact claims require the same rigor as financial claims. Overstating outcomes may accelerate growth short-term but creates existential risk when discovered.

2. Governance failures can undermine even strong impact models

The fraud perpetrated by co-founder Sanberg involved fabricating revenue through fake customer contracts, falsifying financial statements, and misrepresenting available cash ($250 million claimed versus less than $1 million actual).

These actions occurred while the company simultaneously earned B Corp Best for the World recognition and attracted celebrity investors.(How does this happen B Corp?)

Lesson for investors: B Corp certification and celebrity backing do not guarantee governance quality. Due diligence must examine internal controls and verify revenue sources, especially for pre-profit companies.

3. Revenue model innovation requires sustainable economics

The "pay what is fair" model attracted customers but created unpredictable revenue. The pivot to corporate ESG services (eventually 70% of claimed revenue) represented a dramatic business model shift that distanced the company from its consumer banking roots and introduced significant execution risk.

Lesson for founders: Mission-aligned pricing must still produce viable unit economics. Dual business models (consumer and enterprise) require careful resource allocation and may create competing priorities.

4. The consumer demand for sustainable banking remains real

Despite Aspiration's failures, the spin-off consumer business (now GreenFi) continues operating because genuine demand exists. McKinsey found 40% of U.S. consumers interested in climate-linked financial products. The lesson is not that sustainable banking cannot work, but that it requires the same operational integrity as any financial business.

Lesson for the sector: The market opportunity Aspiration identified remains valid. New entrants can learn from Aspiration's product innovations while implementing stronger governance and verification systems.